I& #39;ve just experienced my Come To Jesus moment on product tankers, so here& #39;s a thread on why I think it& #39;s an idea.

The ideas aren& #39;t original but the source may be unfamiliar - a Danish company called Torm, it& #39;s a product tanker company and I& #39;m long: we& #39;re both talking our book. https://twitter.com/hareng_rouge/status/1253400593319833606">https://twitter.com/hareng_ro...

The ideas aren& #39;t original but the source may be unfamiliar - a Danish company called Torm, it& #39;s a product tanker company and I& #39;m long: we& #39;re both talking our book. https://twitter.com/hareng_rouge/status/1253400593319833606">https://twitter.com/hareng_ro...

Their last call was on March 11. At the time of speaking, they said that rates were at around $22,000 for their main class of ships.

It& #39;s hard for me to avoid seeing TC rates around on fintwit, so this was good opportunity to see if they check out.

It& #39;s hard for me to avoid seeing TC rates around on fintwit, so this was good opportunity to see if they check out.

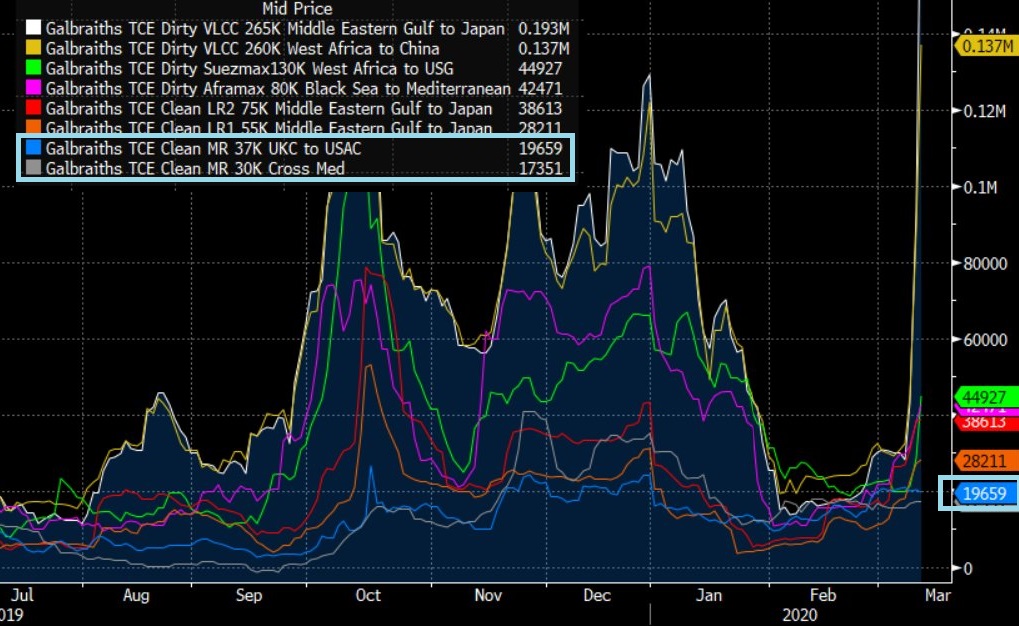

Here& #39;s the daily update from @JHannisdahl for that date, March 11. Blue line on the chart and the blue shaded boxes: they& #39;re both close enough to the numbers discussed in the call.

https://twitter.com/JHannisdahl/status/1237821330537529344?s=20">https://twitter.com/JHannisda...

https://twitter.com/JHannisdahl/status/1237821330537529344?s=20">https://twitter.com/JHannisda...

Now here& #39;s @JHannisdahl yesterday. Up nearly fourfold.

Yes, it may be a short lived spike; I& #39;ve been critical of shipping holders before wondering why the stocks don& #39;t work: the blue line tells you why.

Now the facts have changed: it& #39;s a hockey stick.

https://twitter.com/JHannisdahl/status/1253372349409382400?s=20">https://twitter.com/JHannisda...

Yes, it may be a short lived spike; I& #39;ve been critical of shipping holders before wondering why the stocks don& #39;t work: the blue line tells you why.

Now the facts have changed: it& #39;s a hockey stick.

https://twitter.com/JHannisdahl/status/1253372349409382400?s=20">https://twitter.com/JHannisda...

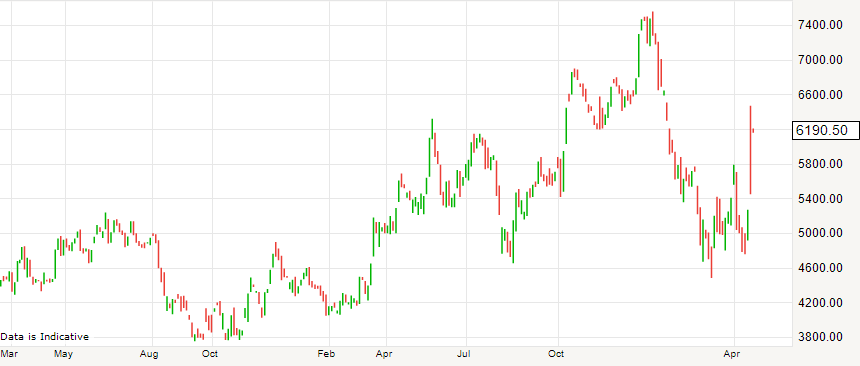

Take a step back. See in the white chart the anticipated reaction in Torm& #39;s price to IMO2020 (the big run in the middle of the black chart)

IMO fizzled, stocks& #39; anticipation was mistaken. Again though, the facts - and the rates - have changed but the stocks are asleep.

IMO fizzled, stocks& #39; anticipation was mistaken. Again though, the facts - and the rates - have changed but the stocks are asleep.

You can stop here because my main argument is that, sure it may well prove to be a spike but unlike previously, it& #39;s not illusory but real - and the stocks have not reacted yet.

If you& #39;re interested, I& #39;ll mention why I think product rather than crude is the play here.

If you& #39;re interested, I& #39;ll mention why I think product rather than crude is the play here.

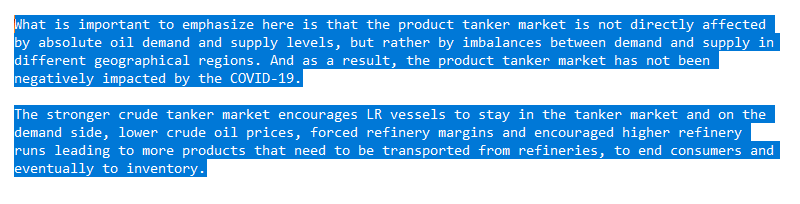

Torm& #39;s call again. TLDR: many ships switched from clean to dirty for various reasons and the clean fleet is back to 2015 levels - therefore, supply tightness

TLDR again: the issues with crude storage encourage ships to stay in that market - further supply tightness for product ships. Products are driven by imbalance more than crude.

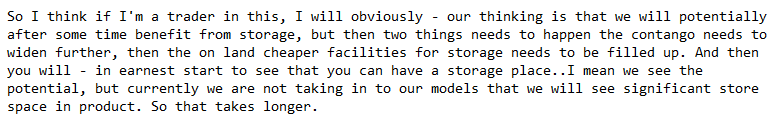

Lastly, everything needs to fill up before ships start getting used: this doesn& #39;t happen until you see the whites of their eyes.

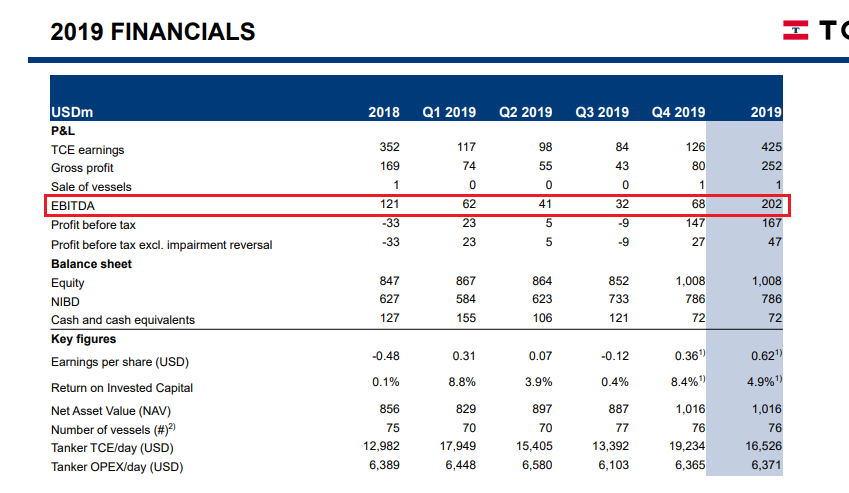

I& #39;ll finish with two pictures: 200 in EBITDA.

"Our case averaged TCE rate $16,526 p/day for the year. In the LR, achieved LR2 rates $19,730 p/day. Largest segment, the MRs, rates $15,840 p/day, and in the Handysize, achieved rates were $14,965 p/day"

Remember the hockey stick

"Our case averaged TCE rate $16,526 p/day for the year. In the LR, achieved LR2 rates $19,730 p/day. Largest segment, the MRs, rates $15,840 p/day, and in the Handysize, achieved rates were $14,965 p/day"

Remember the hockey stick

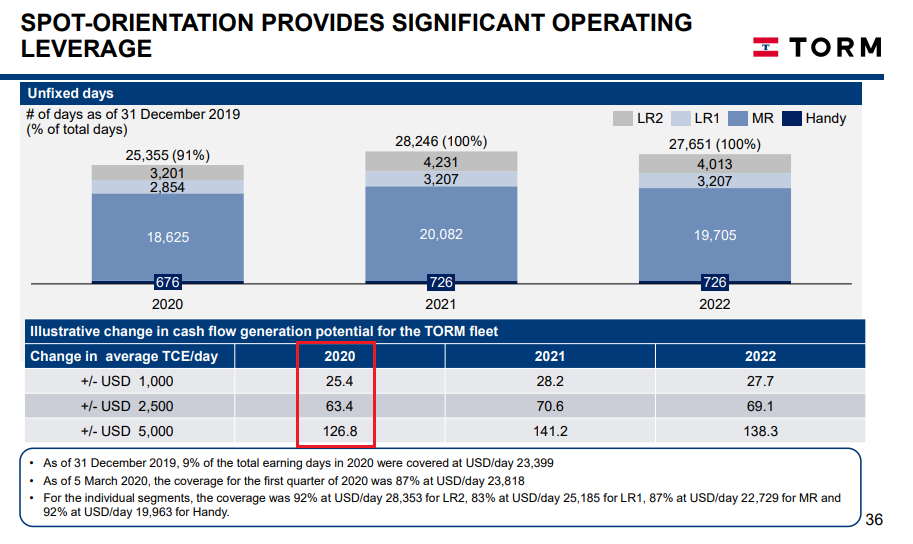

And here& #39;s the sensitivity whilst you think of that 4x hockey stick.

The stocks have done little beyond a post-corona bounce and should be up more on spike in underlying rates alone.

If it& #39;s not a spike and the hockey stick hangs around for a while, then you can work it out..

The stocks have done little beyond a post-corona bounce and should be up more on spike in underlying rates alone.

If it& #39;s not a spike and the hockey stick hangs around for a while, then you can work it out..

It& #39;s time to come back

Read on Twitter

Read on Twitter