Let me tell you about another recent publication:

"Growing up without finance" (with Brown and Heimer)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2809164

It">https://papers.ssrn.com/sol3/pape... came out at the JFE in Dec 2019:

https://www.sciencedirect.com/science/article/abs/pii/S0304405X19301205

I">https://www.sciencedirect.com/science/a... wasn& #39;t on Twitter then, but I am now. I would have posted this thread back then. 1/n

"Growing up without finance" (with Brown and Heimer)

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2809164

It">https://papers.ssrn.com/sol3/pape... came out at the JFE in Dec 2019:

https://www.sciencedirect.com/science/article/abs/pii/S0304405X19301205

I">https://www.sciencedirect.com/science/a... wasn& #39;t on Twitter then, but I am now. I would have posted this thread back then. 1/n

Pt 1: Financial inclusion is important. Notably, households without access to financial products (i.e., the unbanked) are held back for tons of reasons.

Pt 2: Early life experiences matter. A big literature shows exposures in early life affects later-in-life decisions. 2/n

Pt 2: Early life experiences matter. A big literature shows exposures in early life affects later-in-life decisions. 2/n

Our paper connects these two literatures by showing that early-life exposures to local banking lead to long-term improvements to consumer financial risk (lower delinquencies, higher credit scores).

The effects last for more than a decade. 3/n

The effects last for more than a decade. 3/n

Strategy: we study a setting in which exposures to local banks happen for artificial, historical reasons: Native American reservations.

And, we merge Equifax (NYFRB-CCP) data to reservations, with and without local banks. 4/n

And, we merge Equifax (NYFRB-CCP) data to reservations, with and without local banks. 4/n

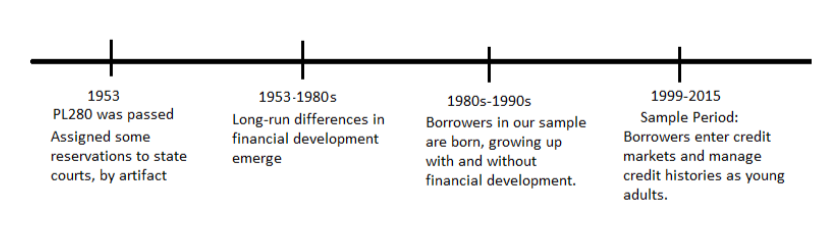

Variation in banking: In 1953, Congress passed a law that state courts could hear civil disputes on reservations (which are naturally sovereign).

The catch: the law didn& #39;t come into force everywhere because (randomly) some states had a clause that didn& #39;t allow this. 5/n

The catch: the law didn& #39;t come into force everywhere because (randomly) some states had a clause that didn& #39;t allow this. 5/n

Local banks flourished under state courts because contracts with businesses were more credible.

This led to a large gap in local financial development, which we studied in a previous paper:

https://academic.oup.com/rfs/article-abstract/30/3/1019/2669944

For">https://academic.oup.com/rfs/artic... this paper, note we have 2 groups: banked and unbanked. 6/n

This led to a large gap in local financial development, which we studied in a previous paper:

https://academic.oup.com/rfs/article-abstract/30/3/1019/2669944

For">https://academic.oup.com/rfs/artic... this paper, note we have 2 groups: banked and unbanked. 6/n

We merged these banked/unbanked geographies with credit histories from the Equifax credit panel for young borrowers.

Our questions: does formative exposure to banks matter for financial health later on? If so, why?

This timeline summarizes our empirical strategy. 7/n

Our questions: does formative exposure to banks matter for financial health later on? If so, why?

This timeline summarizes our empirical strategy. 7/n

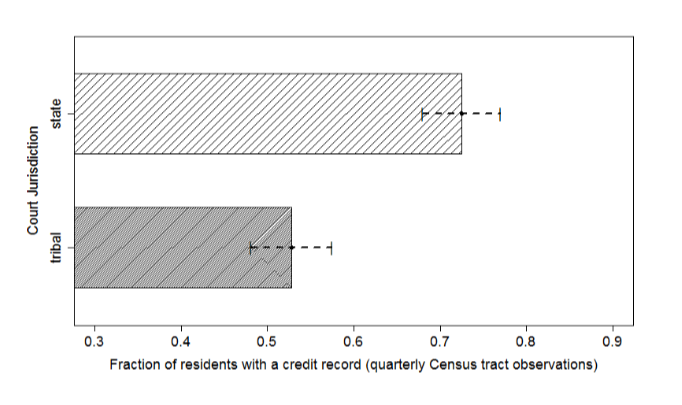

Finding #1: Growing up without finance ==> less likely to have a credit report at all.

Without controls, there& #39;s about a 20pp difference, but this effect survives more sophisticated modeling (see paper). 8/n

Without controls, there& #39;s about a 20pp difference, but this effect survives more sophisticated modeling (see paper). 8/n

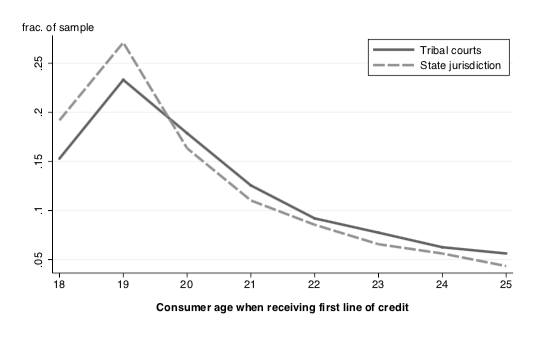

Finding #2: Even for those who access credit eventually, growing up without finance (tribal courts) means later "entry" into formal credit markets.

Again, survives regressions with controls. 9/n

Again, survives regressions with controls. 9/n

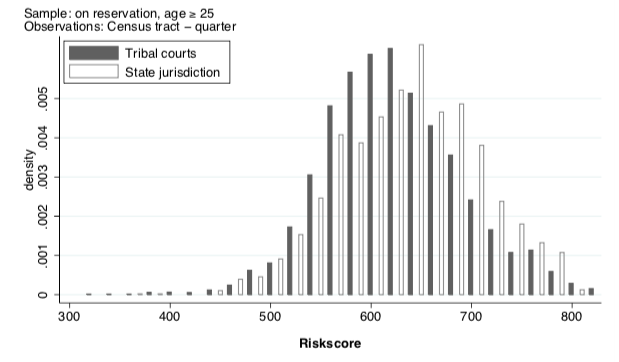

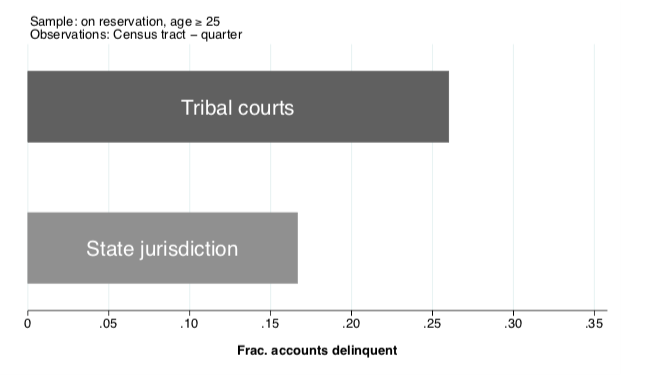

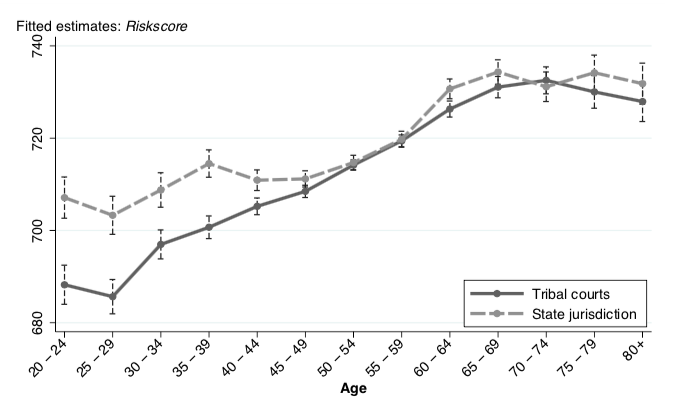

Finding #3: Growing up without finance ==> worse long-term financial health for those who stay in the "bank desert."

Here& #39;s a distribution of consumer riskscores (tribal = growing up without finance). Also worse delinquencies. 10/n

Here& #39;s a distribution of consumer riskscores (tribal = growing up without finance). Also worse delinquencies. 10/n

Finding #4: These effects are driven by folks who *grew up* during a time when state vs tribal had differences in local banks.

Older cohorts see no differences. 11/n

Older cohorts see no differences. 11/n

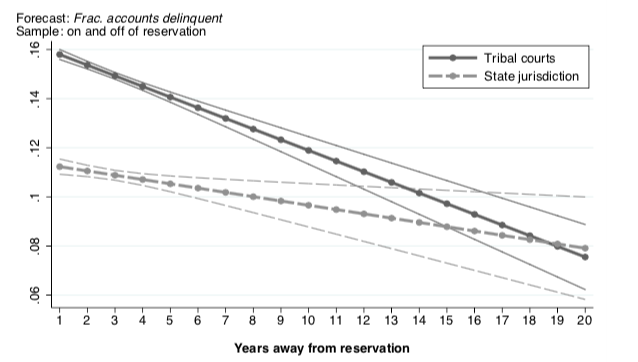

Finding #5: Using a novel movers identification (now also used in a cool paper by @nealemahoney & @Key_Z_E, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3547707),">https://papers.ssrn.com/sol3/pape... we show that the effect takes a long time to go away -- more than a decade. 12/n

Findings #1-5 are great, but you might ask yourself. Why? What about formative exposures leads to these long-term effects?

A number of explanations could come to mind, and credit bureau data offer limited insight into this. Here, I refer you to our very smart referee... 13/n

A number of explanations could come to mind, and credit bureau data offer limited insight into this. Here, I refer you to our very smart referee... 13/n

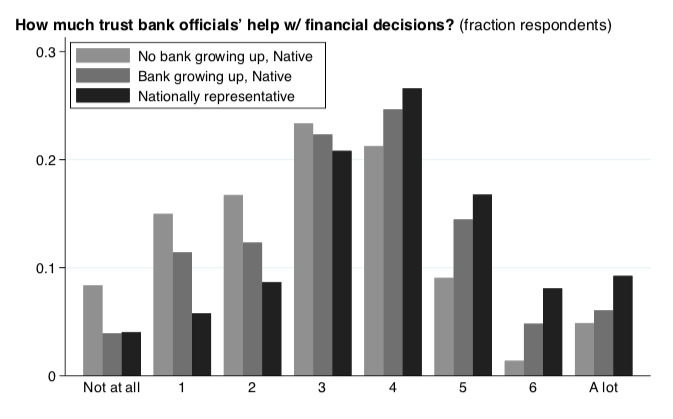

For our JFE revision, we designed a survey to ask about all of these things, working with Qualtrics to recruit nearly 1000 Native Americans to participate.

Most channels didn& #39;t matter, but two items jumped out: bank-specific financial literacy and bank-specific trust. 14/n

Most channels didn& #39;t matter, but two items jumped out: bank-specific financial literacy and bank-specific trust. 14/n

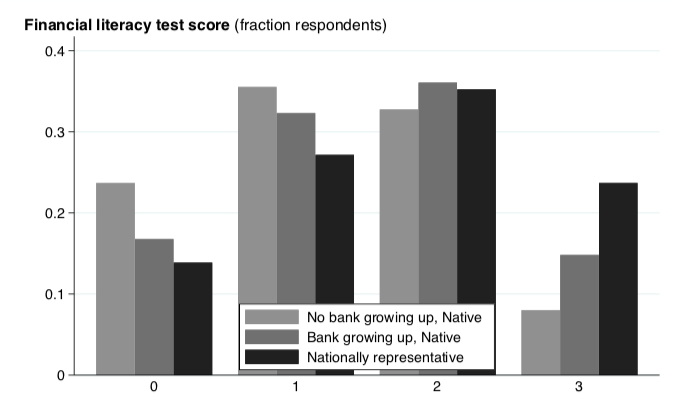

Taking the big-5 fin literacy questions, 2 test knowledge of stocks, whereas 3 deal with interest/compounding.

You can learn interest rates at a bank, stock investing not so much.

Growing up w/o finance ==> worse fin literacy on bank-specific questions (not on stocks). 15/n

You can learn interest rates at a bank, stock investing not so much.

Growing up w/o finance ==> worse fin literacy on bank-specific questions (not on stocks). 15/n

Continuing with the bank-specific theme, we also found that trust in bankers was affected for those who grew up without finance, but not generic trust. 16/n

There& #39;s more in the paper, including other tests of financial literacy & regressions with fixed effects.

For me, the biggest thing I took away from this paper is that surveys can be really useful, especially as a complement to other cool data sources. 17=end.

For me, the biggest thing I took away from this paper is that surveys can be really useful, especially as a complement to other cool data sources. 17=end.

If you& #39;re interested, I also wrote up a lighter take on this paper about a month ago:

https://theconversation.com/growing-up-in-a-banking-desert-can-hurt-your-credit-for-the-rest-of-your-life-130938

This">https://theconversation.com/growing-u... summary focused on how our work relates to the unbanked problem.

https://theconversation.com/growing-up-in-a-banking-desert-can-hurt-your-credit-for-the-rest-of-your-life-130938

This">https://theconversation.com/growing-u... summary focused on how our work relates to the unbanked problem.

Read on Twitter

Read on Twitter