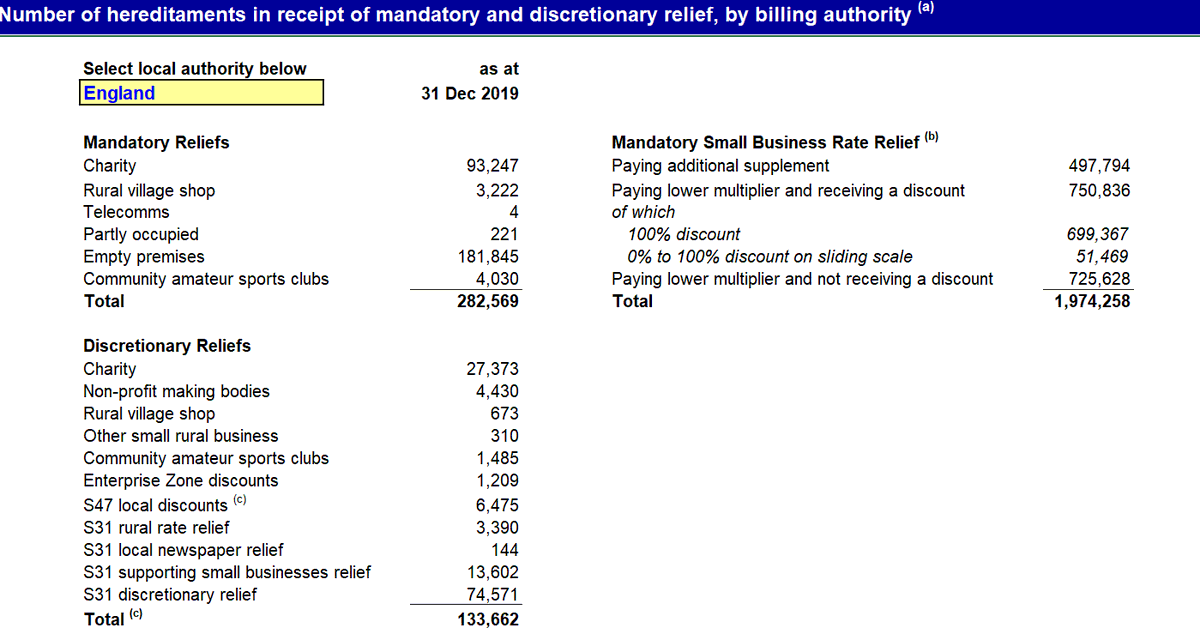

MHCLG has just published really interesting data on the number of #charity properties receiving mandatory (93,247) & discretionary (27,373) #businessraterelief (in England 2019) not sure if it was available in previous years? Also breaks it down by LA area https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/878274/NNDR1_2020-21_Supplementary_table.xlsx">https://assets.publishing.service.gov.uk/governmen...

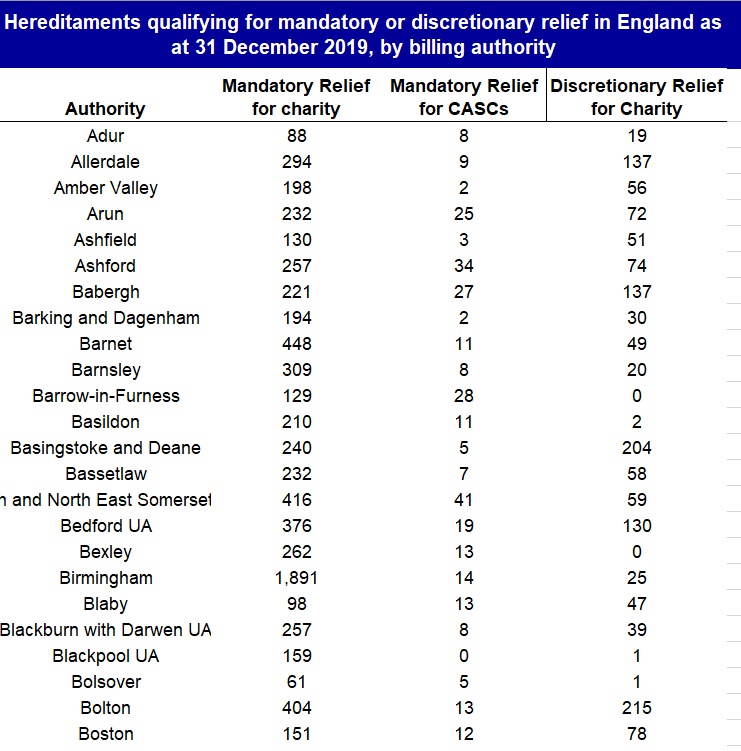

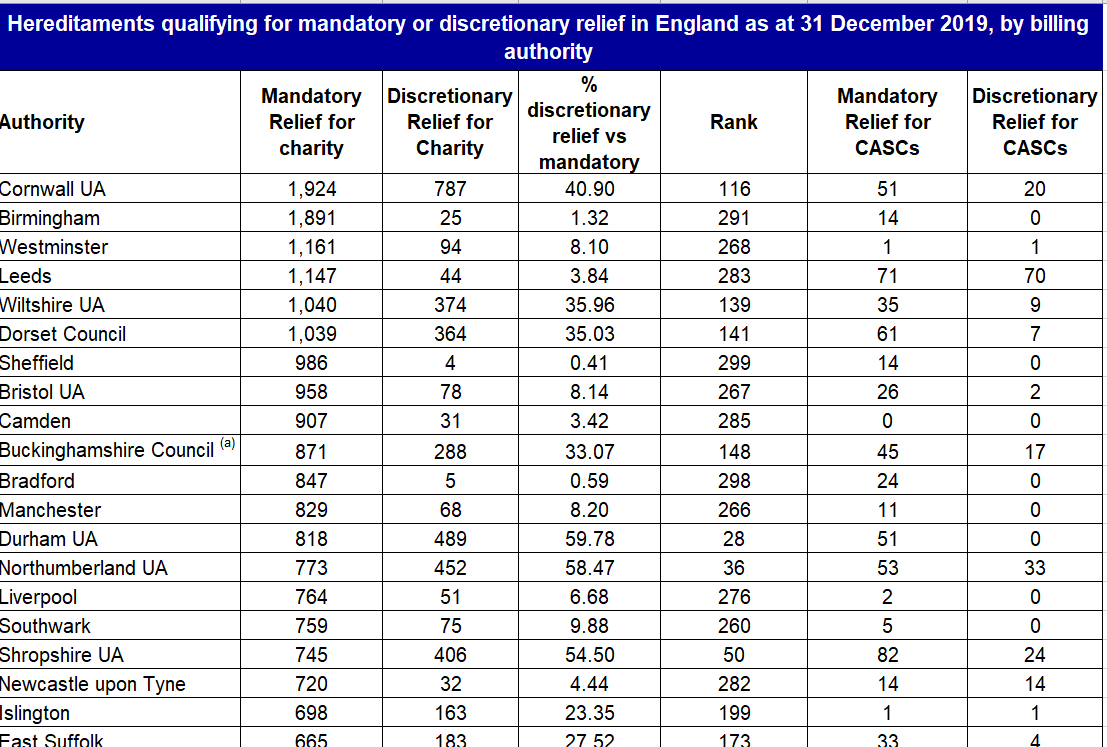

Playing around with the figures it is interesting to see which local authorities have charity properties entitled to mandatory business rates relief: Cornwall, Birmingham, Westminster, Leeds and Wiltshire make up the top 5

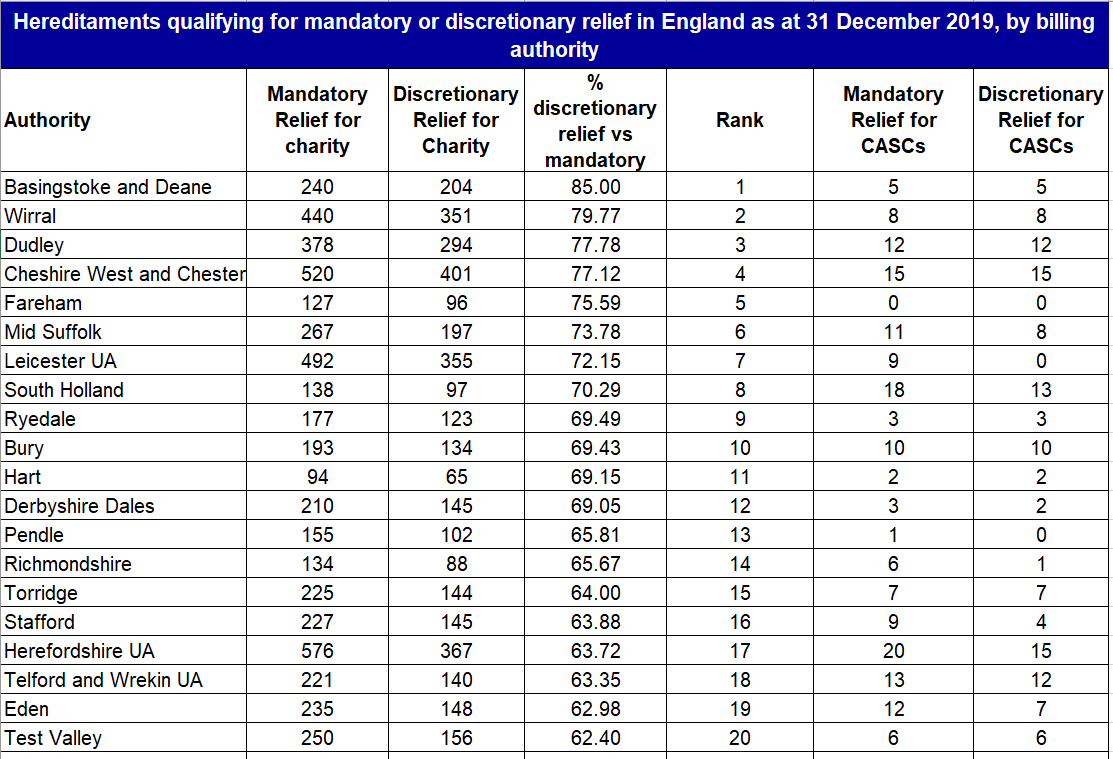

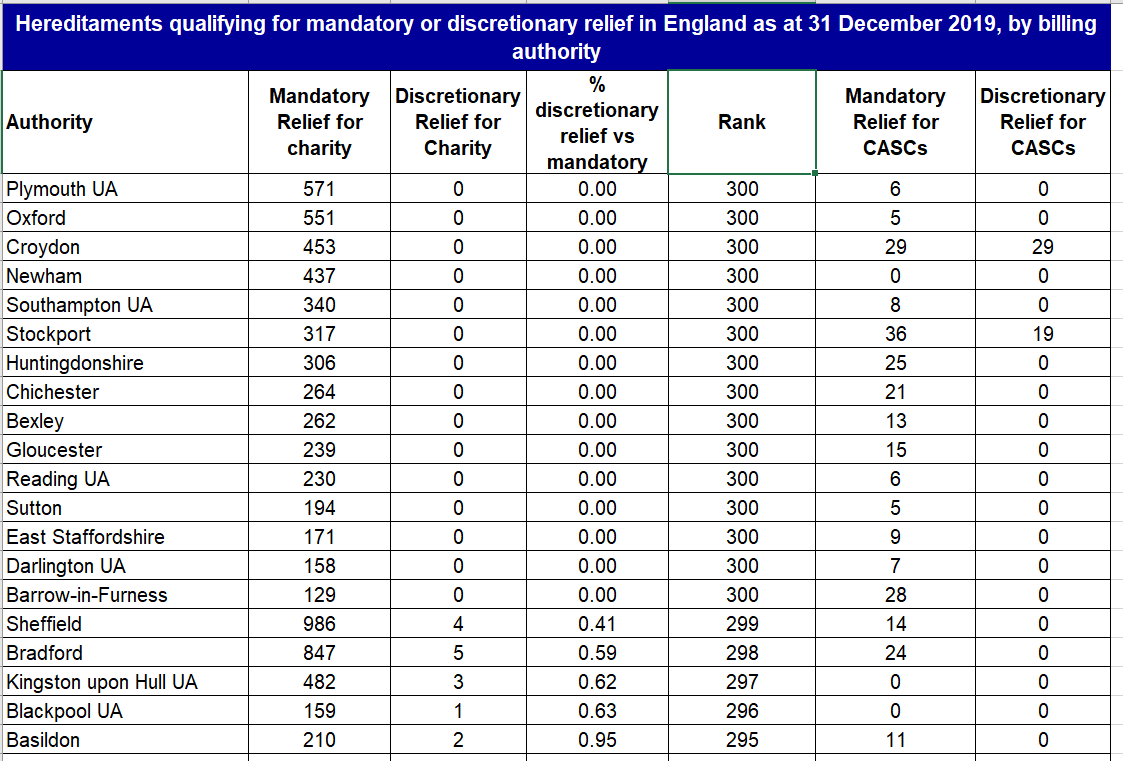

We can also rank local authorities by the % of properties eligible for mandatory rates relief (80%) that also receive discretionary rates relief (20%). Basingstoke, Wirral, Dudley, Cheshire West and Fareham make up the top 5. 71/316 LAs give discretionary relief in 50% of cases

By contrast 15 local authorities award no discretionary rates relief to charities at all including Plymouth, Oxford, Croydon, Newham, Reading and Southampton. This highlights again the #postcodelottery of discretionary rates relief for charities

This thread may be of interest @PaulWinyard @RobertaCFusco @SagarRichard @CharityRetail @daveainsworth4 @kanedr @ThirdSector @CivilSocietyUK @LGAcomms @Jane_NAVCA

Read on Twitter

Read on Twitter