Home loans is going to be a huge issue in the coming months. Several middle class families might default. Coupled with job cuts. Ppl have been pushed beyond a point. Some families are losing their 2 Generations of savings. First hand startling tales. Am not exaggerating here.

A leading brand in manufacturing industry has announced that they won& #39;t be able to pay salary until June 2020. Possibly till July 2020. State Heads & assistants are told to cut 90% of their staff. NINETY PERCENT. That& #39;s the quantum of issue we& #39;re expecting. @FinMinIndia

Out of their 13 State managers, in TN, 11 are to be asked to leave in the coming days. This is a leading brand, I am aware of. They& #39;re into interiors, facade & panel business. Good thing is, this company has stopped dependence on China permanently. Coimbatore cos benefiting here.

Typically, ppl have about 25% of home loan as family savings. Even if they are paying up the 25% to have a roof above their head, they& #39;re not going to be able to pay the rest. This is exactly what happened in Fannie Mae & Freddie Mac in 2008.

This is what is happening in Tier-2 city. Imagine the way it is going to happen in Cities / Metros. Freaking unbelievable.

Those 1 Crore onwards wala housing projects won& #39;t have ANYONE to buy. This entire lockdown has taught ppl how to NOT spend their money. Save. Save. Save.

Those 1 Crore onwards wala housing projects won& #39;t have ANYONE to buy. This entire lockdown has taught ppl how to NOT spend their money. Save. Save. Save.

Real estate, travel & hospitality, would go down by atleast 70-90% (ballpark figure.) Across the board. No ifs & buts. They& #39;re going down. Best time to get into manufacturing. Govt is proactive in kick-starting Indian Manufacturing Jumbo. Don& #39;t expect perks. Work near your homes.

People have changed. Their perception towards life is changing. Only few economic issues might persist. Over time we would recover it. Apart from that, ppl would start saving a LOT. No risk taking henceforth. In short, we& #39;re going to deflate (read correction) for a longer period.

I only emphasis ppl to take care of your mental health. Guys, this is very important. Don& #39;t take ANY extreme step for a few financial failures. Just remember, you are NOT going to be alone in this. Many are like you & Government is trying its best to stop this from reaching you.

Industries would default on their loans at a later stage. First ones to default are those who took loans to pay salaries. Businesses should avoid this path completely. It is better to say NO salary than taking a loan (from banks or otherwise!) to pay salaries.

I think, the moratorium is not going to help a lot many. Banks & lenders should refinance the loans in its entirety. The paradigm shift which no one expected has happened. All honest tax payers, who have paid on time for years, should not be made to lose their homes. :(

All loan rates should go down by atleast 50-60%. Else, this economy is GONE. Be prepared to lose the homes & make it easy to give bankruptcy certificates. To crores of ppl.

Lenders CANNOT be greedy. When everyone is losing their homes.

Lenders CANNOT be greedy. When everyone is losing their homes.

Either banks get their interest rates reduced & refinance so that they get their principle & a limited loss. Or, going to lose the value of the property - when they put it for sale. With no one to buy, lenders only could take it over & leave the borrower.

A significant %age of ppl who would let lenders takeover their property in lieu of unpayable loans, would have their CIBIL ratings marked with negative points.

This would affect many in their "prime" age useless to further borrow from lenders. Afterall, we brainy idiots made CIBIL a norm when trust was the key factor earlier. Now, how many know their bank managers, where their accounts are? (I don& #39;t know mine!)

This is just a gist of what all to expect in the coming months. The music is stopping guys. It is SWIFTLY freaking stopping. Matter of few months before it fully stops. You may have a 7-8 week window to settle whatever you might want to. Do it at the earliest & SIT TIGHT.

Few tips, for a year or so. Avoid travel, avoid unnecessary risks & purchases. Consumption won& #39;t save you. Minimal living for next 2-3yrs atleast is going to help.

Give preference to elders & take good care of them. Don& #39;t compromise on their health & well being. You cut your own comfort & look after them.

Middle class - the growth engine & consumption machine - is finally going down. Like Titanic.

Middle class - the growth engine & consumption machine - is finally going down. Like Titanic.

If you don& #39;t know what I am talking about, and that I am exaggerating what is reality, pls talk to any MSME guy. He& #39;ll tell you. Ask him if he has money to pay salaries for April & May. Worse, for June. They& #39;ll start telling you reality. Face it.

Look, this is an extraordinary situation. Many jobs would JUST BE GONE. They& #39;re not going to return. Reverse migration is SURE to happen. Jobs would be in tier-2 towns & not in Cities / metros.

True story. Today, the guy who delivered us bread & milk, in his family business (bakery), was working in Chennai as sales rep a month ago. Now, doing home-delivery in our tier - 2 city. Ppl& #39;s lifestyle is changing. Rural economy boom is one good thing we& #39;ll see in coming years.

I repeat, let us now not blame the Govt here. They are doing their best to keep everyone happy. Which is impossible till date. As middle class was always shown 3rd finger from either direction. As a friend said, "except for Govt employees & poor, rest are defending themselves."

Amidst this, look at the resilience & beauty of my compatriots. They& #39;re not on streets doing riots. Except single source, almost entire nation is abiding by lockdown restrictions. No L&O issue. We may be chaotic otherwise, but are very well disciplined in public conduct. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👍" title="Thumbs up" aria-label="Emoji: Thumbs up">

That& #39;s it for now. Will post more observations on post-lockdown scenario after I get to speak with more ppl over time. Stay safe, stay healthy. Physically & mentally healthy.

Since many think this is apocalyptic thought process, let me say this. This is something NO Government had in mind. I still wish, we are back to normal when this is all over. Hopefully. BUT, ppl in business are struggling. It& #39;ll take atleast 2-3yrs to be normal. Not usual.

If no business done, certain headers still remain. Many take the easiest way out - cutting salary & perks. Some cut staff as well. Depends on business. Once those businesses are used to this way for an extended period, it is here to stay. And those jobs are gone for a while too.

When job goes away, it is tough to create one again. It also takes down few families down. Some savings would be eroded. First one to go down would be middle class & urban-poor. They& #39;ll take the hit big time. Not many getting this.

Let me give you an example. Everyone is happy about doing work from home. Well, it is deemed to be that way for many months together. Give it a thought. What would happen to housekeeping staff & security guards? What would happen to cafeteria staff? You getting the gist?

A company I know, has said to their staff that only 20-30% staff would be in office for a few months - after the lockdown is lifted. Orgs are cautious. They& #39;re even contemplating to cut down on office space. Now, think of office workspace / co-working space? Think.

I repeat, I& #39;d be happy, if this all gets back to normal automatically. But, fact is, ppl& #39;s thought process has been changed beyond a point. They& #39;ll start reverse migration soon. (Me inclusive in due course.)

Brighter side of all this is, rural economy would go up.

Brighter side of all this is, rural economy would go up.

PM while addressing Sarpanch makes a sharp observation. Which many missed. Make what you want to out of it.

He said, "It is during crisis that real talent & resilience comes to light. And, not when you are secured. Rural population were leading light to others on this."

He said, "It is during crisis that real talent & resilience comes to light. And, not when you are secured. Rural population were leading light to others on this."

Also acknowledged by PM, that the disruption & measures taken by ppl / companies / industries & state governments. Wherever this is leading to, I am sure, govt has ears on ground. Happy at that, for now. How much cut in profits of lenders is something that will be watched.

https://twitter.com/visaraj/status/1253578799456718848">https://twitter.com/visaraj/s...

Feedback is being taken. Let us hope how far Govt can help. If we& #39;re going to see an average 30-50% salary cut, we are going to probably see reduction in interest rate on loans by 30-50% too. Can& #39;t be one sided. Else, we& #39;re looking at large scale default. https://www.thehindu.com/business/Economy/home-dpiit-secretaries-talk-to-industry-associations-for-speeding-up-economic-activity-mha/article31416323.ece">https://www.thehindu.com/business/...

Rightly said. https://www.wionews.com/india-news/biggest-lesson-taught-by-coronavirus-is-to-be-self-reliant-says-pm-modi-via-video-conference-294475">https://www.wionews.com/india-new...

Gkad to know that. Waiting for details. MSME is the way forward. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers"> https://twitter.com/ETNOWlive/status/1253619636840484865">https://twitter.com/ETNOWlive...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤞" title="Crossed fingers" aria-label="Emoji: Crossed fingers"> https://twitter.com/ETNOWlive/status/1253619636840484865">https://twitter.com/ETNOWlive...

TCS says, 75% of its employees to work from home permanently.

Expected 70-80% to work from home. TCS is taking a call to be at 75%. This is going in expected trajectory.

Source: https://www.news18.com/news/business/tcs-says-75-of-its-3-5-lakh-employees-will-work-from-home-even-post-coronavirus-2592291.html">https://www.news18.com/news/busi...

Expected 70-80% to work from home. TCS is taking a call to be at 75%. This is going in expected trajectory.

Source: https://www.news18.com/news/business/tcs-says-75-of-its-3-5-lakh-employees-will-work-from-home-even-post-coronavirus-2592291.html">https://www.news18.com/news/busi...

Story seems to be same. Even for big Cos. Here, JSW Energy, Birla (esp, Cements) & TCS are quoted. Scary read.

M&A correction is to happen as well. Thank god! Never believed those cos are worth that big monies. https://economictimes.indiatimes.com/news/company/corporate-trends/companies-see-cash-as-king-cut-capex-plans/articleshow/75369753.cms">https://economictimes.indiatimes.com/news/comp...

M&A correction is to happen as well. Thank god! Never believed those cos are worth that big monies. https://economictimes.indiatimes.com/news/company/corporate-trends/companies-see-cash-as-king-cut-capex-plans/articleshow/75369753.cms">https://economictimes.indiatimes.com/news/comp...

@visaraj - Exactly what we were discussing yesterday. Unless Central Banks go negative on rates given to banks, this situation is NOT going to be back on track anytime in our generation. MSMEs

@NR_Tatvamasi @rangats https://www.bloomberg.com/opinion/articles/2020-04-24/coronavirus-economy-the-fed-should-go-negative-next-week">https://www.bloomberg.com/opinion/a...

@NR_Tatvamasi @rangats https://www.bloomberg.com/opinion/articles/2020-04-24/coronavirus-economy-the-fed-should-go-negative-next-week">https://www.bloomberg.com/opinion/a...

Comical piece. This is like, "Titanic is not sinking. Ek dhakka aur do..."

Disclaimer: I don& #39;t trust this news item one bit. But, I am just not underestimating our babus. They may come up with such gems. Stop giving them ideas! https://theprint.in/economy/covid-19-cess-40-tax-for-rich-irs-officers-offer-economy-revival-tips-to-modi-govt/409108/">https://theprint.in/economy/c...

Disclaimer: I don& #39;t trust this news item one bit. But, I am just not underestimating our babus. They may come up with such gems. Stop giving them ideas! https://theprint.in/economy/covid-19-cess-40-tax-for-rich-irs-officers-offer-economy-revival-tips-to-modi-govt/409108/">https://theprint.in/economy/c...

While reality is this, @IRSAssociation is thinking about taxing more.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person facepalming" aria-label="Emoji: Person facepalming">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤦" title="Person facepalming" aria-label="Emoji: Person facepalming">

P.S: Am not one bit happy sharing this. But, had to, as many ppl still think, they& #39;re going to sustain in long run. Trust me, in current set of rules, NO! https://twitter.com/NEWS9TWEETS/status/1254348397298855937">https://twitter.com/NEWS9TWEE...

P.S: Am not one bit happy sharing this. But, had to, as many ppl still think, they& #39;re going to sustain in long run. Trust me, in current set of rules, NO! https://twitter.com/NEWS9TWEETS/status/1254348397298855937">https://twitter.com/NEWS9TWEE...

The crap from IRS should be ignored as a cruel joke. On taxpayers. https://twitter.com/avarakai/status/1254322451300773889">https://twitter.com/avarakai/...

The loss is colossal. https://twitter.com/CNBCTV18Live/status/1255822439575023618">https://twitter.com/CNBCTV18L...

https://twitter.com/CNBCTV18Live/status/1255826960455884800">https://twitter.com/CNBCTV18L...

This is what one had been suggesting for weeks now. Finally, some sense seeping through walls of rigidity. Hope @FinMinIndia listens.

One-time loan restructuring would work better than moratorium extension: Axis Bank CEO Amitabh Chaudhry | Business News https://is.gd/x1fj1W ">https://is.gd/x1fj1W&qu...

One-time loan restructuring would work better than moratorium extension: Axis Bank CEO Amitabh Chaudhry | Business News https://is.gd/x1fj1W ">https://is.gd/x1fj1W&qu...

"Moratorium is a bit of a blunt instrument and only pushes the problem down the road," Amitabh Chaudhry told ET Now

HA HA HA.....these guys in Finmin are for real? How they missed this key indicator back in time, only God knows. Beginning to think, if Minister was advised badly.

HA HA HA.....these guys in Finmin are for real? How they missed this key indicator back in time, only God knows. Beginning to think, if Minister was advised badly.

Am really happy that industry is speaking out. Now, expect @RBI to take a call. Am sure they& #39;d do. All needs to be seen is whenever restructuring is happening, make sure, CIBIL score is not touched. Strict NO NO.

#Stimulus https://economictimes.indiatimes.com/markets/expert-view/rbi-should-allow-one-time-loan-restructuring-instead-of-moratorium-extension-amitabh-chaudhry/articleshow/75825277.cms">https://economictimes.indiatimes.com/markets/e...

#Stimulus https://economictimes.indiatimes.com/markets/expert-view/rbi-should-allow-one-time-loan-restructuring-instead-of-moratorium-extension-amitabh-chaudhry/articleshow/75825277.cms">https://economictimes.indiatimes.com/markets/e...

Hear it from experts.

Two arguments here.

Argument #1: https://cfo.economictimes.indiatimes.com/news/moratorium-if-extended-would-increase-the-risk-of-defaults-charanjit-attra-ey/75687644

Argument">https://cfo.economictimes.indiatimes.com/news/mora... #2: https://www.financialexpress.com/money/rbi-to-extend-emi-moratorium-on-home-personal-loans-for-three-more-months-heres-what-sbi-research-says/1962711/lite/">https://www.financialexpress.com/money/rbi...

Two arguments here.

Argument #1: https://cfo.economictimes.indiatimes.com/news/moratorium-if-extended-would-increase-the-risk-of-defaults-charanjit-attra-ey/75687644

Argument">https://cfo.economictimes.indiatimes.com/news/mora... #2: https://www.financialexpress.com/money/rbi-to-extend-emi-moratorium-on-home-personal-loans-for-three-more-months-heres-what-sbi-research-says/1962711/lite/">https://www.financialexpress.com/money/rbi...

Now, we& #39;re talking. This is the only way out. Moratorium path clearly isn& #39;t the path that should have been taken. Interest rates should fall to range of 3-5% or below, from current 8-11%. Otherwise, we& #39;re going to see a volatile market for extended period - in years.

https://timesofindia.indiatimes.com/business/india-business/rbi-may-need-to-aggressively-cut-rates-alongside-fiscal-stimulus-report/articleshow/75848351.cms">https://timesofindia.indiatimes.com/business/...

The 75 basis point rate cut, in March 2020, was not passed on to many customers. If it was meant to ease pressure. Just saying. Any rate cut by RBI should be aimed at passing it to customers. Otherwise, new credit market would never pick up. Mark this.

While am not asking for negative interest rates, am asking for massive cuts in interest rates. If Germany can go this far, am sure, USA will follow suit too. https://twitter.com/Reuters/status/1263167458304802817">https://twitter.com/Reuters/s...

Pls don& #39;t! For godsake, just don& #39;t. https://www.moneycontrol.com/news/business/msmes-seek-nine-month-extension-on-moratorium-for-loan-repayments-report-5291201.html">https://www.moneycontrol.com/news/busi...

They just did something in that direction. An extension is more interest for the same amount. My neighbour just told a nbfc, he& #39;s not getting paid till August & can& #39;t pay interest for this period. He& #39;s not filthy rich nor his loan amount is huge. But interest rate sucks!

End this farce called moratorium, pls! The noose tightening, many ppl are unaware of it yet. They& #39;re in for a shock in due course. https://twitter.com/ZeeNewsEnglish/status/1263696573579456512">https://twitter.com/ZeeNewsEn...

Need interest rate cuts. When other countries are nearing near negative interest rates, in India we& #39;re paying 8-12%. When RBI announced RR & RRR cuts, even 0.5% rate cut also not being passed on to customers, is really irritating, to be honest. FD interest rates cut, already. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😳" title="Flushed face" aria-label="Emoji: Flushed face">

Since the reason given is, to ease lending, am keeping expectations low.

Let& #39;s wait to see how this interest rate cut is passed to customers. https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤐" title="Zipper-mouth face" aria-label="Emoji: Zipper-mouth face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤐" title="Zipper-mouth face" aria-label="Emoji: Zipper-mouth face">

Let& #39;s wait to see how this interest rate cut is passed to customers.

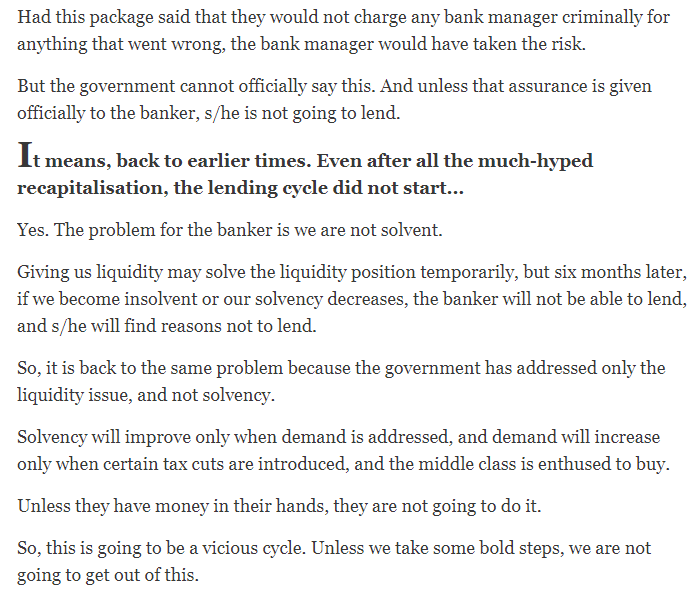

Here, @MRVChennai explained very beautifully.

Problem is, liquidity & solvency are two separate terms. But, some learned ppl in power corridors seems to have mixed it together and arriving at their own conclusions.

Source: https://www.rediff.com/business/interview/economic-package-is-like-an-onion/20200522.htm">https://www.rediff.com/business/...

Problem is, liquidity & solvency are two separate terms. But, some learned ppl in power corridors seems to have mixed it together and arriving at their own conclusions.

Source: https://www.rediff.com/business/interview/economic-package-is-like-an-onion/20200522.htm">https://www.rediff.com/business/...

This is something I would agree to. This is what needs to be done to ppl across board. This way, you& #39;d have taken care of those who "supply" and those who create "demand" in the country. :) https://twitter.com/ANI/status/1263760982561574913">https://twitter.com/ANI/statu...

Meanwhile... from US.

(Via @OosiTappasu) https://twitter.com/business/status/1263839122348785665">https://twitter.com/business/...

(Via @OosiTappasu) https://twitter.com/business/status/1263839122348785665">https://twitter.com/business/...

Read on Twitter

Read on Twitter