1/ Had a bunch of friends ask me about post-Covid #housing mkt, obv a big topic on many minds. So let& #39;s do quick thread, just sharing some thoughts.

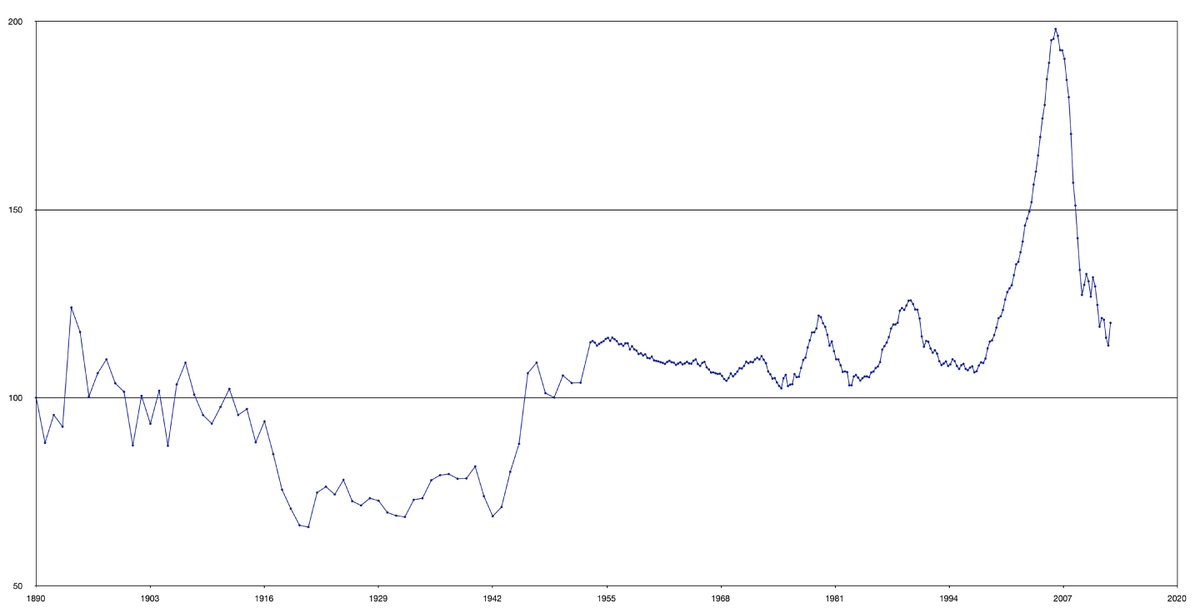

Here& #39;s Case-Shiller home price 1890-now on real basis (1890 = 100). Despite bubbles, note there& #39;s really little real gain.

Here& #39;s Case-Shiller home price 1890-now on real basis (1890 = 100). Despite bubbles, note there& #39;s really little real gain.

2/ Shiller says that& #39;s probably bc housing is actually not that constrained a good: virtually infinite land, technological improvements, & family mobility means prices are kept low over time. That "expensive" you see is really inflation, as I showed here: https://twitter.com/RobbSmith/status/1200003622454513666?s=20">https://twitter.com/RobbSmith...

(Digression: I keep begging people to remember that 70% of their political anger right now—on the right *and* left—is really anger at the effects of inflation. But the government-capital-media nexus is masterful at disguising this fact, when they even understand it.)

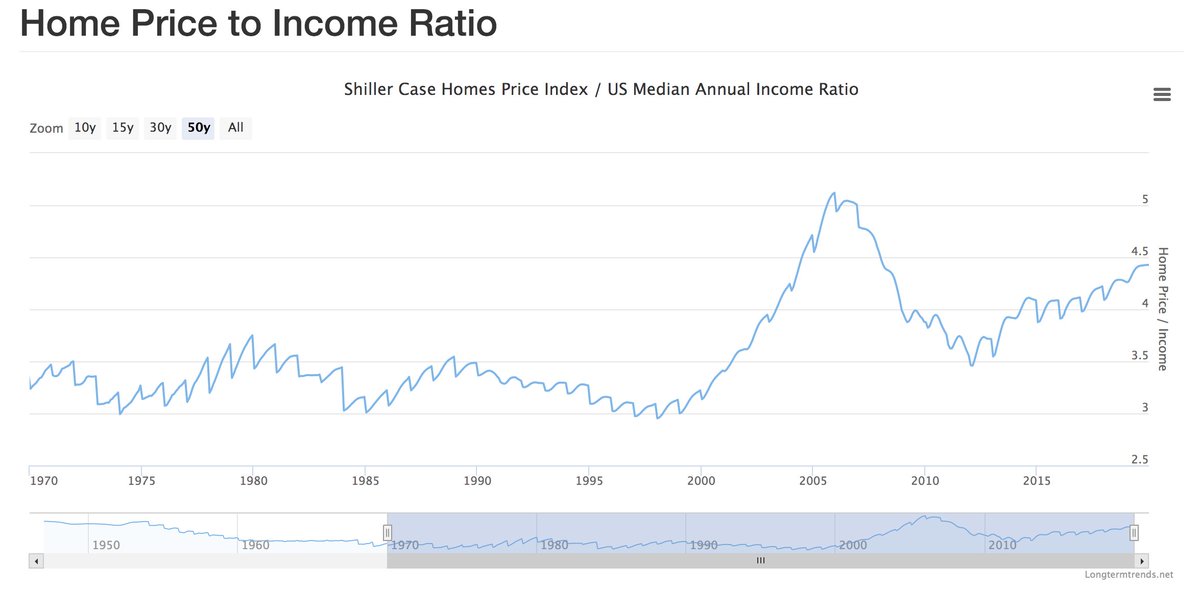

3/ But there& #39;s no doubt that housing is historically expensive now, just pre-Covid. Price/income in the pre-financialization era up to yr 2000 was about 3-3.5. Since 2000, bubbles galore up to 4.5-5.

4/ Even pre-Covid, not sustainable: past 20 years have been "bubble top" amidst declining real interest rates bc of boomer career capital accumulation & China capital surplus, both of which *are reversing right now anyway.*

Pre-Covid housing is prolly overpriced by 20%.

Pre-Covid housing is prolly overpriced by 20%.

5/ Enter Covid, which has immediately made housing 98% illiquid (no sales, or very few) during quarantine. 26.5 million, 20%+ unemployment. Credit tightened instantly as banks pull out of jumbo lending, tighten standards elsewhere.

Across the board de-risking of credit.

Across the board de-risking of credit.

6/ Institutional buyers gone. iBuyers, REITs, foreign buyers, all gone: they& #39;ll each be bailing water themselves so as not to drown in face of massive liquidity problem (solvable by Fed), then insolvency (not easily solvable by Fed, below).

7/ So post-quarantine, marginal buyer will be: employed (govt, healthcare, consumer staples only places there will be credit-worthy jobs); liquid (20%+ downpayment); great credit (700+); & perhaps most important of all: impatient & willing to take huge price risk.

ie: Not many.

ie: Not many.

8/ *Immediately* post-quarantine, I expect a burst of pent-up activity as some ppl rush to get back to normal. Buyers & sellers will want to normalize ASAP. If it happens at all, this will be a VERY SHORT sugar high, maybe less than 2 months. Media will extol it.

9/ But soon after, sugar high ends. Hope can& #39;t sustain reality. High-grade demand evaporates (no jobs, no credit). And sellers, knowing this, will stay off market (as now), so inventory will drop.

10/ Once again, this will also be head fake: it will *look* like price equilibrium as low demand & low supply keep prices maybe somewhere like recent... but only temporarily.

Beneath the surface, market volume has absolutely tanked. Which means we& #39;re not seeing *real prices* yet

Beneath the surface, market volume has absolutely tanked. Which means we& #39;re not seeing *real prices* yet

11/ For those not in finance: With low volume, you can& #39;t trust prices. Bid-ask spreads will be widening. Market will still be relatively illiquid, & you& #39;ll start to see massive price volatility: e.g., house next door sold $400K in & #39;17, asking $550K today, sells $385K tomorrow.

12/ Prices volatile, Feds will have to waive appraisals to lend against anything as this happens, as low volume/high volatility creates hell for creditors trying to assess risk.

Bc at some point, gravity will hit. Housing simply can& #39;t outrun unemployment, deflation & depression.

Bc at some point, gravity will hit. Housing simply can& #39;t outrun unemployment, deflation & depression.

(Digression: Good moment to note: Feds can& #39;t let housing burn. Largest asset class for avg Americans. Destroys pensions, destroys politicians, destroys Wall St... destroys society...

...Power players will do WIT to stop this. Up to & including Federal Reserve directly underwriting mortgages w no credit or real income standards at all.

e.g.: Combine millennial UBI w Fed mortgages & you give Boomers way to safely exit/pass on their biggest financial albatross)

e.g.: Combine millennial UBI w Fed mortgages & you give Boomers way to safely exit/pass on their biggest financial albatross)

13/ In any case, at some point, econ gravity hits. Hard. Sellers want out, but buyers can& #39;t afford it, & real price discovery will finally occur: volume goes way up, and prices will go way down.

14/ Then the panic selling starts. You have to remember 2020 is the end of an 80-year cycle for a reason. It shows up in housing, too: Boomers aging & needing $ for healthcare cannot afford to wait another decade for housing reflation (again). They& #39;ll start selling at any cost.

15/ If you study any asset chart, you& #39;ll see how a bear market behaves. It& #39;s a LOT of false rebounds, head fakes, and shattered hopes amidst a general down trend.

Bottoms are *processes of exhaustion*, as it was from 2006 to 2011. Look at that, wow...

Bottoms are *processes of exhaustion*, as it was from 2006 to 2011. Look at that, wow...

16/ I& #39;ll close this here and add to it as I need to. I& #39;ll say one last thing: housing is not just any asset, it& #39;s a home, precious, amazing, & transcending finance in every important way save one: as the largest asset most people own, if we get it wrong, it can really hurt.

17/ If you& #39;re a buyer, patience is the word. Be willing to wait, as we could see values down 20%, or perhaps in truly dire circumstances and in some locations, 50% (or more). If you& #39;re a seller, try to get out in the "hope rebound" starting now and over the next 90 days.

18/ And, last word, know what $ are worth to you. Money isn& #39;t nearly as valuable as time, so there& #39;s no shame in paying 20% more than you could& #39;ve for a home you raise a family in, or accepting 15% less than a few years ago in order to house a new family.

Life is beautiful.

Life is beautiful.

19/ PS Tweets 2-4: housing isn& #39;t expensive, but it is? Yes! Real value hasn& #39;t moved much in 100 yrs, but nominal value in bubble since 2000, esp on price/income. How to reconcile? INFLATION. It& #39;s destroyed real incomes, & as they& #39;ve stagnated, gold & nominal housing both sky& #39;d

Read on Twitter

Read on Twitter