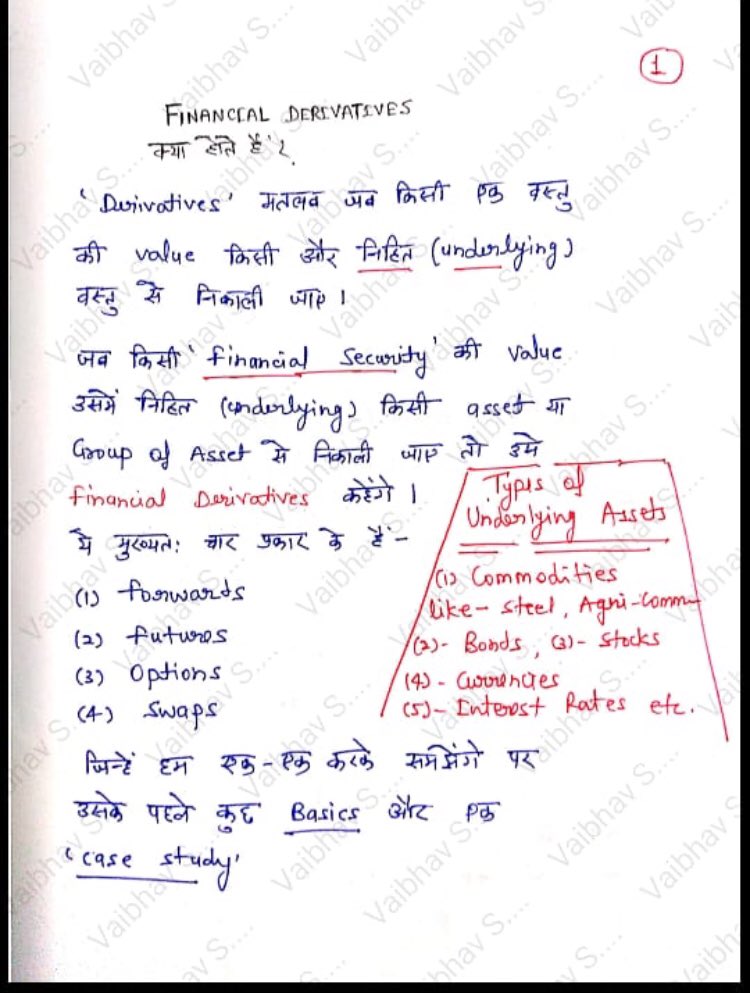

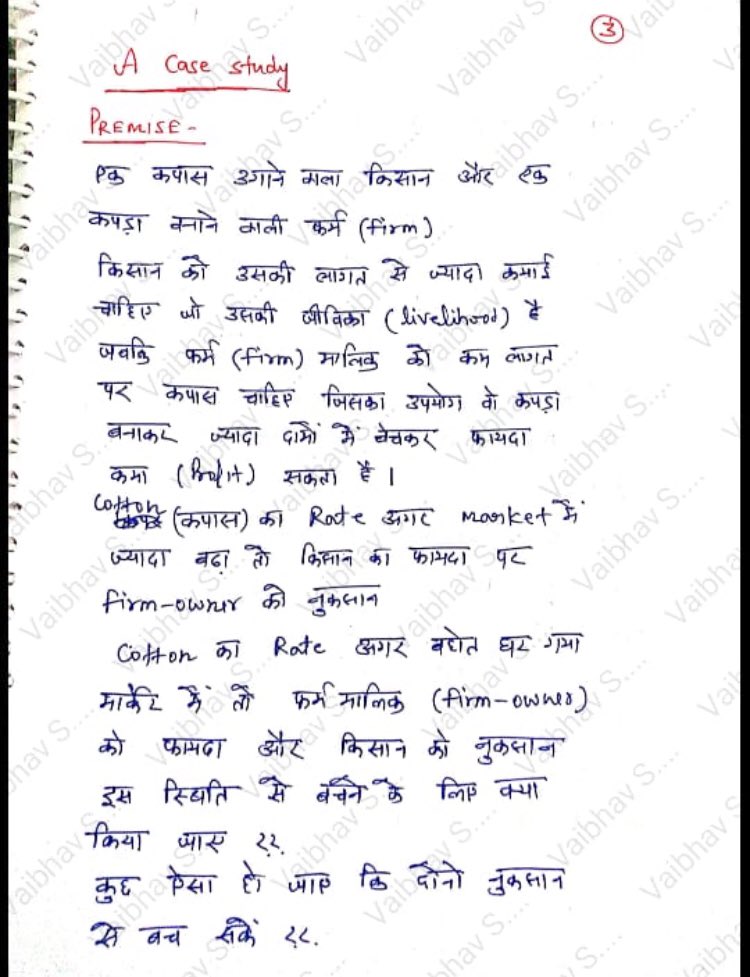

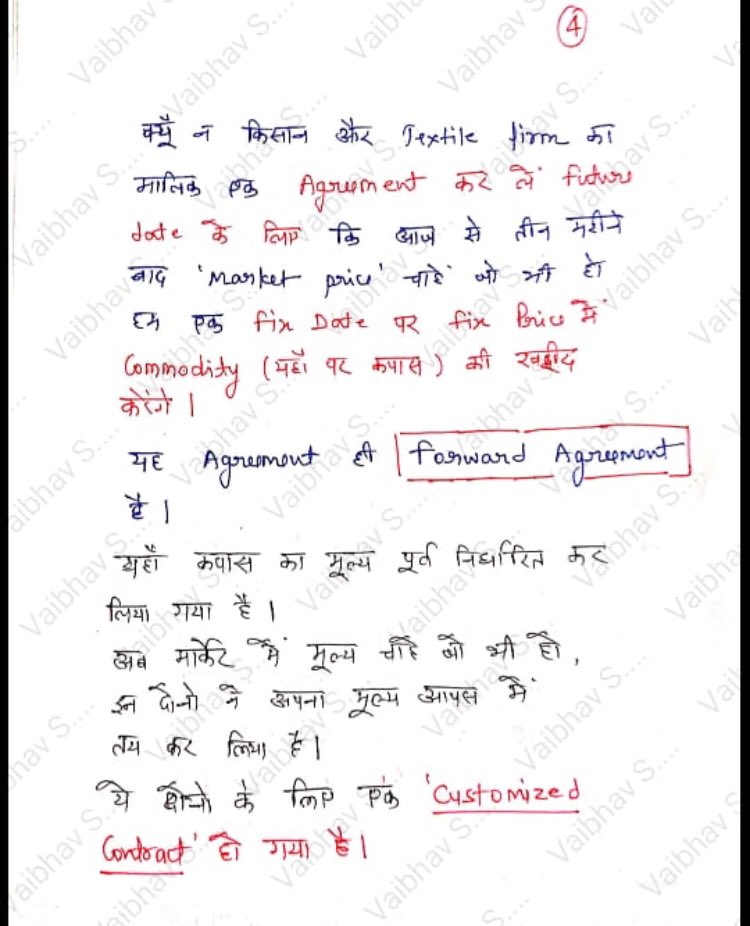

Financial Derivatives- explanation in Layman’s terms to understand why WTI crude fell to below zero pricing !! With an insight to Forwards and Futures with a simple example 1/3

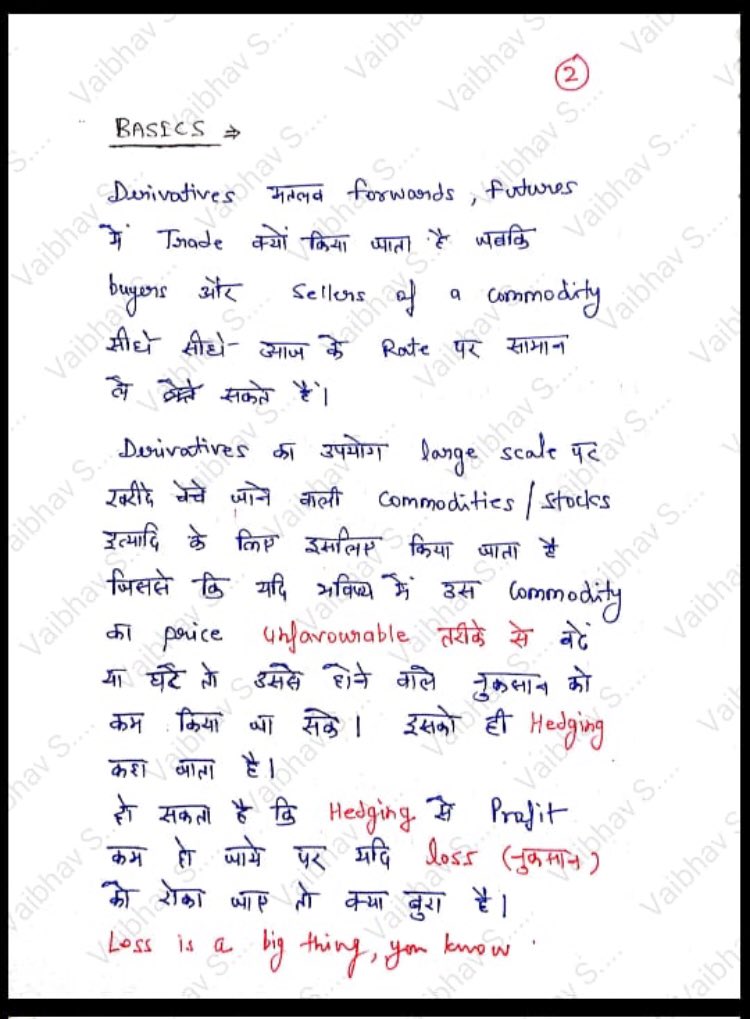

It certainly reflects the ongoing demand supply dynamics where demand is all time low .. leading to traders / speculators to exit the futures contract at any cost . If they don’t they have to execute the contract and buy the whole delivery ..where will they keep ..2/3

Read on Twitter

Read on Twitter