Last night the Trump Administration issued rules that bar states & localities from using the #Coronvirus Relief Fund created in the CARES Act to help cover the massive revenue shortfalls they face because of #COVID-19 & the economic downturn. (Thread) https://home.treasury.gov/system/files/136/Coronavirus-Relief-Fund-Guidance-for-State-Territorial-Local-and-Tribal-Governments.pdf">https://home.treasury.gov/system/fi...

Also, Congressional Republicans & the White House failed to include state & local fiscal relief in the #COVID19 response legislation expected to pass the House today. So now it’s hugely urgent to get new funds in the next package & make existing funds more flexible. Here’s why:

State revenues are plummeting. Millions of people are getting laid off and aren’t paying income taxes; they’re also not spending money so sales tax collections have collapsed.

A few startling examples: by June 30 Maryland projects a 15% revenue drop. New Mexico expects a 20% or more drop in 2021. https://www.cbpp.org/research/state-budget-and-tax/states-start-grappling-with-hit-to-tax-collections">https://www.cbpp.org/research/...

Meanwhile, state costs are rising as they cover both the public health emergency and increased need of programs like food assistance and unemployment insurance. And, states have to balance their budgets – including for this fiscal year which ends June 30. https://www.cbpp.org/research/state-budget-and-tax/states-need-significantly-more-fiscal-relief-to-slow-the-emerging-deep">https://www.cbpp.org/research/...

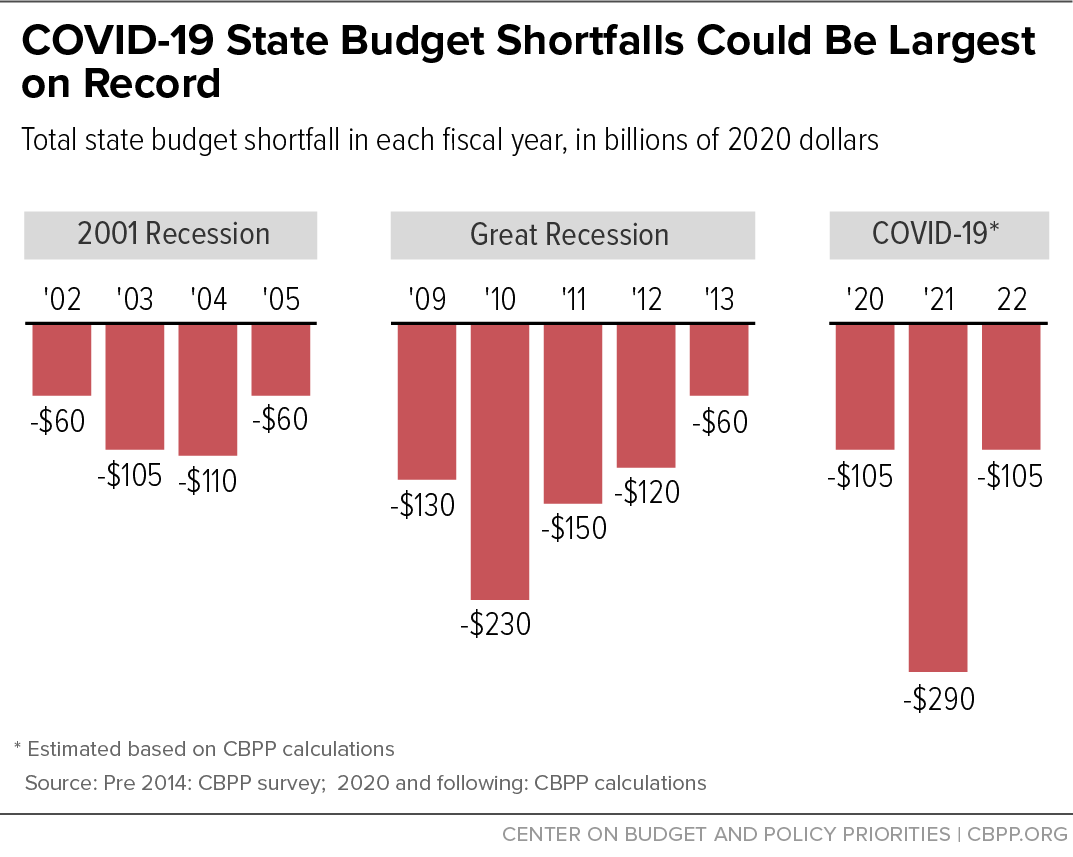

As a result, we project state shortfalls of $500 billion over the next few years. (Not counting local govts - also huge.)

So states need significant, additional & very flexible federal aid – especially more #Medicaid funds. Federal help provided so far falls far short of need & is slated to end much too soon.

And now Treasury is telling states they can’t use the major relief fund in the CARES Act to address these shortfalls.

W/o significant additional aid, states will lay off teachers & other workers & cut health care – in the middle of a pandemic! Other essential public services will be hit too. More people will be hurt, #COVID19 response will be less effective, & the downturn will be deeper/longer.

Some states may also turn to tax & fee increases to balance their budgets. Some of these tax increases could be warranted (eg closing corporate loopholes); others could hit low- and middle-income families hard and worsen the economic downturn.

We particularly worry about increases in criminal legal fees and fines, which cash-strapped states and localities turned to after the last recession and which lead to egregious and inequitable outcomes, including people in jail simply because they can’t pay.

That’s why governors of both parties are asking Congress for help. In a letter yesterday they called for $500 billion in flexible relief AND, importantly, in increase in the federal share of #Medicaid spending. https://www.nga.org/policy-communications/letters-nga/governors-letter-regarding-covid-19-aid-request/">https://www.nga.org/policy-co...

Increasing federal #Medicaid spending is the quickest & most effective way to replace lost state tax revenues & protect health care coverage. Congress took a first step in the #FamiliesFirst Act & now it needs to do more. https://www.cbpp.org/blog/families-firsts-medicaid-funding-boost-a-useful-first-step-but-far-from-enough">https://www.cbpp.org/blog/fami...

The Trump Administration has committed to provide more fiscal relief & to allow states to use the #Coronavirus Relief Fund to address revenue shortfalls. Congress must ensure that the next legislative package does this.

Bottom line: The next #COVID19 federal aid package, to be effective, must include v significant fiscal relief with more flexibility to state & local governments.

Read on Twitter

Read on Twitter