1/ Franklin Templeton has decided to windup six of their marquee debt funds. What happened and what may happen in the future? Thread  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

@dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan

@dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan

2/ Over the years, Franklin& #39;s debt funds has had the reputation of delivering high yields for investors (by deploying money in AA and A papers) but keeping credit risks under control. They have been the envy of the mutual fund industry. Till about 12-15 months back that is.

3/ Slowing Indian economy has lead to more debt defaults in the last 18 months than ever before. Mutual funds have been busy segregating portfolios. The halo around Franklin has crumbled as they have not been immune. Sometime back they wrote down 100% of investment in Vodafone.

4/ Now these six of Franklin& #39;s funds never had much investments in AAA. Yield pickup was name of the game, after all. Now its almost 0. Whatever small numbers they had, they seem to have sold to manage redemption requests. The lower-grade papers are of course highly illiquid.

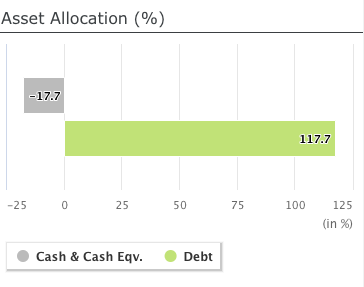

5/ To meet redemptions, they have also been borrowing monies, all the way upto 17.70% of the portfolio in their Short Term Income Plan (as of March). It is likely that the borrowing in these funds have further gone up in the last 23 days. Remember, @SEBI has a 20% borrowing cap.

6/ Inability to sell illiquid paper and lack of space to borrow more to meet the redemption pressure must have led to this decision. Some 28,000 crores of investor money is stuck.

7/ Redemptions will not be allowed until God knows when. Maybe six months, maybe a year, maybe two. Given the extreme distress all around and especially in the middle and lower-rung corporates, Franklin may be able to return back only 60-90% to investors.

8/ More worrying is the ripple effect that this move will have across the industry. Investors will rush to redeem from other funds carrying low-grade high-risk papers. Tomorrow. What will those funds do? They may also have to lockdown / suspend redemptions.

9/ To prevent panic, some regulatory action has to come in right away. The current economic slowdown is much worse than the 2008 Great Recession. Covid-19 situation is not going to resolve for 12-18 months at the least. Talks of a V-shaped recovery seem to be delusional.

10/ What can regulators do? SEBI can raise borrowing limits of mutual funds from the current 20% to a higher number. They had raised it to 40% on a case-to-case basis in the 2008 crisis.

11/ The main role will be of RBI. It is likely that they will announce some measure similar to the one in 2008 wherein they conducted special repos in order to enable banks meet liquidity requirements of mutual funds.

TLTRO 3.0 in the offing?

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=19249">https://www.rbi.org.in/Scripts/B...

TLTRO 3.0 in the offing?

https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=19249">https://www.rbi.org.in/Scripts/B...

Read on Twitter

Read on Twitter @dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan" title="1/ Franklin Templeton has decided to windup six of their marquee debt funds. What happened and what may happen in the future? Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> @dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan" class="img-responsive" style="max-width:100%;"/>

@dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan" title="1/ Franklin Templeton has decided to windup six of their marquee debt funds. What happened and what may happen in the future? Thread https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index"> @dugalira @andymukherjee70 @ananthng @deepakshenoy @WeekendInvestng @latha_venkatesh @NagpalManoj @menakadoshi @ShereenBhan" class="img-responsive" style="max-width:100%;"/>