THREAD: This week, Social Security’s trustees projected that reserves in the retirement trust fund will deplete in 2034 & the disability fund in 2065. But the report didn’t look at how a significant COVID-19 recession could change these dates. So, @nickogladstone & I did. (1/12)

There’s been much discussion over how this downturn will compare to the Great Recession, when Social Security’s trust funds took a beating. In 2008, the trustees thought the retirement trust fund reserves would run out in 2041. By 2012, that date had moved up to 2033. (2/12)

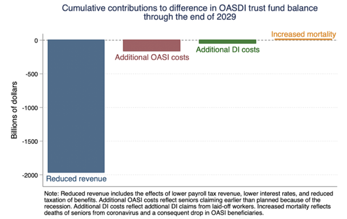

Recessions drain the TFs. Revenue falls. Laid-off people (& their employers) don’t pay payroll taxes. Lower interest rates reduce interest earned by the TF on its bonds. Fewer people earn enough for their SS benefits to be taxed. (3/12)

Recessions also raise costs. Laid-off workers claim disability insurance, while a wave of seniors who are forced to retire early can mean extra claims of retirement benefits in the near term. (4/12)

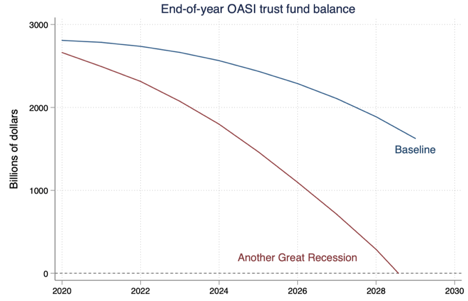

We first simulate a scenario similar to the Great Recession & its aftermath, with small adjustments (eg, an older population & higher senior mortality from covid). This is a replay of 2008-17, so deep recession and slow recovery w/ depressed productivity growth & weak LFPR (5/12)

This “second Great Recession” would deplete the retirement trust fund in 2029 and the disability TF in 2024 (!) – a full 41 years earlier than the current projection. (The disability fund depletion date tends to be highly susceptible to economic swings.) (6/12)

If these trust funds were depleted, benefits could only be paid from Social Security’s revenues, which are not enough to cover promised benefits. Retirement benefits would immediately be cut by 24%, disability benefits by 8%. (7/12)

Nobody knows how COVID will play out, so we model variations on the GR and recovery: a recession twice as bad as GR, and the worst 2 or 3 years of the GR followed by a recovery that’s 2x as fast. In every case, retirement and disability TFs are both depleted this decade. (8/12)

If any of these scenarios materializes, it would mean all Social Security trust funds fail their tests of short-term financial adequacy. This would be the first time the retirement trust fund has failed since the test was introduced in 1991. (9/12)

What’s driving the sooner depletion date? Lower revenue or higher costs? Almost the entire explanation is lower revenue, mostly from reduced payroll taxes. This seems right, since 26M layoffs is no joke! (10/12)

Important note: This isn’t a prediction of how COVID will unfold nor of Social Security’s finances by its end. I hope this recession is milder than anything we modeled! We’re just giving a sense of possible impacts compared to familiar benchmarks (11/12)

These estimates are preliminary and will be refined in a longer report coming soon. We’ll also look at milder scenarios, without long tails like the GR had. Our full preliminary analysis can be read here (12/12) https://bipartisanpolicy.org/blog/covid-19-may-deplete-social-security-trust-funds-this-decade/">https://bipartisanpolicy.org/blog/covi...

Read on Twitter

Read on Twitter