A  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> abt the question we& #39;re going to have to confront at some point but no one wants to talk about: how on earth are we going to pay for the economic response to #COVID19? We are stacking up war-time levels of public debt RIGHT NOW that will define economics for decades...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread"> abt the question we& #39;re going to have to confront at some point but no one wants to talk about: how on earth are we going to pay for the economic response to #COVID19? We are stacking up war-time levels of public debt RIGHT NOW that will define economics for decades...

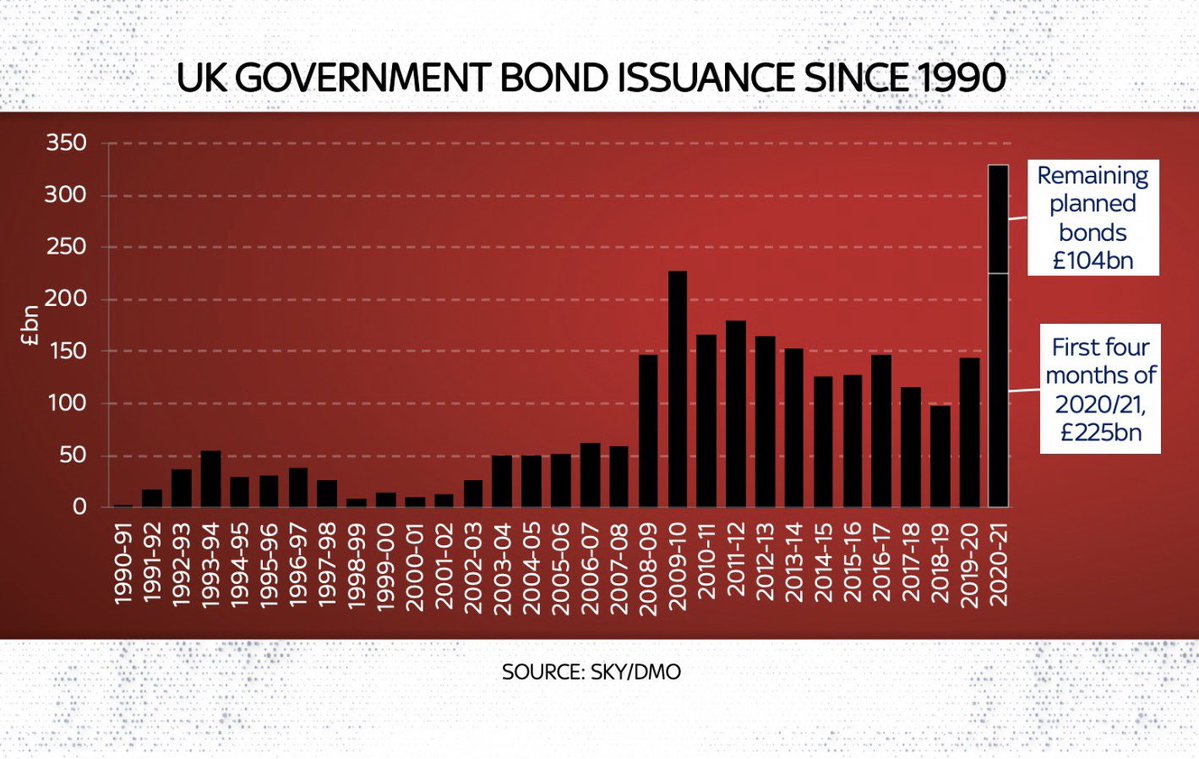

The story starts with this chart. The bar on the far right here is how much the government is planning to issue in debt this year. More than any other year in history. And note the bottom bit is only four months& #39; worth of debt. There& #39;s a v v high chance the bar gets a LOT higher

You thought the cost of the financial crisis was high? You thought austerity was bad? We will end #COVID19 with a HIGHER level of debt. This is depressing & unpalatable, esp for countries like UK which has literally just emerged from a decade of austerity. But there we have it.

It& #39;s disingenuous to believe this changes nothing & life goes back to normal afterwards. It changes EVERYTHING. Think abt how long we mulled over whether to fork out 50bn or so for HS2. Well we& #39;re spending FOUR TIMES that on #COVID19 support between Mar & June. Just like that

While @RishiSunak may insist his levelling up agenda hasn& #39;t gone away, the money spent on #COVID19 makes it far more difficult. Because Britain will begin that agenda with more debt than after the crisis. The kind of debt we have only had after wars. So. What to do about it?

One option: inflate the debt away. In a sense this is the most likely outcome. The @bankofengland is already printing more money than ever before. We have done this before. The establishment is already mobilising behind the idea, cf @TheEconomist today: https://www.economist.com/leaders/2020/04/23/after-the-disease-the-debt">https://www.economist.com/leaders/2...

But inflation is really insidious in all sorts of ways. We just spent the past half a century fighting it. Is the solution to our fiscal problems really unleashing the major economic enemy of the 20th century? Once the toothpaste starts coming out it& #39;s v difficult to get back in

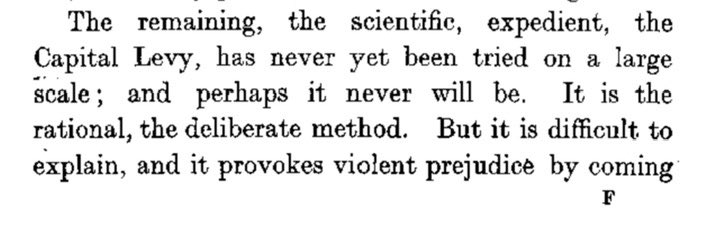

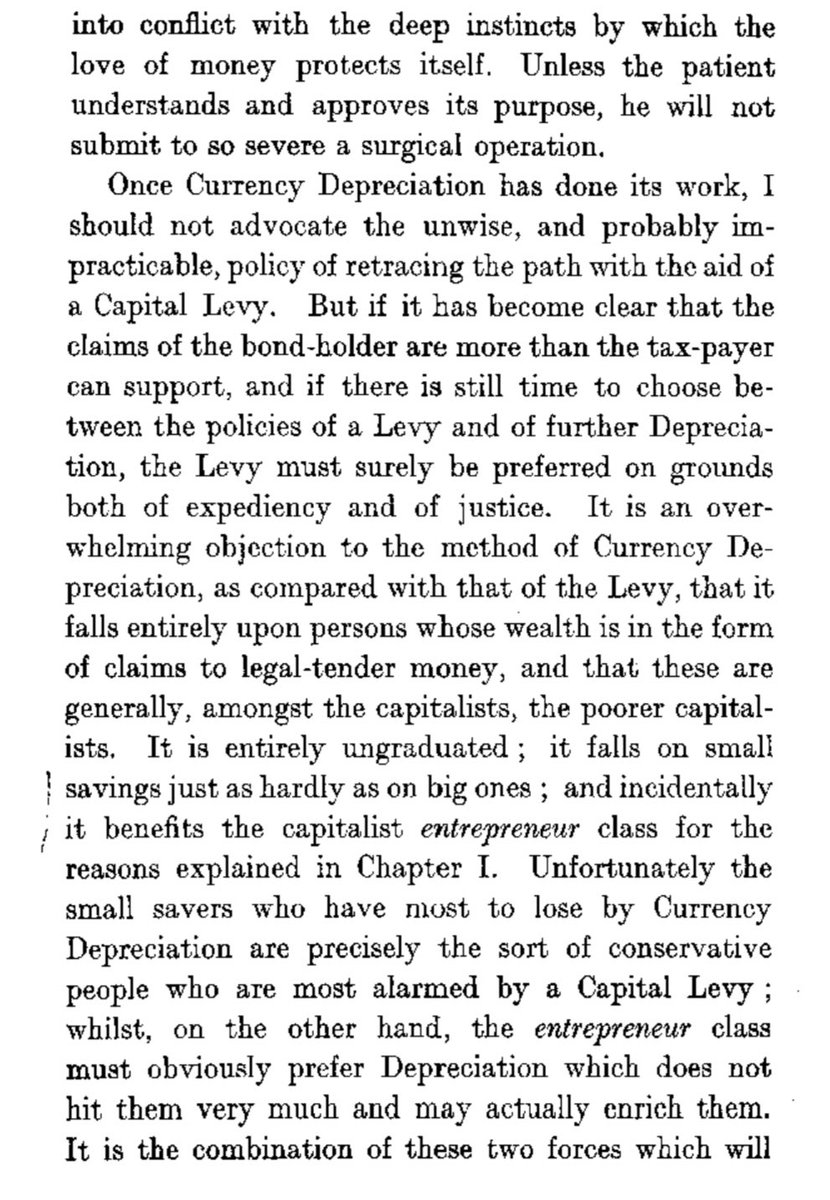

After WW1 there was a v similar debate. Some argued for inflation ("depreciation"). But as Keynes wrote in a Tract on Monetary Reform, while inflation was always the easy and most likely option, it was also the least fair. He proposed something called a "capital levy"

What is a capital levy? It& #39;s a one-off (that bit is v important) tax on wealth. It& #39;s a v v radical idea. So radical it was never tried here in the UK. After all, who would vote for it? It would be painful, unpopular, difficult to administer and might cause short term econ pain.

Yet it wasn& #39;t just Bloomsbury elites like Keynes who supported it. Joseph Schumpeter, who came up with the idea of "creative destruction", actually imposed one in Austria. Friedrich Hayek supported a capital levy after WW2. These are the godfathers of liberal economics!

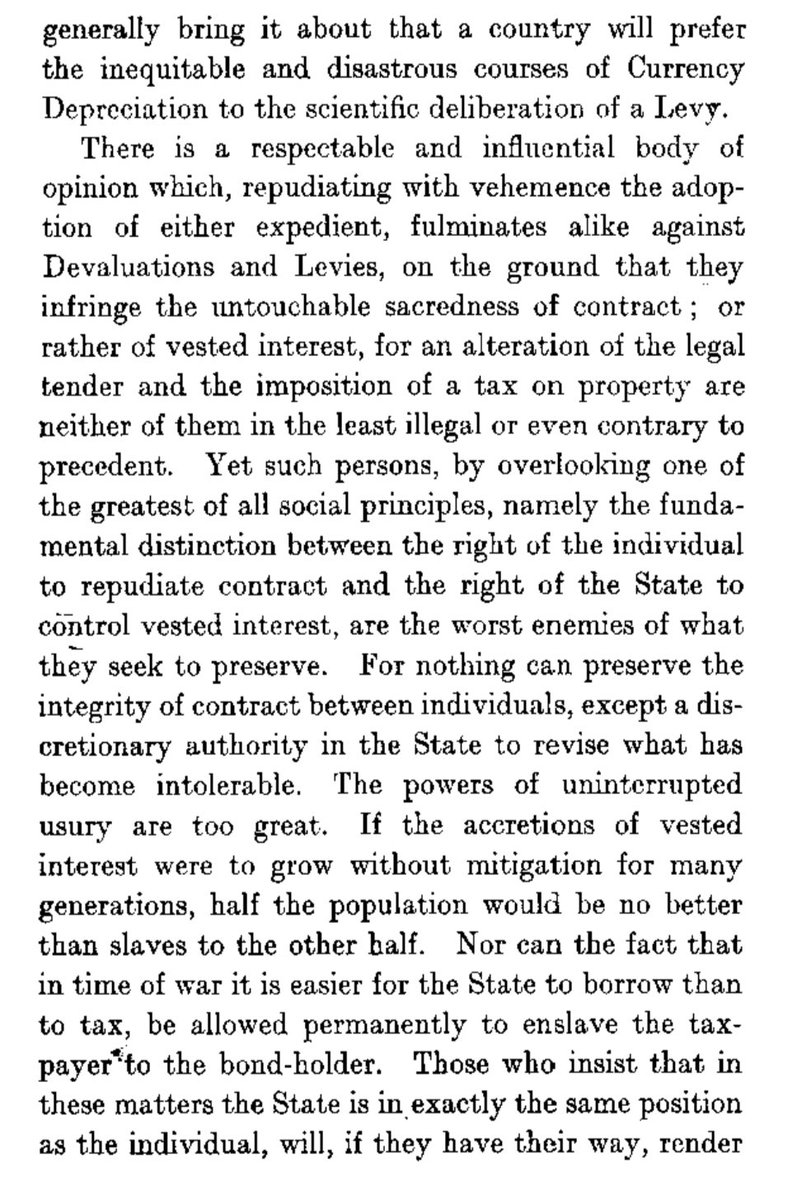

Why did they support it? Because when debt is so high it could engulf an economy, a capital levy is the least bad option. It reduces debts and redistributes capital from those hoarding it to those who might use it for productive purposes. The pain is outweighed by the outcome.

And the outcome is that after one yank of the plaster you can turn a high tax economy into a low tax one. But how to yank that plaster? In short, you need to impose the tax before anyone can get their money out of the country. And you need to protect those who can& #39;t pay.

Don& #39;t get me wrong: there are so, so many problems with this idea. It almost certainly won& #39;t happen. Fine. But 1) it is time to start debating uncomfortable ideas if only to ensure we& #39;ve considered everything before committing to fateful econ decisions abt paying off these debts

2) if you think a capital levy is anti free market, ask yourself why Hayek proposed a version of it? 3) if you don& #39;t like this idea then what& #39;s your alternative? And don& #39;t say "economic growth" because if we knew how to magic that up we wouldn& #39;t be having this conversation

The establishment will tell you a capital levy is a terrible idea. In many senses they are right. But there are no good options here. The least we can do is start debating them. If #COVID19 is our war, it& #39;s about time to start talking abt how we pay for it https://www.thetimes.co.uk/article/d34d6930-8579-11ea-a771-e3cbdc13ee70?shareToken=3e53c75b898c881ef488e2aea1898b7c">https://www.thetimes.co.uk/article/d...

Read on Twitter

Read on Twitter