On #tankers: Let us help our audience on why we are long tankers. Thread...

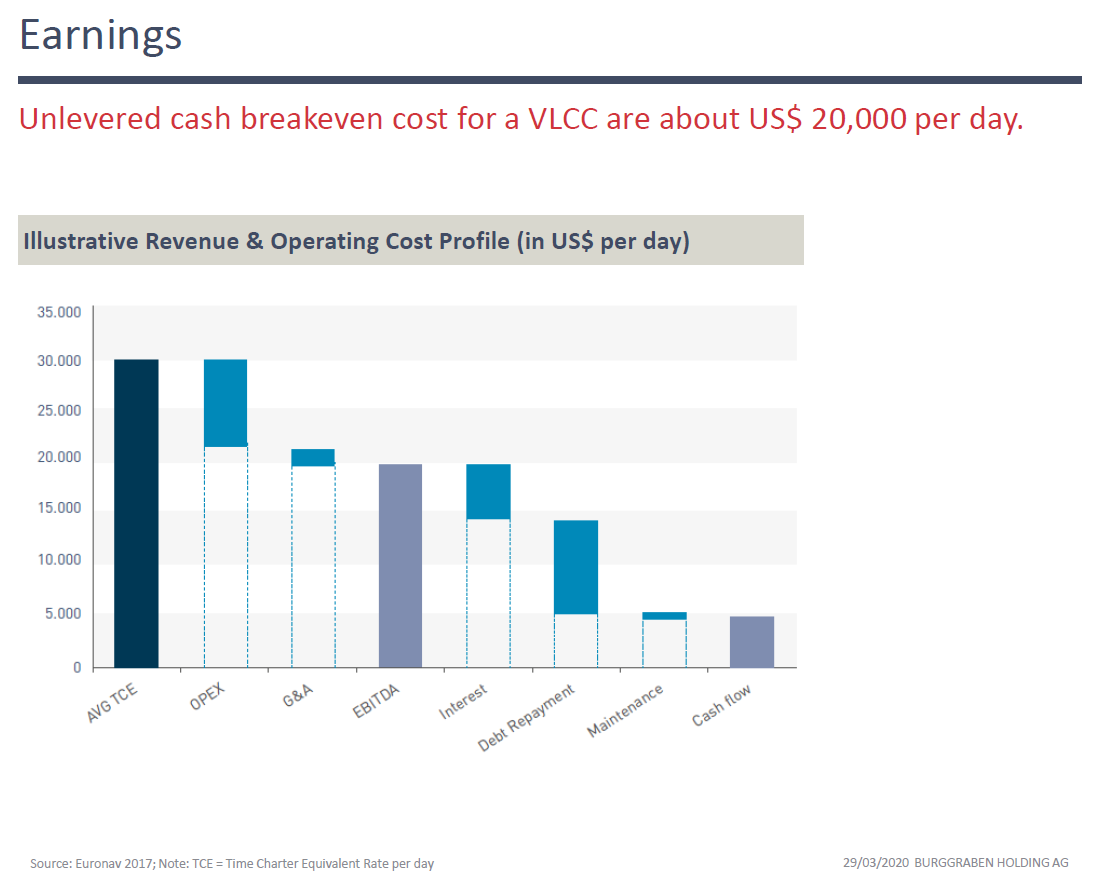

1) A VLCC vessel has high operating leverage, allowing an investor to earn a very high ROIC, if you hit the cycle right.

1) A VLCC vessel has high operating leverage, allowing an investor to earn a very high ROIC, if you hit the cycle right.

In fact, a VLCC vessel may earn a multiple of its invested capital in one good year. See below our illustration for $EURN...

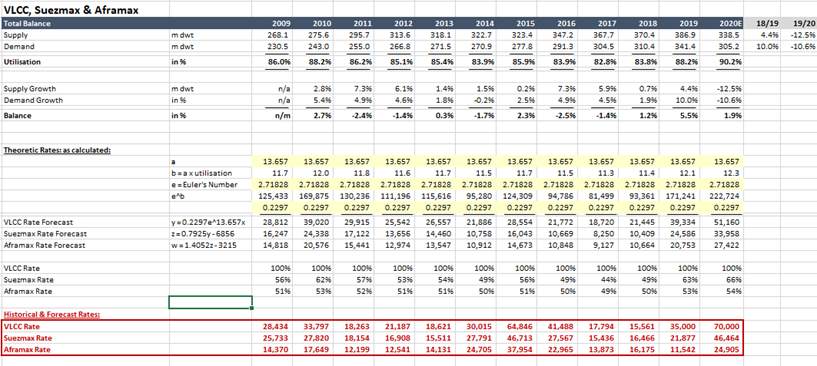

For that however, you need to understand the cycle! Which is why we developed a proprietary, bottom-up tanker market model over the years. Here a snapshot of our output mask...(it is a detailed model, believe us).

Let& #39;s be clear. Rates move on the margin as do oil prices. There are always too many or too little vessels! Worse, it is a very sentimental process as two humans set rates. But the model allows to see trends & develop sensitivities around certain assumptions. So it does help...

Let us now share some insight why we are convinced this cycle has legs.

a) on demand: assume seaborne trade of some 40 mb/d in 2019 decreases by 9% to about 36.5 mb/d on average for the year 2020. Assume this results in 302 million deadweight tons of vessel demand (m dwt).

a) on demand: assume seaborne trade of some 40 mb/d in 2019 decreases by 9% to about 36.5 mb/d on average for the year 2020. Assume this results in 302 million deadweight tons of vessel demand (m dwt).

b) on supply: assume we will have to get 550 million barrels of oil in floating storage to manage this supply overhang (just trust us on this)! This results in 320 m dwt of supply (active fleet).

A + B results in a capacity utilisation of some 94.7%. This is huge. In the past decade, we had sub 90% capacity utilisation (but way higher stock prices than today).

When we know capacity utilisation, we can calculate a theoretic dayrate. Kind of nice! But remember, it is a sentimental process bw humans, not a machine setting the rate. So it remains a model.

To help you decide for yourself, we ran a sensitivity table for different demand & supply drivers. This way, you can decide for yourself in what outcome you believe...kind of nice!

Read on Twitter

Read on Twitter