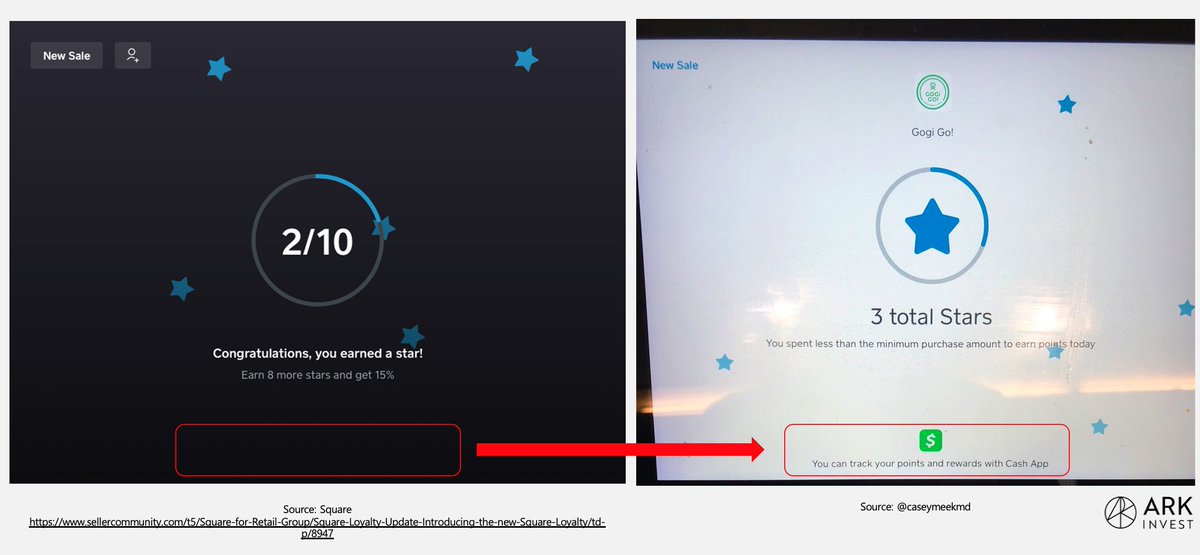

Square is starting to integrate @CashApp into its loyalty program

As captured by @caseymeekMD (below), points and rewards will be accessible via Cash App

Seems pretty straight forward

But could have big implications for customer acquisition in both ecosystems

Short thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">

As captured by @caseymeekMD (below), points and rewards will be accessible via Cash App

Seems pretty straight forward

But could have big implications for customer acquisition in both ecosystems

Short thread

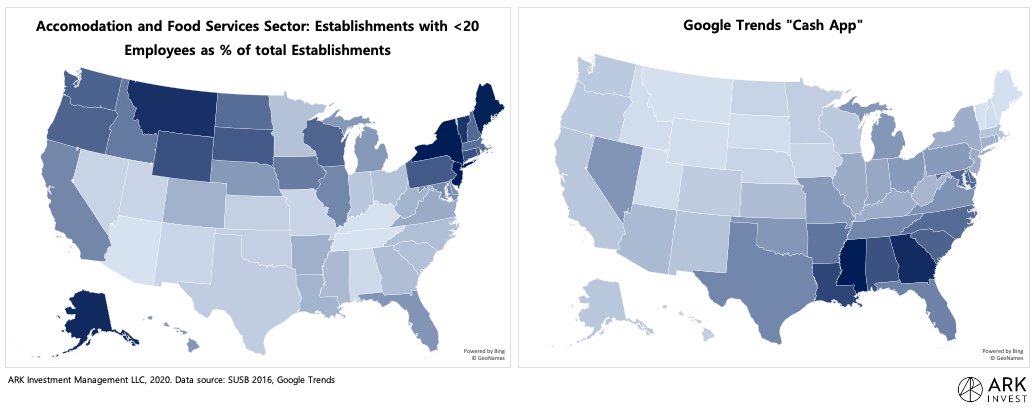

There likely is low geographic overlap between Cash App users and SQ POS merchants

Therefore, loyalty via Cash App could drive

1 Cash App adoption in SQ merchant regions

2 SQ merchant adoption in Cash App regions

See chart below (using Google Trends and US Census data as proxy)

Therefore, loyalty via Cash App could drive

1 Cash App adoption in SQ merchant regions

2 SQ merchant adoption in Cash App regions

See chart below (using Google Trends and US Census data as proxy)

On left map: Establishments ≠ firms. Firms consist of one or more establishments (e.g. chain locations). Square primarily sells to SMBs (using <20 employees as threshold). Square penetration should be high in states where share of <20 employee establishments is high.

... in other words, Square& #39;s POS penetration should be high where there are a lot of independent coffee shops, bakeries etc. (using Accommodation and Food Services sector in example above)

Which translates to the inverse of Cash App& #39;s geography (Cash App: South; POS: Non-South)

Which translates to the inverse of Cash App& #39;s geography (Cash App: South; POS: Non-South)

The loyalty program could incentivize Square POS shoppers in trendy coffee shops in NYC & SF to download Cash App and earn rewards

And Square could use loyalty program to convince businesses to switch over to Square in regions with high Cash App but low Square POS penetration

And Square could use loyalty program to convince businesses to switch over to Square in regions with high Cash App but low Square POS penetration

The latter could be even more impactful

Square& #39;s GPV only is is ~2% of total card spent in US, but more than 10% of US adults are monthly active Cash App users (24m as of 2019)

Providing access to (at least) 10% of local consumers is huge value add Square can offer businesses.

Square& #39;s GPV only is is ~2% of total card spent in US, but more than 10% of US adults are monthly active Cash App users (24m as of 2019)

Providing access to (at least) 10% of local consumers is huge value add Square can offer businesses.

What could "access" mean? When combined with Square& #39;s Boost rewards program, Loyalty could be turned in to an advertising platform for local businesses to directly interact with consumers.

Square could help merchants off the ground by partnering on merchant-side #CashAppFridays.

Square could help merchants off the ground by partnering on merchant-side #CashAppFridays.

To clarify, Square has POS merchants all over the US, including the Southern states. It& #39;s likely though that the density of Square merchants and Cash App users differs geographically as described above. This could be more of a growth opportunity than an obstacle.

Read on Twitter

Read on Twitter " title="Square is starting to integrate @CashApp into its loyalty programAs captured by @caseymeekMD (below), points and rewards will be accessible via Cash AppSeems pretty straight forwardBut could have big implications for customer acquisition in both ecosystemsShort thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">" class="img-responsive" style="max-width:100%;"/>

" title="Square is starting to integrate @CashApp into its loyalty programAs captured by @caseymeekMD (below), points and rewards will be accessible via Cash AppSeems pretty straight forwardBut could have big implications for customer acquisition in both ecosystemsShort thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="⬇️" title="Downwards arrow" aria-label="Emoji: Downwards arrow">" class="img-responsive" style="max-width:100%;"/>