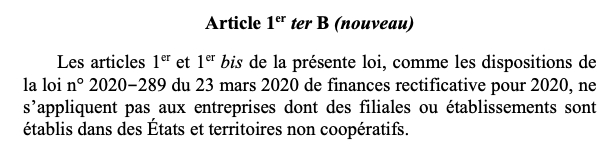

Following Denmark, France announces that corporations headquartered in tax havens (or with empty shells in tax havens) will be barred from government coronavirus bailout https://twitter.com/BrunoLeMaire/status/1253324545496215552">https://twitter.com/BrunoLeMa...

The main limitation of the French approach is that the official French list of tax havens is way too restrictive.

It excludes the key European tax havens (Luxembourg, Netherlands, Ireland) towards which the bulk of profit shifting takes place

See: https://missingprofits.world"> https://missingprofits.world

It excludes the key European tax havens (Luxembourg, Netherlands, Ireland) towards which the bulk of profit shifting takes place

See: https://missingprofits.world"> https://missingprofits.world

Read on Twitter

Read on Twitter