Interesting problem to think through:

Bankrupt shale companies will emerge from 2020 far less leveraged, but

Solvent shale companies will emerge from 2020 MUCH more highly leveraged.

Discuss.

Bankrupt shale companies will emerge from 2020 far less leveraged, but

Solvent shale companies will emerge from 2020 MUCH more highly leveraged.

Discuss.

Thinking through $CLR for example. They& #39;re cutting production spending like crazy: https://www.reuters.com/article/us-continental-resources-shale-north-dak-idUSKCN2260PX">https://www.reuters.com/article/u... so they may actually produced some "FCF" ("Fool& #39;s Cash Flow") this year. I say Fool& #39;s cash flow because while they get money in for selling oil even at catastrophic prices,

they have a deficit of billions they need to spend in order to replace the production they just sold. In other businesses, this looks "liquidating in place." So the real metric we need is to find a steady-state level of production spending, subtract this year& #39;s realizations

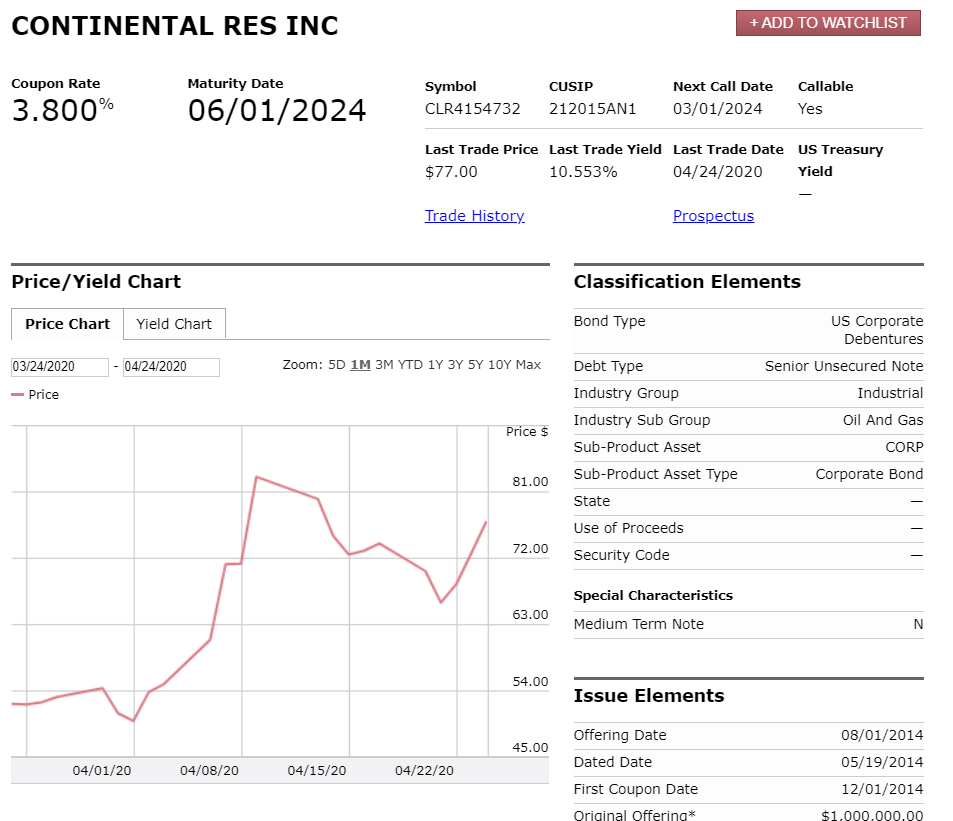

and the rest is money they need to borrow in order get back up to speed. I observe that even though you& #39;ve seen the stock move up this week, this bond is not a happy camper:

Read on Twitter

Read on Twitter