The Lira:USD exchange rate isn& #39;t exclusively determined by BDL. Let& #39;s be clear about how the market exchange rate is determined. There is only one real solution to preventing the Lira from depreciating uncontrollable.

1/ BDL can pump $ into the market from what remains of its fx reserves, which are peoples $ deposits. This will be short-lived as the demand for $ will last longer than BDL has in reserves. These reserves are needed now for essential imports and spending them increases losses.

2/ The only sustainable way to lower the exchange rate is to have a sustainable inflow of $ into the country that can be used to support the exchange rate. What are sustainable $ inflows? To different extents, these are export receipts, foreign direct investment, remittances, etc

3/ These sustainable $ inflows come from having a proper export industry, confidence in the country& #39;s economy to encourage foreign investment and encourage people to want to hold the Lira, restructured banks that aren& #39;t insolvent that people want to transfer money to, etc.

4/ So the solution isn& #39;t necessarily having BDL pump its remaining reserves down the drain to lower the exchange rate temporarily. That would come at the expense of having $ left for critical imports, or to use to re-energize the economy, and will increases the $80bn+ losses.

5/ We must be realistic about the extent to which we can use these reserves to defend the exchange rate. Many countries have used up every last penny in reserves fighting a losing battle against currency depreciation, rather than focusing on the actual causes of depreciation

6/ That doesn& #39;t mean BDL shouldn& #39;t support the exchange rate at all to prevent it from overshooting and really getting out of control in a short period of time. It& #39;s a decision that requires a ton of analytical effort, which I& #39;m not sure BDL is doing.

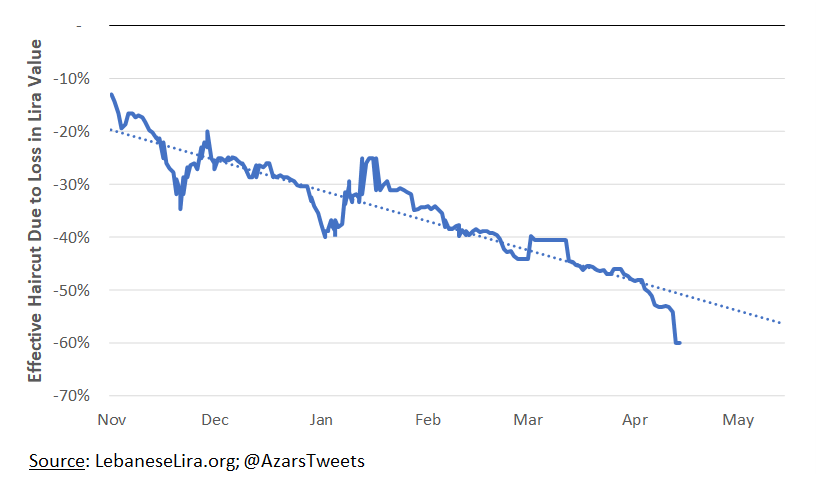

7/ At the same time, BDL could make the problem worse (and it has been) by converting USD deposits into Lira. By increasing the supply of Lira at a time of weak confidence in the Lira, which makes people want to go buy USD, this could put additional pressure on the exchange rate.

8/ But the problem of having MASSIVE $ deposits that can not be repaid in $ (& are being repaid in Lira) can only be solved by REMOVING them from the banking system & putting them into some type of value recovery instrument.The only question is WHAT does the instrument look like?

9/ Until we sort out (8) above, people need to be able to withdraw some money to live and transact. The only way to let people withdraw money is in Liras as there are few $ remaining. It& #39;s a fine line and the right decision isn& #39;t that obvious.

10/ The only solution to exchange rate issue is rapid economic/financial reforms,& external financial support as a bridge until the economy is growing again in a sustainable way. These are the only things that BDL,Cabinet,President,Parliament,Political Parties shld be working on

Read on Twitter

Read on Twitter