https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚨" title="Police cars revolving light" aria-label="Emoji: Police cars revolving light"> LATEST research: where are people in the most in debt?

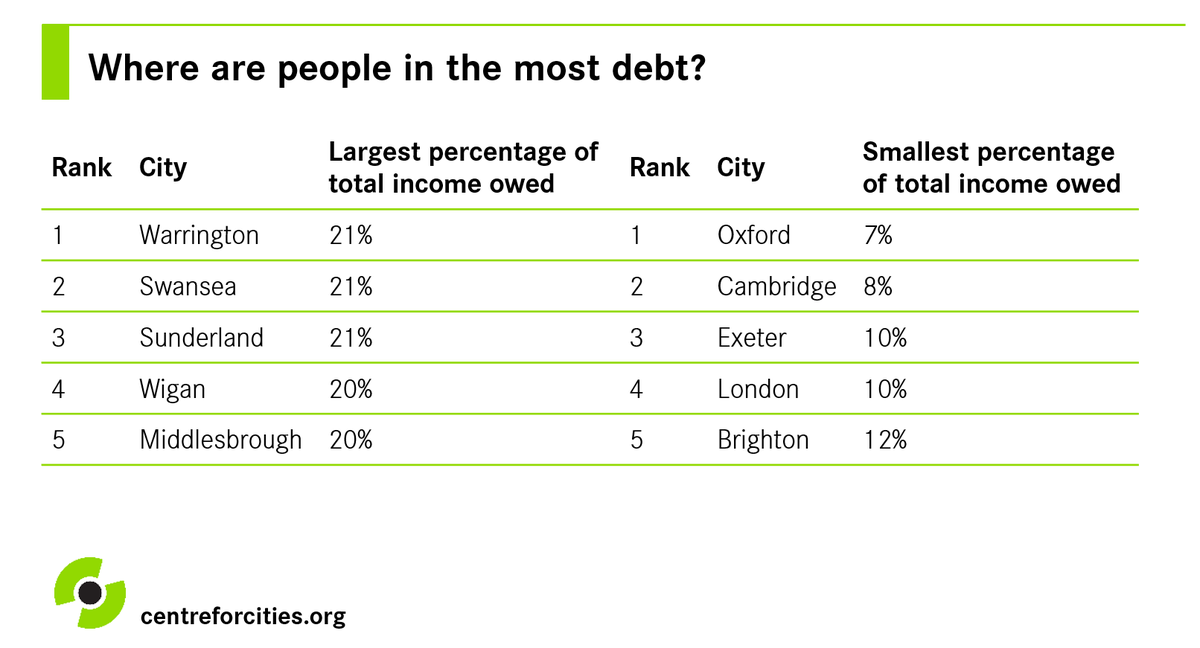

New analysis reveals that people in large cities and towns in Northern England and Wales have the most household debt and will be hit hardest in the coming economic downturn.

https://www.centreforcities.org/publication/household-debt-british-cities/">https://www.centreforcities.org/publicati...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> While consumer debt is not necessarily a cause for concern, the inability to pay it off – or problem debt – is.

Our latest research by

@KanishkaNarayan is the first detailed breakdown of debt across the country.

Where are people in the most debt?

https://www.centreforcities.org/publication/household-debt-british-cities/">https://www.centreforcities.org/publicati...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> Where has the most problem debt?

Economically weaker cities hit hard by Coronavirus also have the most people with problem debt, defined by the issuing of court judgements (CCJs).

Before Coronavirus, many cities outside the South East saw increases people with problem debt.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Chart with downwards trend" aria-label="Emoji: Chart with downwards trend"> The roots of this problem debt crisis lie in the 2008 Financial Crash. However, a decade of squeezed pay, flat productivity, welfare cuts and a more aggressive approach to debt collection have made it worse.

Our policy recommendations to soften the impact of this:

Read on Twitter

Read on Twitter While consumer debt is not necessarily a cause for concern, the inability to pay it off – or problem debt – is.Our latest research by @KanishkaNarayan is the first detailed breakdown of debt across the country. Where are people in the most debt? https://www.centreforcities.org/publicati..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> While consumer debt is not necessarily a cause for concern, the inability to pay it off – or problem debt – is.Our latest research by @KanishkaNarayan is the first detailed breakdown of debt across the country. Where are people in the most debt? https://www.centreforcities.org/publicati..." class="img-responsive" style="max-width:100%;"/>

While consumer debt is not necessarily a cause for concern, the inability to pay it off – or problem debt – is.Our latest research by @KanishkaNarayan is the first detailed breakdown of debt across the country. Where are people in the most debt? https://www.centreforcities.org/publicati..." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> While consumer debt is not necessarily a cause for concern, the inability to pay it off – or problem debt – is.Our latest research by @KanishkaNarayan is the first detailed breakdown of debt across the country. Where are people in the most debt? https://www.centreforcities.org/publicati..." class="img-responsive" style="max-width:100%;"/>

Where has the most problem debt?Economically weaker cities hit hard by Coronavirus also have the most people with problem debt, defined by the issuing of court judgements (CCJs).Before Coronavirus, many cities outside the South East saw increases people with problem debt." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> Where has the most problem debt?Economically weaker cities hit hard by Coronavirus also have the most people with problem debt, defined by the issuing of court judgements (CCJs).Before Coronavirus, many cities outside the South East saw increases people with problem debt." class="img-responsive" style="max-width:100%;"/>

Where has the most problem debt?Economically weaker cities hit hard by Coronavirus also have the most people with problem debt, defined by the issuing of court judgements (CCJs).Before Coronavirus, many cities outside the South East saw increases people with problem debt." title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="💷" title="Banknote with pound sign" aria-label="Emoji: Banknote with pound sign"> Where has the most problem debt?Economically weaker cities hit hard by Coronavirus also have the most people with problem debt, defined by the issuing of court judgements (CCJs).Before Coronavirus, many cities outside the South East saw increases people with problem debt." class="img-responsive" style="max-width:100%;"/>

The roots of this problem debt crisis lie in the 2008 Financial Crash. However, a decade of squeezed pay, flat productivity, welfare cuts and a more aggressive approach to debt collection have made it worse.Our policy recommendations to soften the impact of this:" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Chart with downwards trend" aria-label="Emoji: Chart with downwards trend"> The roots of this problem debt crisis lie in the 2008 Financial Crash. However, a decade of squeezed pay, flat productivity, welfare cuts and a more aggressive approach to debt collection have made it worse.Our policy recommendations to soften the impact of this:" class="img-responsive" style="max-width:100%;"/>

The roots of this problem debt crisis lie in the 2008 Financial Crash. However, a decade of squeezed pay, flat productivity, welfare cuts and a more aggressive approach to debt collection have made it worse.Our policy recommendations to soften the impact of this:" title="https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Chart with downwards trend" aria-label="Emoji: Chart with downwards trend"> The roots of this problem debt crisis lie in the 2008 Financial Crash. However, a decade of squeezed pay, flat productivity, welfare cuts and a more aggressive approach to debt collection have made it worse.Our policy recommendations to soften the impact of this:" class="img-responsive" style="max-width:100%;"/>