On Wednesday @CMO_England said that social distancing measures could be in place until the end of the year.

What might that mean for the economy?

A thread…

What might that mean for the economy?

A thread…

This thread is based on a new @resfoundation report on the economic and fiscal impact of #coronavirus – see: https://www.resolutionfoundation.org/publications/doing-more-of-what-it-takes/">https://www.resolutionfoundation.org/publicati...

(work with @rjdhughes, @jackhleslie, @charliejmccurdy, @carapacitti, @dan_tomlinson_)

(work with @rjdhughes, @jackhleslie, @charliejmccurdy, @carapacitti, @dan_tomlinson_)

First, to be clear, shutting down the economy to protect lives is the right thing to do: protecting public health is paramount.

Doing so has large economic costs, though. The government has rightly decided to support the economy through this– effectively insuring the population

Doing so has large economic costs, though. The government has rightly decided to support the economy through this– effectively insuring the population

That is the right decision too, but is expensive.

And the key problem is that, the longer social distancing measures are in place, the bigger that expense becomes.

We don& #39;t know how how long those measures will be needed - vaccines aren& #39;t guaranteed to work, for example.

And the key problem is that, the longer social distancing measures are in place, the bigger that expense becomes.

We don& #39;t know how how long those measures will be needed - vaccines aren& #39;t guaranteed to work, for example.

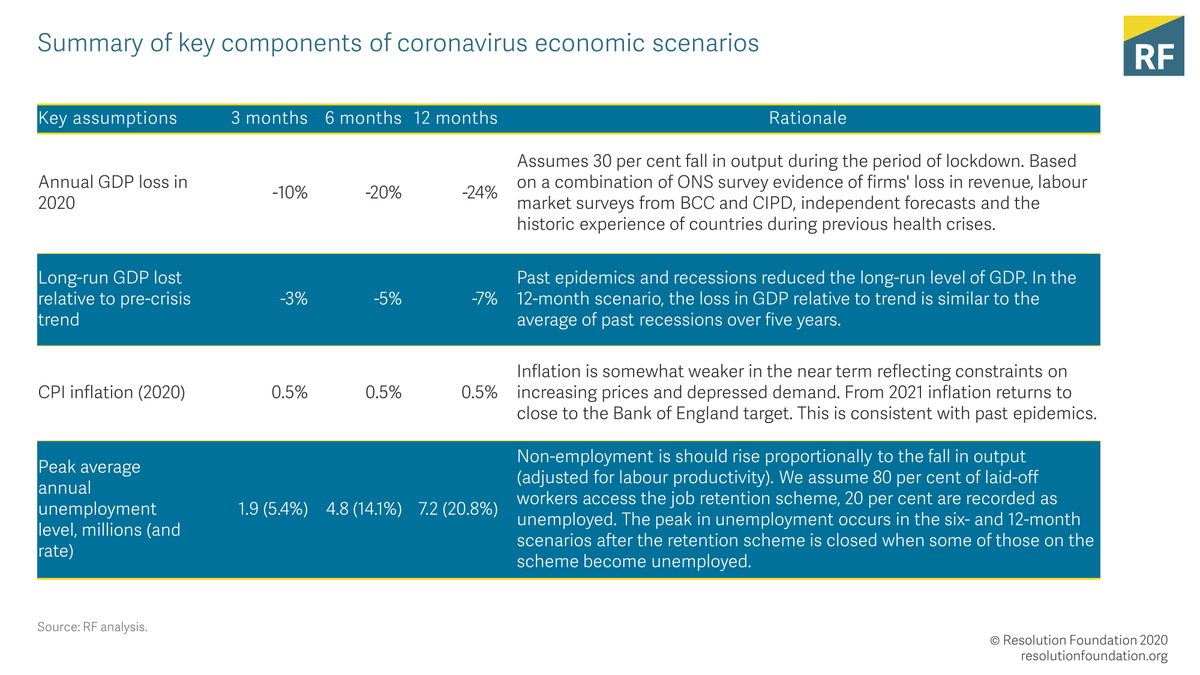

We look at 3 scenarios for the duration of social distancing measures: 3, 6 or 12 months.

This is not nec lockdown for 12 months - eg it could be that restrictions are lifted and the virus returns.

For those who say, 12m is untenable, @CMO_England& #39;s comments are a wake up call.

This is not nec lockdown for 12 months - eg it could be that restrictions are lifted and the virus returns.

For those who say, 12m is untenable, @CMO_England& #39;s comments are a wake up call.

Below is a summary of the economic impact in each scenario, assuming nearly a third of the economy shuts down for 3, 6 or 12 months.

Obviously the proportion of the economy that is mothballed is very uncertain but a range of evidence suggests a third cd be in the right ballpark

Obviously the proportion of the economy that is mothballed is very uncertain but a range of evidence suggests a third cd be in the right ballpark

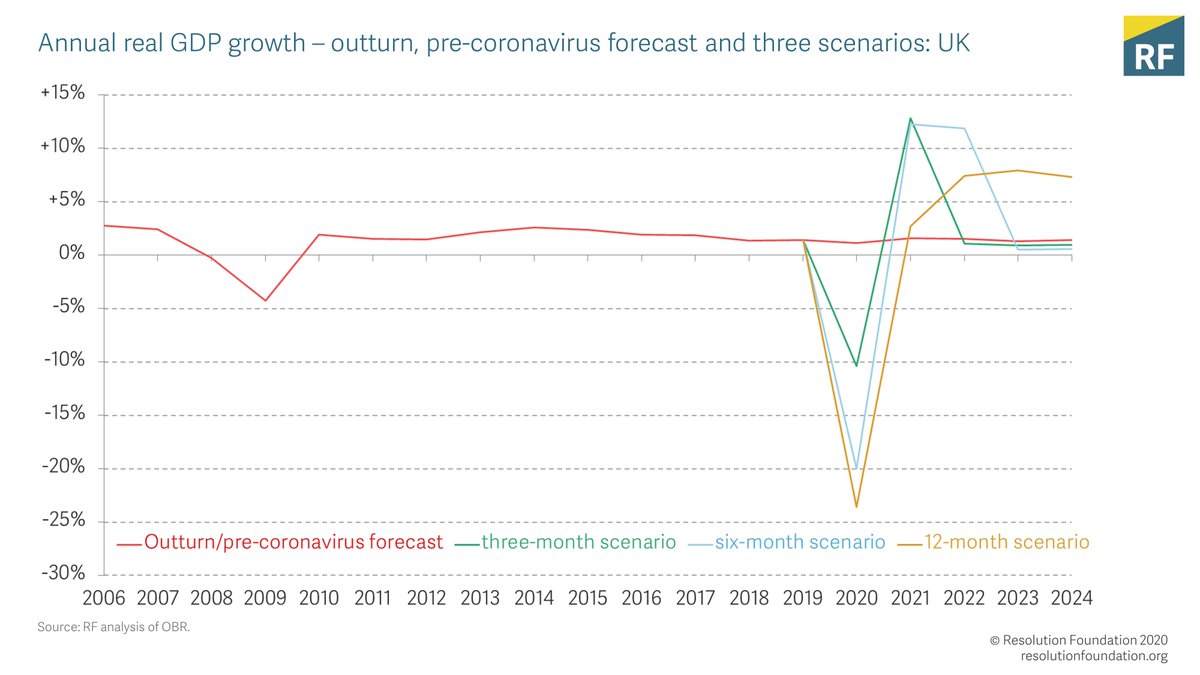

This is the GDP impact: the resulting fall in 2020 could range from 10 to 24 per cent - falls not seen in the UK for over three centuries (peak unemployment ranges from 2 to 7 million people).

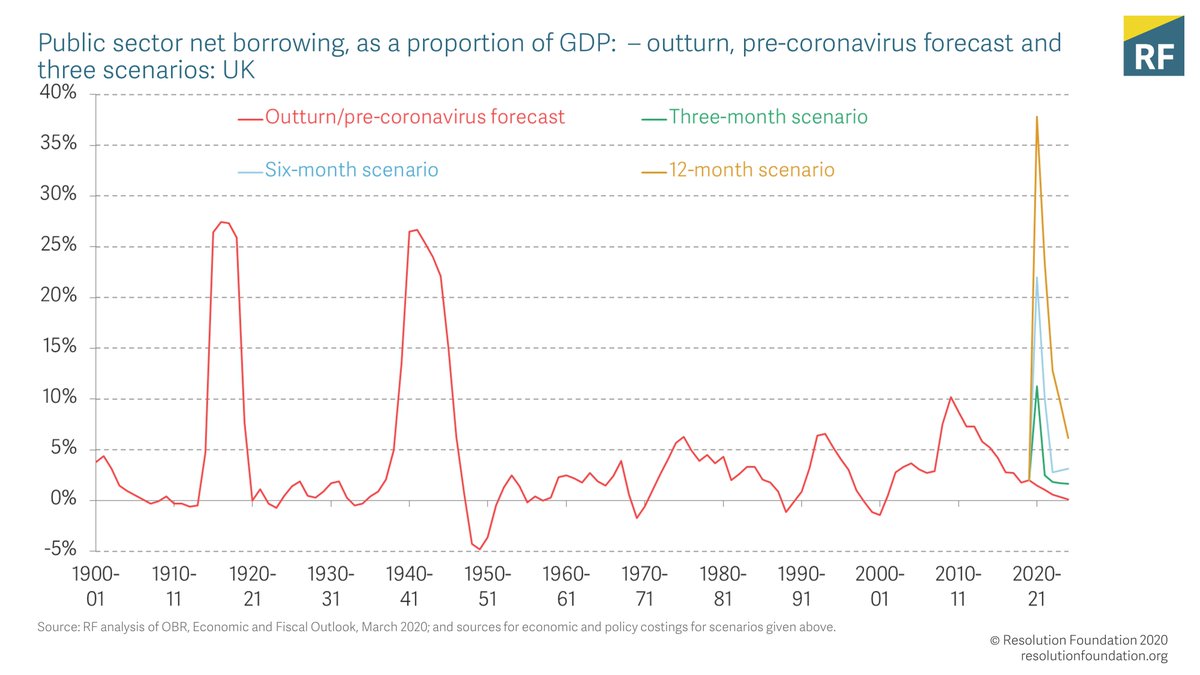

The contraction in economic activity, coupled with the government’s policy response will put extraordinary pressure on the public finances.

Public sector net borrowing (below) increases by more than any other peace-time year even in the 3 month scenario.

Public sector net borrowing (below) increases by more than any other peace-time year even in the 3 month scenario.

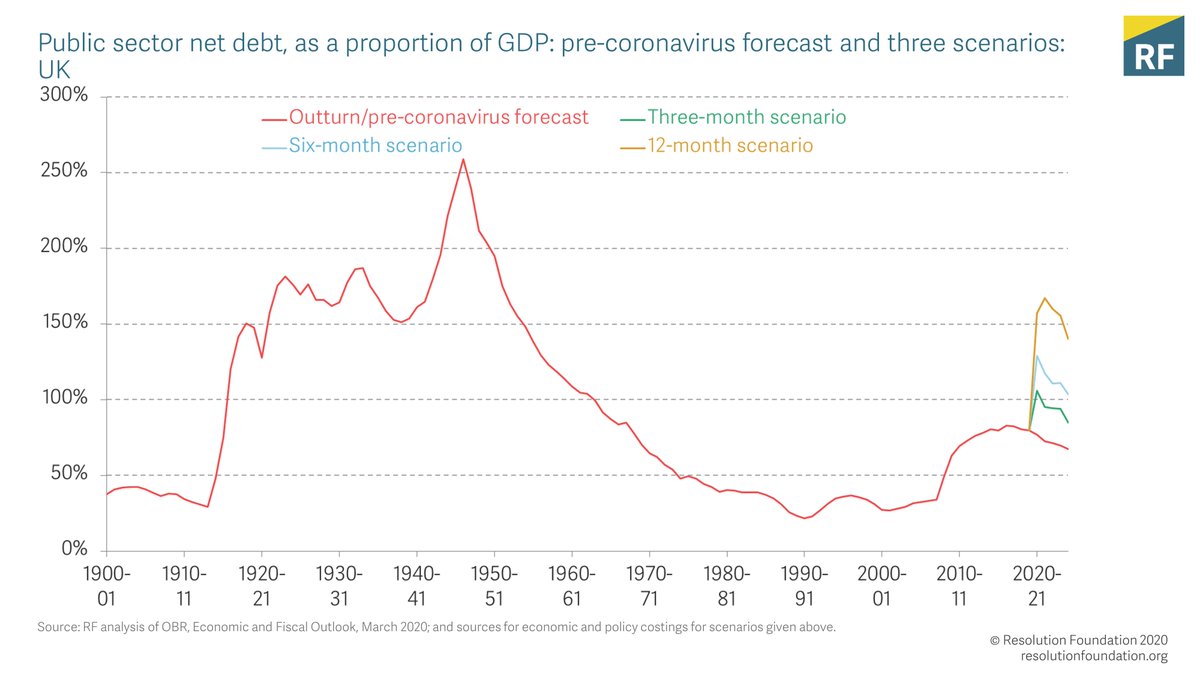

Debt rises above 100% of GDP in all three scenarios, peaking at 106% of GDP in the three-month scenario, 129% in the six-month scenario, and 167% under the 12-month scenario.

Theses are levels of public indebtedness not seen for generations.

Theses are levels of public indebtedness not seen for generations.

Our starting point is that this rise in borrowing *is* manageable.

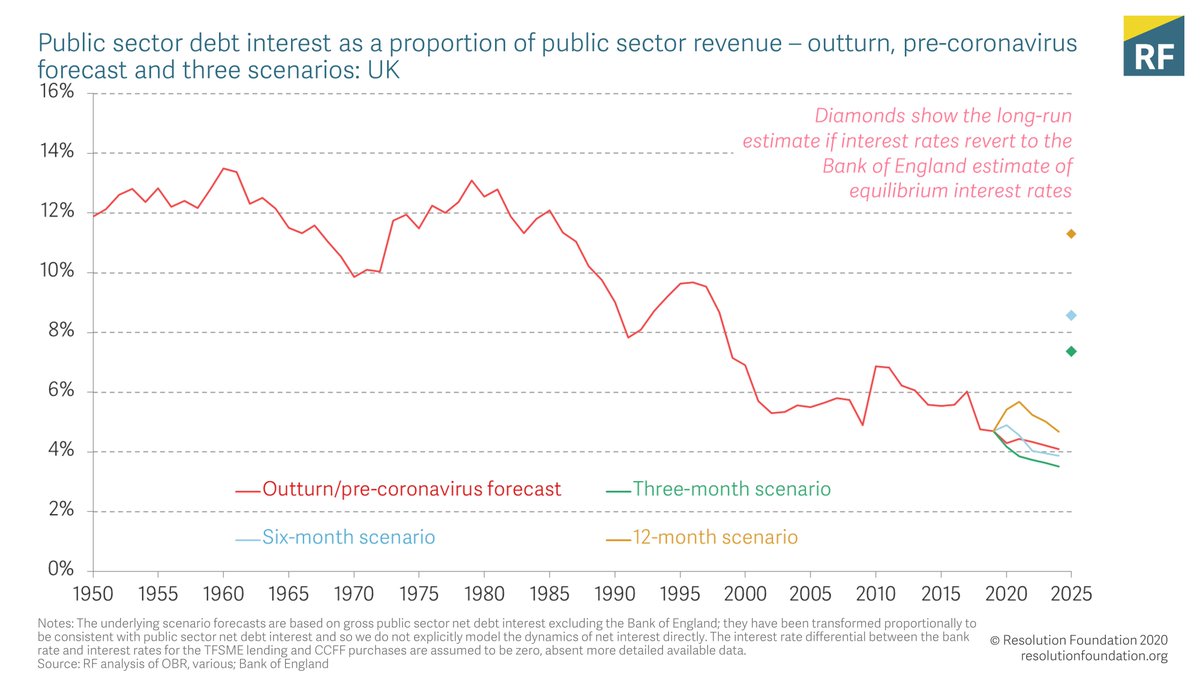

Below is a key reason: the share of tax revenues used to pay debt interest *falls* in all three scenarios.

But there is a big risk: any unexpected rise in inflation or interest rates cd change this picture.

Below is a key reason: the share of tax revenues used to pay debt interest *falls* in all three scenarios.

But there is a big risk: any unexpected rise in inflation or interest rates cd change this picture.

Big question is how can policy be used to make sure public health objectives are met *and* still provide vital support to limit hardship and reduce the size of the overall economic hit.

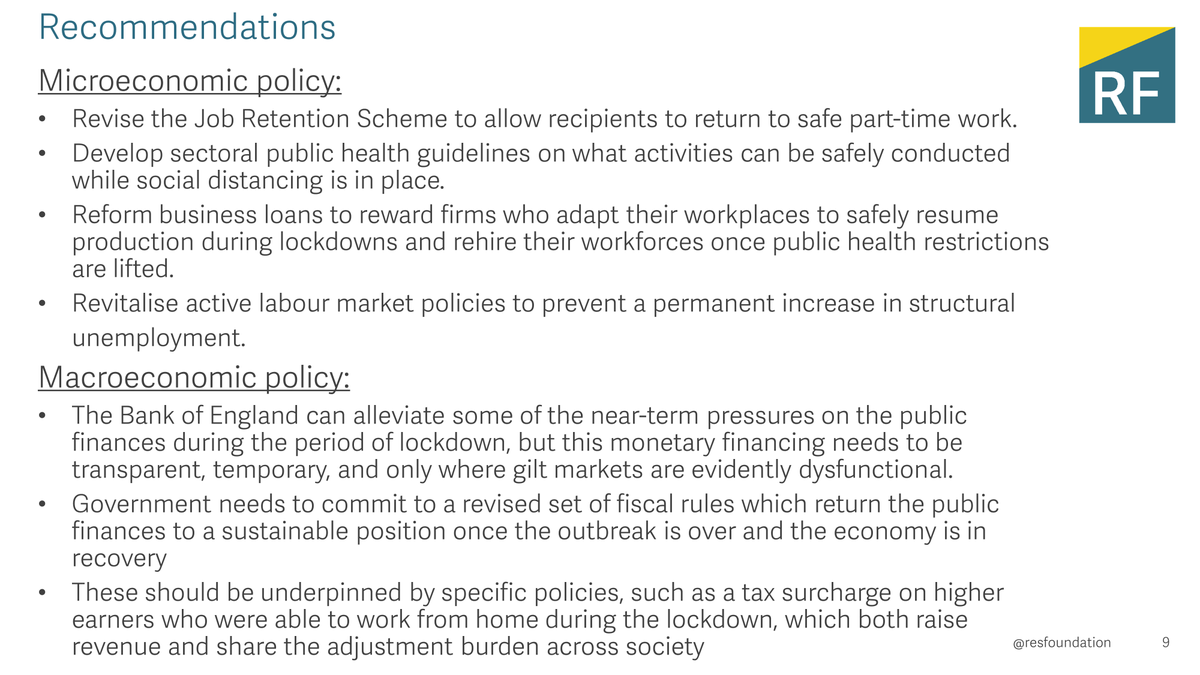

There are steps the government needs to follow:

1) Reduce the cost (or increase effectiveness) of current schemes

2) Strengthen the macro policy framework

3) Take steps that allow the economy to open safely

More details in the table below + in the paper: https://www.resolutionfoundation.org/publications/doing-more-of-what-it-takes/">https://www.resolutionfoundation.org/publicati...

1) Reduce the cost (or increase effectiveness) of current schemes

2) Strengthen the macro policy framework

3) Take steps that allow the economy to open safely

More details in the table below + in the paper: https://www.resolutionfoundation.org/publications/doing-more-of-what-it-takes/">https://www.resolutionfoundation.org/publicati...

Read on Twitter

Read on Twitter