Richard is effectively modelling here a capital gains tax that works on an accruals (instead of realisation) basis, which is not totally crazy, in fact what a lot of economists advocate. BUT: https://www.theguardian.com/politics/2020/apr/22/wealth-tax-rise-could-raise-174bn-tackle-covid-19-expert-says?CMP=Share_iOSApp_Other">https://www.theguardian.com/politics/...

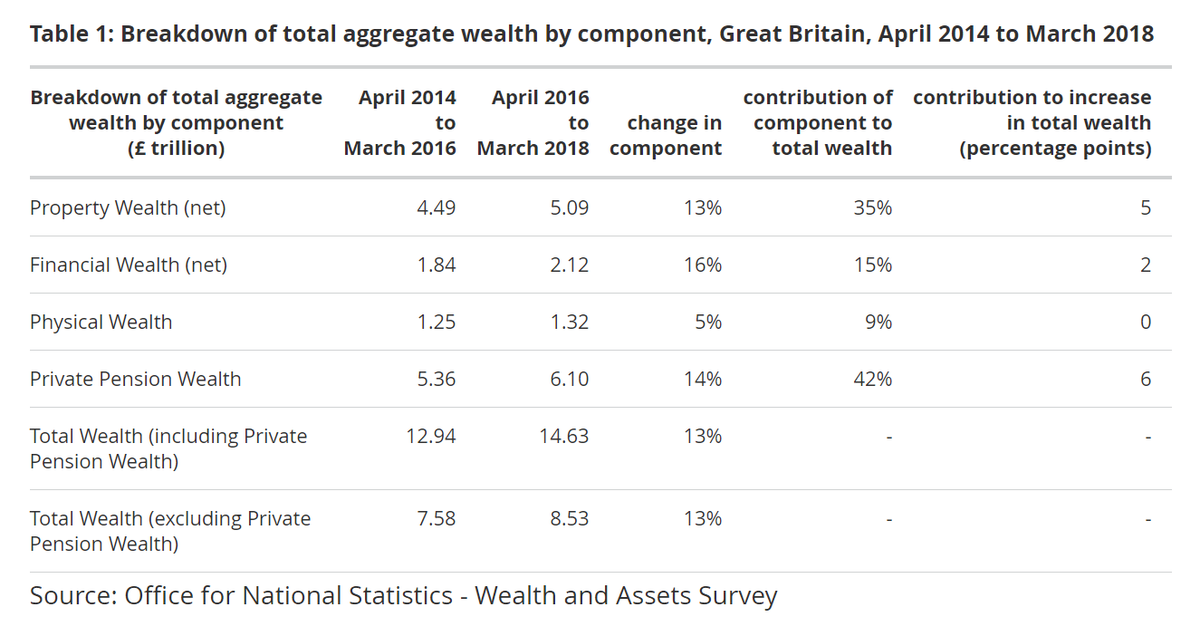

1. The £174bil figure for potential revenue assumes that the tax base is annual increase in *all* UK household wealth (basically the year-to-year difference based on Wealth and Assets Survey total private wealth).

2. (As Richard acknowledges) no-one seriously thinks we should tax paper gains in main homes on an accrual basis (let alone at Income Tax rates). Or gains on pension pots given that we already tax pensions when in payment.

3. Unfortunately these two types of wealth account for vast majority of total private wealth in UK, and even higher proportion (maybe as much as 80%) of increase in private wealth over recent years.

4. And if you& #39;re going to tax capital gains on an accrual basis, then your revenue estimate needs to deduct the tax we already get from taxing (some) gains on a realisation basis. Because clearly we& #39;re not going to do both.

5. If you take all those items off the £174bil estimate, then you end up with a figure in the low 10s of billions. Still *A LOT* of money, especially when the alternative may be increasing NICs/Basic Rate on income from work...

6. But worth being realistic that this is not a serious proposal to replace Income Tax etc any time soon.

Read on Twitter

Read on Twitter