BIG THREAD: the fiscal policy response to the economic crisis caused by COVID-19 should match the extraordinary human hardship & economic need – not arbitrary dollar comparisons to stimulus in prior recessions, the level of debt, or even the debt ratio. 1/

EXTRAORDINARY NEED. The pace of economic decline suggests this recession will be especially deep -- deeper than the 2007-09 Great Recession.

The U.S has never seen anything near the pace of job losses in this chart. (Between the start of the Great Recession & when total employment hit bottom, the number of people with a job fell by 8.3 million.) https://twitter.com/hshierholz/status/1253301657187708929">https://twitter.com/hshierhol...

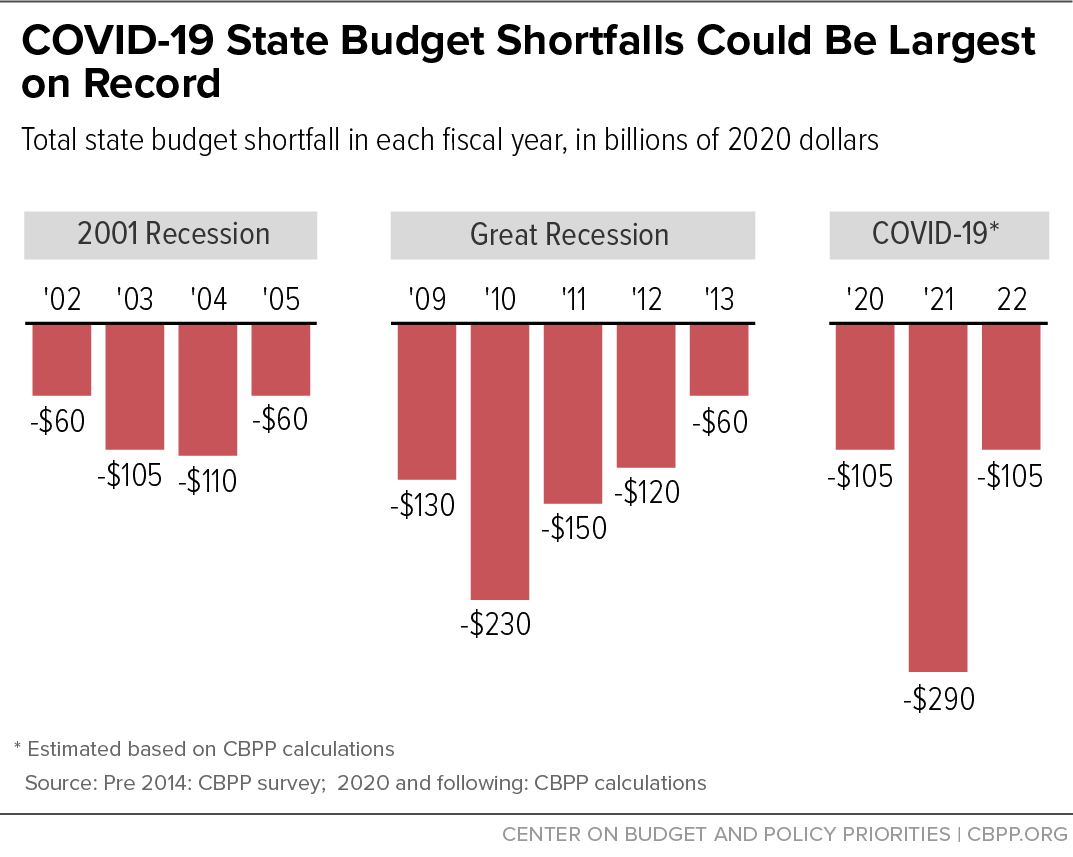

States are on the brink of budget shortfalls that could be the largest on record, totaling >$500 billion. W/o more federal help, states, as they can’t run budget deficits, will be forced to make sharp cuts that would deepen & prolong the recession. https://www.cbpp.org/research/state-budget-and-tax/states-need-significantly-more-fiscal-relief-to-slow-the-emerging-deep">https://www.cbpp.org/research/...

Because this is both a health crisis and a recession, maintaining states’ ability to meet growing Medicaid costs w/o severe cuts in other services is vital. Millions of people are losing employer-provided health coverage and having their incomes shrink. https://www.cbpp.org/blog/families-firsts-medicaid-funding-boost-a-useful-first-step-but-far-from-enough">https://www.cbpp.org/blog/fami...

I could sadly go on. The scale of hardship and need is staggering: https://twitter.com/ShannonCBPP/status/1251487945267318784">https://twitter.com/ShannonCB...

THE COST OF DOING TOO LITTLE, TOO LATE, IS HIGH. The harm from this COVID-19 recession may be *more* concentrated on the most economically vulnerable than other recessions — intensifying the need to act to avoid deep & lasting hardship for those already struggling.

Health impacts, including deaths, are falling disproportionately on Black, Latino, & low-income Americans, due to structural health inequities, emerging data indicates. E.g. https://www.kff.org/disparities-policy/issue-brief/communities-of-color-at-higher-risk-for-health-and-economic-challenges-due-to-covid-19/">https://www.kff.org/dispariti... by @SArtiga2 @RachelLGarfield Kendal Orgera; https://covidtracking.com/blog/tracking-race-and-ethnicity">https://covidtracking.com/blog/trac...

Initial job losses have been concentrated in low-paid service-sector jobs. For this reason, this type of pandemic recession may be more apt to concentrate its damaging economic effects on lower-income people. (For the 3-part intuition, see: https://drive.google.com/file/d/1VUx-Bhx02XdXsb7Oo4ZJTrqmoOgf2UIH/view.)">https://drive.google.com/file/d/1V...

Interest rates heading into this crisis were lower than they were leading up to the Great Recession. The Fed has exhausted room for cutting short-term interest rates. & while the Fed is rightly using unconventional measures, it needs fiscal policy help.

The U.S. still has relatively weak “automatic stabilizers,” so it must rely more heavily on enacting discretionary fiscal relief/stimulus in a downturn: https://www.brookings.edu/blog/up-front/2019/07/02/what-are-automatic-stabilizers/">https://www.brookings.edu/blog/up-f... by @lsheiner Vivien Lee

The response to the Great Recession is a lesson -- & be careful about using its size as a benchmark.

The substantial fiscal response prevented a more severe recession, but ended too fast & was too small. @ChadCBPP has more here: https://www.cbpp.org/research/economy/fiscal-stimulus-needed-to-fight-recessions">https://www.cbpp.org/research/...

The substantial fiscal response prevented a more severe recession, but ended too fast & was too small. @ChadCBPP has more here: https://www.cbpp.org/research/economy/fiscal-stimulus-needed-to-fight-recessions">https://www.cbpp.org/research/...

WE HAVE THE FISCAL SPACE to mount the needed aggressive fiscal response.

Debt worries shouldn’t inhibit the needed aggressive fiscal response to this recession. There’s fiscal space to increase deficits & debt without debt holders losing confidence and provoking a debt crisis.

Debt worries shouldn’t inhibit the needed aggressive fiscal response to this recession. There’s fiscal space to increase deficits & debt without debt holders losing confidence and provoking a debt crisis.

The cost of government borrowing now is low: real interest rates are negative & expected to remain low.

Acting fast can help avoid both a deeper near-term fall in GDP & the erosion of the economy’s longer-term productive capacity (hysteresis). See e.g. https://www.kansascityfed.org/~/media/files/publicat/sympos/2017/2017furman.pdf?la=en">https://www.kansascityfed.org/~/media/f...

Acting fast can help avoid both a deeper near-term fall in GDP & the erosion of the economy’s longer-term productive capacity (hysteresis). See e.g. https://www.kansascityfed.org/~/media/files/publicat/sympos/2017/2017furman.pdf?la=en">https://www.kansascityfed.org/~/media/f...

This is a mainstream view. In 2016, @jasonfurman said that after the Great Recession “the tide of expert opinion” shifted to the view that “fiscal stimulus is less constrained by fiscal space than previously appreciated.” https://obamawhitehouse.archives.gov/sites/default/files/page/files/20161011_furman_suerf_fiscal_policy_cea.pdf">https://obamawhitehouse.archives.gov/sites/def...

& now that economic crisis is here, here’s @ojblanchard1 as an example of a chorus that includes Yellen, Gopinath, Mankiw, & many more.

https://www.piie.com/blogs/realtime-economic-issues-watch/whatever-it-takes-getting-specifics-fiscal-policy-fight-covid">https://www.piie.com/blogs/rea...

https://www.piie.com/blogs/realtime-economic-issues-watch/whatever-it-takes-getting-specifics-fiscal-policy-fight-covid">https://www.piie.com/blogs/rea...

(Even Mnuchin https://www.wsj.com/articles/mnuchin-says-we-need-to-spend-what-it-takes-to-overcome-coronavirus-crisis-11587565557.)">https://www.wsj.com/articles/...

There’s no evidence for any debt ratio level that& #39;s a “tipping point” into a debt crisis or slower growth:

https://www.imf.org/external/pubs/ft/wp/2014/wp1434.pdf">https://www.imf.org/external/... https://www.cbpp.org/blog/international-evidence-provides-poor-guide-for-us-budget-policy">https://www.cbpp.org/blog/inte...

https://www.imf.org/external/pubs/ft/wp/2014/wp1434.pdf">https://www.imf.org/external/... https://www.cbpp.org/blog/international-evidence-provides-poor-guide-for-us-budget-policy">https://www.cbpp.org/blog/inte...

Fretting about round but otherwise meaningless numbers like debt/GDP of 100% (which may be reached in ~6 months) would be a mistake for for the same reason.

(Fretting about round number *nominal* debt or deficit $ levels would be even sillier.)

(Fretting about round number *nominal* debt or deficit $ levels would be even sillier.)

Yes, the U.S. has long-term fiscal challenges ( https://www.cbpp.org/research/federal-budget/long-term-budget-outlook-has-improved-substantially-since-2010-but-remains).">https://www.cbpp.org/research/... But debt concerns should go on the back burner in a recession.

Lawmakers should enact effective fiscal policy that& #39;s scaled to the extraordinary human hardship & economic crisis we are now facing. END

Lawmakers should enact effective fiscal policy that& #39;s scaled to the extraordinary human hardship & economic crisis we are now facing. END

Read on Twitter

Read on Twitter