Treasury now wants public companies to give back their PPP money. Look closely at its new guidance and it& #39;s injecting more uncertainty for startups that got PPP too. THREAD... https://www.wsj.com/articles/public-companies-have-to-repay-small-business-rescue-loans-11587670442">https://www.wsj.com/articles/...

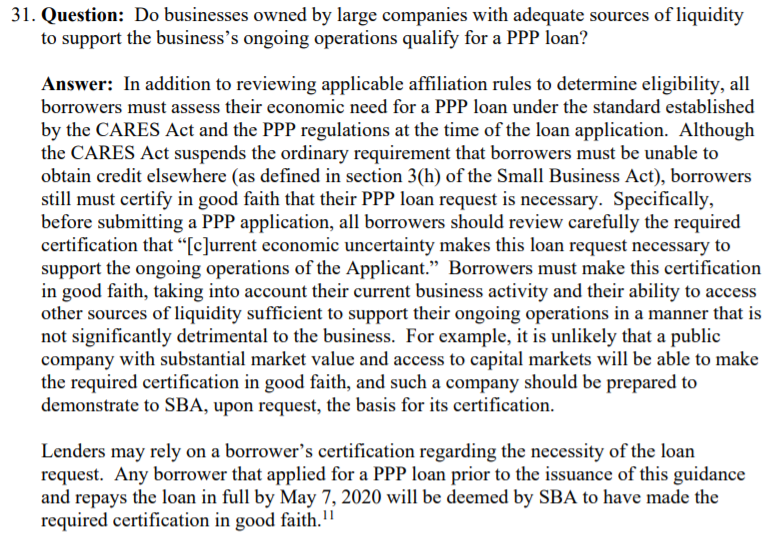

The news this morning was Treasury updated its FAQ, adding a question at the end, #31: https://home.treasury.gov/system/files/136/Paycheck-Protection-Program-Frequently-Asked-Questions.pdf">https://home.treasury.gov/system/fi...

Before there was the simple, yet vague certification: "Current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant."

Now there& #39;s a new proviso that borrowers take into account "their current business activity and their ability to access other sources of liquidity sufficient to support their ongoing operations in a manner that is

not significantly detrimental to the business."

not significantly detrimental to the business."

Sidenote: #17 on the same FAQ --published 4/6-- says you don& #39;t have to worry about new guidance. You can rely on the guidance that was in effect when you applied. But moving on....

In a backhanded way, Treasury seems to be reasserting the traditional SBA rule that borrowers exhaust other financing options before applying for an SBA loan. Lawmakers had gotten rid of that for PPP.

Having talked to a few dozen startups on this, they were already defining "necessary" differently. "Current business activity" and "access to other sources of liquidity" are both open to interpretation as well.

Some PPP applicants we& #39;ve talked to have a year of cash, ambiguous Covid impact on their business, and/or could raise VC money, if at a lower price. Are they rethinking PPP applications?

A key here seems to be this new amnesty provision. Companies that got the money but under the new guidance feel they shouldn& #39;t have applied, can return it by May 7. No harm no foul.

Read on Twitter

Read on Twitter