RSI Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in price

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in price

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments

1/n

#StockMarket #Technicals

1/n

#StockMarket #Technicals

RSI Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

How to trade with #RSI

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do selling

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do selling

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO

How to trade with #RSI

RSI Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

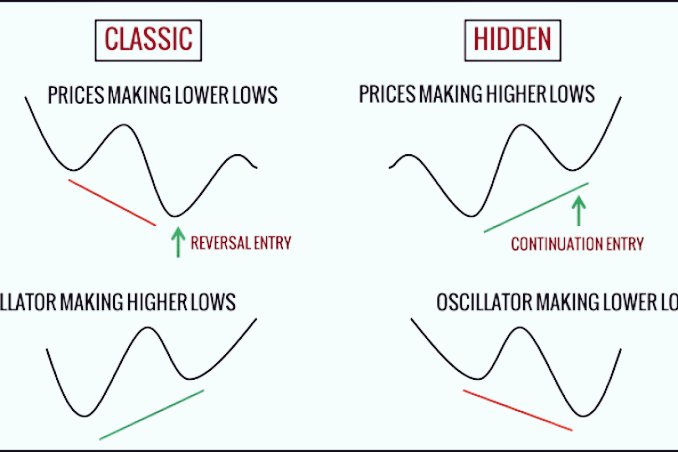

Trading Divergences https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it

3/n

#StockMarket #Technicals

Trading Divergences

3/n

#StockMarket #Technicals

RSI Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

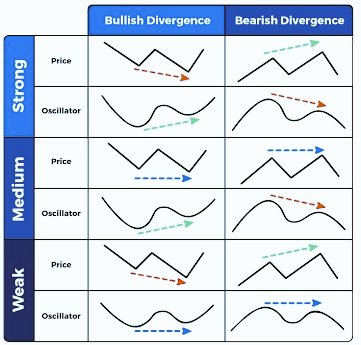

Trading Checklist for RSI

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergences

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergences

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergences

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergences

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in nature

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in nature

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade

4/n

#StockMarket #Technicals

Trading Checklist for RSI

4/n

#StockMarket #Technicals

RSI Simplified https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Study

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Study https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pic

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pic

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST charts

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST charts

End of Thread

Thanks https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

End of Thread

Thanks

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments1/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments1/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments1/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its one of the leading indicator which measures the strength of any move in pricehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Its an oscillator which moves between two extremes (0—100) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Reading above 70 indicates overbought while below 30 indicates oversold sentiments1/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

How to trade with #RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do sellinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">How to trade with #RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do sellinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO" class="img-responsive" style="max-width:100%;"/>

How to trade with #RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do sellinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">How to trade with #RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">50—70 is as zone where trades buy the #stocks by considering other factors (BO, Divergences)https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">Below 40 is weakness zone where some traders do sellinghttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">40-50 is an indecision zone where most of the traders avoid trading & wait for BO" class="img-responsive" style="max-width:100%;"/>

Trading Divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it3/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Trading Divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it3/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

Trading Divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it3/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Trading Divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">There are 2 type of divergences occurs b/w RSI&Price (Bullish & Bearish) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bullish Divergence RSI makes HH-HL while price doesn& #39;t do it https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">In Bearish Divergence RDI makes LH-LL while price doesn& #39;t do it3/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

Trading Checklist for RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in naturehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade4/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Trading Checklist for RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in naturehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade4/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

Trading Checklist for RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in naturehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade4/n #StockMarket #Technicals" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">Trading Checklist for RSIhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Buy on bullish or positive divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Sell on Bearish or negative divergenceshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Wait if divergence is very low in naturehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle"> Remember more the divergence better the success rate of trade4/n #StockMarket #Technicals" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Studyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pichttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST chartsEnd of ThreadThankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Studyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pichttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST chartsEnd of ThreadThankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Studyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pichttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST chartsEnd of ThreadThankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" title="RSI Simplifiedhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="📒" title="Ledger" aria-label="Emoji: Ledger">https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Chart with upwards trend" aria-label="Emoji: Chart with upwards trend">Case Studyhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">We can see RSI bearish or negative divergence in the pichttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">RSI cont. making LL-LH pattern while price is making HH-HL pattern (Selling or Profit Booking zone) https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔵" title="Blue circle" aria-label="Emoji: Blue circle">It is often considered as fake move as well in ST chartsEnd of ThreadThankshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">" class="img-responsive" style="max-width:100%;"/>