debt funds

small thread

Investors believed debt mutual funds are safe and can be replaced with Fixed Deposit. In September 2018, after the IL&FS fiasco, Indian investors realized how debt mutual funds are different than fixed deposit & there are risk associated.

#mutualfunds

small thread

Investors believed debt mutual funds are safe and can be replaced with Fixed Deposit. In September 2018, after the IL&FS fiasco, Indian investors realized how debt mutual funds are different than fixed deposit & there are risk associated.

#mutualfunds

Since September 2018 a lot of issuers have been downgraded to D by the rating agencies. D means default, it means payment has not been made on time. Please note mutual funds follow “one day one rupee” default rule. Following is the list of default from September 2019.

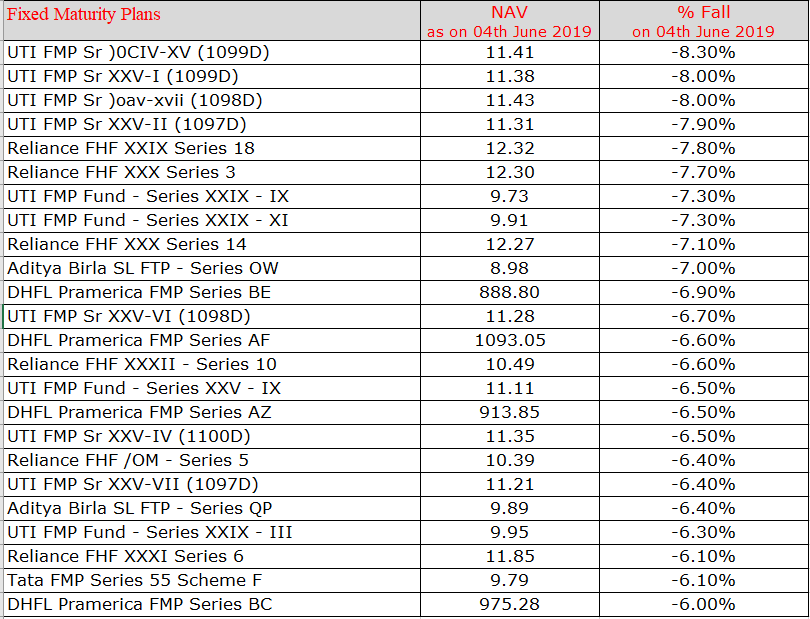

There is a lot of buzz going on that credit risk funds are risky. I think there are other categories out there which are also risky. Look at the impact of DHFL default on open ended funds and Fixed Maturity Plans

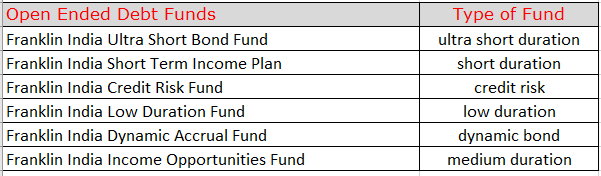

The Trustees of @FTIIndia on recommendations submitted by Franklin Templeton AMC, voluntarily decided to wind up its suite of six yield-oriented fixed income funds, post cut-off time from April 23, 2020.

these six schemes are in different category.

these six schemes are in different category.

One has to scan through their debt portfolio & be sure that the credit quality is of top quality in the respective schemes.

just avoiding credit risk fund as category is not enough.

Scan you fixed income portfolio carefully.

just avoiding credit risk fund as category is not enough.

Scan you fixed income portfolio carefully.

Please make sure you are using your debt allocation only for the purpose of asset allocation as per respective objectives and don& #39;t try to generate excess returns on debt.

Debt is for safety & equity is for risk.

And don& #39;t take that equity risk in small cap ;)

@AdityaD_Shah

Debt is for safety & equity is for risk.

And don& #39;t take that equity risk in small cap ;)

@AdityaD_Shah

Read on Twitter

Read on Twitter