"Last time we did money printing nothing happened"

Few people actually understand why we got away with it

1/ It was done at the same time China was undertaking massive infrastructure spending

2/Tech also held prices down

3/Globalisation was in full swing which is deflationary

Few people actually understand why we got away with it

1/ It was done at the same time China was undertaking massive infrastructure spending

2/Tech also held prices down

3/Globalisation was in full swing which is deflationary

All these factors have now broken down or reversed

Globalisation is now dead.

Talk is of restoring national production chains which is hugely inflationary (rebuilding the chain and doing it with a higher cost labour force).

Supply chains are also broken at both ends

Globalisation is now dead.

Talk is of restoring national production chains which is hugely inflationary (rebuilding the chain and doing it with a higher cost labour force).

Supply chains are also broken at both ends

We now have a supply shock and a demand shock

Tech offshoring manufacturing may have to be re-shored with the corresponding price increases. Tech startups can no longer burn cash indefinitely

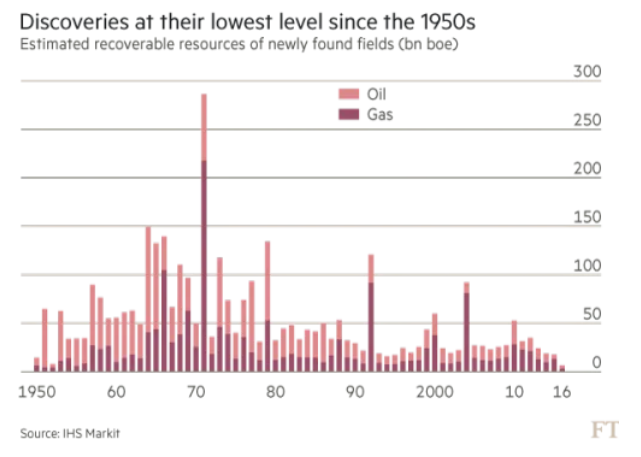

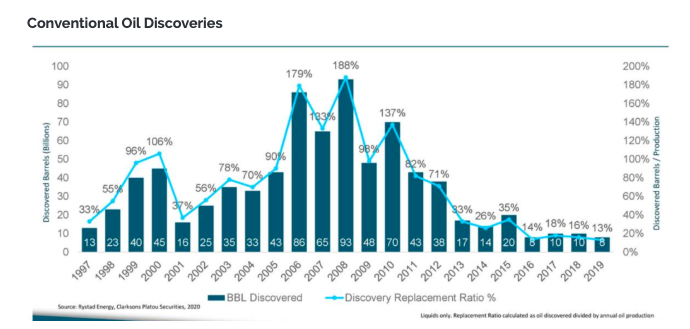

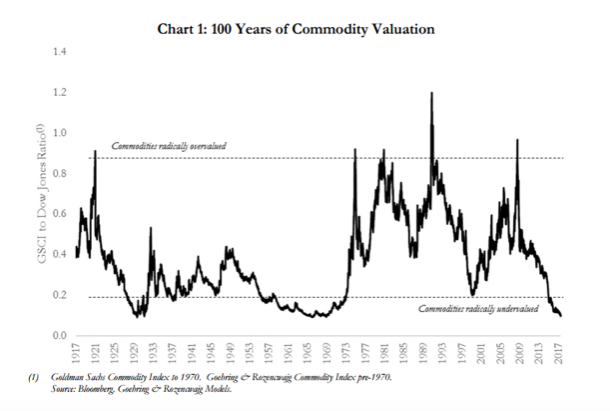

What we are seeing in the commodities (particularly oil) is further reduction of CAPEX

Tech offshoring manufacturing may have to be re-shored with the corresponding price increases. Tech startups can no longer burn cash indefinitely

What we are seeing in the commodities (particularly oil) is further reduction of CAPEX

Read on Twitter

Read on Twitter