Plunge and bounce. All the market is doing now is debating whether we’ll be on the red line or the green line next year https://twitter.com/adam_tooze/status/1250506680367935488">https://twitter.com/adam_tooz...

Everyone has an opinion on red vs green. Objectively, there is no way to have any degree of certainty given the large number of unknowns

More https://twitter.com/adam_tooze/status/1250416082139086849">https://twitter.com/adam_tooz...

This extreme uncertainty is reflected in volatility, and years like this have an overwhelming tendency to remain volatile https://twitter.com/MacroCharts/status/1252915050190213120">https://twitter.com/MacroChar...

You can throw 1Q (a different world) and 2Q (epically bad) in the toilet. 3Q (and 4Q more so) will offer the first clue about whether we’ll be on the red or green line next year https://twitter.com/LaMonicaBuzz/status/1253766281599295490">https://twitter.com/LaMonicaB...

Also throw valuations based on next 12 months in the toilet: 2Q (and 3Q) will be horrible. Market is focused on FY21: will it be 5, 10 or 15% below trend EPS? Red or green line?

That uncertainly (and extended timeframe) obviously implies a much lower PE than the 19x at which $SPX was priced in February.

Fun with numbers: Ed Yardeni expects FY21 EPS of $150 (8% below FY20).

- At 15x (long term median PE), $SPX ‘fair value’ 2250.

- 14x = 2100.

- 13x = 1950.

Market doesn’t follow 1-yr forward PEs very closely (R2 < 10%) but a return to those levels would make some sense

- At 15x (long term median PE), $SPX ‘fair value’ 2250.

- 14x = 2100.

- 13x = 1950.

Market doesn’t follow 1-yr forward PEs very closely (R2 < 10%) but a return to those levels would make some sense

A ‘second wave’ in the autumn will drive those numbers lower; a breakthrough in technology will push them higher. A sideways range 2000-3000 (false breaks in both directions) will frustrate the most

https://twitter.com/HumbleStudent/status/1254427706353057793">https://twitter.com/HumbleStu...

There is no discernible correlation between rates and valuations at all http://fat-pitch.blogspot.com/2014/11/are-low-rates-responsible-for-high.html">https://fat-pitch.blogspot.com/2014/11/a...

FY20 EPS will be a disaster. Mr market is instead pricing off FY21 and trying to guess how much below FY19 it& #39;ll be. Current swag of $170 likely to fall to ~$150. Look higher in thread https://twitter.com/GS_CapSF/status/1255183932741447680">https://twitter.com/GS_CapSF/...

If you reopen, they still might not come https://twitter.com/adam_tooze/status/1255361166521643009">https://twitter.com/adam_tooz...

Likewise: https://twitter.com/DiMartinoBooth/status/1255186879030362115">https://twitter.com/DiMartino...

It’s early and it will take time https://twitter.com/JHWeissmann/status/1259903233994248193">https://twitter.com/JHWeissma...

What happened 2 months ago (1Q20) and even now (2Q20) is not indicative of what is likely in 2021 and beyond ($SPX’s focus) https://twitter.com/TheOneDave/status/1259906995886477312">https://twitter.com/TheOneDav...

https://twitter.com/TheOneDave/status/1260267063463096321">https://twitter.com/TheOneDav...

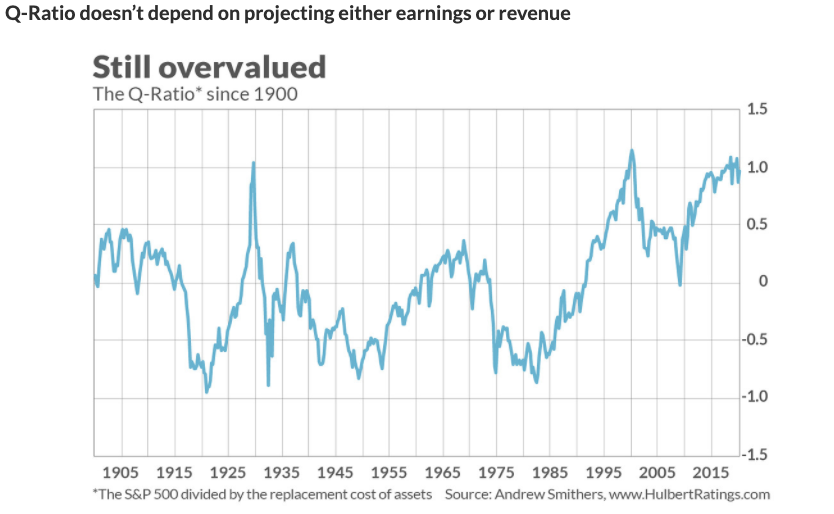

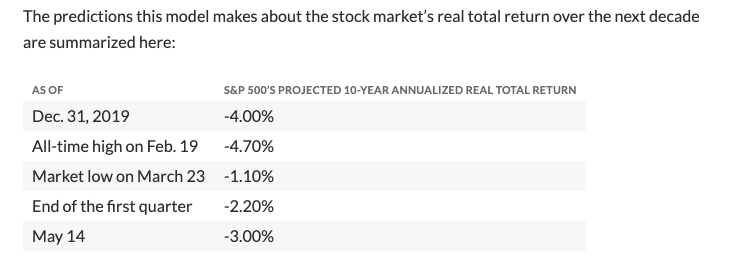

Q-Ratio has been able to explain 52% of the variations in the market’s 10-year returns, one of the highest r-squareds you will ever find in the stock-market

https://www.marketwatch.com/story/this-settles-the-stock-market-valuation-debate-between-david-tepper-and-nelson-peltz-2020-05-15">https://www.marketwatch.com/story/thi...

https://www.marketwatch.com/story/this-settles-the-stock-market-valuation-debate-between-david-tepper-and-nelson-peltz-2020-05-15">https://www.marketwatch.com/story/thi...

Public pension funds are already underfunded.

https://twitter.com/adam_tooze/status/1261533084740182017">https://twitter.com/adam_tooz...

https://twitter.com/DiMartinoBooth/status/1262865413240692737">https://twitter.com/DiMartino...

$SPX is overvalued (scroll up) but looking at next 12-m makes it absurd because it’s focused on what is probably an extreme outlier period

Read on Twitter

Read on Twitter