This is a short thread on Fx risks, devaluation and asset portfolios https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

#ManagingWealth #AssetPortfolio #FxRisks #WO 1/24

#ManagingWealth #AssetPortfolio #FxRisks #WO 1/24

This thread was inspired by a tweet exchange I saw between @Segalink and @eldivyn on a very interesting topic but the comments from people suggest that many people don’t understand the impact of FX risks on individual’s asset portfolio.

#FxRisks #Advisor #WO 2/24

#FxRisks #Advisor #WO 2/24

Mr A and Mr B were given a cash inheritance of N60 million each after the death of their rich grandfather in Year 2000. This was during the Obasanjo years when the Fx rate was about N120/$. The inheritance was worth about $500,000 - cool money!

#ManagingWealth #FxRisks #WO 3/24

#ManagingWealth #FxRisks #WO 3/24

Mr A, an entrepreneurial minded person, bought a very big house in VGC with the N60 million. The house has valid legal title and has obtained the “Governor’s Consent” on the Deed of Sublease.

#ManagingWealth #FxRisks #WO 4/24

#ManagingWealth #FxRisks #WO 4/24

The property earns N2M annually in cash from the house rent. This means he has made another N40M (N2M x 20 years) while also still owning his house. He saved his N60M rent income in Standard Chartered Bank.

#ManagingWealth #FxRisks #WO 5/24

#ManagingWealth #FxRisks #WO 5/24

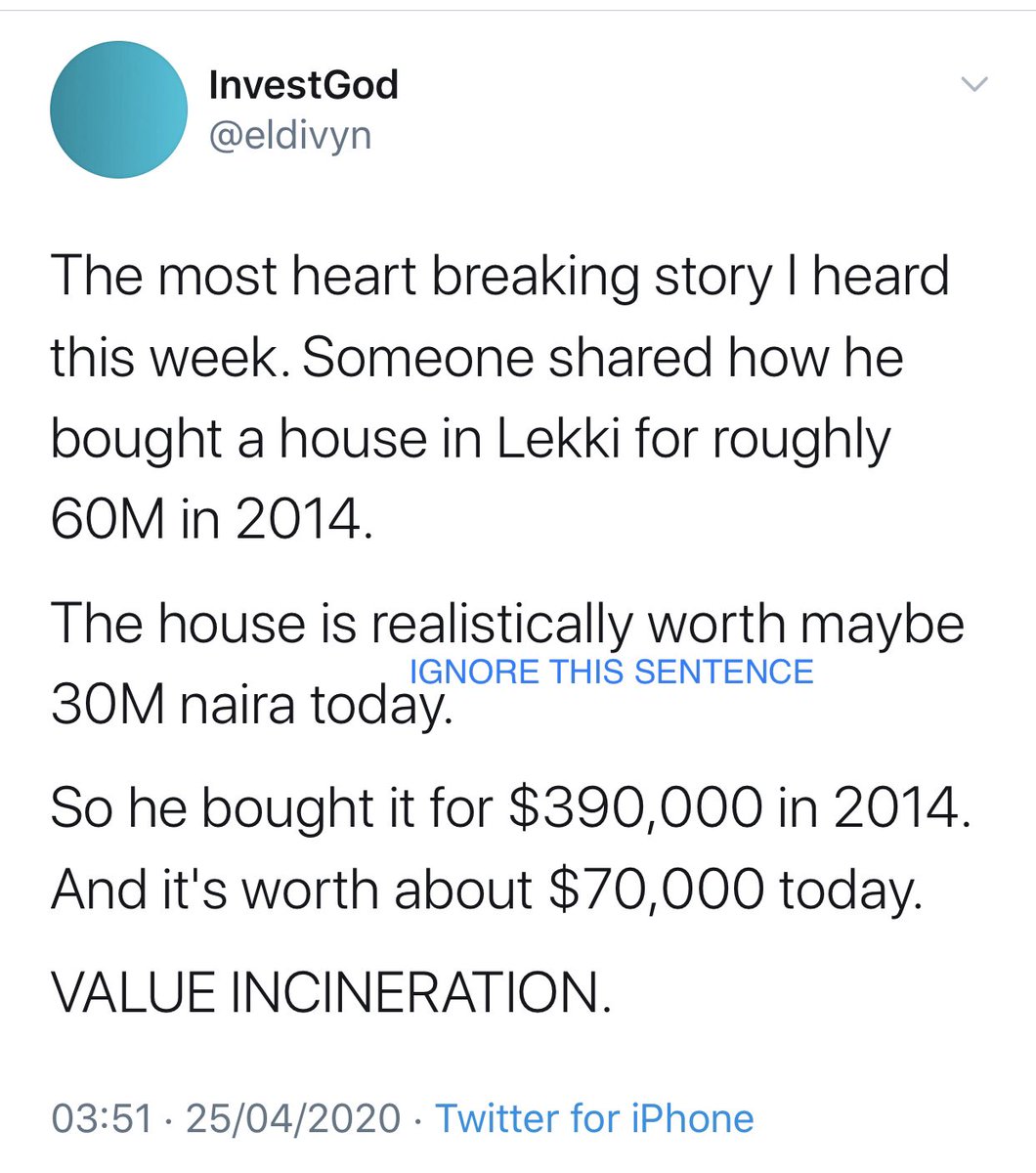

Really, Mr A is like the person that @eldivyn is talking about here - https://twitter.com/eldivyn/status/1254000130065301505?s=21

https://twitter.com/eldivyn/s... href="https://twtext.com//hashtag/ManagingWealth"> #ManagingWealth #FxRisks #WO 6/24

Mr B, a career engineer with strong finance knowledge, went to EKO hotel to convert the money to dollars. He deposited the $500,000 into his bank account in Sterling Bank, the “1-Customer” bank.

#ManagingWealth #FxRisks #WO 7/24

#ManagingWealth #FxRisks #WO 7/24

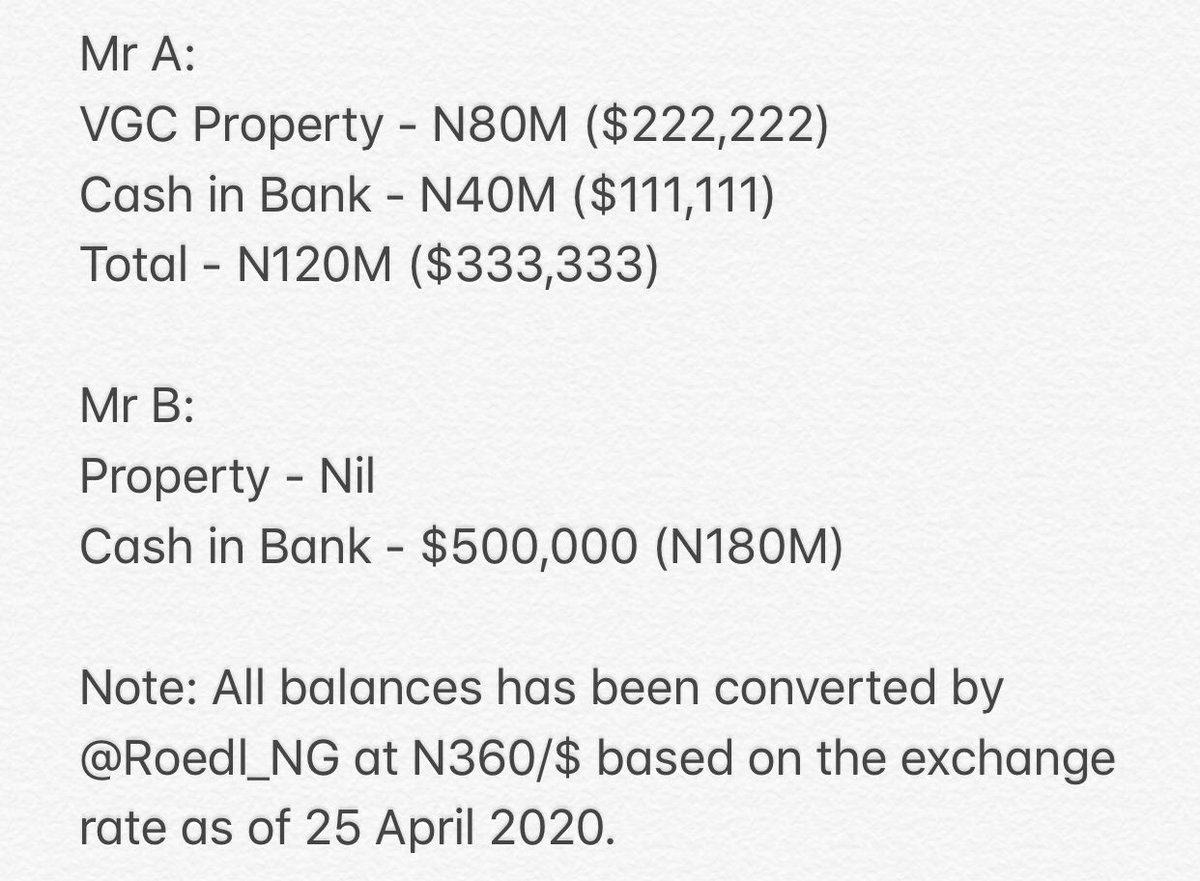

Due to their interest to jointly apply for a bank loan, the two brothers invited @Roedl_NG to prepare a special statement of their net worth in NAIRA (and a separate one in dollars), based only on their real estate properties and bank balances.

#ManagingWealth #FxRisks #WO 8/24

#ManagingWealth #FxRisks #WO 8/24

Mr A‘s property at VGC has been valued at N80M based on a recent property valuation exercise that was done by Jeunkoku Olorinla & Co, a firm of Estate surveyors and valuers.

#ManagingWealth #FxRisks #WO 9/24

#ManagingWealth #FxRisks #WO 9/24

This confirms that the property has indeed appreciated in value as @Segalink suggested here - https://twitter.com/segalink/status/1254046519264784384?s=21

https://twitter.com/segalink/... href="https://twtext.com//hashtag/ManagingWealth"> #ManagingWealth #FxRisks #WO 10/24

Although Mr A made a gain of N40M on his inheritance amount of N60M (worth about $500,000 when he collected his inheritance), the foreign exchange devaluation (from N120/$ to N360/$) has decreased the value of his VGC property down to $222,222

#ManagingWealth #FxRisks #WO 12/24

#ManagingWealth #FxRisks #WO 12/24

It would have been worse for Mr A if not for the property value appreciation during the 20-year period that has been recognised. But why?

Chill. Take a pack of @ReelFruit to digest this learning very well.

#ManagingWealth #FxRisks #WO 13/24

Chill. Take a pack of @ReelFruit to digest this learning very well.

#ManagingWealth #FxRisks #WO 13/24

However, Mr B was able to hedge the Fx risk by holding a US$ denominated asset whereas Mr A’s property was held in a property market that is Naira based and valued (even if he had used US$ to settle the payment for the property in VGC).

#ManagingWealth #FxRisks #WO 14/24

#ManagingWealth #FxRisks #WO 14/24

This is what @gossyomega was saying here - https://twitter.com/gossyomega/status/1254060526314885120?s=21

https://twitter.com/gossyomeg... href="https://twtext.com//hashtag/ManagingWealth"> #ManagingWealth #FxRisks #WO 15/24

The above also addresses the concern raised by @dawuzi here - https://twitter.com/dawuzi/status/1254074664919408640?s=21">https://twitter.com/dawuzi/st... - regarding @eldivyn’s comment that a N60M property became N30M worth.

#ManagingWealth #FxRisks #WO 16/24

#ManagingWealth #FxRisks #WO 16/24

I will ignore the statement made by @eldivyn regarding the worth of the house dropping from N60M to N30M in that story.

#ManagingWealth #FxRisks #WO 17/24

Apart from this erroneous comment, all his other comments are logical https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">

#ManagingWealth #FxRisks #WO 17/24

Apart from this erroneous comment, all his other comments are logical

It is unusual (but not totally impossible) for properties (with necessary legal documentation) to lose value except where the initial transaction involving the property was overpriced or in situations of general deflation, ceteris paribus.

#ManagingWealth #FxRisks #WO 18/24

#ManagingWealth #FxRisks #WO 18/24

The takeaway is that HNIs in countries with currencies that are highly volatile (like Nigeria) must seek to balance their asset portfolio with a good currency spread to hedge against FX risks, in order to preserve value in their asset portfolio

#ManagingWealth #FxRisks #WO 19/24

#ManagingWealth #FxRisks #WO 19/24

At certain levels, the focus shouldn’t be on only value appreciation (like Mr A) but also value conservation (like Mr B).

#ManagingWealth #FxRisks #WO 20/24

#ManagingWealth #FxRisks #WO 20/24

The above thread shows that @segalink’s argument about property appreciation is legit but does not automatically contradict @eldivyn and @gossyomega’s positions. Infact, they all provided complimentary view points on #assetportfolio management.

#ManagingWealth #FxRisks #WO 21/24

#ManagingWealth #FxRisks #WO 21/24

The above is a simplified version of a real life situation but the names of the parties, property location and amounts have been altered.

#ManagingWealth #FxRisks #WO 22/24

#ManagingWealth #FxRisks #WO 22/24

The purpose of a thread like this is for intellectual debate and learning. Please feel free to disagree (or agree) with any position or viewpoint (including mine) raised in this thread. However, kindly refrain from using any abusive language on anyone on my post.

#WO 23/24

#WO 23/24

Read on Twitter

Read on Twitter #ManagingWealth #AssetPortfolio #FxRisks #WO 1/24" title="This is a short thread on Fx risks, devaluation and asset portfolioshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #ManagingWealth #AssetPortfolio #FxRisks #WO 1/24" class="img-responsive" style="max-width:100%;"/>

#ManagingWealth #AssetPortfolio #FxRisks #WO 1/24" title="This is a short thread on Fx risks, devaluation and asset portfolioshttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)"> #ManagingWealth #AssetPortfolio #FxRisks #WO 1/24" class="img-responsive" style="max-width:100%;"/>

" title="I will ignore the statement made by @eldivyn regarding the worth of the house dropping from N60M to N30M in that story. #ManagingWealth #FxRisks #WO 17/24Apart from this erroneous comment, all his other comments are logical https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">" class="img-responsive" style="max-width:100%;"/>

" title="I will ignore the statement made by @eldivyn regarding the worth of the house dropping from N60M to N30M in that story. #ManagingWealth #FxRisks #WO 17/24Apart from this erroneous comment, all his other comments are logical https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏽" title="Down pointing backhand index (medium skin tone)" aria-label="Emoji: Down pointing backhand index (medium skin tone)">" class="img-responsive" style="max-width:100%;"/>