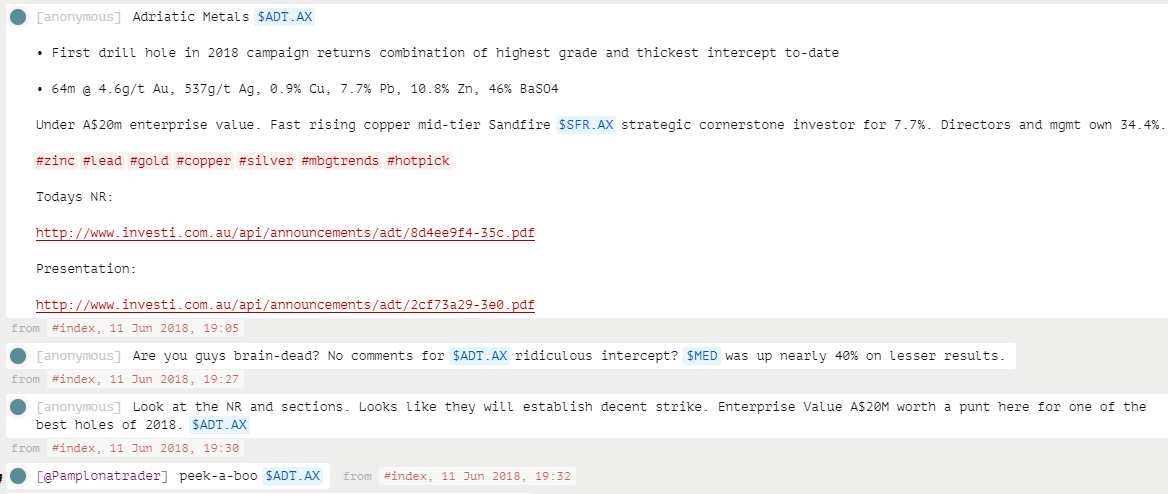

$ADT.AX - one of my larger positions. Bought my position nearly 2 years ago and am just sitting tight. I wanted to go down memory lane and set up what happens next. June 11, 2018 - @mineralised tweeted about it and it caught eye of @TraderPamplona who posted this. 1/

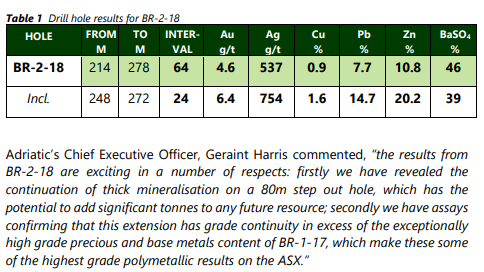

A lot of investors whom I follow, soon bought. I looked at hole BR-2-18 at Rupice and saw it had zinc, lead, gold, silver and copper and was 46% barite. So I called a geologist friend and said, how does this work (Met-wise) but first I bought my initial stake at 30 cents AUD. 2/

I recall the geologist pal said something like, "well, the silver will report to the lead, the copper will report to the gold and honestly, the zinc might get washed out with the tailings, though they could have a way around that. The Met work will figure that out eventually." 3/

Good enough I thought. I felt it was one of the better drill specs of 2018. So I more than doubled my position in mid 40s the next week and ended up at 37 cents AUD cost. But where did this drill story in Bosnia come from? It was a new jurisdiction to almost all the investors. 4/

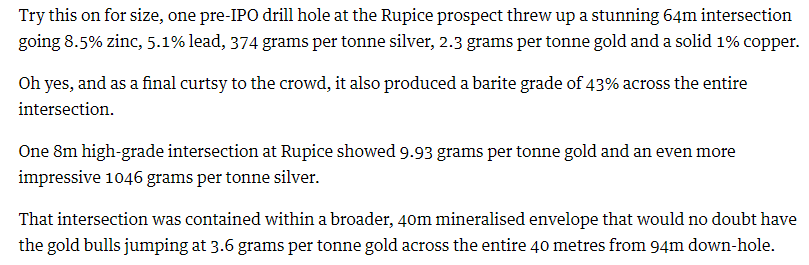

April 30, 2018 - this article appears down under, detailing the story of the then "Bosnian Beast". Adriatic Metals had just IPO& #39;ed at 30 cents AUD. https://thewest.com.au/business/public-companies/bosnian-beast-lurking-as-adriatic-hits-the-boards-on-asx-ng-b88821921z">https://thewest.com.au/business/... 5/

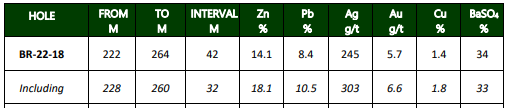

Throughout June to October, Adriatic reported more and more nice intercepts highlighted by the below image on Oct 30, 2018. Now more commonly referred to as the #thebigbosnian on twitter and online, Adriatic seemed ready to fly any day but flatlined around 50 cents for months. 6/

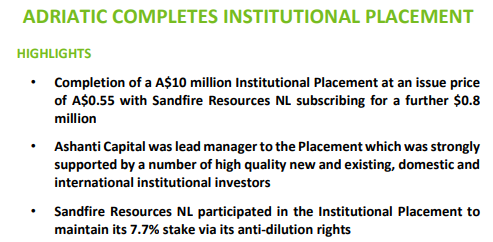

Why? Cash raise. As usual, the market knew the company would need to raise to drill out Rupice. They raised A$10 million at 55 cents. There is that Sandfire company, they liked the project at IPO and continued to support it and maintain their stake. 7/

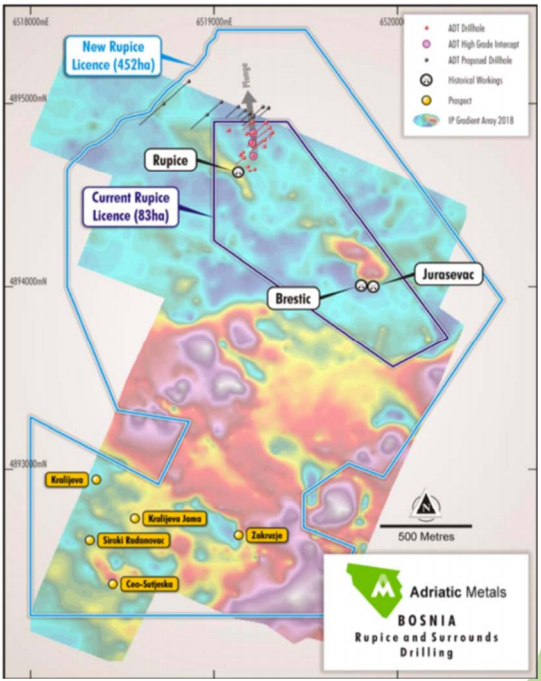

Adriatic was getting very good drill results but also wanted to expand the size of their land package. Shareholders were wary that someone (Sandfire?) might try to get land adjacent to the project. In Feb 2019, ADT was granted an extension which increased Rupice size by 445%. 8/

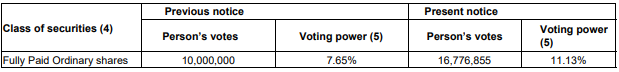

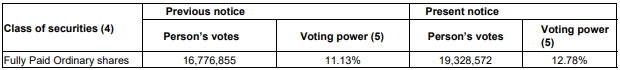

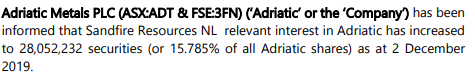

Sandfire definitely liked what was going on. In early July 2019, they filed the first "Notice of change of interests of substantial holder" - this took their stake from 7.65% to 11.13%. Some were nervous SFR might move on ADT in the near future. Share price > $1 at this point. 9/

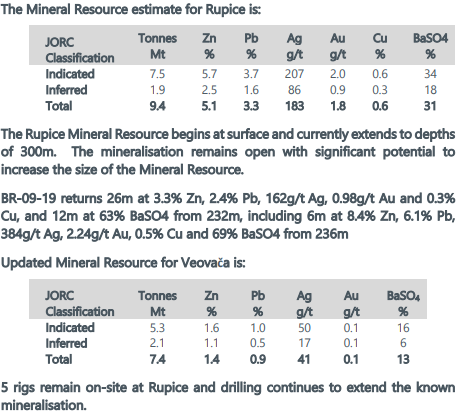

But first, Adriatic had some derisking measures to take on the project. First up on July 22, 2019, the maiden JORC resource estimate on Rupice along with updated RE on historic low grade Veovoca. 9.4 Mt of high grade mineralization for Rupice. Cool. 10/

A small but fierce poly-metallic deposit. 9.4Mt @ 19% ZnEq or 10g/t AuEq. You need good grade if you are going to take on a project that is not a multi cycle project. (maybe it is if you tack on Veovoca project after Rupice is done) 11/

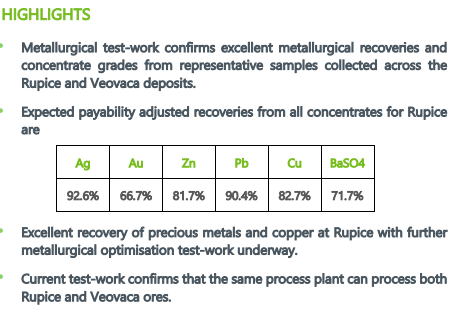

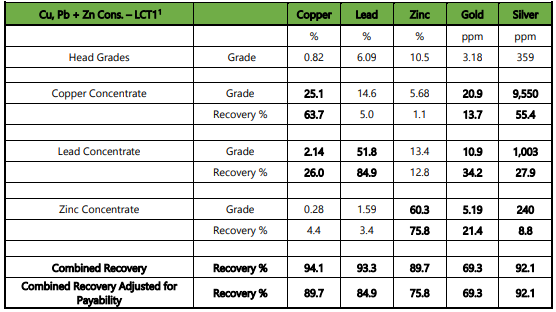

It was now time for the scoping study (PEA for Cdn Venture folks). First though, ADT reported the metallurgical results on Sept 24, 2019 that would go into the scoping study. Stock still hovering around A$1. They also officially appointed Paul Cronin as CEO the week before. 13/

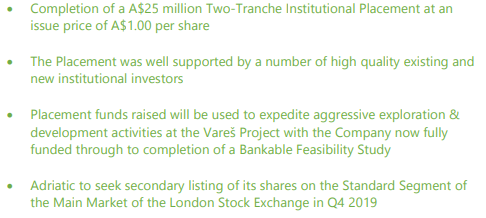

But wait - that damn stock price just kept hovering around a dollar despite good news continuing to be reported. That& #39;s right - another cash raise, on Oct 30, 2019. A$25 million at A$1 per share. With that out of the way, the stock ran from ~$1 to $1.42 on Nov 18, 2019. 14/

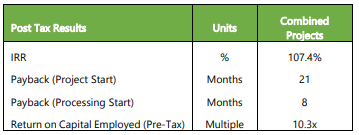

Now what? Oh yeah, scoping study. Nov 18, 2019 - Paul Cronin and company drop the mic with this beauty. Highlights were post tax NPV (8%) of US$916.6m and post tax IRR of 107.4% per page 47 of this document. $https://www.investi.com.au/api/announcements/adt/d6d7a8c4-071.pdf 15/

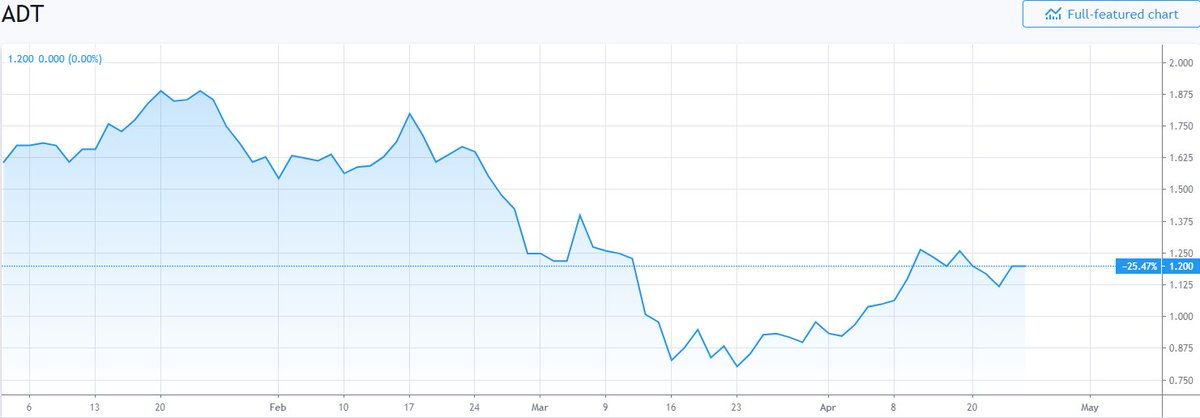

The stock took off in the next couple months, peaking at A$1.86 and becoming dual listed on the London Stock Exchange to make takeovers more difficult. Sandfire bought more. That took us into 2020 where talk centred around getting environmental then exploitation permits. 16/

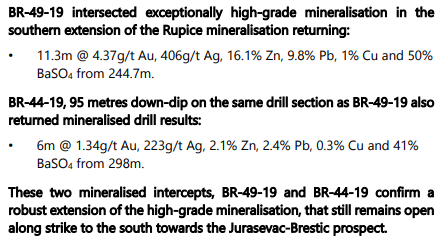

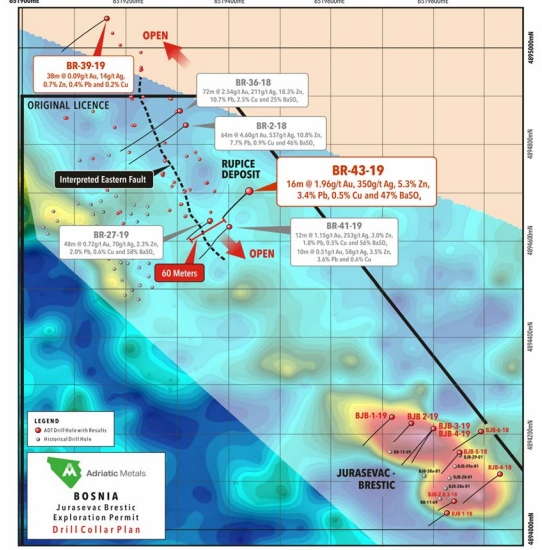

Adriatic was still drilling though. On Jan 16, 2020, they reported high grade intercepts which extended Rupice to the south. These are not as thick of intercepts as the best parts of Rupice but I was pleased to see the high grade was still showing up there. 17/

The hope is that Rupice eventually connects to the south to Jurasevic-Brestic but much more drilling will be needed to sort that out. They are hitting the mineralization deeper right now so my hope is for something like a syncline as they proceed towards J-B. 18/

More met work came down in January 2020. "it is now expected that the copper concentrate will be in excess of

95% payable as compared to the previous assumption that the copper/lead concentrate would be only 30% payable." A nice improvement overall. 19/

95% payable as compared to the previous assumption that the copper/lead concentrate would be only 30% payable." A nice improvement overall. 19/

Feb 2020 was kind of a quiet month then boom. COVID-19 came along to throw us sideways, no, straight down. To be fair, the stock price started dropping before March but the flight to liquidity took its toll here before ADT partly recovered in April. 20/

That takes us to current days. Drilling has been slowed down a little but the Bosnian government has been incredibly supportive and ADT still has 5 drills going. The Veovoca environmental permit was delayed due to COVID but approved last week. Will receive permit in 30 days. 21/

Next up..."Adriatic will submit an application for an Urban Planning Permit to the Federal Ministry for Spatial Planning. This application

requires approvals from nine different utility and community service companies

to be submitted. These approvals have been obtained." 22/

requires approvals from nine different utility and community service companies

to be submitted. These approvals have been obtained." 22/

"Upon receiving the Urban Planning Permit, the application for Exploitation will

be made to the Federal Ministry for Energy, Mining & Industry." Meanwhile ADT will likely produce a PFS on the project by Q3/20. 23/

be made to the Federal Ministry for Energy, Mining & Industry." Meanwhile ADT will likely produce a PFS on the project by Q3/20. 23/

ADT said PFS is due Q2/20 but I cannot imagine it hasn& #39;t been slightly delayed by events this year. Rupice will grow and I expect some improvements from prior scoping study. I expect a bit larger NPV due to bigger resource, addition of copper concentrate, etc etc. 24/

So that& #39;s some of the story as of April 24, 2020. Did I miss anything notable? @Pete__Panda had a great post explaining the below historic chart to late 2019 here: https://petepanda.com/timelines-adriatic-metals/

Where">https://petepanda.com/timelines... do we go from here twitter-land? #thebigbosnian @croninpd 25/25

Where">https://petepanda.com/timelines... do we go from here twitter-land? #thebigbosnian @croninpd 25/25

Read on Twitter

Read on Twitter