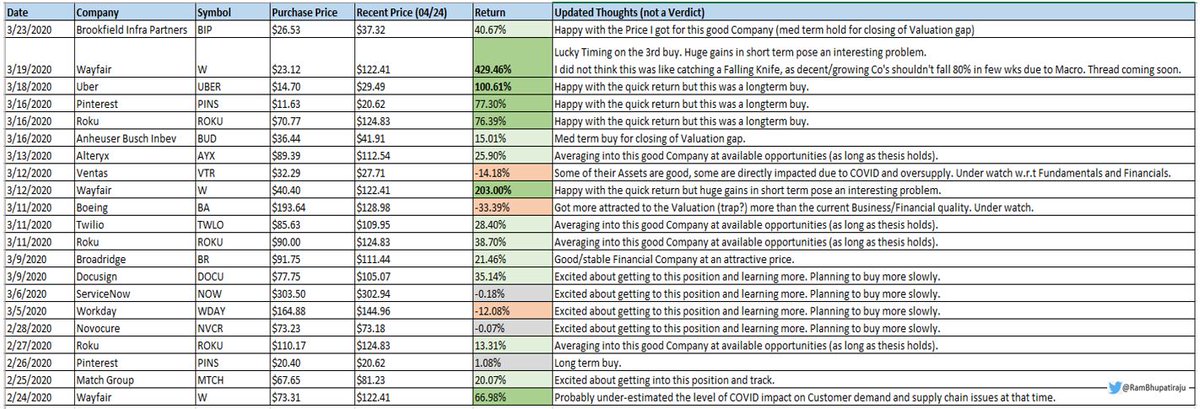

Some quick reflections from the recent Bear Market. Thoughts, actions, results and more...

cc: @saxena_puru @FromValue @Matt_Cochrane7 @BrianFeroldi @TMFJMo @BluegrassCap

$W, $PINS, $UBER, $ROKU, $TWLO, $BUD, $BIP, $AYX, $DOCU, $NOW, $WDAY, $NVCR, $MTCH, $BIP, $BR, $BA, $VTR

cc: @saxena_puru @FromValue @Matt_Cochrane7 @BrianFeroldi @TMFJMo @BluegrassCap

$W, $PINS, $UBER, $ROKU, $TWLO, $BUD, $BIP, $AYX, $DOCU, $NOW, $WDAY, $NVCR, $MTCH, $BIP, $BR, $BA, $VTR

This thread is not as much about the short term results (grateful for the results as the bounce back was quick/big).

It& #39;s to share some of the thoughts on and observations from the Feb/Mar meltdown.

It& #39;s to share some of the thoughts on and observations from the Feb/Mar meltdown.

It& #39;s also a look back to see if any mistakes were made in the process/thesis during that volatile/stressful time.

**This is more like a journal. None of this should be taken as Investing advice as each person& #39;s situation is highly unique.**

**This is more like a journal. None of this should be taken as Investing advice as each person& #39;s situation is highly unique.**

I& #39;m not a trader (nothing wrong with that if you& #39;re competent/disciplined & good at managing risk).

My usual activity in normal times is very low (<1 transaction a Mo) but bought so many in Feb/Mar

My usual activity in normal times is very low (<1 transaction a Mo) but bought so many in Feb/Mar

as they have been in my Watchlist for a while, and the crazy volatility presented an incredible opportunity.

Most of these are bought as long term positions with growth thesis (except for valuation based buys like BUD, BIP, BR, VTR, BA...).

Most of these are bought as long term positions with growth thesis (except for valuation based buys like BUD, BIP, BR, VTR, BA...).

The time to do initial research on good Co& #39;s is during normal times. If you try to do this during Bear mkts, the falling prices and negative sentiment all around will dictate your qualitative analysis of the Co, and make the Co appear weaker than it actually is for the longterm.

You can still do some scenario analysis during bear markets to see if the Co can survive/thrive and the probable outcomes for the Co and the stock, but the initial thesis formation on the company is better to be done during normal times.

The purchases made early in the Bear Market could feel very bad in the short term (losing 30-40% more very quickly) and make you question your thesis really hard.

Purchases made at the bottom (known only in hindsight) can accumulate huge gains within a very short time.

Purchases made at the bottom (known only in hindsight) can accumulate huge gains within a very short time.

There are gut wrenching days in the Market when it looks like you& #39;re staring at an abyss and you just want to curl up in a corner. For me personally, March 18th/19th 2020, Dec 24th 2018, Feb 9th 2016 etc definitely felt so.

These are also the exact times when we need to zoom out of the paralyzing fear, widen our mindset/timeframe, maintain our calm and remember our longterm goals and why we& #39;re investing and act accordingly.

No one expected the Market to fall so much and so quick, and no one expected the Market then to rise so much and so quickly.

No one knows how the overall and eventual economic impact due to COVID-19, and the market gyrations in the meantime are going to turn out.

No one knows how the overall and eventual economic impact due to COVID-19, and the market gyrations in the meantime are going to turn out.

Personally I plan for it being conservative, only buying quality Co& #39;s, waiting for opportunities to buy, buying in smaller chunks but more frequently, not letting Market dictate your conviction in the businesses (and ur estimate of intrinsic value), thinking and acting longterm.

Good Luck to you all w.r.t Portfolios with whatever impact COVID-19 may bring to the Economy & Markets in the next few months.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

/END

/END

Read on Twitter

Read on Twitter