SAUCE THREAD |

Will pin this to my profile so you can easily find it. Will continue to add to this.

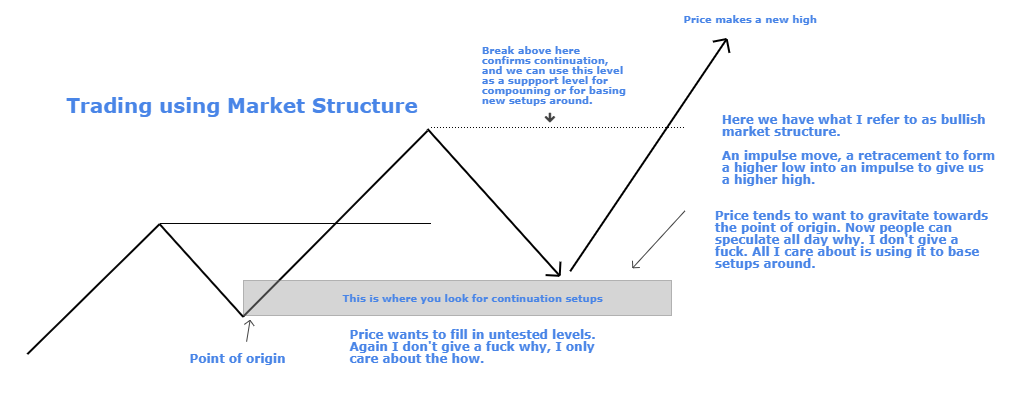

MARKET STRUCTURE 101 - Bullish Market Structure

Knowing how to read market structure and trend is a highly underutilised skill.

Will pin this to my profile so you can easily find it. Will continue to add to this.

MARKET STRUCTURE 101 - Bullish Market Structure

Knowing how to read market structure and trend is a highly underutilised skill.

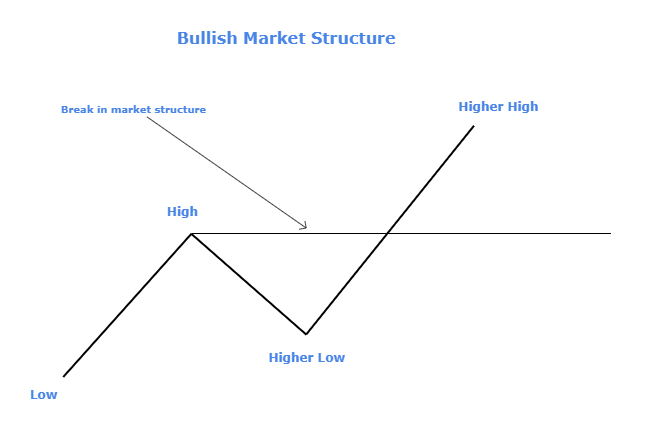

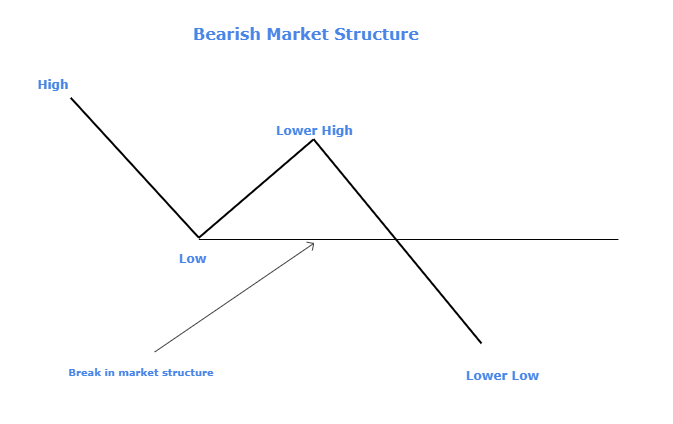

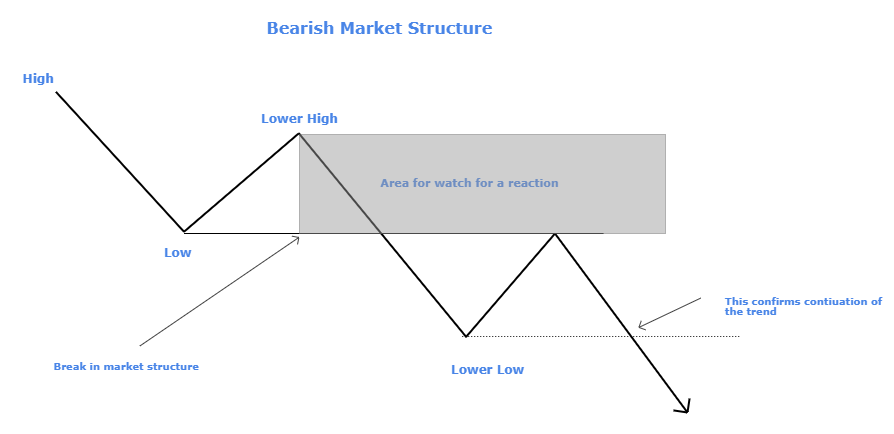

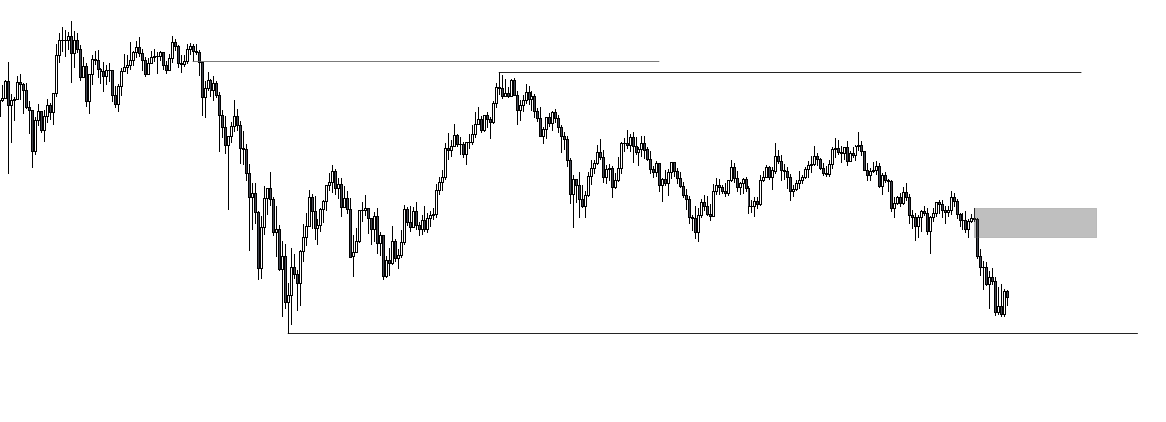

MARKET STRUCTURE 101

Simple way to gauge trend using nothing but highs and lows.

- The most recent level of market structure is the MOST important.

- Break in market structure does NOT mean the trend has changed. I use this as an indication that price MAY change direction.

Simple way to gauge trend using nothing but highs and lows.

- The most recent level of market structure is the MOST important.

- Break in market structure does NOT mean the trend has changed. I use this as an indication that price MAY change direction.

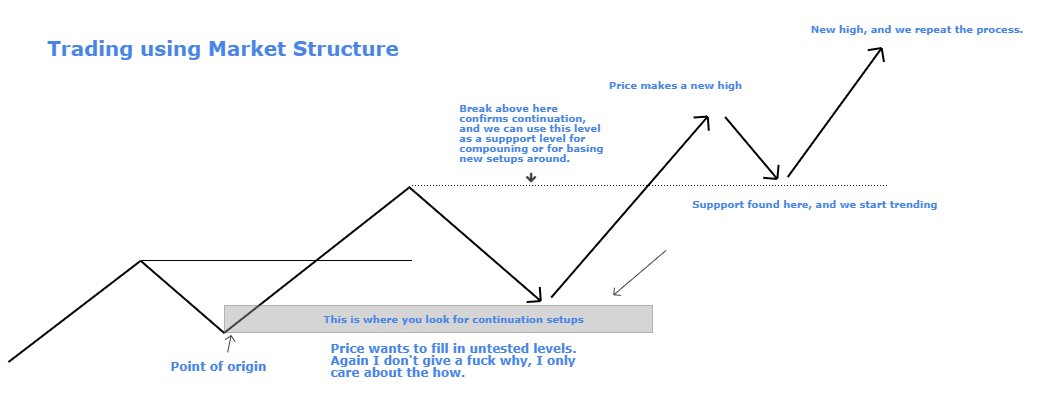

TRADING AROUND MARKET STRUCTURE |

Learn how price moves, and you& #39;ll learn to get an edge over the market.

This is how trends form. And you know the old saying,

tren is ur fren

Learn how price moves, and you& #39;ll learn to get an edge over the market.

This is how trends form. And you know the old saying,

tren is ur fren

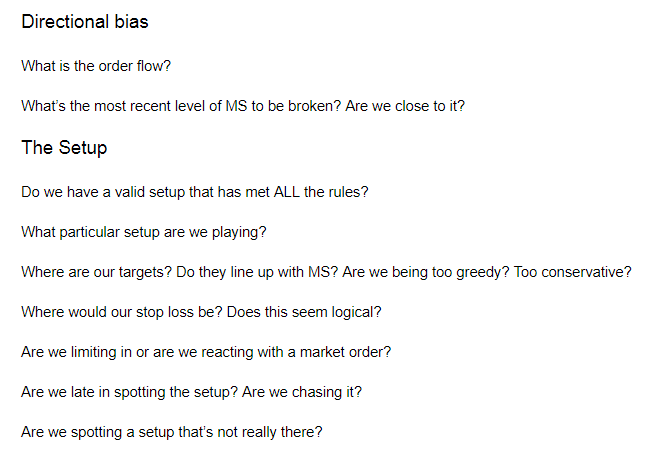

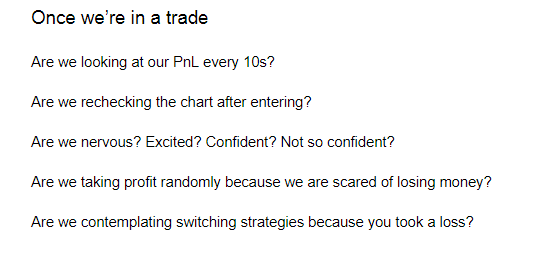

SETUP CHECKLIST |

Thought this would be relevant for everyone even if you don& #39;t trade with the same style as me.

Most questions still apply.

Thought this would be relevant for everyone even if you don& #39;t trade with the same style as me.

Most questions still apply.

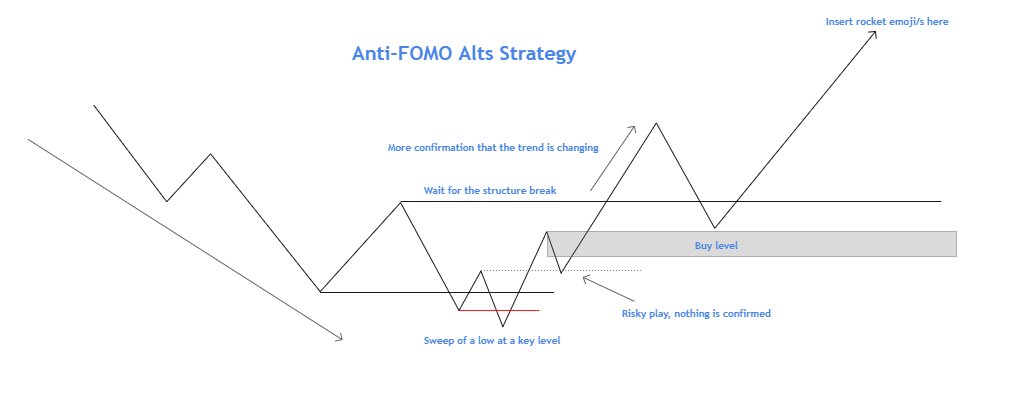

ALTS STRATEGY |

Here& #39;s another diagram for those who want confirmation for their setups in the alt markets.

Anti-FOMO is built in with patience.

Here& #39;s another diagram for those who want confirmation for their setups in the alt markets.

Anti-FOMO is built in with patience.

SETUP EXAMPLES - 1|

$SXP - Short

Using previous structure and a downside shift to frame this setup.

Pic 1 - 4H

Pic 2 - 30m

Pic 3 - 1m entry

Lots of valuable data in here, so save this and study it if you like.

$SXP - Short

Using previous structure and a downside shift to frame this setup.

Pic 1 - 4H

Pic 2 - 30m

Pic 3 - 1m entry

Lots of valuable data in here, so save this and study it if you like.

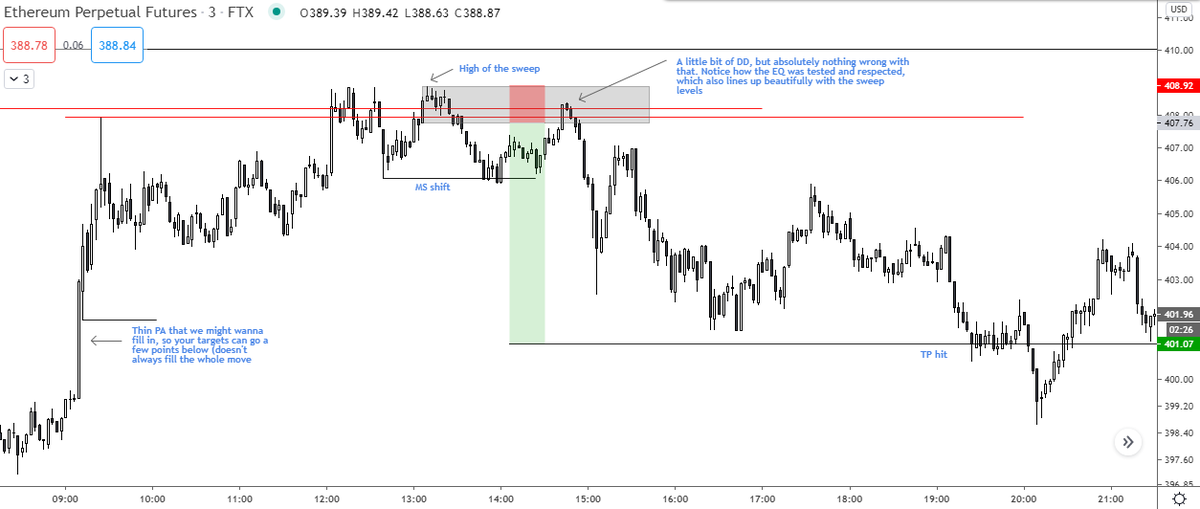

SETUP EXAMPLES - 2 |

$ETH - Short

Using previous structure and a downside shift to frame this setup too.

Almost identical to the SXP short I shared, but here it is in its glory.

Rinse and repeat :)

$ETH - Short

Using previous structure and a downside shift to frame this setup too.

Almost identical to the SXP short I shared, but here it is in its glory.

Rinse and repeat :)

DIRECTIONAL BIAS ANALYSIS |

Thought I& #39;d share this here. Nice bit of analysis of $ETH. Some sauce in there if you listen and watch carefully https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerdgezicht" aria-label="Emoji: Nerdgezicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤓" title="Nerdgezicht" aria-label="Emoji: Nerdgezicht">

https://vimeo.com/455094400

RTs">https://vimeo.com/455094400... appreciated.

Thought I& #39;d share this here. Nice bit of analysis of $ETH. Some sauce in there if you listen and watch carefully

https://vimeo.com/455094400

RTs">https://vimeo.com/455094400... appreciated.

Some of these concepts might be new to you, in terms of the classification of levels.

This was a video shared with the #SMS2x traders. We& #39;re stepping things up, and we& #39;re gonna take over.

This was a video shared with the #SMS2x traders. We& #39;re stepping things up, and we& #39;re gonna take over.

ICT breaker play in less than 90 seconds |

ICT put a YT video out about a recent trade he took. Video was nearly 90 minutes long...

Here is the whole setup, start to finish, in 90s. No & #39;lectures& #39; needed.

Enjoy. https://vimeo.com/458541651/cd6946d49c">https://vimeo.com/458541651...

ICT put a YT video out about a recent trade he took. Video was nearly 90 minutes long...

Here is the whole setup, start to finish, in 90s. No & #39;lectures& #39; needed.

Enjoy. https://vimeo.com/458541651/cd6946d49c">https://vimeo.com/458541651...

Trading Tip |

If you are looking at a level that price is approaching and you are unsure if it will hold or not, just assume it will.

In doing so, my critical thinking and reactive decision making has been much better as apposed to speculating whether it will or not.

If you are looking at a level that price is approaching and you are unsure if it will hold or not, just assume it will.

In doing so, my critical thinking and reactive decision making has been much better as apposed to speculating whether it will or not.

Trading Tip |

Many of you are now following the system I use, which is awesome.

But don& #39;t get confused when I say & #39;price will always test the origin& #39;.

It will, but your analysis is used to figure out if/when it& #39;s gonna hold, and if it& #39;s worth putting money down on it.

Many of you are now following the system I use, which is awesome.

But don& #39;t get confused when I say & #39;price will always test the origin& #39;.

It will, but your analysis is used to figure out if/when it& #39;s gonna hold, and if it& #39;s worth putting money down on it.

FAQs |

Do you have a group? Yes, and it& #39;s not free.

Can you help me with xyx strategy? No, if it& #39;s not my strategy I can& #39;t help.

What& #39;s your strike rate? You shouldn& #39;t care.

Do you have a mentor? Youtube was my mentor.

Do you have a group? Yes, and it& #39;s not free.

Can you help me with xyx strategy? No, if it& #39;s not my strategy I can& #39;t help.

What& #39;s your strike rate? You shouldn& #39;t care.

Do you have a mentor? Youtube was my mentor.

How long have you been trading? 4 years

Do you trade full time? Yes

Do you mentor? No

Do you trade stocks? Never, and never will.

Do you trade full time? Yes

Do you mentor? No

Do you trade stocks? Never, and never will.

If I give you my BTC, will you trade it for me? Fuck no.

How long does it take to become profitable? Non quantifiable. How long is a piece of string?

What do you think of *insert twitter handle here*? Fuck off and gossip somewhere else.

How long does it take to become profitable? Non quantifiable. How long is a piece of string?

What do you think of *insert twitter handle here*? Fuck off and gossip somewhere else.

Bitesize Analysis on ETHPERP - October 14th |

If you complain about the video quality, you& #39;re getting blocked :) https://vimeo.com/468081271/c7e14cd198">https://vimeo.com/468081271...

If you complain about the video quality, you& #39;re getting blocked :) https://vimeo.com/468081271/c7e14cd198">https://vimeo.com/468081271...

Who wants another #ETH video rundown?  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👀" title="Ogen" aria-label="Emoji: Ogen">

1 hour until the 4H close.

50 likes/comments/RTs by then and I& #39;ll throw a full top down for you twitter folk.

Gotta incentivise it somehow :P

#ETH

50 likes/comments/RTs by then and I& #39;ll throw a full top down for you twitter folk.

Gotta incentivise it somehow :P

#ETH

Trading Tip |

WHEN price reacts to a level is more important than HOW it reacts.

Was discussing this in a recent video and came to my realisation that not many follow this particular logic.

WHEN price reacts to a level is more important than HOW it reacts.

Was discussing this in a recent video and came to my realisation that not many follow this particular logic.

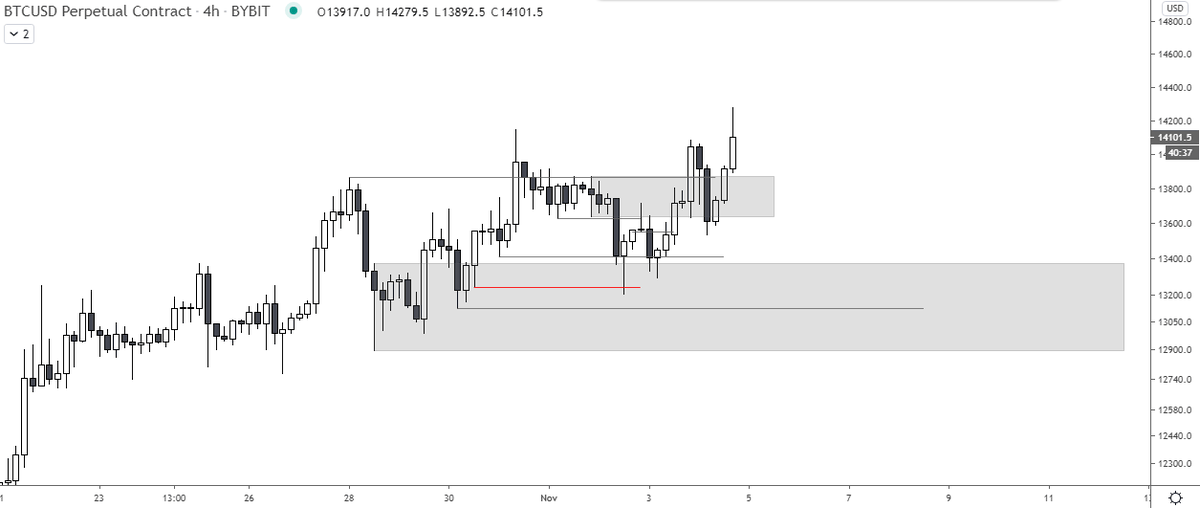

BTCUSD 4H Analysis - November 2nd |

Quick video with my thoughts and analysis on #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> & #39;s current PA.

https://abs.twimg.com/hashflags... draggable="false" alt=""> & #39;s current PA.

Hope you can glean something from this. https://vimeo.com/474626542/9900130c81">https://vimeo.com/474626542...

Quick video with my thoughts and analysis on #BTC

Hope you can glean something from this. https://vimeo.com/474626542/9900130c81">https://vimeo.com/474626542...

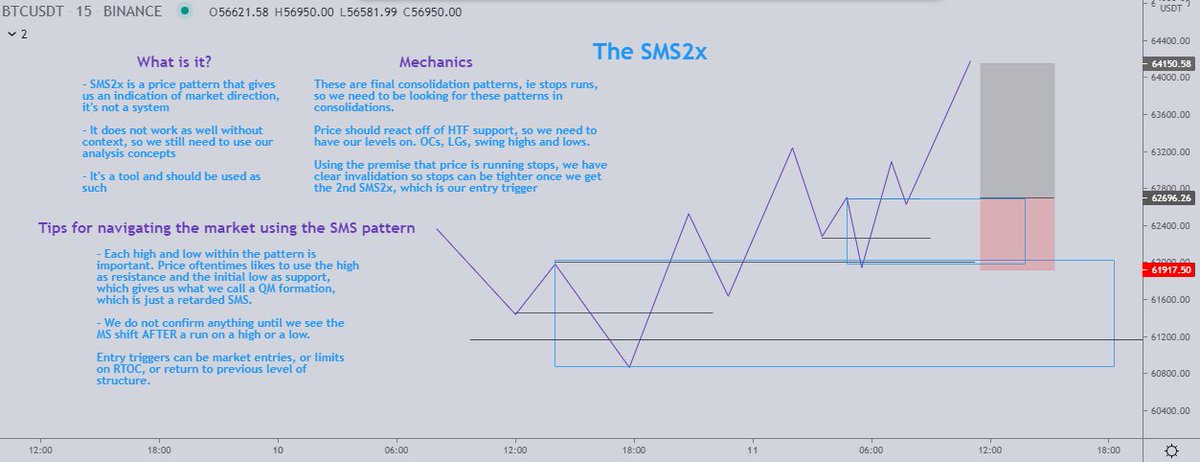

If you watched my recent #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> analysis vid, you& #39;ll have seen this played out perfectly.

https://abs.twimg.com/hashflags... draggable="false" alt=""> analysis vid, you& #39;ll have seen this played out perfectly.

The long trigger was the 30m sweep to the downside, which gave us the higher low.

Swing highs and swing lows and origins is all you need :)

#SMS2x

The long trigger was the 30m sweep to the downside, which gave us the higher low.

Swing highs and swing lows and origins is all you need :)

#SMS2x

Thinking about making this a weekly thing for Twitter.

Would you be interested in a weekly market outlook for BTC, ETH and possibly another major like LINK?

RT and Like if you would enjoy this.

(If there& #39;s enough interest, I might upgrade my video setup too.)

Would you be interested in a weekly market outlook for BTC, ETH and possibly another major like LINK?

RT and Like if you would enjoy this.

(If there& #39;s enough interest, I might upgrade my video setup too.)

TRADING TIP |

At the end of the week, don& #39;t delete your levels.

Go back through the week& #39;s PA and map out potential setups, annotate what you need to and then compare that to your weekly haul.

If you& #39;re missing a lot of setups, you know what to do :)

At the end of the week, don& #39;t delete your levels.

Go back through the week& #39;s PA and map out potential setups, annotate what you need to and then compare that to your weekly haul.

If you& #39;re missing a lot of setups, you know what to do :)

If you think trading is all about hitting a buy or sell button, you are naively mistaken.

Just like everything in life, the work is done behind the scenes.

Think of the duck analogy.

Just like everything in life, the work is done behind the scenes.

Think of the duck analogy.

Live Scalping EURUSD December 16th |

Setup 1 - https://youtu.be/0IPERTcrC0g

Setup">https://youtu.be/0IPERTcrC... 2 - https://youtu.be/jjXkiO1VanA

Enjoy!">https://youtu.be/jjXkiO1Va...

Setup 1 - https://youtu.be/0IPERTcrC0g

Setup">https://youtu.be/0IPERTcrC... 2 - https://youtu.be/jjXkiO1VanA

Enjoy!">https://youtu.be/jjXkiO1Va...

Don& #39;t just watch it, study it. Watch where I& #39;m putting levels and where I& #39;m buying and selling etc.

Not huge trades but bread and butter all day every day setups that you can make a career on.

Not huge trades but bread and butter all day every day setups that you can make a career on.

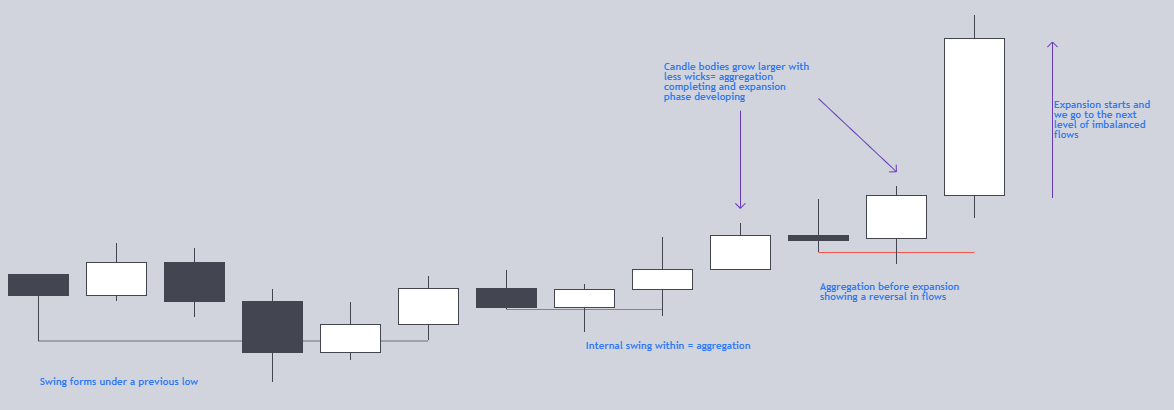

My take on the 4 market Market tenets:

Works on any market, any time frame. Go test it out.

- Expansion

- Retracement

- Consolidation

- Reversal

Works on any market, any time frame. Go test it out.

- Expansion

- Retracement

- Consolidation

- Reversal

Trading Tip |

- Identify current market tenet

- Identify bias

- If bullish, buy weakness (below lows)

- If bearish, sell strength (above highs)

This flies in the face of what most believe, but works wonders for long term profitability.

- Identify current market tenet

- Identify bias

- If bullish, buy weakness (below lows)

- If bearish, sell strength (above highs)

This flies in the face of what most believe, but works wonders for long term profitability.

How I Mark My Levels |

Adding this here so it& #39;s easy to find in the future. https://vimeo.com/494827524/f05c341ae2">https://vimeo.com/494827524...

Adding this here so it& #39;s easy to find in the future. https://vimeo.com/494827524/f05c341ae2">https://vimeo.com/494827524...

Cliff Notes on My Trading System |

Where are the key highs and lows?

What& #39;s the daily range?

Where are the untested origins and liquidity gaps?

If bullish, we& #39;re looking for sharp moves down to get long.

If bearish, we& #39;re looking for sharp moves up to get short.

Where are the key highs and lows?

What& #39;s the daily range?

Where are the untested origins and liquidity gaps?

If bullish, we& #39;re looking for sharp moves down to get long.

If bearish, we& #39;re looking for sharp moves up to get short.

THREAD |

Think of your trading plan like your training plan.

You think Ronnie Coleman got a back like his by doing whacky exercises every back sesh?

Na bro, he did the same thing for 20 years, and has the best back I& #39;ve ever seen.

1/

Think of your trading plan like your training plan.

You think Ronnie Coleman got a back like his by doing whacky exercises every back sesh?

Na bro, he did the same thing for 20 years, and has the best back I& #39;ve ever seen.

1/

If you& #39;re using fancy indicators, a buttload of other analysis parameters, and other shit that you haven& #39;t tested/proven as legit, you& #39;re doing this wrong.

Stick to the basics. And fucking master them. It& #39;s that easy.

2/

Stick to the basics. And fucking master them. It& #39;s that easy.

2/

The idea of rinse and repeat is no joke.

Can you find a method that works over and over again with consistency? Then fucking stick to it. Mold your risk model around it.

Now go lift some weights and learn how to trade.

3/

Can you find a method that works over and over again with consistency? Then fucking stick to it. Mold your risk model around it.

Now go lift some weights and learn how to trade.

3/

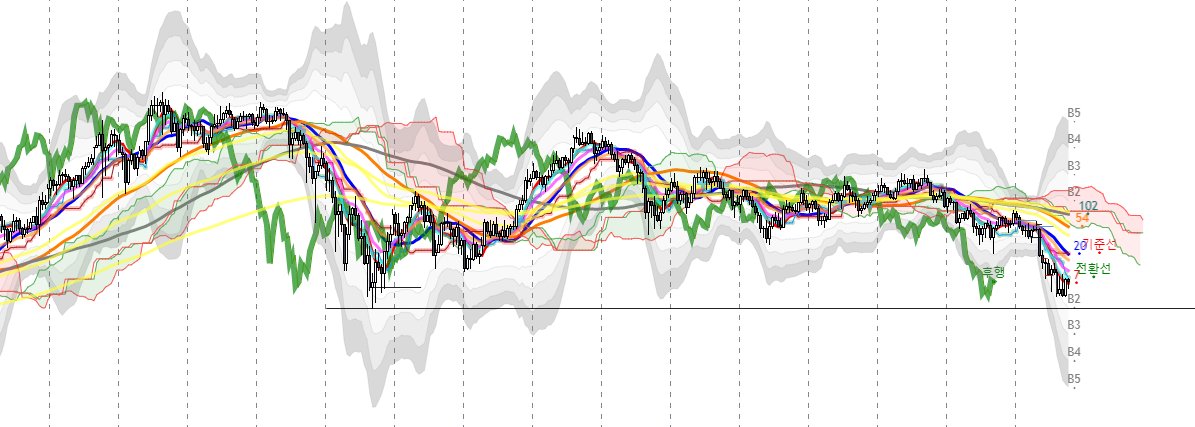

Yes, all methods work as long as they have clear guidelines.

But I sure as fuck know what chart I would rather look at.

But I sure as fuck know what chart I would rather look at.

Have you tested the theory you& #39;re presenting to the market? I guess not.

The reason why most lose is because they are too lazy to put the work into formulating a trading plan, a risk model, and a fucking profitable system.

You& #39;re at the precipice of freedom, why slack?

The reason why most lose is because they are too lazy to put the work into formulating a trading plan, a risk model, and a fucking profitable system.

You& #39;re at the precipice of freedom, why slack?

Trading Tip |

If a level is lost, fuck it off.

So many idiots continue to maintain a bias on a particular level and it& #39;s irrational as fuck. Grow a set.

If it& #39;s gone, let it go. It& #39;s not a fucking blow up sex doll you accidentally popped.

If a level is lost, fuck it off.

So many idiots continue to maintain a bias on a particular level and it& #39;s irrational as fuck. Grow a set.

If it& #39;s gone, let it go. It& #39;s not a fucking blow up sex doll you accidentally popped.

TRADING TIP |

What people call a blow off top also happens at the bottom. It& #39;s what they call capitulation.

They are just & #39;throwovers& #39; at the end of a trend. Learn the mechanics of them and you& #39;ll never fucked in the ass again unless you ask for it :)

What people call a blow off top also happens at the bottom. It& #39;s what they call capitulation.

They are just & #39;throwovers& #39; at the end of a trend. Learn the mechanics of them and you& #39;ll never fucked in the ass again unless you ask for it :)

Intraday Setup Example |

$AAVE

This is the exact thing I look for every time. 90% of my trades look like this.

I also make sure the 4H is pointing up, which was confirmed for me early this morning.

This setup has a 85% strike rate.

Paid group leaders, take note https://abs.twimg.com/emoji/v2/... draggable="false" alt="📓" title="Notitieboekje" aria-label="Emoji: Notitieboekje">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📓" title="Notitieboekje" aria-label="Emoji: Notitieboekje">

RT :)

$AAVE

This is the exact thing I look for every time. 90% of my trades look like this.

I also make sure the 4H is pointing up, which was confirmed for me early this morning.

This setup has a 85% strike rate.

Paid group leaders, take note

RT :)

TOP 3 TRADING TIPS THAT ALWAYS KEEP ME ABOVE WATER |

1. Losses are just that. Forget them, move on.

2. If you miss a move, DO NOT chase it. It& #39;s gone.

3. Evaluate your system each and every week, and never stop sharpening your sword.

1. Losses are just that. Forget them, move on.

2. If you miss a move, DO NOT chase it. It& #39;s gone.

3. Evaluate your system each and every week, and never stop sharpening your sword.

Trading Tip |

Identifying impulses and consolidations are a big part of my trading.

Knowing when a move is starting and ending gives us the best possible R:R for any trade on any time frame.

Hunt in the consolidation so you can take a slice of the impulse.

Identifying impulses and consolidations are a big part of my trading.

Knowing when a move is starting and ending gives us the best possible R:R for any trade on any time frame.

Hunt in the consolidation so you can take a slice of the impulse.

Tip for Intraday Trading |

Separate the chart into London, NY, and Asia

Bullish London = possible retracement in NY into the London range

Asia consolidation = possible fakeout during London (stop run) into previous London/NY ranges

and so on. Go test this if it interests you.

Separate the chart into London, NY, and Asia

Bullish London = possible retracement in NY into the London range

Asia consolidation = possible fakeout during London (stop run) into previous London/NY ranges

and so on. Go test this if it interests you.

Here& #39;s an example playing out as we speak on $LTC

Things to note in your testing of this method:

- Reactions around session lows and highs

- Reactions around range EQs

- Areas of price within a specific session that led to an impulse

NOW FUCKING SEND THIS TO 220.

Things to note in your testing of this method:

- Reactions around session lows and highs

- Reactions around range EQs

- Areas of price within a specific session that led to an impulse

NOW FUCKING SEND THIS TO 220.

Setup Example |

5m Setup

Intraday Bias - Down

Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.

Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool">

$BTC

5m Setup

Intraday Bias - Down

Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.

Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom

$BTC

Setup Example 2 |

5m Setup

Intraday bias - Down

Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.

Look similar?

I& #39;m a robot. Be a robot.

$BTC

5m Setup

Intraday bias - Down

Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.

Look similar?

I& #39;m a robot. Be a robot.

$BTC

How to trade with ZERO emotion |

Pick a pair that you have no investment in, emotional of monetary.

Spend a week doing nothing but observing price. Just making notes as you go along.

You& #39;ll notice the & #39;big moves& #39; don& #39;t affect you as much :)

Pick a pair that you have no investment in, emotional of monetary.

Spend a week doing nothing but observing price. Just making notes as you go along.

You& #39;ll notice the & #39;big moves& #39; don& #39;t affect you as much :)

Trading Tip |

This turns a 50% strike rate into a 65% strike rate without doing anything.

Spend the most time mastering MARKET DIRECTION.

If I know where price is going with an accuracy of 90%, then entries become arbitrary.

The money comes to you.

This turns a 50% strike rate into a 65% strike rate without doing anything.

Spend the most time mastering MARKET DIRECTION.

If I know where price is going with an accuracy of 90%, then entries become arbitrary.

The money comes to you.

Trading Tip |

Not being in a trade DOES NOT mean that you have to be looking for one.

@tradingview has this cool feature that alerts you when price hits a level.

Once it gets there, react to what price is doing, and make a decision. Enter or don& #39;t. It& #39;s not Sophie& #39;s Choice.

Not being in a trade DOES NOT mean that you have to be looking for one.

@tradingview has this cool feature that alerts you when price hits a level.

Once it gets there, react to what price is doing, and make a decision. Enter or don& #39;t. It& #39;s not Sophie& #39;s Choice.

Trading Tip |

Stop focusing on why your losers lose and start focusing on why your winners win.

It& #39;s a much more efficient process towards success.

Focusing on the negative outcomes is a strange mindset, and only facilitates poor judgement and piss poor decision making.

Stop focusing on why your losers lose and start focusing on why your winners win.

It& #39;s a much more efficient process towards success.

Focusing on the negative outcomes is a strange mindset, and only facilitates poor judgement and piss poor decision making.

Best piece of trading advice I could ever give you is...

ALWAYS aim for the gap fill.

Doesn& #39;t matter what time frame, asset, whatever.

ALWAYS aim for the gap fill.

Doesn& #39;t matter what time frame, asset, whatever.

Trading Tip |

Should be obvious, but unfortunately it& #39;s obvious it& #39;s not lmao.

When you take a trade on a particular timeframe, you do not care about what happens on the timeframes lower, because your trigger is on the chart you& #39;re on, so you focus on that.

Don& #39;t fuck up.

Should be obvious, but unfortunately it& #39;s obvious it& #39;s not lmao.

When you take a trade on a particular timeframe, you do not care about what happens on the timeframes lower, because your trigger is on the chart you& #39;re on, so you focus on that.

Don& #39;t fuck up.

Read on Twitter

Read on Twitter

analysis vid, you& #39;ll have seen this played out perfectly. The long trigger was the 30m sweep to the downside, which gave us the higher low. Swing highs and swing lows and origins is all you need :) #SMS2x" title="If you watched my recent #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> analysis vid, you& #39;ll have seen this played out perfectly. The long trigger was the 30m sweep to the downside, which gave us the higher low. Swing highs and swing lows and origins is all you need :) #SMS2x" class="img-responsive" style="max-width:100%;"/>

analysis vid, you& #39;ll have seen this played out perfectly. The long trigger was the 30m sweep to the downside, which gave us the higher low. Swing highs and swing lows and origins is all you need :) #SMS2x" title="If you watched my recent #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> analysis vid, you& #39;ll have seen this played out perfectly. The long trigger was the 30m sweep to the downside, which gave us the higher low. Swing highs and swing lows and origins is all you need :) #SMS2x" class="img-responsive" style="max-width:100%;"/>

RT :)" title="Intraday Setup Example | $AAVE This is the exact thing I look for every time. 90% of my trades look like this. I also make sure the 4H is pointing up, which was confirmed for me early this morning. This setup has a 85% strike rate.Paid group leaders, take note https://abs.twimg.com/emoji/v2/... draggable="false" alt="📓" title="Notitieboekje" aria-label="Emoji: Notitieboekje">RT :)" class="img-responsive" style="max-width:100%;"/>

RT :)" title="Intraday Setup Example | $AAVE This is the exact thing I look for every time. 90% of my trades look like this. I also make sure the 4H is pointing up, which was confirmed for me early this morning. This setup has a 85% strike rate.Paid group leaders, take note https://abs.twimg.com/emoji/v2/... draggable="false" alt="📓" title="Notitieboekje" aria-label="Emoji: Notitieboekje">RT :)" class="img-responsive" style="max-width:100%;"/>

$BTC" title="Setup Example |5m SetupIntraday Bias - Down Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool"> $BTC">

$BTC" title="Setup Example |5m SetupIntraday Bias - Down Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool"> $BTC">

$BTC" title="Setup Example |5m SetupIntraday Bias - Down Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool"> $BTC">

$BTC" title="Setup Example |5m SetupIntraday Bias - Down Filled an inefficiency, moved away and came back to the origin (balancing the inefficiency) so here we have now an efficient market.Short term swing ran after LH, rebalance ultra LTF inefficiency, next impulse, boom https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔫" title="Waterpistool" aria-label="Emoji: Waterpistool"> $BTC">