1) Due to recent events in the oil futures market, I thought it could be a good idea to explain what roll yield is and why knowing where the price (of a commodity) is going is not enough.

(Meme for attention)

(Meme for attention)

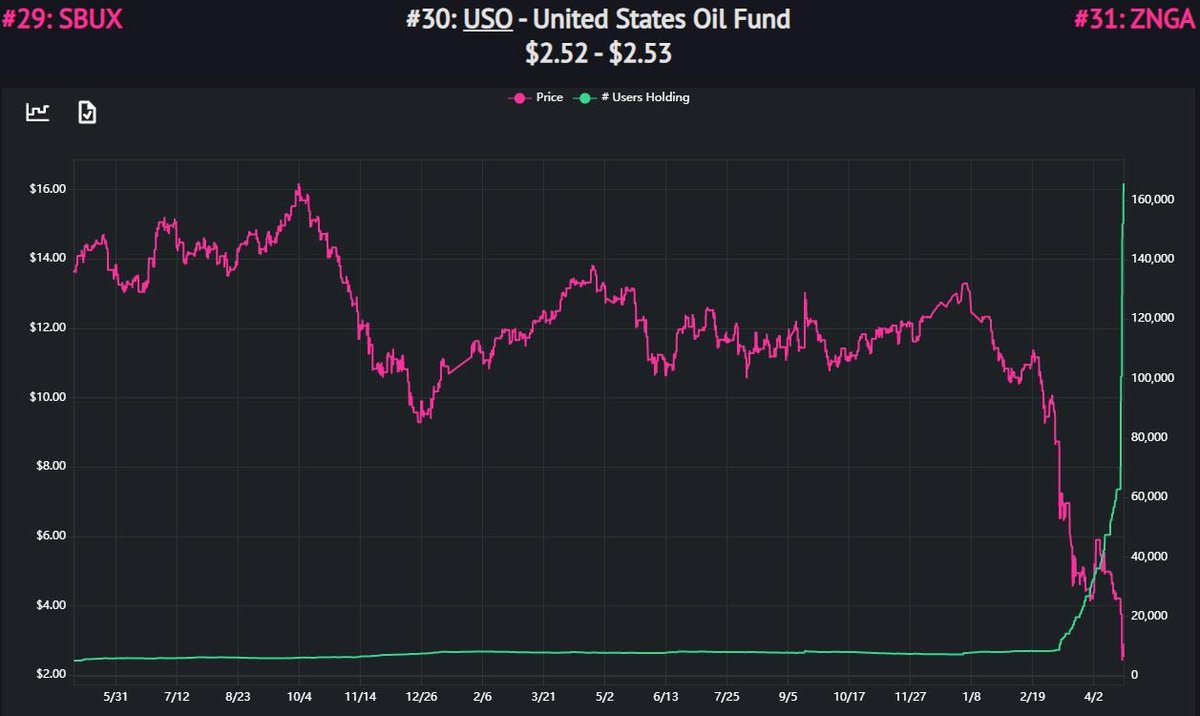

2) ...And if you think you understand how it works this thread is not for you but for the investors thinking they made a good bet when buying the United States Oil Fund (yes, I’m talking to you).

3) To understand the concept of roll yield, we need first to understand the difference between the price of a future and the spot price of a commodity. When discussing the price of a commodity, we have to separate the spot price from futures prices.

4) The spot price is the local cash price for immediate delivery of the commodity.

Roll yield = Futures Return - Spot Return

Roll yield = Futures Return - Spot Return

5) To make it simple, if you buy a bushel of soybeans at the market, what will you have to pay? The futures prices reflect the expected price of the commodity for the delivery at the contract& #39;s end.

6) Imagine you don& #39;t want to buy the soybeans with delivery right now but three months from now. If you believe that the price of the commodity will go up closer to the delivery date for that specific contract, you could buy it today and hold it until delivery.

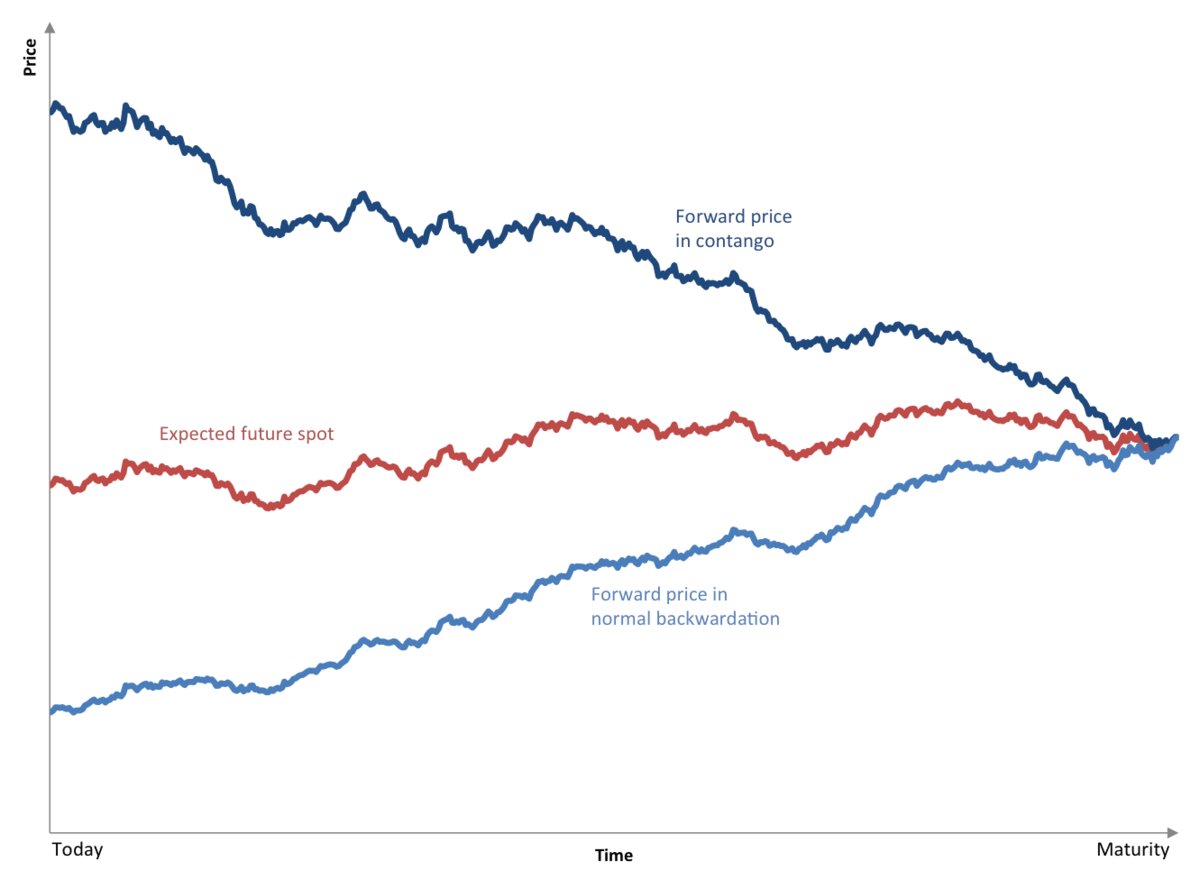

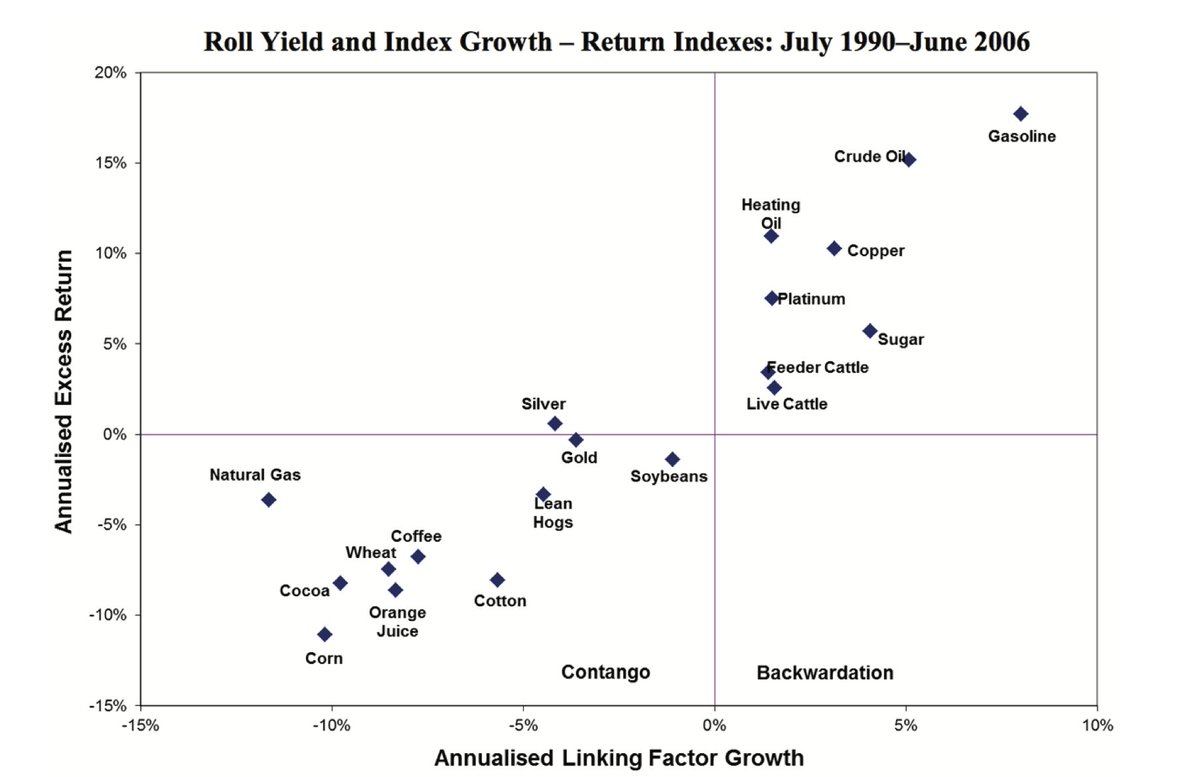

7) Roll yield is the term for describing when the futures price differs from the spot price. When talking about contango, we mean that the futures price is trading at higher levels than the spot price.

8) When mentioning backwardation (which is often referred to as the normal state), we mean that the futures price is trading at lower levels than the spot price.

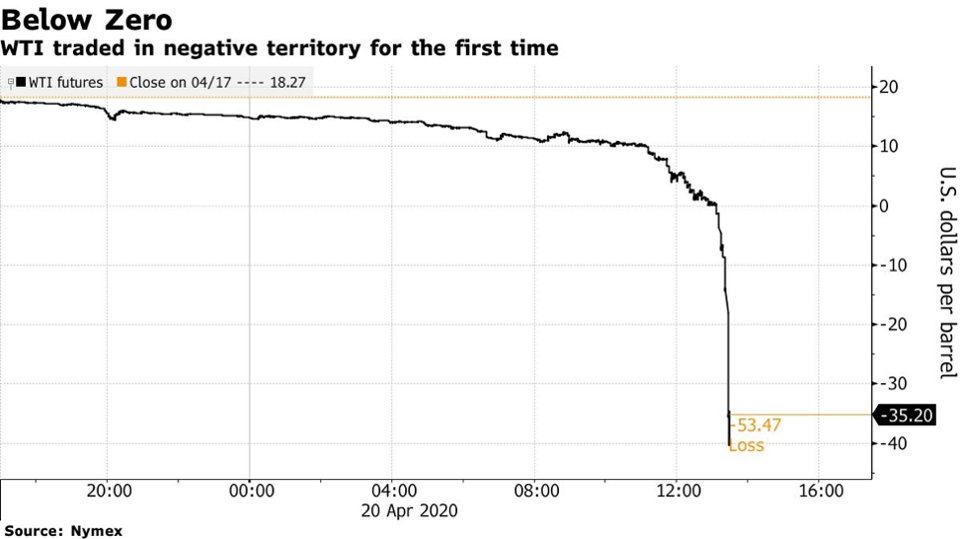

9) When the WTI oil fell under 0 and for a while traded as low as -40 USD, it had to do with no one wanting to take on the cost for storage.

10) At the same time, as the contracts with the closest delivery (May) were trading negatively, the contracts for June 2021 went up over 1% and traded around 30 USD.

11) Let& #39;s say you want to stay exposed to the WTI price with futures but not take delivery. The simplest way to do so is by selling the contract on the last days before delivery and buy the next one.

12) The problem, as with WTI, is when you have to sell a contract for less than you buy the next one – which makes you lose money even if the price goes up.

13) That means that even if the spot price went from -40 USD to 30 USD, you would still have to sell the May contract for -40 USD and buy the next at 30 USD, not earning the return in between.

So, contango eats return for breakfast. And lunch and dinner.

So, contango eats return for breakfast. And lunch and dinner.

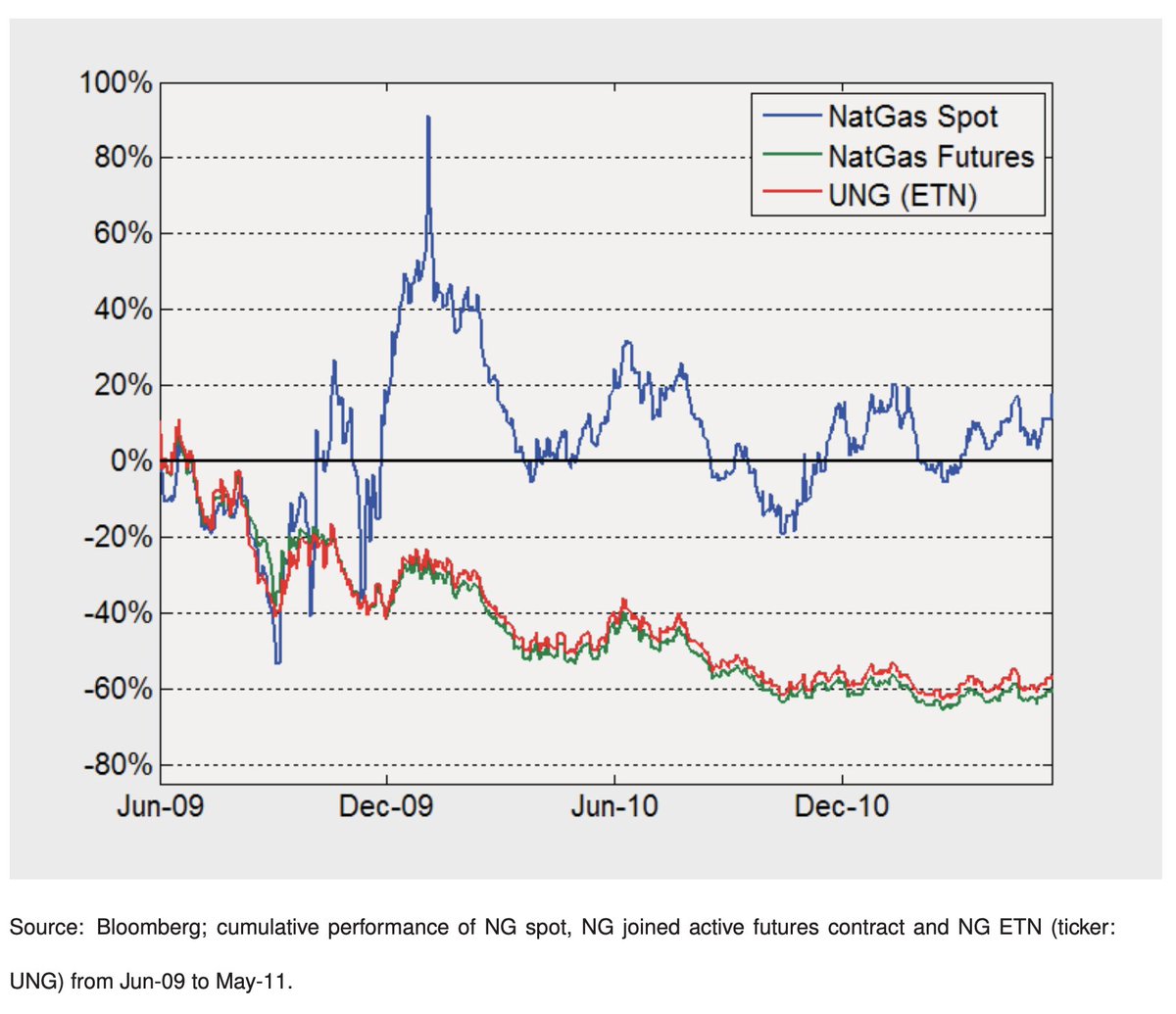

14) Let me show you an example. You want to get exposure to Natural Gas. Since it is hard to store Nat Gas, the cost to do so is high, and the price of the futures tends to fall closer to the delivery date.

15) If you would buy the futures contract and sell it before delivery and always roll it over to the next contract (this is how passive ETFs work btw, not very efficient), your return would look like this compared to the spot price.

Read on Twitter

Read on Twitter