Most common question lately: does the strong rally mean there won& #39;t be a retest? Short answer: no it doesn& #39;t eliminate odds of a retest, but it increases the chances it will be milder.

We looked at waterfall declines. Chart shows avg. Details in next 4 tweets.

@NDR_Research 1/5

We looked at waterfall declines. Chart shows avg. Details in next 4 tweets.

@NDR_Research 1/5

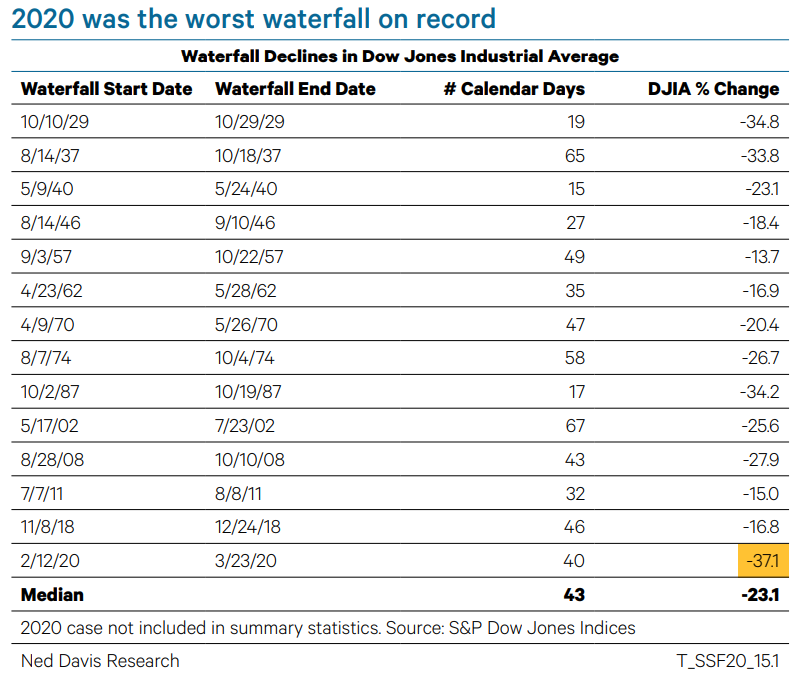

2020 was the worst waterfall on record at -37%.

Caveat: picking waterfall start dates is more art than science. If you start 1929 waterfall on 9/3, the decline is worse, but that includes 4 up days in 5. Regardless, this was a big one. 2/5

Caveat: picking waterfall start dates is more art than science. If you start 1929 waterfall on 9/3, the decline is worse, but that includes 4 up days in 5. Regardless, this was a big one. 2/5

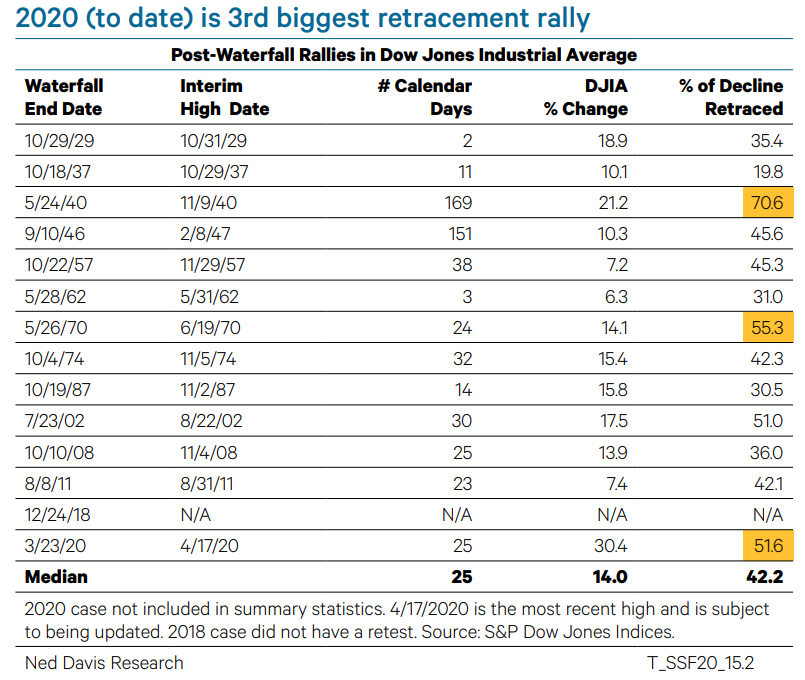

At 30%, the 3/23-4/17 rally is bigger than any previous post-waterfall rally. But after such a big drop, a big bounce isn& #39;t unsurprising.

To adjust for volatility, we looked at % retracement. At 52%, 2020 is the 3rd-biggest post-waterfall retracement rally. 3/5

To adjust for volatility, we looked at % retracement. At 52%, 2020 is the 3rd-biggest post-waterfall retracement rally. 3/5

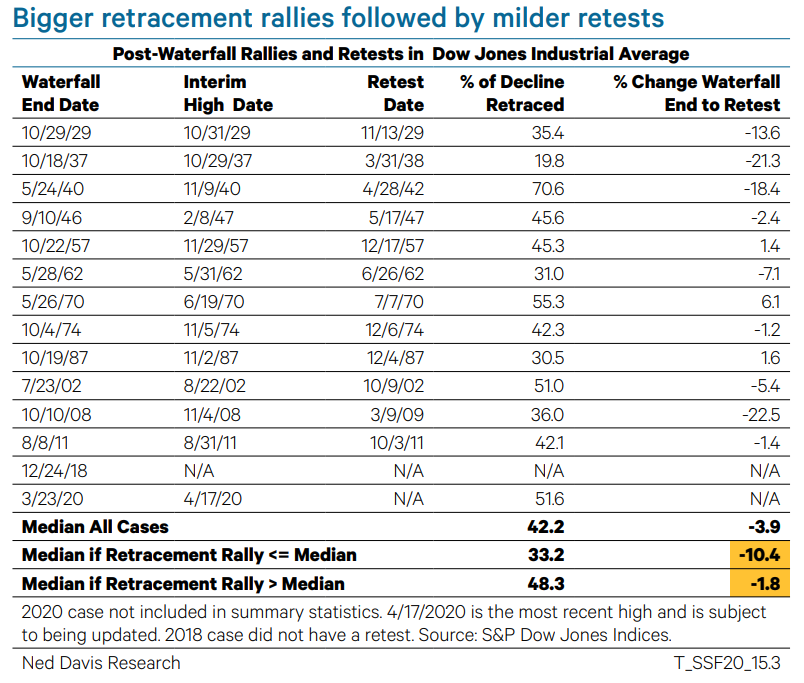

When retracement rallies have been bigger than avg, the retest has been milder. 3 of 4 mildest retests happened after big retracements.

In most cases (9/13), DJIA broke waterfall low. Fed + fiscal stimulus reduced risk of worst-case scenario. Ultimately, it depends on virus. 4/5

In most cases (9/13), DJIA broke waterfall low. Fed + fiscal stimulus reduced risk of worst-case scenario. Ultimately, it depends on virus. 4/5

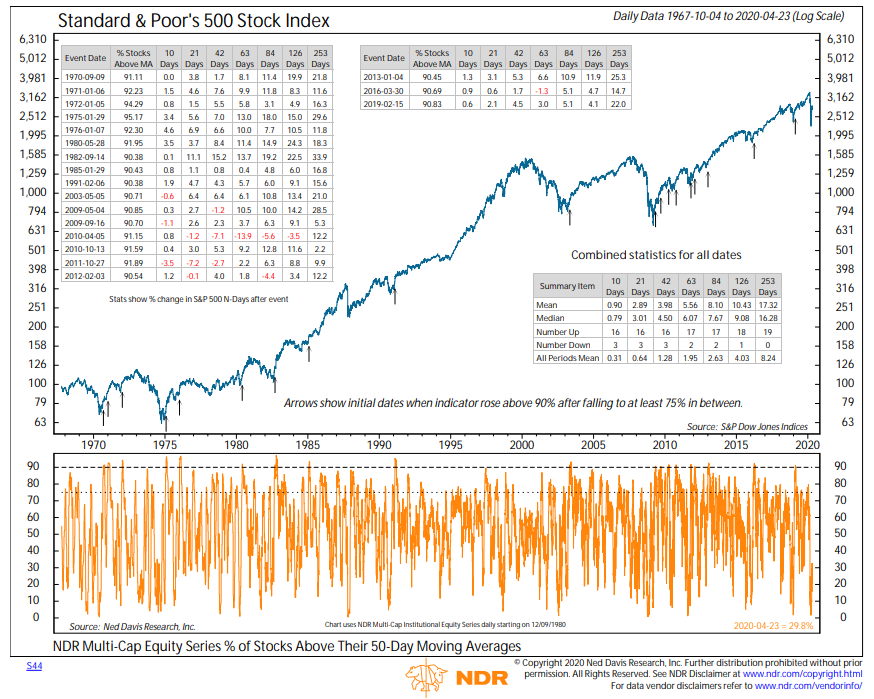

When will we know that retest is over or not going to happen? Look to long-term breadth measures. % stocks > 50-day MA didn& #39;t signal until May 2009, 2 months after the low. It confirmed the rally had follow through. Still strong gains 1 year later. 5/5

Read on Twitter

Read on Twitter