Money Flow in Indian Markets: Need for more data disclosure for better insights

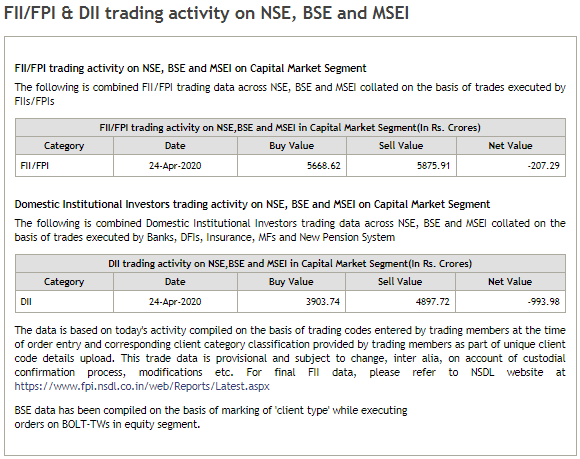

For the past 15-20 years, everyday, market participants look upon the NSE website for the following data. This data helps in understanding flows into Indian Equity Market by Institutional Investors

For the past 15-20 years, everyday, market participants look upon the NSE website for the following data. This data helps in understanding flows into Indian Equity Market by Institutional Investors

The data was a big deal way back 20 years ago but is the relevance same today?

Maybe or maybe not. In 2003, we were unfolding into a bull market after a 3 year downtrend and Nifty was in 3 digits. In 2020, Nifty was trading in 5 digits in the Q1.

So what exactly should we expect?

Maybe or maybe not. In 2003, we were unfolding into a bull market after a 3 year downtrend and Nifty was in 3 digits. In 2020, Nifty was trading in 5 digits in the Q1.

So what exactly should we expect?

Following are the few types of FIIs investing in India:

1)Hedge Funds

2) Foreign MF& #39;s / AMC& #39;s

3) Sovereign Wealth Funds

4) Pension Funds

5) Trusts

6) Endowments

7) University Funds

8) ETF

9) Sub Accounts /P-Notes

10) Foreign Insurance Companies.

Do we get breakup of FII data?

1)Hedge Funds

2) Foreign MF& #39;s / AMC& #39;s

3) Sovereign Wealth Funds

4) Pension Funds

5) Trusts

6) Endowments

7) University Funds

8) ETF

9) Sub Accounts /P-Notes

10) Foreign Insurance Companies.

Do we get breakup of FII data?

Similarly Indian Institutional investors can be categorised into following sections

1) AMC& #39;s (Data Available)

2) Private/Public Insurance Companies

3) Private/Public Bank Treasuries

4) AIF& #39;s

5) PMS

6) Corporate Treasury

7) Broker Proprietary Book

Do we get breakup of DII data?

1) AMC& #39;s (Data Available)

2) Private/Public Insurance Companies

3) Private/Public Bank Treasuries

4) AIF& #39;s

5) PMS

6) Corporate Treasury

7) Broker Proprietary Book

Do we get breakup of DII data?

One last piece which call complete the jigsaw puzzle is the gross buy/sell figure of Retail (individual PAN Card holders).

Reason for non availability of such break up of Data:

Some say its done so to maintain secrecy of client trades.

Agreed. But who needs the stock wise data?

Reason for non availability of such break up of Data:

Some say its done so to maintain secrecy of client trades.

Agreed. But who needs the stock wise data?

All we ask is for Gross Buy Sell Data of FII/DII with a breakup into smaller sections like mentioned above.

We don& #39;t seek names of stocks or institutions who have purchased / sold the stock.

It will help in improving market analysis.

We don& #39;t seek names of stocks or institutions who have purchased / sold the stock.

It will help in improving market analysis.

No point in just knowing how much FII bought/sold if we don& #39;t know whether the buyer/seller was a pension fund or an ETF.

All investors have to go through a rigorous KYC process while registering & exchanges in consultation with respective regulators can provide gross buy/sell

All investors have to go through a rigorous KYC process while registering & exchanges in consultation with respective regulators can provide gross buy/sell

data either on the exchange website or on the NSDL/CDSL website.

Greater disclosure and transparency in Data will help India being viewed as a potential opportunity by investors.

Hope you liked my thoughts.

To know more about me read https://twitter.com/KAnantrao/status/1238750486171271169?s=20">https://twitter.com/KAnantrao...

Greater disclosure and transparency in Data will help India being viewed as a potential opportunity by investors.

Hope you liked my thoughts.

To know more about me read https://twitter.com/KAnantrao/status/1238750486171271169?s=20">https://twitter.com/KAnantrao...

Read on Twitter

Read on Twitter