The API Industry

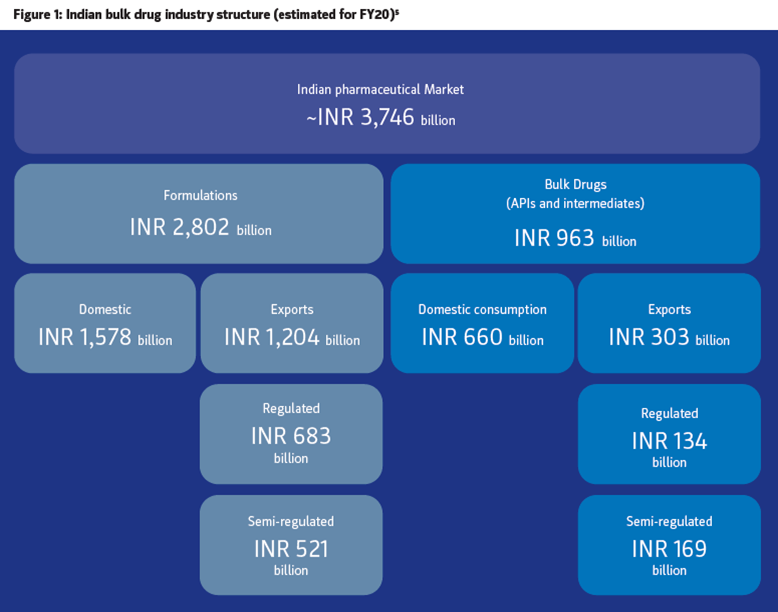

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The backbone of India pharma industry is the bulk drug industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The backbone of India pharma industry is the bulk drug industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India has highest no. of US FDA approved plants (665) outside of the US

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India has highest no. of US FDA approved plants (665) outside of the US

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India has 44% of global abbreviated new drug applications (ANDA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India has 44% of global abbreviated new drug applications (ANDA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India needs to proactively boost the API Industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India needs to proactively boost the API Industry

@Harrshit1

Contribution to Economy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Provides Employment to 2.7 Mn Ppl

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Provides Employment to 2.7 Mn Ppl

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Generates $11Bn trade surplus every yr

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Generates $11Bn trade surplus every yr

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Amongst the top 5 sectors contributing to the reduction of trade deficit

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Amongst the top 5 sectors contributing to the reduction of trade deficit

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> 2 Bn FDI inflows over the last 3 yrs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> 2 Bn FDI inflows over the last 3 yrs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dominated by MSMEs which are primary employment generators

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dominated by MSMEs which are primary employment generators

#Bulkdrug

@unseenvalue

#API

@unseenvalue

#Pharmaceutical

High Imports

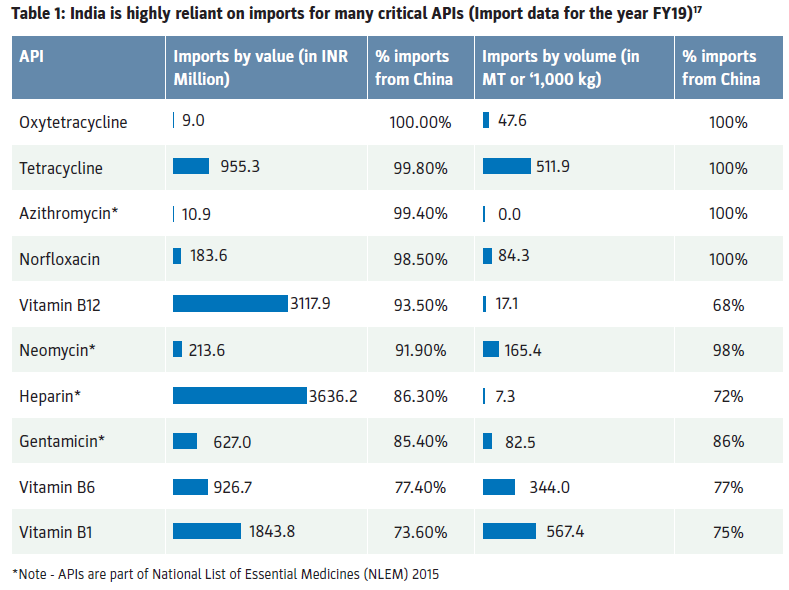

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient manner

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient manner

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs

Challanges face by Indian API Industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Limited government support in the past

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Limited government support in the past

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Inadequate infrastructure

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Inadequate infrastructure

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Environemental clearnace issues

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Environemental clearnace issues

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Price control regime (NLEM/DPCO/NPPA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Price control regime (NLEM/DPCO/NPPA)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Price volatility due to high import dependancy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Price volatility due to high import dependancy

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Increased Scrutiny of quality compliance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Increased Scrutiny of quality compliance

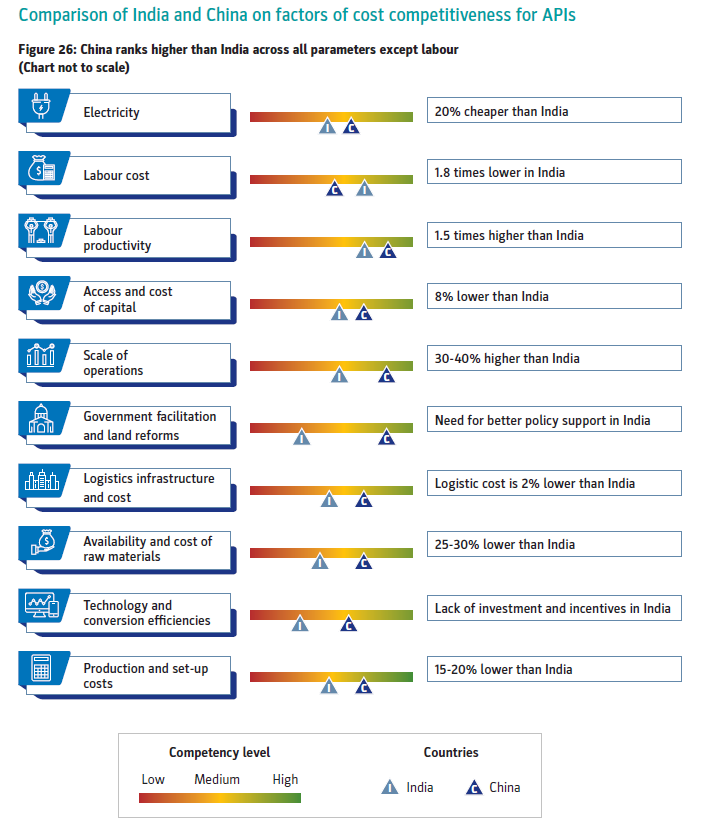

India and China

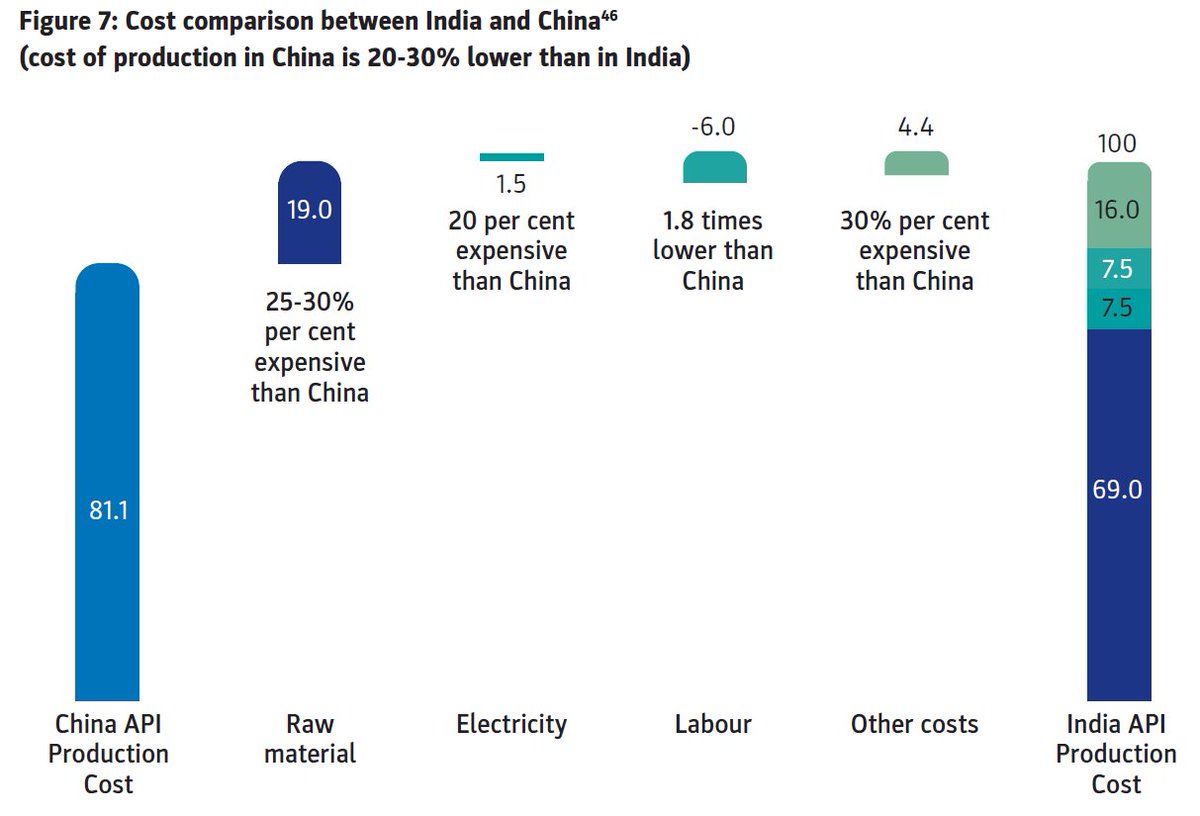

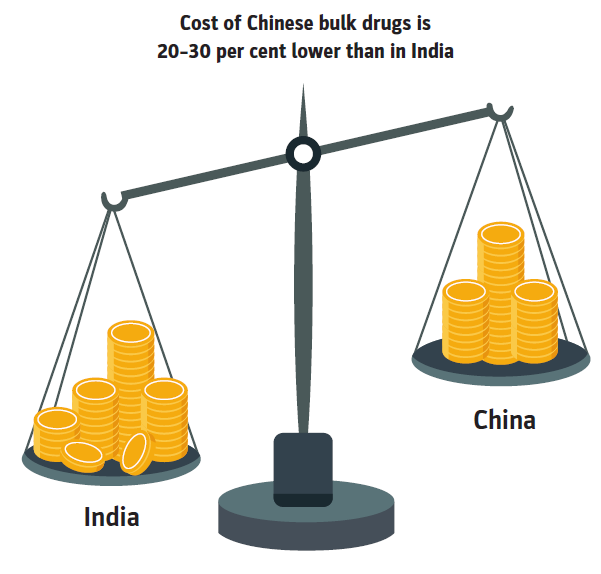

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs molecules

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs molecules

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonnes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonnes

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants

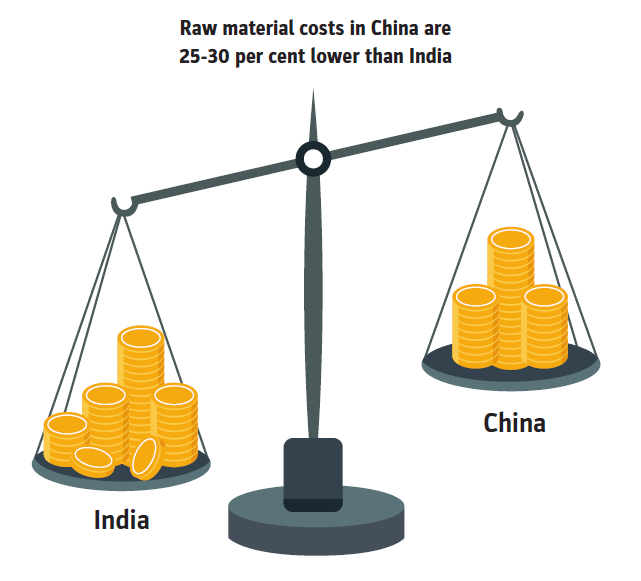

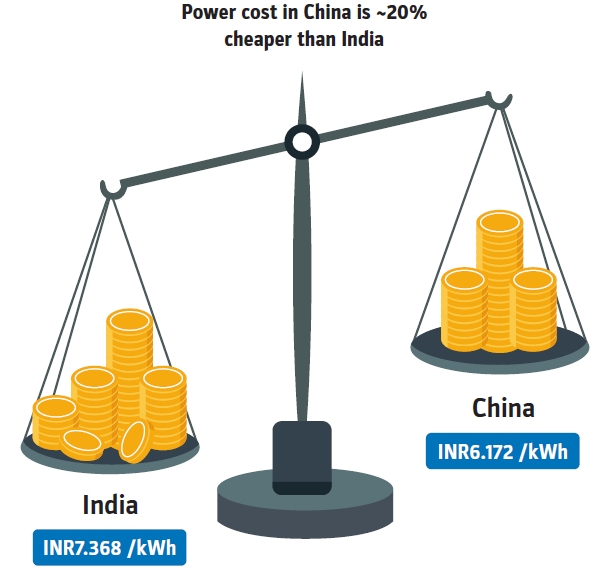

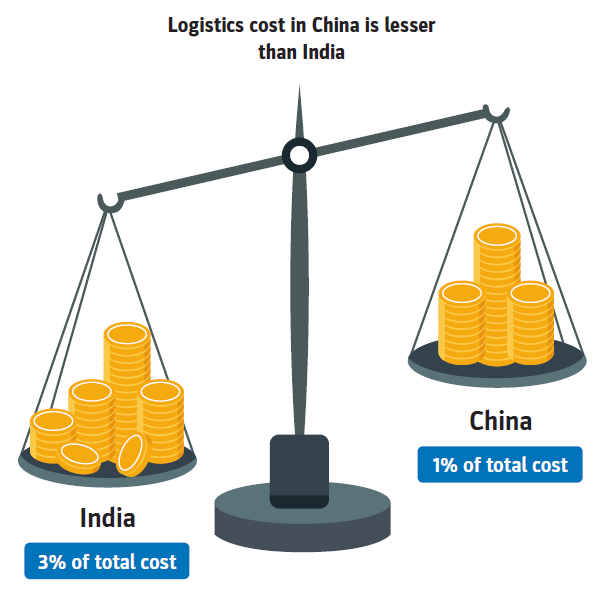

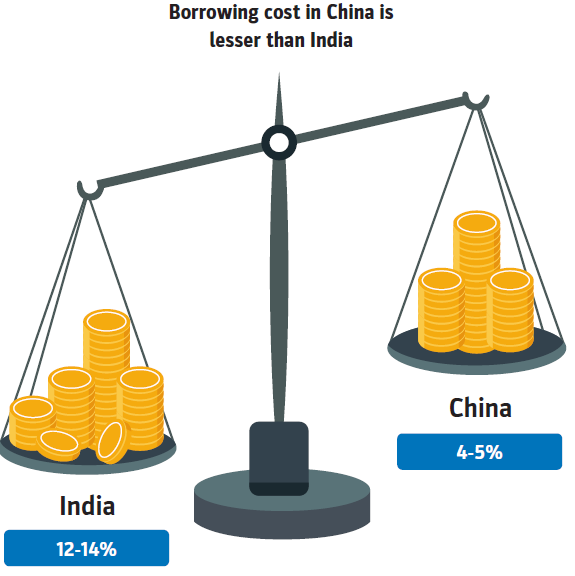

Cost Comparison India v China

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India

@npal20 @_N_U_P_K_Y @DIALWEALTH_IN

@npal20 @_N_U_P_K_Y @DIALWEALTH_IN

#Pharmaceuticals

#API

#China

Boosting API Industry

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Recently GOI approved Bulk drug park & Production linked Incentive Scheme for promotion of domestic mfging of 53 critical APIs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Recently GOI approved Bulk drug park & Production linked Incentive Scheme for promotion of domestic mfging of 53 critical APIs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Ease of doing business

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Ease of doing business

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Incentives and subsidies

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Incentives and subsidies

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Infrastructure development

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Infrastructure development

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Innovation and technical capabilities

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Innovation and technical capabilities

Read on Twitter

Read on Twitter The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs">

The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs">

The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs">

The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The Indian pharma industry is the world& #39;s 3rd largest in terms of volhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India& #39;s API industry is ranked the 3rd largest in the worldhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India fulfils 20% of global demand for generic medicines in terms of Vol & supplies over 60% of global demand of various vaccines & ARV drugs">

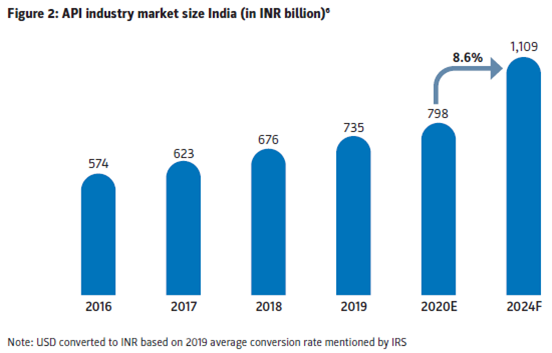

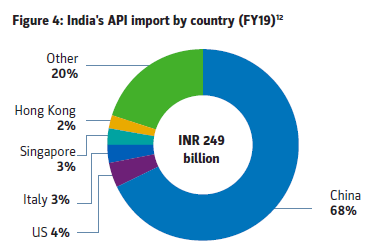

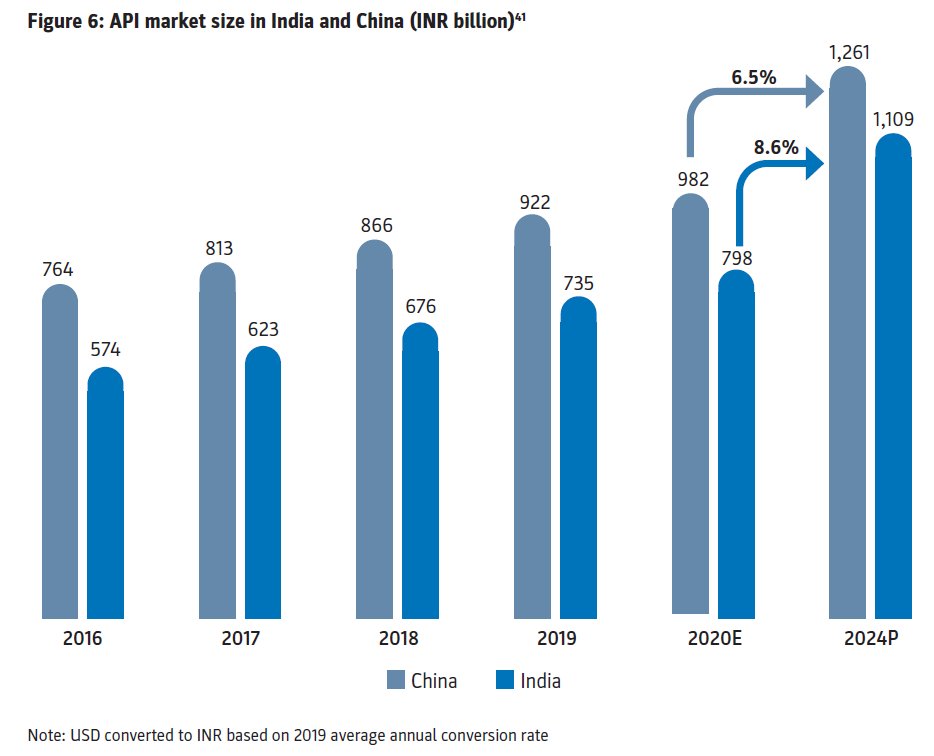

Indian bulk drug industry has grown at CAGR of 8.6% over 2016-2020. It is further expeacted to grow at similar CAGR during 2020-2024https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The import of APIs has risen at a CAGR of 8.3% from 2012-2019https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Bulk drug import reached a value of INR ~249 billion in 2019 @Harrshit1" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indian bulk drug industry has grown at CAGR of 8.6% over 2016-2020. It is further expeacted to grow at similar CAGR during 2020-2024https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The import of APIs has risen at a CAGR of 8.3% from 2012-2019https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Bulk drug import reached a value of INR ~249 billion in 2019 @Harrshit1" class="img-responsive" style="max-width:100%;"/>

Indian bulk drug industry has grown at CAGR of 8.6% over 2016-2020. It is further expeacted to grow at similar CAGR during 2020-2024https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The import of APIs has risen at a CAGR of 8.3% from 2012-2019https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Bulk drug import reached a value of INR ~249 billion in 2019 @Harrshit1" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indian bulk drug industry has grown at CAGR of 8.6% over 2016-2020. It is further expeacted to grow at similar CAGR during 2020-2024https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The import of APIs has risen at a CAGR of 8.3% from 2012-2019https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Bulk drug import reached a value of INR ~249 billion in 2019 @Harrshit1" class="img-responsive" style="max-width:100%;"/>

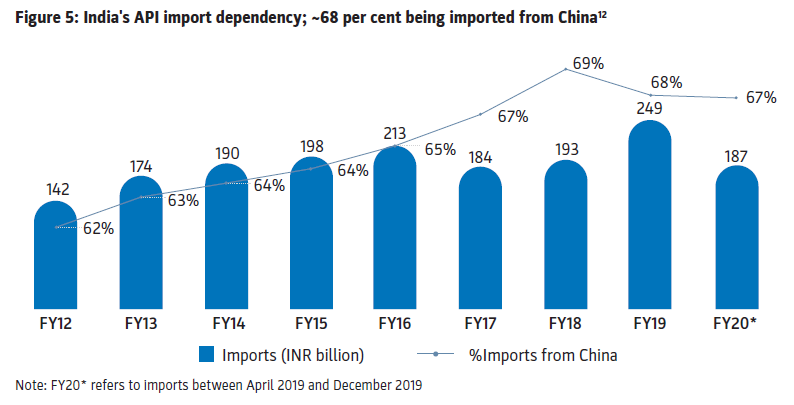

Imports from China have been on a steady rise over the yrs (Frm 62% in FY12 to 68% in FY19)https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India imported 169 Bn worth of APIs from China in FY19https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> High import dependancy is largely attributed to lack of cost-effective options in domestic API mfging as compared to imports" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Imports from China have been on a steady rise over the yrs (Frm 62% in FY12 to 68% in FY19)https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India imported 169 Bn worth of APIs from China in FY19https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> High import dependancy is largely attributed to lack of cost-effective options in domestic API mfging as compared to imports" class="img-responsive" style="max-width:100%;"/>

Imports from China have been on a steady rise over the yrs (Frm 62% in FY12 to 68% in FY19)https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India imported 169 Bn worth of APIs from China in FY19https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> High import dependancy is largely attributed to lack of cost-effective options in domestic API mfging as compared to imports" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Imports from China have been on a steady rise over the yrs (Frm 62% in FY12 to 68% in FY19)https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> India imported 169 Bn worth of APIs from China in FY19https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> High import dependancy is largely attributed to lack of cost-effective options in domestic API mfging as compared to imports" class="img-responsive" style="max-width:100%;"/>

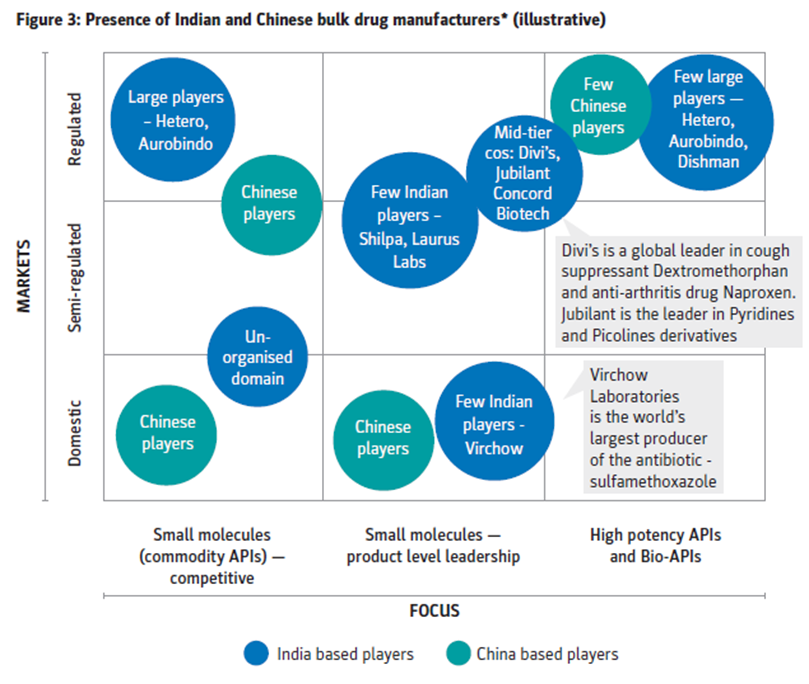

The bulk drug industry is highly fragmented with around 1500 plants that manufacture APIs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> In FY18, top 14-16 players (including large formulation companies) comprised just 16-17 percent of total market share.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Current market is largely dependent on China for many APIs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The bulk drug industry is highly fragmented with around 1500 plants that manufacture APIs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> In FY18, top 14-16 players (including large formulation companies) comprised just 16-17 percent of total market share.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Current market is largely dependent on China for many APIs" class="img-responsive" style="max-width:100%;"/>

The bulk drug industry is highly fragmented with around 1500 plants that manufacture APIs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> In FY18, top 14-16 players (including large formulation companies) comprised just 16-17 percent of total market share.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Current market is largely dependent on China for many APIs" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> The bulk drug industry is highly fragmented with around 1500 plants that manufacture APIs.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> In FY18, top 14-16 players (including large formulation companies) comprised just 16-17 percent of total market share.https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Current market is largely dependent on China for many APIs" class="img-responsive" style="max-width:100%;"/>

Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient mannerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs" title="High Importshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient mannerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs" class="img-responsive" style="max-width:100%;"/>

Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient mannerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs" title="High Importshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Low cost Imports have a gradual erosion of india& #39;s mfging capacity of many APIshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Dependancy on imports can be reduced if India is able to manufacture the APIs in a cost efficient mannerhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China is a single supplier for many of the critical intermediates & APIs" class="img-responsive" style="max-width:100%;"/>

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants" title="India and Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China enjoys cost advantage of around 20%-30% over Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Chinese API market has now over 2000 APIs moleculeshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China has more than 7000 APIs manufacturers with annual production capacity exceeding 2 Mn tonneshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Indin has around 1500 APIs mfging plants">

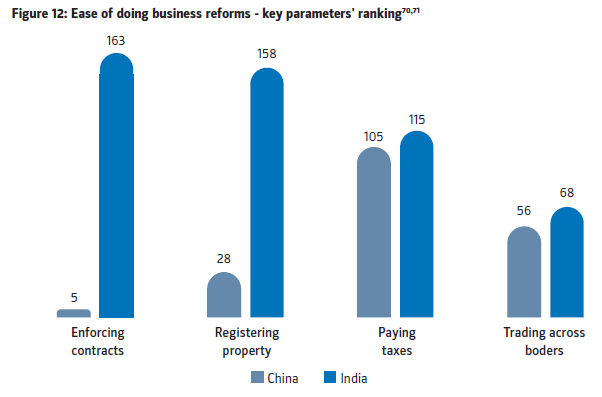

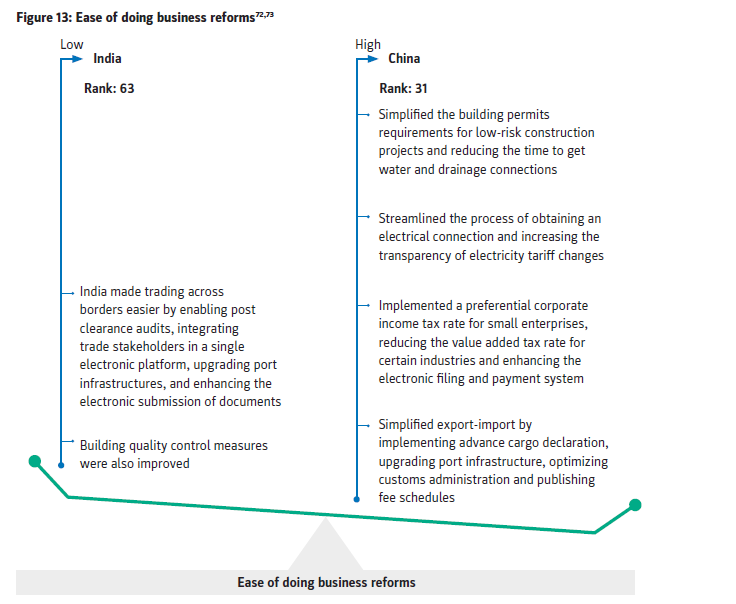

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China& #39;s dominant position in the mkt is a result of infrastructure investment, large-scale mfging capacities, cost effieciency, technical capabilities and supportive govt policieshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> China implemented a greater no of reforms to improve its business climate in FY19 than India">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN" title="Cost Comparison India v Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> RM costs in China are 25%-30% lower than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Power cost in China is 20% cheaper than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Logistics costs in China are lesser than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Borrowing cost in China is lesser than India @npal20 @_N_U_P_K_Y @DIALWEALTH_IN">

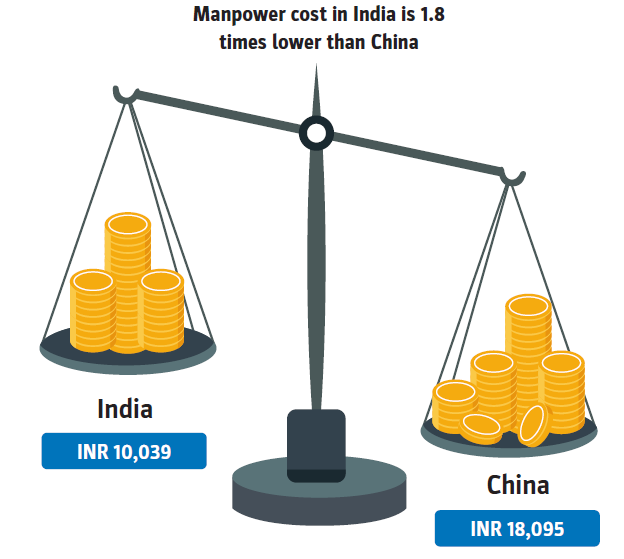

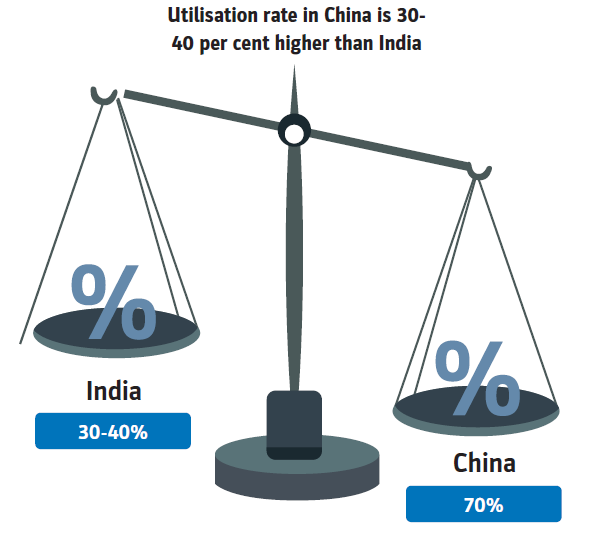

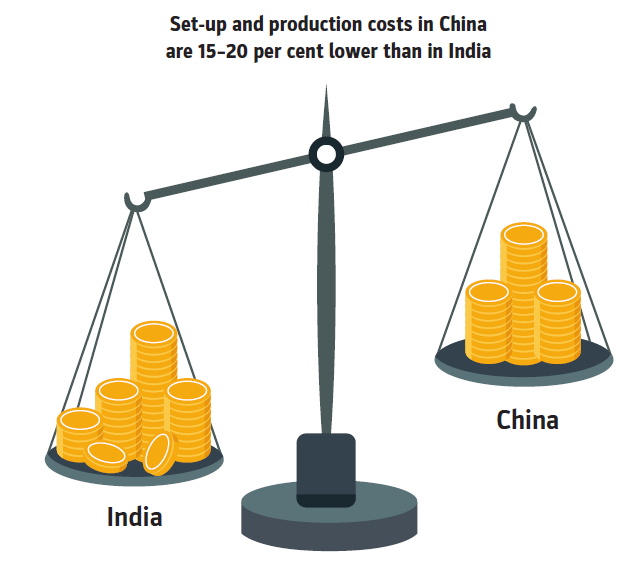

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">

Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Manpower cost in India is 1.8 times lower than Chinahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Capacity Utilization rate in China 30%-40% higher than Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Set-up & production costs in China are 15%-20% lower than in Indiahttps://abs.twimg.com/emoji/v2/... draggable="false" alt="✍️" title="Writing hand" aria-label="Emoji: Writing hand"> Cost of Chinese bulk drug is 20%-30% lower than in India #Pharmaceuticals #API #China">