Highlight of the day - Facebook acquired 9.99% stake in Reliance’s Jio platform for an investment of Rs 43,574 cr valuing it at Rs 4.36 lakh crore. That& #39;s 56% of market cap of RIL (~7.8 lakh cr) – huge right!!

A simplified thread on the deal, Jio platfrom and competition.

1/n

A simplified thread on the deal, Jio platfrom and competition.

1/n

2/n

Landmark deal:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Largest investment for a minority stake by a technology company ANYWHERE in the world

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Largest investment for a minority stake by a technology company ANYWHERE in the world

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Largest FDI in the technology sector in India.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Largest FDI in the technology sector in India.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Values Jio Platforms amongst the top 5 largest listed cos. in India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Values Jio Platforms amongst the top 5 largest listed cos. in India

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Improves India& #39;s $ reserves & fiscal balances

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📝" title="Memo" aria-label="Emoji: Memo">Improves India& #39;s $ reserves & fiscal balances

Landmark deal:

3/n

Deal rationale - Facebook had $50B of cash on B/S making practically no money. Deploying $5.7 bn in Jio gives them broader access to India and India 2 retail users. For Reliance, it strengthens their consumer wallet share and brings big ability to cross service clients.

Deal rationale - Facebook had $50B of cash on B/S making practically no money. Deploying $5.7 bn in Jio gives them broader access to India and India 2 retail users. For Reliance, it strengthens their consumer wallet share and brings big ability to cross service clients.

4/n

Cross selling using Reliance Retail: Commercial partnership between Reliance Retail and WhatsApp to accelerate Reliance Retail’s New Commerce business on the JioMart platform using WhatsApp.

Reliance has denied has relevance of relation to this deal to the "super app" plan

Cross selling using Reliance Retail: Commercial partnership between Reliance Retail and WhatsApp to accelerate Reliance Retail’s New Commerce business on the JioMart platform using WhatsApp.

Reliance has denied has relevance of relation to this deal to the "super app" plan

5/n

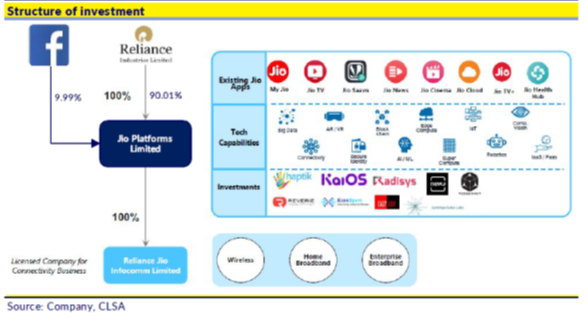

Deal structure:

Reducing leverage of the parent: Of Rs 436 bn inflow, Rs 280 bn will be used to redeem OCPS of RIL and 150 bn retained in the Jio Platforms. Pre money equity value is Rs 4.21 tn.

Implied net debt for Jio Platform before transaction is Rs 410 bn.

Deal structure:

Reducing leverage of the parent: Of Rs 436 bn inflow, Rs 280 bn will be used to redeem OCPS of RIL and 150 bn retained in the Jio Platforms. Pre money equity value is Rs 4.21 tn.

Implied net debt for Jio Platform before transaction is Rs 410 bn.

6/n

Relevant subsidiaries of RIL:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">Jio Platforms: Wholly-owned subsidiary of RIL that gets 15K crores

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">Jio Platforms: Wholly-owned subsidiary of RIL that gets 15K crores

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">Reliance Jio Infocomm: Provides connectivity platform to over 388 mn subscribers, will continue to be a wholly-owned subsidiary of Jio Platforms. Gets zero from this deal.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏦" title="Bank" aria-label="Emoji: Bank">Reliance Jio Infocomm: Provides connectivity platform to over 388 mn subscribers, will continue to be a wholly-owned subsidiary of Jio Platforms. Gets zero from this deal.

Relevant subsidiaries of RIL:

7/n

About Jio:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio

About Jio:

8/n

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Green circle" aria-label="Emoji: Green circle"> Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Green circle" aria-label="Emoji: Green circle"> Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute).

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls.

9/n

Saturation in target market?

Churn in Q3 FY20 was the highest at 6.3%. This may depict high price sensitivity of Jio’s customers, being a late entrant and tapping the bottom of pyramid. This affects Jio’s ability to onboard new ones from here "organically"

Saturation in target market?

Churn in Q3 FY20 was the highest at 6.3%. This may depict high price sensitivity of Jio’s customers, being a late entrant and tapping the bottom of pyramid. This affects Jio’s ability to onboard new ones from here "organically"

10/n

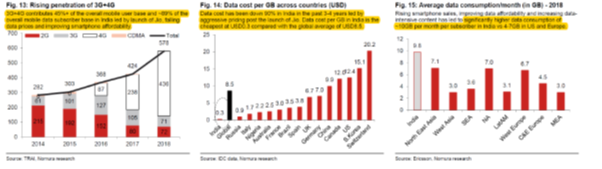

Jio brought internet to the rural masses and effectively enabled 4G in India, driven by its significantly cheaper tariff plans for high-speed 4G connectivity - leading to massive increase in data consumption, largely video (tik-tok?)

Jio brought internet to the rural masses and effectively enabled 4G in India, driven by its significantly cheaper tariff plans for high-speed 4G connectivity - leading to massive increase in data consumption, largely video (tik-tok?)

11/n

Competition:

Jio is expected to become the # 1 telecom network in India by end of Q4FY20, taking share from Vodafone-Idea whose subscriber base is expected to see some churn with price hikes undertaken recently. Imminent price hikes look unlikely.

Competition:

Jio is expected to become the # 1 telecom network in India by end of Q4FY20, taking share from Vodafone-Idea whose subscriber base is expected to see some churn with price hikes undertaken recently. Imminent price hikes look unlikely.

12/n

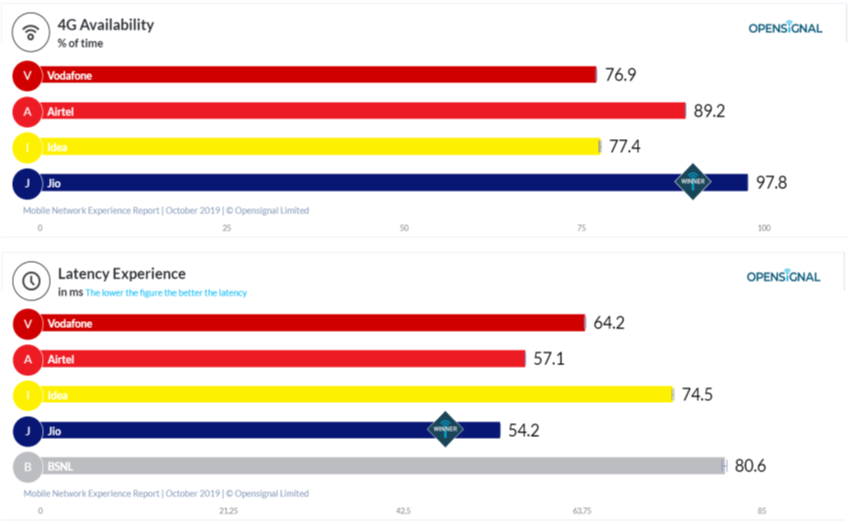

Customer experience - Positives

Jio’s investments in superior fiber based 4G technology helps it ensure a good customer experience and retain users – better 4G network connectivity and lower latency

Customer experience - Positives

Jio’s investments in superior fiber based 4G technology helps it ensure a good customer experience and retain users – better 4G network connectivity and lower latency

13/n

Customer experience - Negatives

Jio’s download speed while significantly faster than 3G speeds for incumbents, is slower in the 4G category due to significantly more users and cheap unlimited data tariff plans

Customer experience - Negatives

Jio’s download speed while significantly faster than 3G speeds for incumbents, is slower in the 4G category due to significantly more users and cheap unlimited data tariff plans

14/n

AGR issues and Airtel: Clarity on the issue of AGR dues should emerge soon with Airtel already having announced their intent to settle the same by Mar’20 post their successful QIP of $3 bn in Jan’20

AGR issues and Airtel: Clarity on the issue of AGR dues should emerge soon with Airtel already having announced their intent to settle the same by Mar’20 post their successful QIP of $3 bn in Jan’20

15/n

For Vodafone-Idea, its’ ability to negotiate a deferred payment schedule would be key to their survival. Inability to do this would mean they will file for bankruptcy and Jio and Airtel would be best placed to share the additional 325 mm odd customers

For Vodafone-Idea, its’ ability to negotiate a deferred payment schedule would be key to their survival. Inability to do this would mean they will file for bankruptcy and Jio and Airtel would be best placed to share the additional 325 mm odd customers

16/n

Implication for Telecom competition (Airtel and Vodafone) - there are both pros and cons for the peers. Suggest one to read this insightful write-up for details by @mobis_philipose https://www.livemint.com/market/mark-to-market/is-the-jio-facebook-deal-bad-news-for-bharti-airtel-and-vodafone-idea/amp-11587550782310.html?__twitter_impression=true">https://www.livemint.com/market/ma...

Implication for Telecom competition (Airtel and Vodafone) - there are both pros and cons for the peers. Suggest one to read this insightful write-up for details by @mobis_philipose https://www.livemint.com/market/mark-to-market/is-the-jio-facebook-deal-bad-news-for-bharti-airtel-and-vodafone-idea/amp-11587550782310.html?__twitter_impression=true">https://www.livemint.com/market/ma...

17/n

For a deeper perspective on the investment, please read @akm1410& #39;s note (behind paywall). Recommended.

End/ https://themorningcontext.com/a-note-on-the-facebook-jio-investment/">https://themorningcontext.com/a-note-on...

For a deeper perspective on the investment, please read @akm1410& #39;s note (behind paywall). Recommended.

End/ https://themorningcontext.com/a-note-on-the-facebook-jio-investment/">https://themorningcontext.com/a-note-on...

18/n

Addendum: Good details on possible WhatsApp synergies in this note by Rahil https://twitter.com/rahiljasani/status/1252854890147135488?s=19">https://twitter.com/rahiljasa...

Addendum: Good details on possible WhatsApp synergies in this note by Rahil https://twitter.com/rahiljasani/status/1252854890147135488?s=19">https://twitter.com/rahiljasa...

19/n

Read: The most expensive board seat at India’s e-commerce table. https://www.livemint.com/opinion/online-views/the-most-expensive-seat-at-india-s-e-commerce-table-11587573503297.html">https://www.livemint.com/opinion/o...

Read: The most expensive board seat at India’s e-commerce table. https://www.livemint.com/opinion/online-views/the-most-expensive-seat-at-india-s-e-commerce-table-11587573503297.html">https://www.livemint.com/opinion/o...

20/n

Read: One year of talks, Covid-19 hurdles and more. The backstory about the Facebook-Jio deal. https://www.vccircle.com/one-year-of-talks-covid-19-hurdles-and-more-backstory-about-facebook-jio-deal?utm_source=twitter&utm_medium=social&utm_campaign=One%20year%20of%20talks,%20Covid-19%20hurdles%20and%20more%20backstory%20about%20Facebook-Jio%20deal">https://www.vccircle.com/one-year-...

Read: One year of talks, Covid-19 hurdles and more. The backstory about the Facebook-Jio deal. https://www.vccircle.com/one-year-of-talks-covid-19-hurdles-and-more-backstory-about-facebook-jio-deal?utm_source=twitter&utm_medium=social&utm_campaign=One%20year%20of%20talks,%20Covid-19%20hurdles%20and%20more%20backstory%20about%20Facebook-Jio%20deal">https://www.vccircle.com/one-year-...

Read on Twitter

Read on Twitter

Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues). https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio" title="7/nAbout Jio:https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues). https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio" class="img-responsive" style="max-width:100%;"/>

Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues). https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio" title="7/nAbout Jio:https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> Jio launched in 2016; In 3 years since launch, Jio has ~39 cr subscribers (~37% market share and 40%+ of industry revenues). https://abs.twimg.com/emoji/v2/... draggable="false" alt="📲" title="Mobile phone with rightwards arrow at left" aria-label="Emoji: Mobile phone with rightwards arrow at left"> In FY 2019, Jio carried close to 71% of the total 4G traffic of India! Effectively 4G in India = Jio" class="img-responsive" style="max-width:100%;"/>

Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls." title="8/nhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Green circle" aria-label="Emoji: Green circle"> Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls." class="img-responsive" style="max-width:100%;"/>

Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls." title="8/nhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🟢" title="Green circle" aria-label="Emoji: Green circle"> Pace of gross subscriber additions has increased to 3.7 cr last quarter (290 Jio subscribers added every minute). https://abs.twimg.com/emoji/v2/... draggable="false" alt="🛑" title="Stop sign" aria-label="Emoji: Stop sign">Interestingly, there is a large churn of 22m subs last qtr, mainly due to company passing through IUC charge to customers for off-Jio network calls." class="img-responsive" style="max-width:100%;"/>