UPDATE re CJRS and calendar days/working days.

Previous position here https://twitter.com/hselftax/status/1252248435299889153">https://twitter.com/hselftax/...

Previous position here https://twitter.com/hselftax/status/1252248435299889153">https://twitter.com/hselftax/...

Briefly, I had reached the view that, where payrolls were run on a 260 day basis:

- apportioning on a 1/260 basis made sense & was consistent with direction

- but to be prudent, max grant should be restricted to HMRC daily rate (£80.65 for March)

- apportioning on a 1/260 basis made sense & was consistent with direction

- but to be prudent, max grant should be restricted to HMRC daily rate (£80.65 for March)

Views from others eg @rbeccabeneworth seemed consistent

https://twitter.com/rbeccabeneworth/status/1251937660895219720?s=21">https://twitter.com/rbeccaben... https://twitter.com/rbeccabeneworth/status/1251937660895219720">https://twitter.com/rbeccaben...

https://twitter.com/rbeccabeneworth/status/1251937660895219720?s=21">https://twitter.com/rbeccaben... https://twitter.com/rbeccabeneworth/status/1251937660895219720">https://twitter.com/rbeccaben...

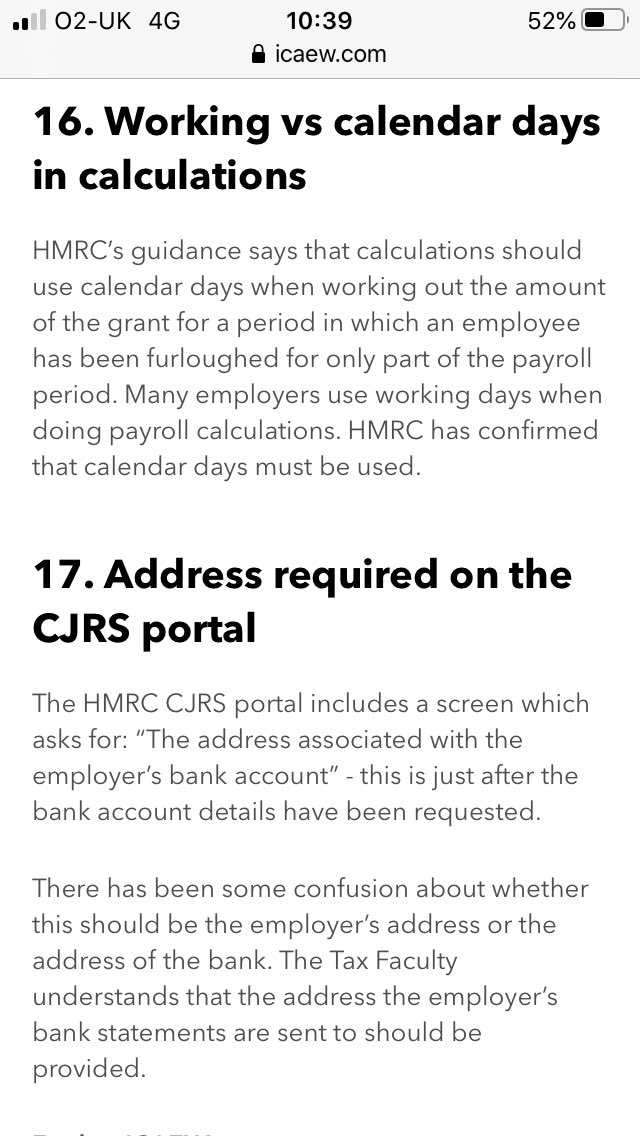

But @ICAEW_Tax have just published their list of emerging issues (NB very useful and thanks @carolinemiskin and team) https://www.icaew.com/insights/tax-news/2020/apr-2020/cjrs-emerging-issues-and-answers">https://www.icaew.com/insights/...

So this seems to me to be a problem.

Apparently CCMs have been saying this to large companies too.

If you’ve not yet submitted claims you may want to think again - particularly for March claims.

Apparently CCMs have been saying this to large companies too.

If you’ve not yet submitted claims you may want to think again - particularly for March claims.

Read on Twitter

Read on Twitter