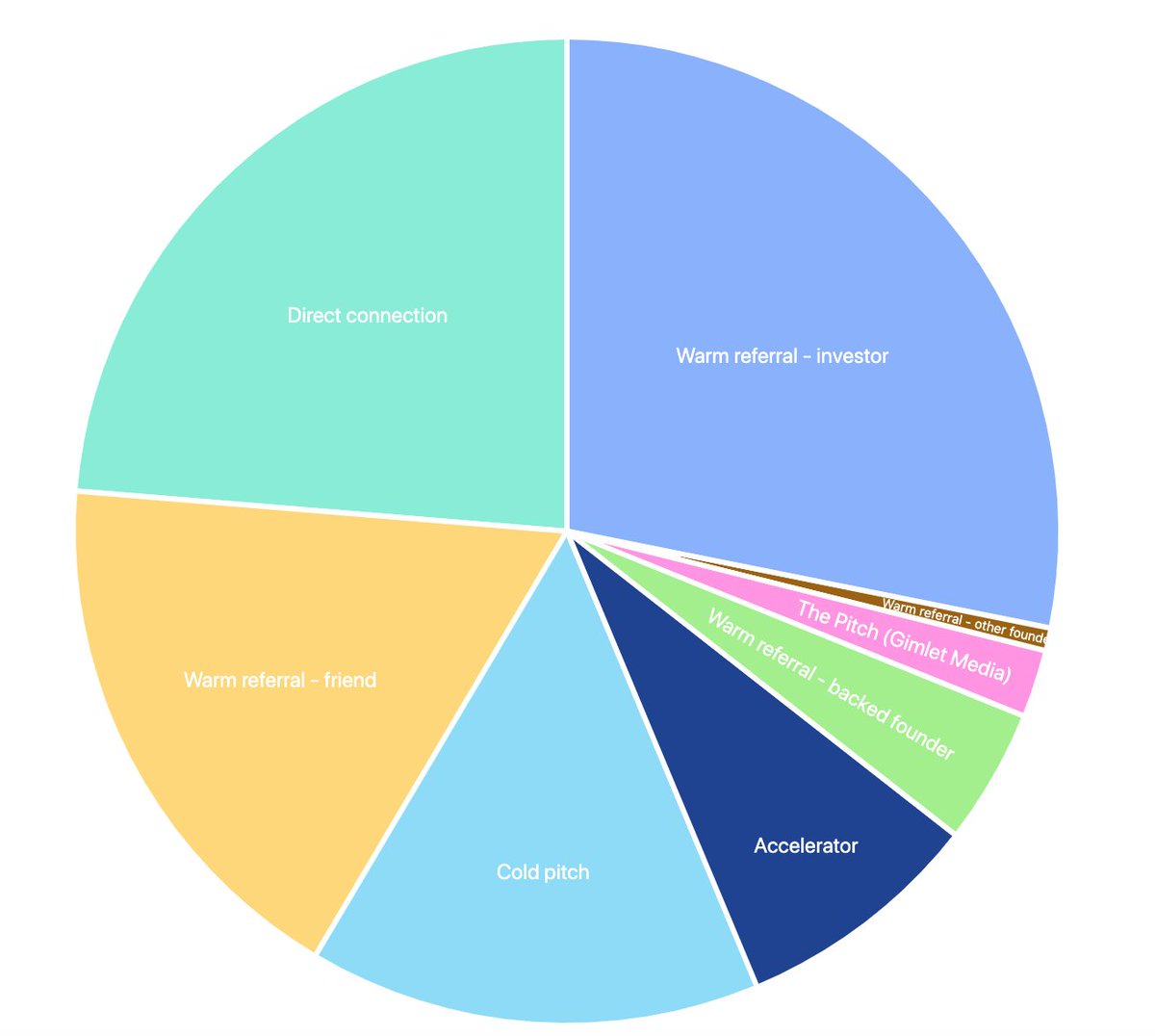

Today I want to share with you publicly where our deals @HustleFundVC fund come from. We& #39;ve done 135 investments since Sept 2017. 1 investment per week. Here& #39;s a high level graph.

Some thoughts on these referral channels...

Some thoughts on these referral channels...

1) When we say we are open to cold pitches, we mean it. Currently 15% of cos we& #39;ve invested in were cold. I.e. they went directly to http://hustlefund.vc"> http://hustlefund.vc & submitted an app.

Every app is reviewed & responded to. (sometimes slowly but we believe we have gotten back to all)

Every app is reviewed & responded to. (sometimes slowly but we believe we have gotten back to all)

2) If you have not received a response & applied before April 19th, it means that we inadvertently dropped the ball & didn& #39;t see your application. Sometimes we have process and technical snafus, and this is something we are working on. We are a startup, too, figuring out scale.

2b) So, please let us know, and we will take a look!

3) Often, ppl ask us "well how do those completely cold pitches turn out??" As it would turn out, while the data is early, they are at the same "quality" as our investments that come from warm channels.

4) Indicators of this incl: proportionally they go on to raise more money and grow revenues at the same level as our warm-referral-cos.

In other words, you would NOT be able to tell which companies of ours came in cold or warm.

In other words, you would NOT be able to tell which companies of ours came in cold or warm.

4b) For this reason, we encourage everyone w/ a pre-seed software startup to pitch us even if they don& #39;t have a warm referral. It& #39;s a less-friction, more scalable way for both startups and VCs to do business. It is the future.

5) As an aside, what is funny and somewhat ironic is that a lot of the best companies start out as "outsiders" but once they get some validation they are considered "insiders".

6) This is what accelerators have done for the industry - they put their stamp of approval on cos & make them insiders. Obv results vary depending on the acc, but as an industry, acc have made the startup ecosystem a bit more inclusive. But it shouldn& #39;t have to be that way.

7) This also means that most of the companies we invest in -- currently 85% -- are warm referrals. But, we use "warm" quite loosely. Let& #39;s talk about some of these.

8) 24% come from direct. While these incl folks we went to school with, we have also been investing in startups for years. To date, I& #39;ve backed ~340 cos & have looked at 30k+ companies in my career. All of these founders - incl those I& #39;ve passed on prev - would be incl in this #

9) And I expect this direct # to continue growing. This may feel counterintuitive.

But, investing in startups is a long-term game. An entrepreneur& #39;s first company may not work out. But, if you set the tone right with ppl, you may have a shot at investing in the 2nd company.

But, investing in startups is a long-term game. An entrepreneur& #39;s first company may not work out. But, if you set the tone right with ppl, you may have a shot at investing in the 2nd company.

9b) The more ppl we meet over time - whether we back the first company or not - the larger this "direct" # will be.

10) For this reason, if we didn& #39;t get involved in your first co and if you end up starting another software co, I encourage you to apply again.

Often we do a quick pass just on an idea alone. While the founding team is certainly very important, IMO, the idea matters a lot more.

Often we do a quick pass just on an idea alone. While the founding team is certainly very important, IMO, the idea matters a lot more.

11) Warm referrals from other investors, friends, founders we& #39;ve backed before, and even founders we& #39;ve passed on comprises 50%+ of our deals.

I think that latter category is the most interesting - sometimes we pass on teams and then they refer their friends whom we invest in.

I think that latter category is the most interesting - sometimes we pass on teams and then they refer their friends whom we invest in.

12) Yrs ago, when I was a founder and a founder-friend would ask me to ping an investor who passed on my co about introing him/her, I would often say, "I& #39;m happy to do that, but that investor passed on me, so I& #39;m not sure if he/she would be interested."

13) Now that I& #39;m on the other side, that was totally the wrong attitude. Passing isn& #39;t personal. When we pass on founders, almost always it& #39;s because we don& #39;t have conviction in the idea or OUR participation in the idea as a small fund (but could be great for a big fund).

14) So, I very much welcome everyone to think of us if you have a friend whom you think highly of and is starting a software company. Thank you for all of the referrals!

15) < 10% of our deals come from accelerators. We look at lists from all the major acc.

And we are excited to see pitches even well before pitches are polished / before demo day.

And we are excited to see pitches even well before pitches are polished / before demo day.

16) Shoutout to @thepitchshow - you are now a slice in this pie of our deals, and I hope to be invited back for many seasons :)

Read on Twitter

Read on Twitter