Today the @ecb announced new measures to alleviate the effects of potential rating downgrades on collateral availability. On this occasion, our Vice President Luis de Guindos & I have published a blog to explain the economic rationale behind our collateral easing measures. 1/7 https://twitter.com/ecb/status/1253059162474524672">https://twitter.com/ecb/statu...

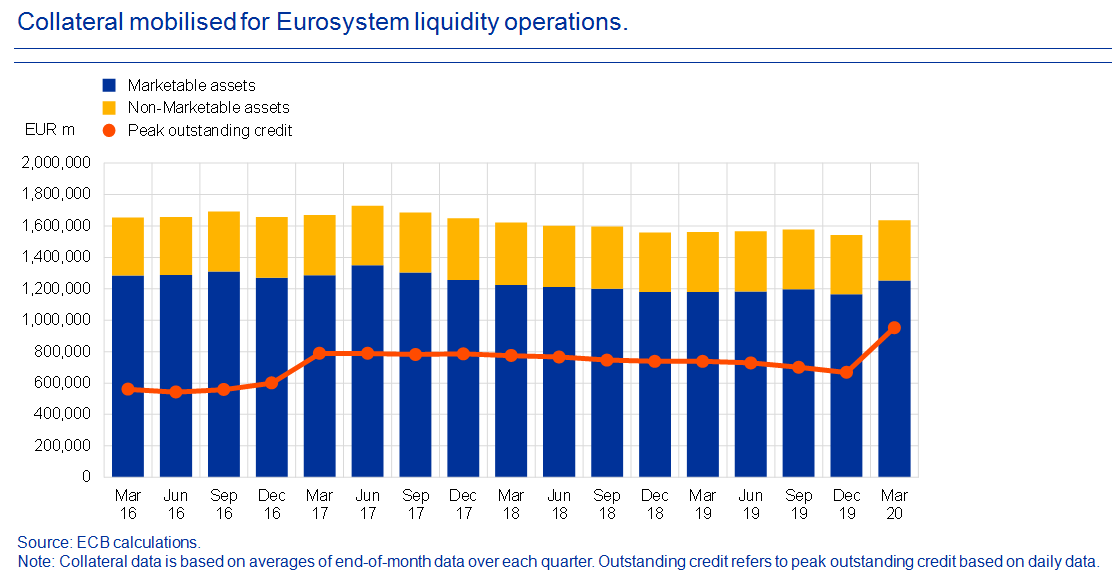

The #ECB conducts all lending operations, like LTROs or TLTROs, based on adequate collateral. A large part of collateral is marketable assets. The amount of mobilized collateral & the volume of our liquidity operations have increased since the onset of the COVID-19 pandemic. 2/7

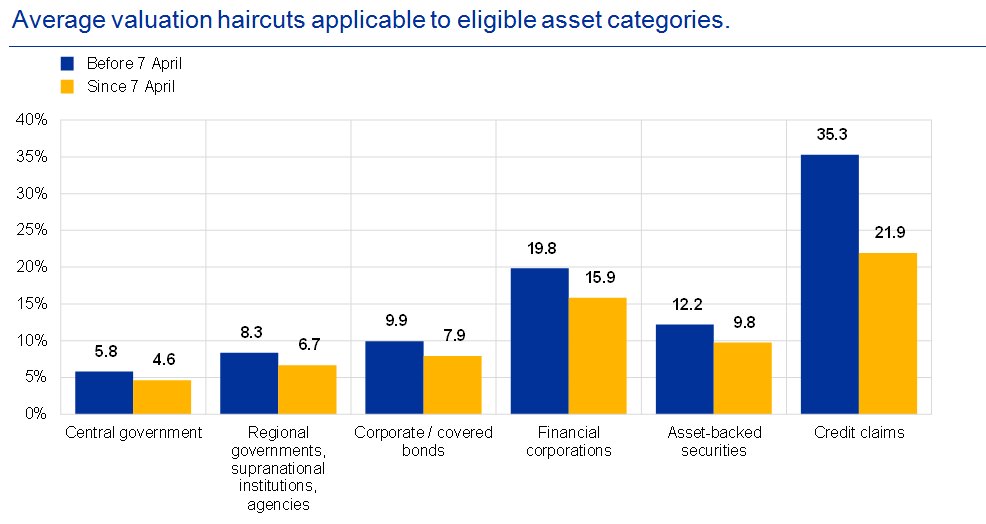

Under our collateral frameworks, assets must fulfil minimum credit quality requirements. Falling asset prices & rating downgrades put pressure on the availability of collateral. One main objective of our collateral easing packages is to prevent procyclical feedback loops. 3/7

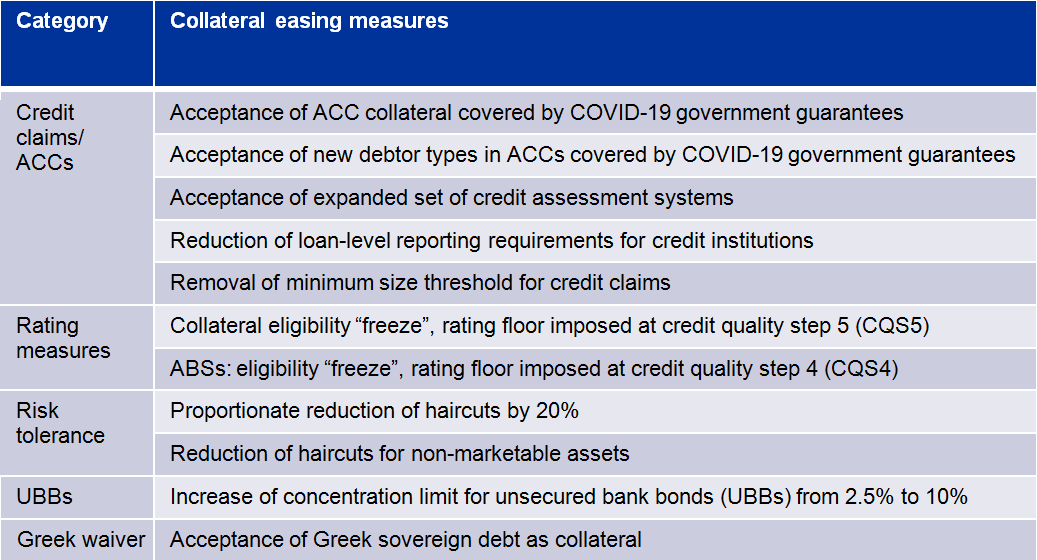

This table summarizes the measures adopted by the #ECB on April 7 & today. The first set of measures expands the acceptance of credit claims as collateral, including loans to small and medium-sized enterprises and self-employed individuals benefitting from public guarantees. 4/7

The 2nd set of measures, announced today, is a temporary rating "freeze” for collateral. All marketable assets that were eligible on 7 April 2020 remain eligible after a downgrade, provided that the rating remains above BB (or BB+ for ABSs). Appropriate haircuts will be used. 5/7

Further measures include a general reduction of haircuts by 20%, an increase in the concentration limits for unsecured bank bonds from 2.5% to 10%, and a waiver for Greek sovereign bonds, implying that these bonds are now eligible for the Eurosystem’s lending operations. 6/7

All measures are temporary & are applied until September 2021. They make sure that banks retain access to ample liquidity at favourable terms & foster bank lending. Together with our other measures, they provide for a smooth transmission of monetary policy in the euro area. 7/7

Read on Twitter

Read on Twitter