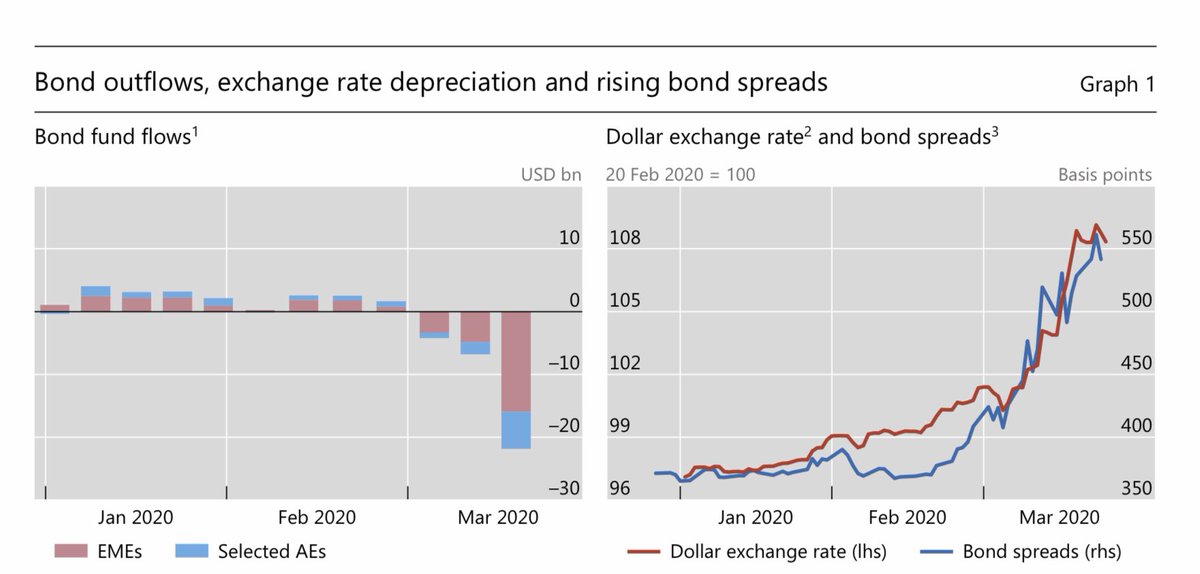

1/ Extremely important lesson. Even if many emerging markets have developed local bond curves they are still exposed to swings in global financial cycles. This time dependent on $US, not VIX indicators. https://twitter.com/HyunSongShin/status/1254078663596924929">https://twitter.com/HyunSongS...

2/ Nonetheless, it is encouraging that this time around #EmergingMarkets have more flexible FX and credible central banks. Most could cut into the shock even if FX contaminated local spreads.

3/ Some even ventured into forms of #QE, although many won’t call it that, but rather market stabilizing measures including South Africa, Turkey, Indonesia.

4/ Others found that it is easier to control local market (it is a dilemma after all) by pushing foreign investors away from their local markets following in the footsteps of Malaysia some 20y earlier @tashecon

5/ The line between capital controls and capital control management tools is fine. We are waiting for some guidance from the @IMFNews integrated policy framework.

Having developed local markers and moved away from the “original sin” doesn’t insulate #EmergingMarkets from global financial cycles. It is a dilemma, not a trilemma @helene_rey, but @HyunSongShin makes an additional point that now it is dollar driven rather than VIX.

Read on Twitter

Read on Twitter