I borrow the words of the great V.S Naipaul in describing Indian Agriculture: An Area of Darkness. Instead of letting rhetoric get in d way, let data to the talking. Except in some parts, it sings. Note: depending on d change in base yr, the interpretation will moderately change.

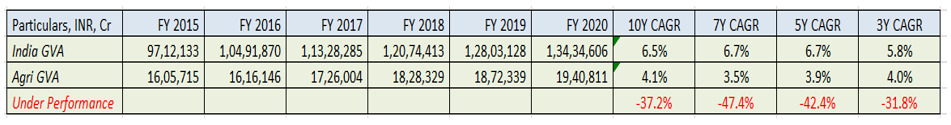

#1 – What 7% growth?

Across all time periods, the avg growth of Indian agri has been just 3.87%. Basically, 50% of India’s pop has subsisted on GVA grwth of just 3%. Categorizing this as grwth is a numerical compulsion. The extent of underperf vs India’s GVA is a massive 40%!

Across all time periods, the avg growth of Indian agri has been just 3.87%. Basically, 50% of India’s pop has subsisted on GVA grwth of just 3%. Categorizing this as grwth is a numerical compulsion. The extent of underperf vs India’s GVA is a massive 40%!

# 2 – It gets worse.

Field Crops, which are the mainstay of agriculture, has grown at a meager 2.5% pa on 10ys & 3ys. Over a 5yr & 7yr frame, growth is 1% or less. (GVA is actual monetary val). Again, categorizing this as growth for any time period is a numerical compulsion.

Field Crops, which are the mainstay of agriculture, has grown at a meager 2.5% pa on 10ys & 3ys. Over a 5yr & 7yr frame, growth is 1% or less. (GVA is actual monetary val). Again, categorizing this as growth for any time period is a numerical compulsion.

# 3 – What the Fish?

The entire drive of growth in the sector has been Livestock & Aquaculture. Aquaculture has been a saviour for several micro economies & the value creation across stake holders is being savoured. However, the glut today in the Coromandel coast is real.

The entire drive of growth in the sector has been Livestock & Aquaculture. Aquaculture has been a saviour for several micro economies & the value creation across stake holders is being savoured. However, the glut today in the Coromandel coast is real.

# 4 – Will it smell?

This presents a high base case risk. One hopes demand keeps pace, but v need to be cognizant of the math. Shrimp economics have deteriorated and should run off sharply in the future, risking slowing down growth rates for the sector.

This presents a high base case risk. One hopes demand keeps pace, but v need to be cognizant of the math. Shrimp economics have deteriorated and should run off sharply in the future, risking slowing down growth rates for the sector.

# 5 Okay, what’s the point?

60% of Agri GVA has seen little/no growth, meaning, there is little/no growth in income & discretionary ability for 30% of India’s population; (60% x 50% of the depndnt population).

60% of Agri GVA has seen little/no growth, meaning, there is little/no growth in income & discretionary ability for 30% of India’s population; (60% x 50% of the depndnt population).

# 6 Meaning? Traditional GVA over 7&3 yrs is just 1%&3% CAGR. This is materially<real CPI & points to a poor lvl of sustenance for 30% of India. W/0 getting into BPL slicing, how do u feed this base into d consumption, grwth, earnings, & ultimately the risk, val vs reward funnel?

# 7 Meaning?

If 50% of India is still dependent on agri which is growing at 3-4% in real terms. Where’s the disposable income and spending power going to emerge from? Except for support from doles, waivers & higher subsidies? Did you just mutter fisc deficit?

If 50% of India is still dependent on agri which is growing at 3-4% in real terms. Where’s the disposable income and spending power going to emerge from? Except for support from doles, waivers & higher subsidies? Did you just mutter fisc deficit?

# 8 A sticky 50

Even though GDP contri from different sectors has undergone a complete overhaul, the # of people employed in Agri as a % of work force has been ticky. In abs numbers, over 20 years, that is more or less static at 50%.

Even though GDP contri from different sectors has undergone a complete overhaul, the # of people employed in Agri as a % of work force has been ticky. In abs numbers, over 20 years, that is more or less static at 50%.

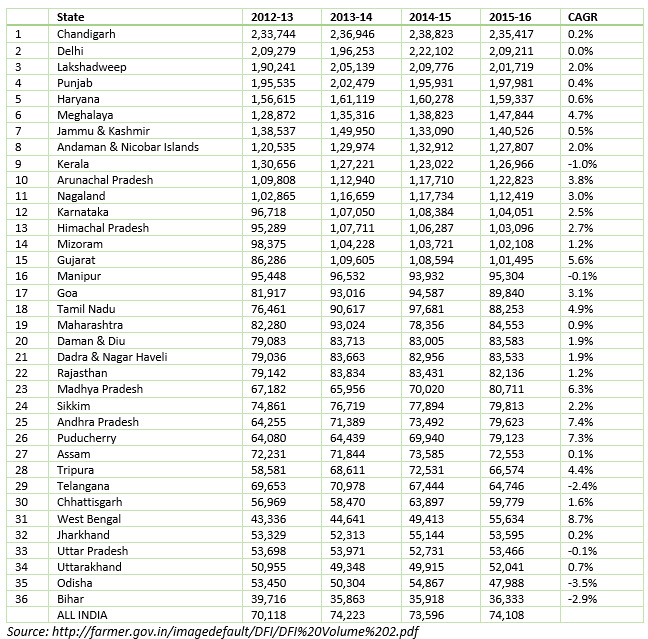

# 9 Does this corroborate with inc of agri houses eing stagnant?

Yup. Between 13-16

•Orisa, Bihar, Teleng, Keral, UP have had -VE incomes

•Ahom, Jharkh, Pnjab, & Maha have had < 1% growth

• States with>than 5% growth: WB, AP, MP & Gujrat. Pass me a Roshogulla n Thepla pl

Yup. Between 13-16

•Orisa, Bihar, Teleng, Keral, UP have had -VE incomes

•Ahom, Jharkh, Pnjab, & Maha have had < 1% growth

• States with>than 5% growth: WB, AP, MP & Gujrat. Pass me a Roshogulla n Thepla pl

# 10 Kitna bana lete ho?

Very few States made > Rs.120,000 p.a. or Rs.10,000 pm. Importantly, the number for India has been more or less stagnant at Rs,75,000 p.a., or Rs.6,200 per month.

Very few States made > Rs.120,000 p.a. or Rs.10,000 pm. Importantly, the number for India has been more or less stagnant at Rs,75,000 p.a., or Rs.6,200 per month.

# 11 This is no longer funny

Almost 50% of all of India’s rural households have seen little or no income growth (from Agriculture) during this period | (How to read this table? UP houses 20% of India’s agricultural households)

Almost 50% of all of India’s rural households have seen little or no income growth (from Agriculture) during this period | (How to read this table? UP houses 20% of India’s agricultural households)

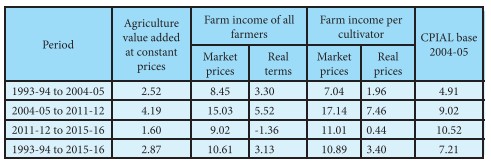

# 12 Give me some Inflation

Even when market prices grew at 15% in favorable conditions, in terms of real growth, it was around 5.5%. This means: commodity level inflation does not translate to farm gate income. It continues to be captured by the traders.

Even when market prices grew at 15% in favorable conditions, in terms of real growth, it was around 5.5%. This means: commodity level inflation does not translate to farm gate income. It continues to be captured by the traders.

#13 Too much of carbs!

Cereals is India’s primary crop & the entire baskets been stagnant. Paddy & friends have had just 0-2% growth! Terming this growth is a math compulsion.

CEREALS occupy 50% of acreage & cont to 30% in value. No change in patterns since Mountbatten left.

Cereals is India’s primary crop & the entire baskets been stagnant. Paddy & friends have had just 0-2% growth! Terming this growth is a math compulsion.

CEREALS occupy 50% of acreage & cont to 30% in value. No change in patterns since Mountbatten left.

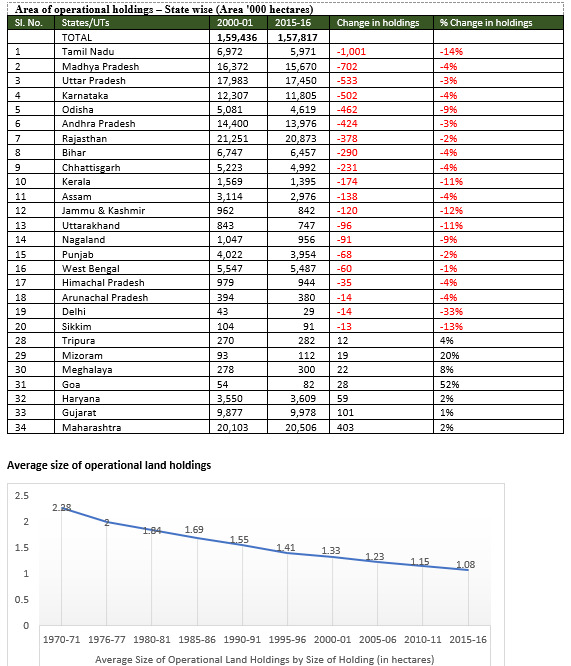

#14 Honey, I shrunk the land

The average size of operational holdings has shrunk by more than half from 2.28 hectares in 1970 to 1.08 hectares in 2016. Because of smaller holdings with limited economic capacity, the economics of cultivation is likely to get worse.

The average size of operational holdings has shrunk by more than half from 2.28 hectares in 1970 to 1.08 hectares in 2016. Because of smaller holdings with limited economic capacity, the economics of cultivation is likely to get worse.

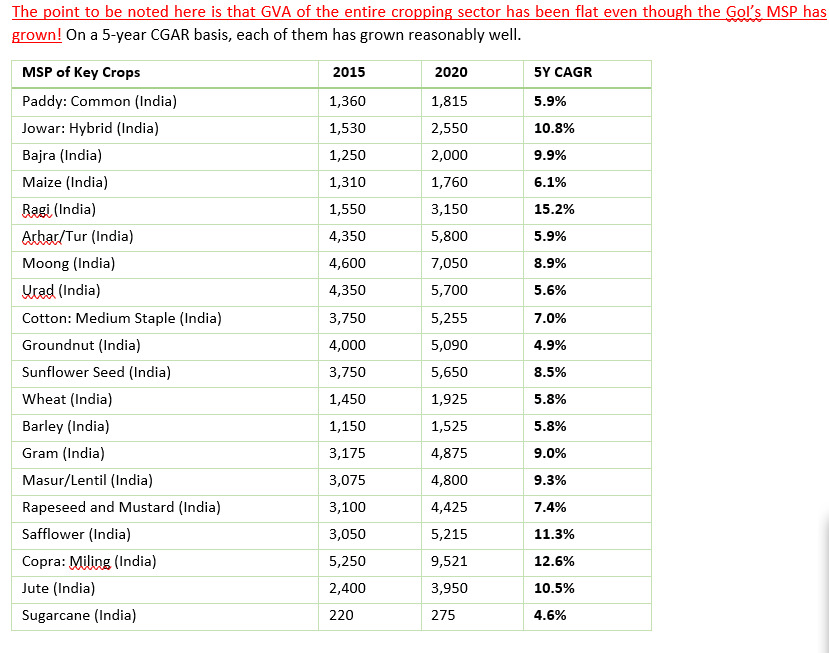

# 15 But MSP?

By some est., MSP cover isn’t > 15%. According to NITI Ayog, farmers in Bihar, UP, MP & Bangla hardly sold at MSP. There are approximately 33.6 million wheat farmers as of 2019, the number availing MSPs in the last 4 years have been less than 4 million.

By some est., MSP cover isn’t > 15%. According to NITI Ayog, farmers in Bihar, UP, MP & Bangla hardly sold at MSP. There are approximately 33.6 million wheat farmers as of 2019, the number availing MSPs in the last 4 years have been less than 4 million.

# 16 What is the point of this noise?

The grumble & pain of B2C’s in India need to be seen from the sensitivity of their business to rural health. 2-W& #39;s to cookies to rural retail to Ag-Chem: the quality of inc in Indian Agri is sub-par & a structural pain.

The grumble & pain of B2C’s in India need to be seen from the sensitivity of their business to rural health. 2-W& #39;s to cookies to rural retail to Ag-Chem: the quality of inc in Indian Agri is sub-par & a structural pain.

#17 The point is this -

What is the eq val of a rural retailer with a great B/S, promoter, and fisc discip, if his underlying is suscep to a peren weak qlty of inc? 1Q out of 4 struggles to recov fixd costs, & the balance depends on how much the rural economy makes... ++

What is the eq val of a rural retailer with a great B/S, promoter, and fisc discip, if his underlying is suscep to a peren weak qlty of inc? 1Q out of 4 struggles to recov fixd costs, & the balance depends on how much the rural economy makes... ++

++ When the base of urban & semi urban spends merge into rural vagaries & competes with urban merchandising that’s getting deeper into rural India, what is the play off between safety & return of incremental capital? How do u recov lost capital? ++

++ How do you value the equity of one of India’s best agri chem chains, with India’s best hybrid and generic portfolios, who after yrs of discipline, has been forced to grow their B/S to maintain sustenance? It is apparent that growth isn’t a play w/o the supp of the B/S ++

+ What is the sustainable eq val of subprime lending to a pocket where ltd earnings & extraneous shocks are business as usual?

How does one consumer the context of the end users purcashing power, in the val of the eq of a tractor majors, with a 5 yr CAGR if 4%? +

How does one consumer the context of the end users purcashing power, in the val of the eq of a tractor majors, with a 5 yr CAGR if 4%? +

At a policy level, what is the structural case against food inflation? The inflation in absolute terms in incrementally < than % terms

# 18 In closing

This is a good time to get 2nd and 3rd order behind your investing narrative right. Whatever that may be. So that you implement the basic tenet of investing in the next cycle. Of protecting your capital at Scale. Operating word: SCALE. End of thread.

This is a good time to get 2nd and 3rd order behind your investing narrative right. Whatever that may be. So that you implement the basic tenet of investing in the next cycle. Of protecting your capital at Scale. Operating word: SCALE. End of thread.

Misc: Safe to assume very high dispersion in the segment of land holdings, and crop wise earnings. The mode and median numbers do not change.

Read on Twitter

Read on Twitter