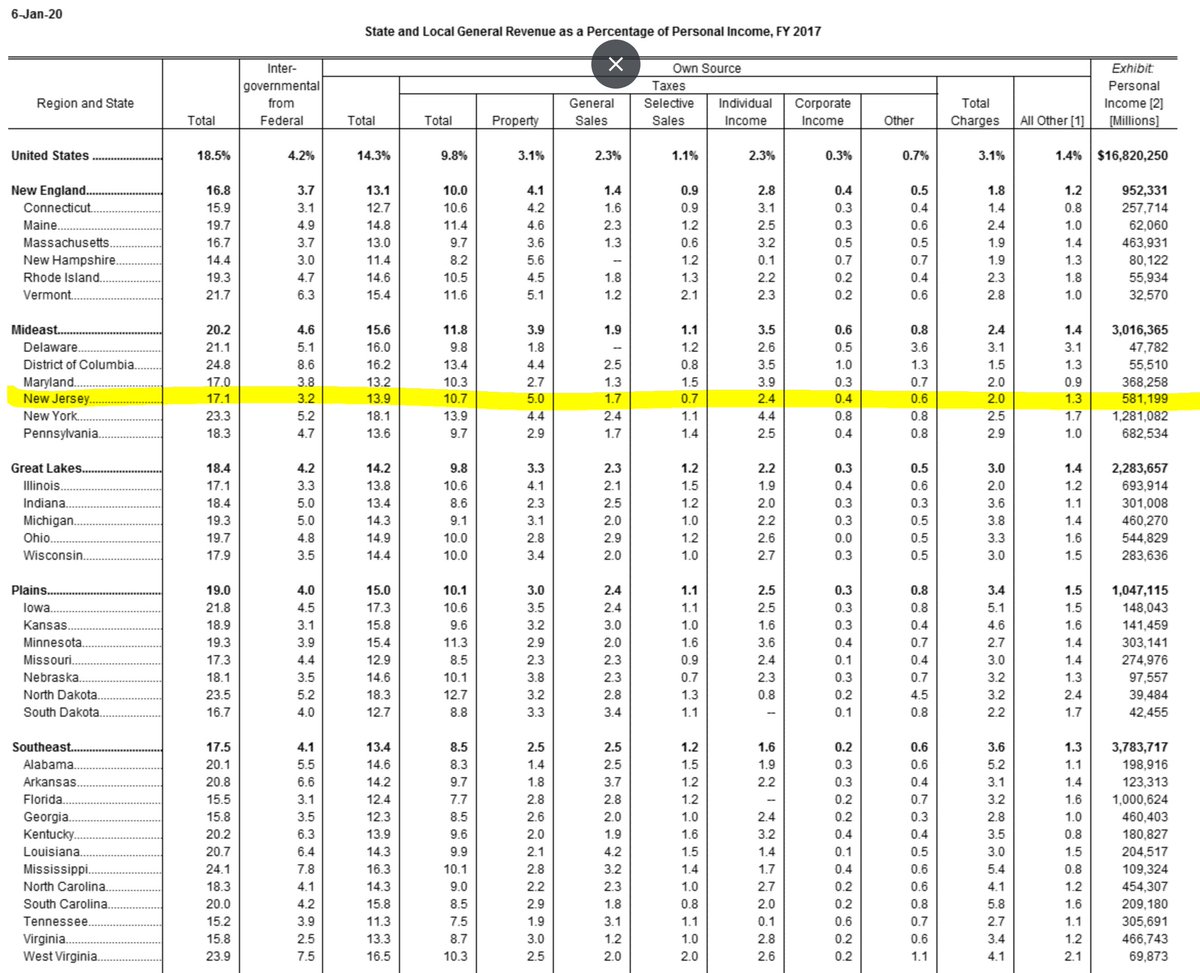

PSA: I know many in our state will find this blasphemous, but New Jersey isn& #39;t near tops in the nation for total taxes as a share of personal income. Not even top 5. When you take into account income, our level of taxes isn& #39;t eye-popping. https://www.taxpolicycenter.org/statistics/rankings-state-and-local-general-revenue-percentage-personal-income">https://www.taxpolicycenter.org/statistic...

I know - this goes against every talking point you& #39;ve heard all your life that New Jersey has the highest taxes in the nation and is taxed to hell. Yes, re: property taxes we& #39;re up there (tho still outpaced by NH & VT), but taking every other tax into account, we& #39;re not absurd.

Seriously, look at the above chart again. Delaware AND Pennsylvania - states that don& #39;t have nearly the assets (i.e. schools, transit, desirable local communities, etc) that NJ does - levy taxes on a greater share of their residents& #39; total income to fund their budgets than NJ.

Now this analysis is based on FY2017 budgets, but I really don& #39;t expect changes that NJ& #39;s made since to alter the picture very much. Point is, everyone acts like we& #39;re this out of control behemoth & we& #39;re just not when you place things in context with our lvls of income & assets.

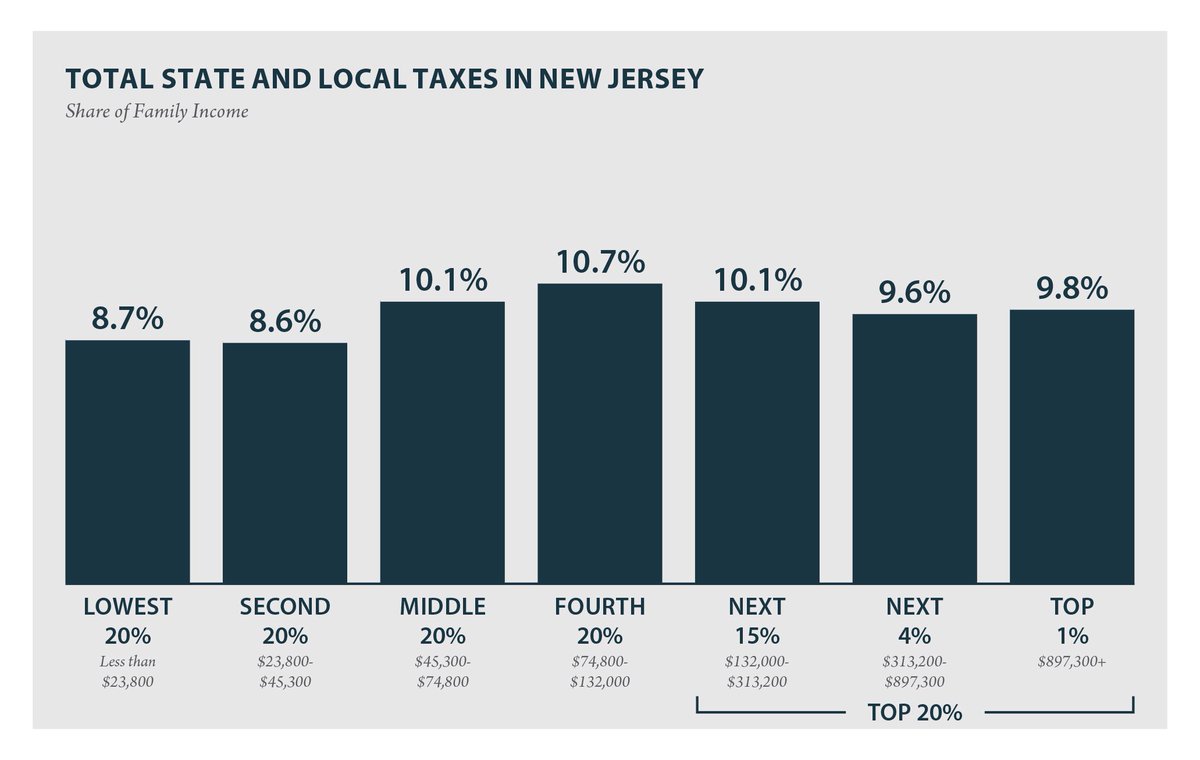

When folks argue against a fairer tax code, they& #39;re saying the rich shouldn& #39;t be expected to contribute more than others to the public services & assets critical to growing our economy. For me, that just doesn& #39;t square w/ our shared history as a nation. https://www.thenation.com/article/society/inequality-and-poverty-were-destroying-america-well-before-covid-19/">https://www.thenation.com/article/s...

If we really want to fix the inequity shown in this chart - where the middle class pays a bigger share of income to taxes than the richest 5% do - w/o worsening existing racial & economic disparities, we need to restore taxes on the very wealthy that were cut in the past.

Many obfuscate all this because: 1) it& #39;s politically convenient; 2) tax policy isn& #39;t straightforward so it isn& #39;t easy for the public to discount their errors.

Reducing property taxes equitably requires the rich contribute their fair share. #millionairestax https://www.taxpolicycenter.org/statistics/state-and-local-general-revenue-percentage-personal-income">https://www.taxpolicycenter.org/statistic...

Reducing property taxes equitably requires the rich contribute their fair share. #millionairestax https://www.taxpolicycenter.org/statistics/state-and-local-general-revenue-percentage-personal-income">https://www.taxpolicycenter.org/statistic...

As NJ crafts its budget this year, it must raise revenue to blunt/mitigate cuts to critical services during the downturn. Lawmakers need to have a clear understanding of how our tax policy really works - one based on data, not personal anecdotes & perpetual myths. #MathIsReal

Read on Twitter

Read on Twitter