[THREAD]

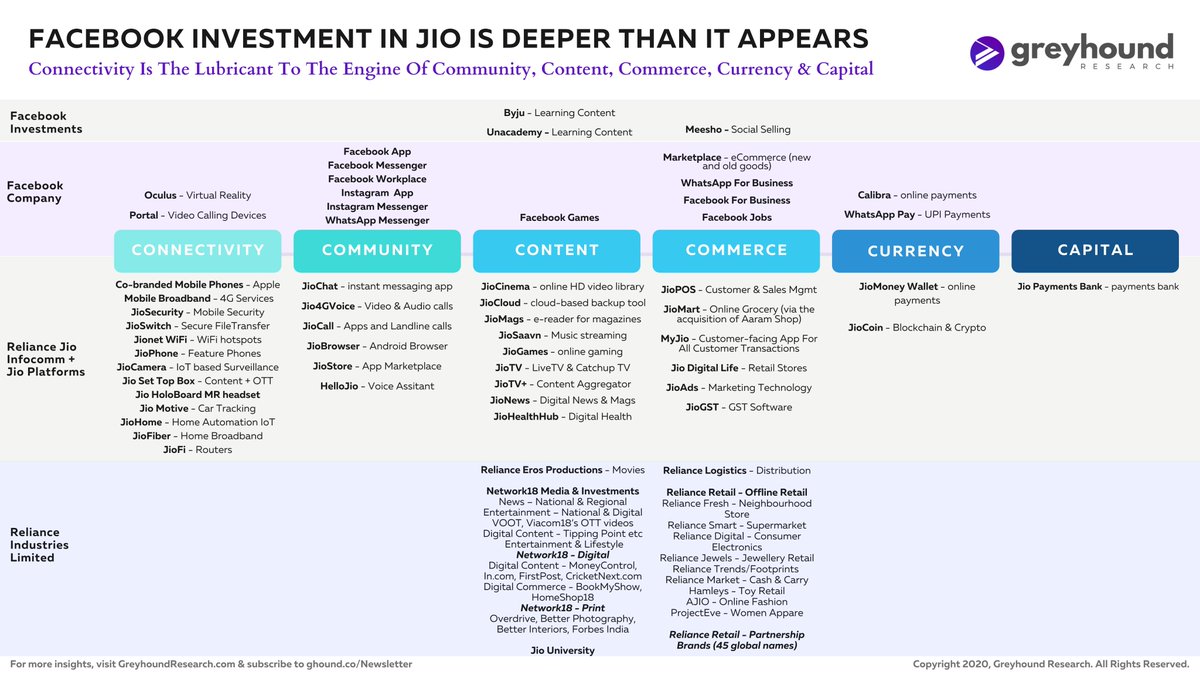

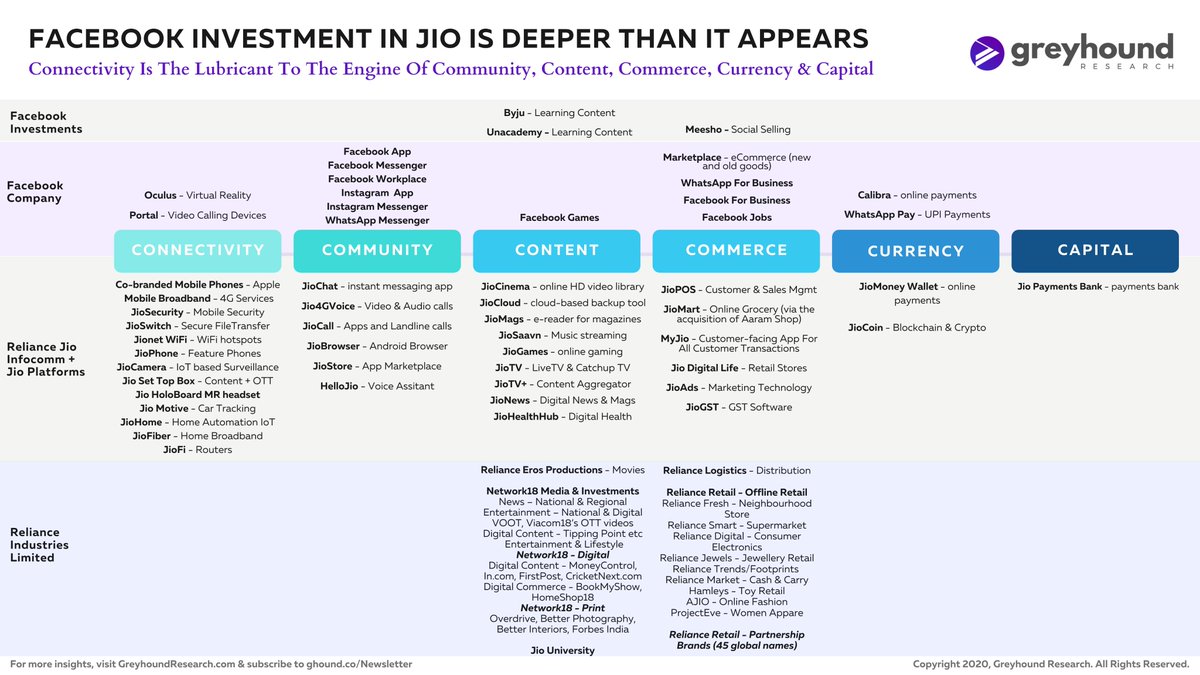

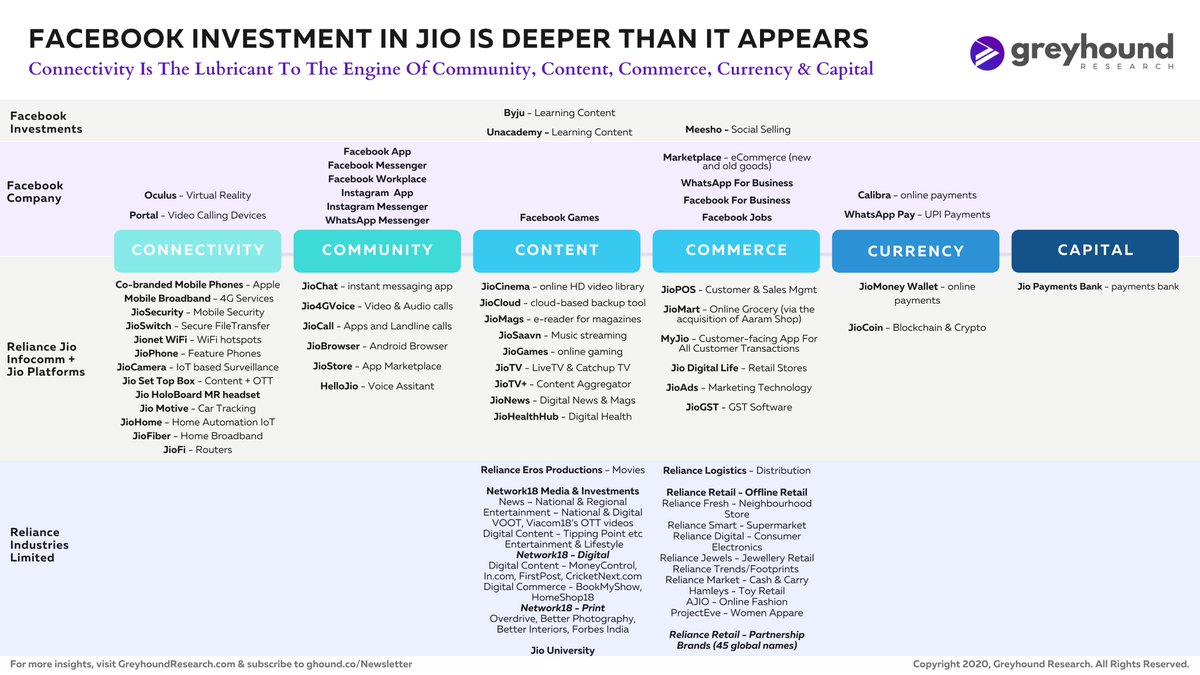

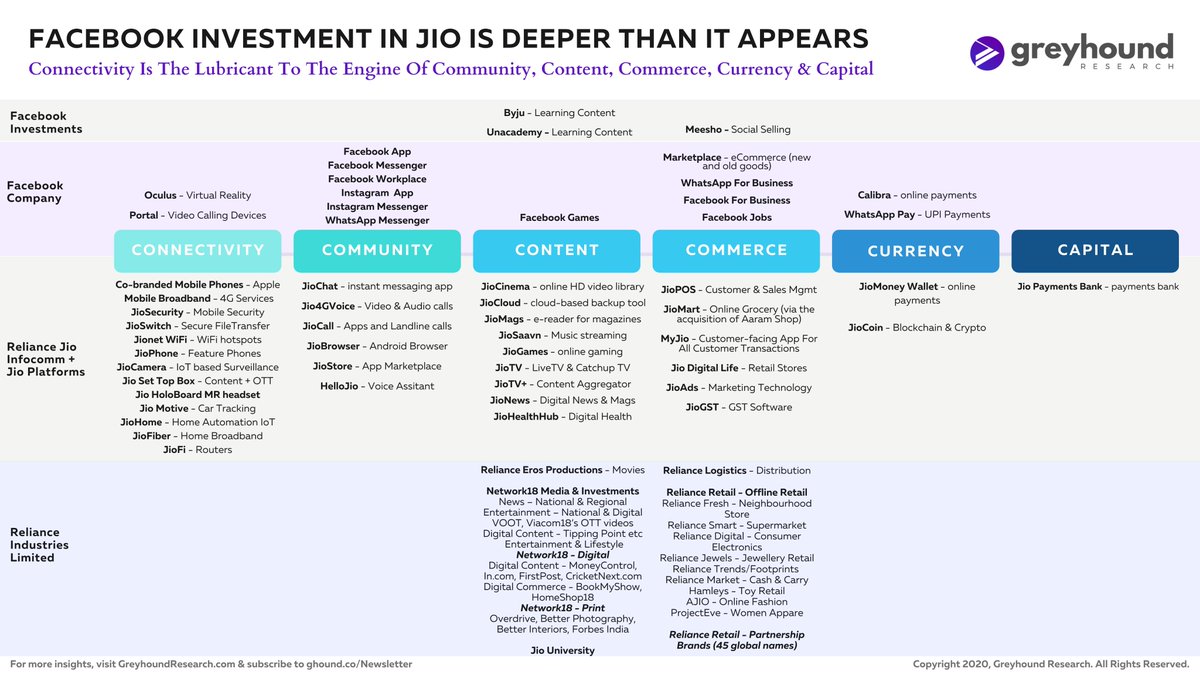

We at Greyhound Research believe, " @Facebook Investment In @RelianceJio Is Deeper Than It Appears."

In short - Connectivity Is The Lubricant To The Engine Of Community, Content, Commerce, Currency & Capital.

#GreyhoundStandpoint on #JioFacebook #Data by @Greyhound_R

We at Greyhound Research believe, " @Facebook Investment In @RelianceJio Is Deeper Than It Appears."

In short - Connectivity Is The Lubricant To The Engine Of Community, Content, Commerce, Currency & Capital.

#GreyhoundStandpoint on #JioFacebook #Data by @Greyhound_R

1/ First things first, to analyse the possibilities of this investment, what we have to do, is to consider the impact it will have on the broader businesses both these giants run

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here will be to leverage offline assets, on-ground expertise and tap into subscriber network.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here will be to leverage offline assets, on-ground expertise and tap into subscriber network.

2/ Even before we understand the possibilities together, important to have context.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.

3/ Both parties have also had their share of troubles in recent times:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> RIL, parent company of Reliance Infocomm Private Limited (Jio), has been in the news for a debt of Rs 2.88 lakh crore.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> RIL, parent company of Reliance Infocomm Private Limited (Jio), has been in the news for a debt of Rs 2.88 lakh crore.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook has also been at receiving end of issues with data, privacy & fake news.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook has also been at receiving end of issues with data, privacy & fake news.

4/ Talking of Facebook, its 98% revenue comes from advertising, a space that is dominated by Google & increasingly being attacked by Amazon, Twitter and a host of other players that also have a dedicated user-base.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Growth is critical for Facebook at given investor pressures.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Growth is critical for Facebook at given investor pressures.

5/ Facebook has tried in the past (but failed) to get through to China. It has been blocked by the country’s Great Firewall & hence lost it’s key chance in expanding its user-base.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb"> In 2018, Facebook setup a $30 Mn subsidiary to incubate startups but permission was withdrawn.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb"> In 2018, Facebook setup a $30 Mn subsidiary to incubate startups but permission was withdrawn.

6/ Hungry for growth, Facebook has done enough and more in #India as well but not all has gone down well.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook Free Basics got a ton of bad PR on account of it not adhering to the principles of #NetNeutrality

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook Free Basics got a ton of bad PR on account of it not adhering to the principles of #NetNeutrality  https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook has also gotten flak for fake news on @WhatsApp.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Facebook has also gotten flak for fake news on @WhatsApp.

7/ Facebook has also been trying to enter India’s payment space and compete with @Paytm.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Despite tedious efforts with the National Payments Corporation of India (NPCI), Facebook has not been able to “boil the ocean” in its favour.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Despite tedious efforts with the National Payments Corporation of India (NPCI), Facebook has not been able to “boil the ocean” in its favour.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">A local partner with “reach” was needed.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">A local partner with “reach” was needed.

8/ At this end, Jio had proven to be a force but was facing its own share of battles.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> The ever growing debt was an issue - imp to note in 2012, it was virtually debt free

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> The ever growing debt was an issue - imp to note in 2012, it was virtually debt free

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Soft response to apps it had launched

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Soft response to apps it had launched

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">It needed a partner with money & user reach, hence Facebook.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">It needed a partner with money & user reach, hence Facebook.

9/ This union bw Facebook & Jio is a marriage of equals, convenience & massive possibilities.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> But then, massive debts of Reliance Infcomm (Jio) would mean the boards (of a proposed partner) would not approve of the investment.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> But then, massive debts of Reliance Infcomm (Jio) would mean the boards (of a proposed partner) would not approve of the investment.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">A new Wholly Owned Subsidiary was the answer.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">A new Wholly Owned Subsidiary was the answer.

10/ In case you missed it, this Wholly Owned Subsidiary was discussed in investor meetings of RIL wherein clear statements were shared:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">Jio to become (virtually) debt-free; an efficient structure for investment by any potential partner

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">Jio to become (virtually) debt-free; an efficient structure for investment by any potential partner

First came in @Microsoft then @Faceook

First came in @Microsoft then @Faceook

11/ Intent was to set up a 3 layer company structure that would be a win-win for the group, the partner (and it& #39;s money) and also keep Jio& #39;s license valid as a telecom player.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Reliance Infocomm is a WOS of Jio Platforms (where Facebook has invested), which is a WOS of RIL.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Reliance Infocomm is a WOS of Jio Platforms (where Facebook has invested), which is a WOS of RIL.

12/ This proposal to reorganise was an extremely smart move by RIL that had already spent a lot of money on 3 areas:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> Network: Home Broadband, Mobile Broadband and Enterprise Broadband services.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> Network: Home Broadband, Mobile Broadband and Enterprise Broadband services.

14/ Other than the network, RIL has spent considerable money on

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> Technology: AI/ML, Cloud, IoT, Narrow Band IoT, AR/VR, Identity, Blockchain and a whole lot more

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> Technology: AI/ML, Cloud, IoT, Narrow Band IoT, AR/VR, Identity, Blockchain and a whole lot more

15/ Last but not the least, RIL over the course of years has also been pumping in a lot of money in acquisitions:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> this includes Haptik, KaiOS, Radisys, Aaram Shop, newJ, Tesseract, Hathway TV, DEN, Reverie, KareXpert, EasyGov and Sankhya Sutra Labs

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> this includes Haptik, KaiOS, Radisys, Aaram Shop, newJ, Tesseract, Hathway TV, DEN, Reverie, KareXpert, EasyGov and Sankhya Sutra Labs

16/ Before we even move on to how does this all tie in together, imp to talk about the investments of RIL in movies, media, content production, education, logistics, retail & payments bank with @TheOfficialSBI.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here is to marry Digital offerings to physical distribution

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here is to marry Digital offerings to physical distribution

17/ While marrying Digital offerings to the physical distribution sounds ideal, it& #39;s something that RIL can do.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics.

18/ So, at one end it had the physical assets (Retail, Fiber and mobile broadband), at the other end it was building digital assets in form of new apps and services.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">what is now needed was a fabric that ties it all together under one window.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">what is now needed was a fabric that ties it all together under one window.

19/ Two things came out of this:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partners

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partners

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer

20/ These are important developments:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">JioMart taps into a USD 700 Bn market of SME retailers that are informal & not digitised - add Reliance Retail portfolio to this

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">JioMart taps into a USD 700 Bn market of SME retailers that are informal & not digitised - add Reliance Retail portfolio to this

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">JioPOS & JioGST can help digitise billing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">JioPOS & JioGST can help digitise billing

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">MyJio can enable one window purchase to all Jio/Reliance

https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">MyJio can enable one window purchase to all Jio/Reliance

21/ In parallel, there& #39;s another motion of investments that RIL was making:

- Investments into DTH networks, in content providers, media networks and aggregators

- this offers a very healthy revenue stream both in today& #39;s context (TV) with possibilities of future (OTT)

- Investments into DTH networks, in content providers, media networks and aggregators

- this offers a very healthy revenue stream both in today& #39;s context (TV) with possibilities of future (OTT)

23/ With so many transactions happening on a common platform, key for any player is to go deeper into the customer wallet, and there comes in JioMoney Wallet.

- Fully aware of the limited margin and possibilities in the payments wallet business, the company opened payments bank.

- Fully aware of the limited margin and possibilities in the payments wallet business, the company opened payments bank.

24/ But despite so many investments across a variety of areas, Jio has failed to gain popular acceptance of its apps.

-Other than obsessive Jio branding for all its services, the company failed to garner recall against for the most formidable players in key categories.

-Other than obsessive Jio branding for all its services, the company failed to garner recall against for the most formidable players in key categories.

25/ Facebook on its part also has made attempts to go beyond its traditional revenue sources and be relevant by way of launching Hardware (Oculus, Portal) and also Calibra (the blockchain-based online payments). But India market has also been a tricky one for them.

26/ On the side, after having failed in its attempt to re-enter China with #startup fund, Facebook ventured into India and invested in @Meesho_Official, an app for social selling with the aim of digitising India& #39;s SMEs. It also invested in @unacademy

& via foundation in @BYJUS

& via foundation in @BYJUS

27/ Coming together of Facebook and Jio is truly a confluence of forces with common interests:

- Connectivity (Broadband, HW)

- Community (Messaging, Calls)

- Content (News, Entertainment, Education, Games)

- Commerce (physical/digital)

- Currency (wallets)

- Capital (Banking)

- Connectivity (Broadband, HW)

- Community (Messaging, Calls)

- Content (News, Entertainment, Education, Games)

- Commerce (physical/digital)

- Currency (wallets)

- Capital (Banking)

28/ With such significant overlaps, easy to assume that Jio Platform (Apps, services and Jio connectivity) along with support from Facebook will become in due course one of the biggest Digital Services provider in the world (by numbers).

29/ In order to understand the impact of this union on our daily lives, it& #39;s important to first understand the stakeholders Jio currently works with and caters to:

- Consumers Mobiles (Broadband + Devices)

- Consumers Homes (Broadband + Devices + IoT + Content + DTH + TV + News)

- Consumers Mobiles (Broadband + Devices)

- Consumers Homes (Broadband + Devices + IoT + Content + DTH + TV + News)

30/

- Consumers Cars (IoT + Apps)

- Consumers Shopping (Offline/Online)

- Consumers Food (Grocery)

- Consumers Education (Jio University)

- Consumers Cars (IoT + Apps)

- Consumers Shopping (Offline/Online)

- Consumers Food (Grocery)

- Consumers Education (Jio University)

32/ On enterprise side, Jio also has a far-reaching impact:

- Enterprise Bandwidth

- News and Media houses

- Content Producers

- Advertising and media buyers

- Government agencies and e-governance

- Healthcare services

- Farmers (Reliance Retail sources directly)

- & more

- Enterprise Bandwidth

- News and Media houses

- Content Producers

- Advertising and media buyers

- Government agencies and e-governance

- Healthcare services

- Farmers (Reliance Retail sources directly)

- & more

33/ With services being combined under one umbrella & on a common platform, two outcomes are certain:

- #data monetisation will be a norm hereon

- single #identity (JioID) will capture all personal data like password, retina and fingerprint

#GreyhoundStandpoint @Greyhound_R

- #data monetisation will be a norm hereon

- single #identity (JioID) will capture all personal data like password, retina and fingerprint

#GreyhoundStandpoint @Greyhound_R

34/ Biggest action in the comings times will be in the area of capital. Also an area where RIL has limited footprints.

- RIL has been keen on the equities markets and over financial services for a while now and they even had a partnership with DE Shaw.

- Possible acquisitions.

- RIL has been keen on the equities markets and over financial services for a while now and they even had a partnership with DE Shaw.

- Possible acquisitions.

35/ While the pieces in the Jio + Facebook are falling neatly together, one area which is still not as stong a foothold is last-mile delivery - This is a critical success factor in the commerce game.

- BUT RIL is known for vertical integration in value chain and can plug this.

- BUT RIL is known for vertical integration in value chain and can plug this.

36/ One of the many Qs that have come to me on this is, are we going the WeChat way?

- Directionally, yes.

But India isn’t there just yet. Here’s why:

- Broadband limited & patchy

- Not all have smartphones

- Users still warming to digital

- Users getting wary about privacy

- Directionally, yes.

But India isn’t there just yet. Here’s why:

- Broadband limited & patchy

- Not all have smartphones

- Users still warming to digital

- Users getting wary about privacy

37/ Despite all of this, what& #39;s missing is the ability of Jio to capture one key user base, i.e. the youth in Tier 2 and Tier 3 towns. Here& #39;s why:

- They have all migrated in flocks to @TikTok_IN and have nearly given up on @facebookapp and @instagram

Must consider.

- They have all migrated in flocks to @TikTok_IN and have nearly given up on @facebookapp and @instagram

Must consider.

38/ The counter argument being proposed by many is the same users are on @WhatsApp so Jio can still solve the issue of users flocking to TikTok.

- Actually, not - WA chiefly used to share content amongst circles, not create - even WA Stories has only gained mild acceptance.

- Actually, not - WA chiefly used to share content amongst circles, not create - even WA Stories has only gained mild acceptance.

39/ While the use of WhatsApp for facilitating commerce between SME retailers is a winner, it has its limitations :

- WA can facilitate payments, it has limited ability to engage buyers in a meaningful manner - Jio will have to use @Meesho_Official or like to build engagement.

- WA can facilitate payments, it has limited ability to engage buyers in a meaningful manner - Jio will have to use @Meesho_Official or like to build engagement.

41/ Must consider competition before we declare JioMart as a winner in the #eCommerce game:

- @amazonIN and @flipkart have well established supplier networks & consumer mindshare

- cannot discount @google from this - they are happy to have retailers “sell for free” + own search

- @amazonIN and @flipkart have well established supplier networks & consumer mindshare

- cannot discount @google from this - they are happy to have retailers “sell for free” + own search

Read on Twitter

Read on Twitter![[THREAD]We at Greyhound Research believe, " @Facebook Investment In @RelianceJio Is Deeper Than It Appears."In short - Connectivity Is The Lubricant To The Engine Of Community, Content, Commerce, Currency & Capital. #GreyhoundStandpoint on #JioFacebook #Data by @Greyhound_R [THREAD]We at Greyhound Research believe, " @Facebook Investment In @RelianceJio Is Deeper Than It Appears."In short - Connectivity Is The Lubricant To The Engine Of Community, Content, Commerce, Currency & Capital. #GreyhoundStandpoint on #JioFacebook #Data by @Greyhound_R](https://pbs.twimg.com/media/EWQqfpCVAAICJLQ.jpg)

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics." title="2/ Even before we understand the possibilities together, important to have context.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉🏻" title="Right pointing backhand index (light skin tone)" aria-label="Emoji: Right pointing backhand index (light skin tone)"> Both parties have been struggling over past 12 months with growth and overall a choppy demand for their services.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This was reflecting in their stock prices. Esp in last 3 months. See pics.">

Key here is to marry Digital offerings to physical distribution" title="16/ Before we even move on to how does this all tie in together, imp to talk about the investments of RIL in movies, media, content production, education, logistics, retail & payments bank with @TheOfficialSBI.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here is to marry Digital offerings to physical distribution" class="img-responsive" style="max-width:100%;"/>

Key here is to marry Digital offerings to physical distribution" title="16/ Before we even move on to how does this all tie in together, imp to talk about the investments of RIL in movies, media, content production, education, logistics, retail & payments bank with @TheOfficialSBI.https://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">Key here is to marry Digital offerings to physical distribution" class="img-responsive" style="max-width:100%;"/>

It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics." title="17/ While marrying Digital offerings to the physical distribution sounds ideal, it& #39;s something that RIL can do.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics." class="img-responsive" style="max-width:100%;"/>

It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics." title="17/ While marrying Digital offerings to the physical distribution sounds ideal, it& #39;s something that RIL can do.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index"> It owns a significant chunk of retail by way of partner stores, reliance-branded stores, reliance Jio stores and logistics." class="img-responsive" style="max-width:100%;"/>

RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partnershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer" title="19/ Two things came out of this:https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partnershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer" class="img-responsive" style="max-width:100%;"/>

RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partnershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer" title="19/ Two things came out of this:https://abs.twimg.com/emoji/v2/... draggable="false" alt="👉" title="Right pointing backhand index" aria-label="Emoji: Right pointing backhand index">RIL acquired AaramShop for a system it had built to digitise SME retailers - in parallel, they were building something similar for Jio partnershttps://abs.twimg.com/emoji/v2/... draggable="false" alt="💡" title="Electric light bulb" aria-label="Emoji: Electric light bulb">This is now JioMart, JioPOS and MyJio - essentially two sides to it - one, retailer two, consumer" class="img-responsive" style="max-width:100%;"/>