1/10 Let& #39;s take a close look at a dumpster fire of a BDC and how these BDCs use fake marks and leverage to boost fees - Franklin Square/EIG Power and Energy Fund. $3.5 Billion in asset value at 12/31/19 ($4.1 Billion cost). As I will show, leverage eliminates ANY equity value.

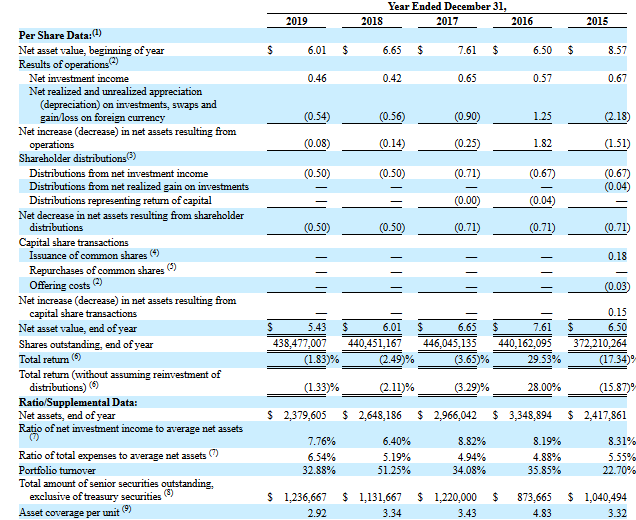

2/10 The asset value is broken down into $2.25B in equity and $1.24B in debt. The BDC charges a 1.75% management fee on TOTAL ASSETS which means that given the leverage the 1.75% turns into 2.7%. On $3.5B of asset valye, the extra 1% = $35 Million each year. Nice!

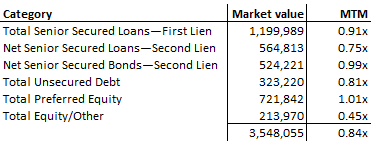

3/10 The portfolio is has $1.2B in 1L Loans, $565M in 2L Loans, $524M in 2L bonds, $323M in unsecured bonds, $722M in preferred and $214M in equity. 52% E&Ps, 30% Midstream, 12% Power, 6% service.

4/10 Given the upstream exposure, one would think there would be some pain in the portfolio, right? Well, check out below. Pref mark > 2L mark... easier to value private preferreds I guess.... Level 1 valuation is <1.5%, Level II is <30% and rest is Level III (wild wild west)

5/10 some of the marks are curious. Ascent resources equity was marked at 88c at YE19. Rosehill (which is prob in a tough spot with banks) was marked at 1.08x. A Canadian E&P company called Hammerhead was marked at 98c. Would love to work with these valuation experts for my comp

6/10 Checking in on the debt situation. total debt is $1.26B split amongst three tranches - 1st is a Goldman facility with $425M, 2nd is JPM with $311M, 3rd is $500M bonds. The BDC had a margin call and is in violation of covenants (ooops!). JPM reduced its facility by $126M.

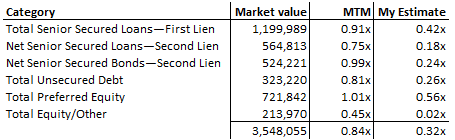

7/10 So, with the debt guys looming. What IF the portfolio was marked to "fair value" and what would the result on the equity value be (recall, net equity value was $2.25B at YE19). Based on my recovery estimates, the portfolio should be marked at 32c on dollar

8/10 I individually valued each security in the portfolio using broker quotes where I could find them or applying my best guess depending on the situation (familiar with most of the portfolio). Below table lays out where i think things shake out.

9/10 So, with looming debt maturities and a rapidly declining portfolio value - what happens to the investors?

Well, luckily this BDC was sold to a bunch of private investors who don& #39;t have a market to sell the securities (they have to rely on tender offers by manager).

Well, luckily this BDC was sold to a bunch of private investors who don& #39;t have a market to sell the securities (they have to rely on tender offers by manager).

10/10 EIG has collected $250 Million in the last three years to deliver NEGATIVE annual returns. What a great business model. Heads I win, Tails you lose. Thanks for playing. fin.

Link to BDC if you want to look at the portfolio:

https://www.fsinvestments.com/investments/funds/fsep">https://www.fsinvestments.com/investmen...

https://www.fsinvestments.com/investments/funds/fsep">https://www.fsinvestments.com/investmen...

Read on Twitter

Read on Twitter