ELI5 thread on @NervosNetwork https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

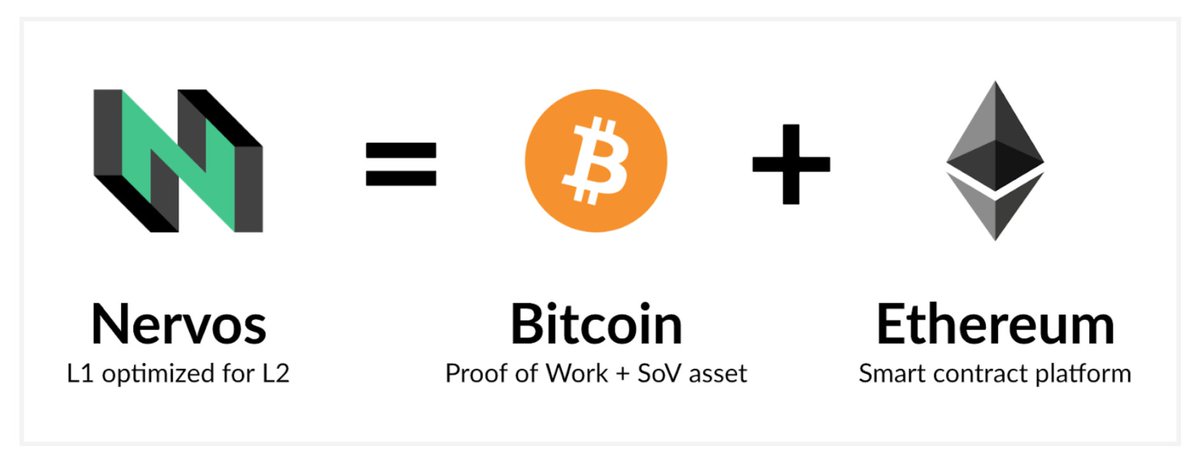

1/ What is Nervos?

A PoW L1 blockchain optimized for app-specific L2 chains.

Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum.

1/ What is Nervos?

A PoW L1 blockchain optimized for app-specific L2 chains.

Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum.

2/ Overview of Nervos:

Nervos launched its mainnet in late 2019.

L1 = a high-throughput PoW chain.

L2 = Nervos’ Axon SDK enables devs to run high-performance & Turing complete app-specific chains with VMs and consensus protocols of their choice.

Nervos launched its mainnet in late 2019.

L1 = a high-throughput PoW chain.

L2 = Nervos’ Axon SDK enables devs to run high-performance & Turing complete app-specific chains with VMs and consensus protocols of their choice.

3/ Nervos tackles the unsustainable economic incentives of Bitcoin:

Bitcoin’s capped supply (decreasing block rewards) and BTC’s role as a SoV asset (low tx activity):

→ might lead to unsustainable economic incentives for miners in the long-run.

Bitcoin’s capped supply (decreasing block rewards) and BTC’s role as a SoV asset (low tx activity):

→ might lead to unsustainable economic incentives for miners in the long-run.

4/ Nervos tackles the heavy asset dilemma of Ethereum:

In Ethereum, the value of its native asset ETH is not directly tied to the value of L2 apps.

This is a security risk in case the value of L2 > L1 → economically rational to attack L1 to steal assets on L2.

In Ethereum, the value of its native asset ETH is not directly tied to the value of L2 apps.

This is a security risk in case the value of L2 > L1 → economically rational to attack L1 to steal assets on L2.

5/ Nervos has a perpetual secondary issuance for its native asset (CKB):

In addition to a base supply of 33 billion CKBs (capped similar to BTC’s 21 million), Nervos has a fixed (1.3 billion CKBs) annual secondary issuance to incentivize miners in the longer-term.

In addition to a base supply of 33 billion CKBs (capped similar to BTC’s 21 million), Nervos has a fixed (1.3 billion CKBs) annual secondary issuance to incentivize miners in the longer-term.

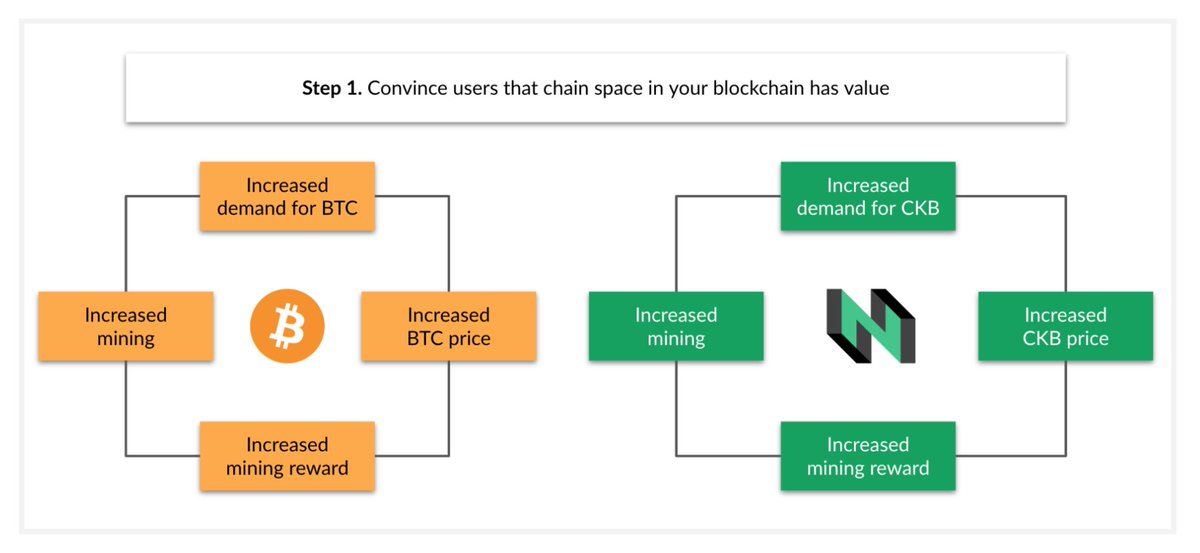

6/ To make CKB a SoV asset → CKB is used to pay for tx fees & storage:

All L2’s apps need to continuously lock up CKB in proportion to the size of their apps.

The more demand there is for chain space on Nervos → the more valuable CKBs become.

All L2’s apps need to continuously lock up CKB in proportion to the size of their apps.

The more demand there is for chain space on Nervos → the more valuable CKBs become.

7/ Locked up CKBs are subject to “state rent” via inflation:

Apps that lock up CKB forego the annual inflation rewards from the secondary issuance (= aka pay state rent).

This model automates state rent payments.

Apps that lock up CKB forego the annual inflation rewards from the secondary issuance (= aka pay state rent).

This model automates state rent payments.

8/ L1 chain space = subject to a secondary market:

In Ethereum, data storage is paid for once and stored forever → leads to state bloat and higher requirements for full nodes.

In Nervos, apps should unlock and sell their CKBs if they no longer have relevant state to store.

In Ethereum, data storage is paid for once and stored forever → leads to state bloat and higher requirements for full nodes.

In Nervos, apps should unlock and sell their CKBs if they no longer have relevant state to store.

9/ CKB investors can offset inflation:

1. Investors buy CKBs.

2. Deposit CKBs into NervosDAO.

3. NervosDAO receives a part of the secondary issuance to offset inflation.

CKBs in NervosDAO = akin to holding “treasury bonds”.

1. Investors buy CKBs.

2. Deposit CKBs into NervosDAO.

3. NervosDAO receives a part of the secondary issuance to offset inflation.

CKBs in NervosDAO = akin to holding “treasury bonds”.

10/ Applications on top of Nervos:

Nervos has set up a $30M grant to fund application development.

@summa_one received a grant to build a BTC <> Nervos bridge similar to tBTC between Bitcoin and Ethereum.

Check out the Nervos roadmap for 2020 here: https://www.nervos.org/roadmap-2020/ ">https://www.nervos.org/roadmap-2...

Nervos has set up a $30M grant to fund application development.

@summa_one received a grant to build a BTC <> Nervos bridge similar to tBTC between Bitcoin and Ethereum.

Check out the Nervos roadmap for 2020 here: https://www.nervos.org/roadmap-2020/ ">https://www.nervos.org/roadmap-2...

11/ Blockchain in China is on the rise:

The Nervos team ( @janhxie, @lgn21st, @knwang, and @poshboytl) has partnered with many notable investors (Sequoia China, Polychain, Dragonfly, etc.) to boost the blockchain innovation coming out of China: https://www.cnbc.com/2019/12/16/china-looks-to-become-blockchain-world-leader-with-xi-jinping-backing.html">https://www.cnbc.com/2019/12/1...

The Nervos team ( @janhxie, @lgn21st, @knwang, and @poshboytl) has partnered with many notable investors (Sequoia China, Polychain, Dragonfly, etc.) to boost the blockchain innovation coming out of China: https://www.cnbc.com/2019/12/16/china-looks-to-become-blockchain-world-leader-with-xi-jinping-backing.html">https://www.cnbc.com/2019/12/1...

fin/ Shoutout:

We recommend checking out @knwang’s presentation on the cryptoeconomic design of Nervos CKB: https://www.youtube.com/watch?v=1GjmHLmCcg8">https://www.youtube.com/watch...

We recommend checking out @knwang’s presentation on the cryptoeconomic design of Nervos CKB: https://www.youtube.com/watch?v=1GjmHLmCcg8">https://www.youtube.com/watch...

Read on Twitter

Read on Twitter 1/ What is Nervos? A PoW L1 blockchain optimized for app-specific L2 chains. Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum." title="ELI5 thread on @NervosNetworkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> 1/ What is Nervos? A PoW L1 blockchain optimized for app-specific L2 chains. Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum." class="img-responsive" style="max-width:100%;"/>

1/ What is Nervos? A PoW L1 blockchain optimized for app-specific L2 chains. Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum." title="ELI5 thread on @NervosNetworkhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> 1/ What is Nervos? A PoW L1 blockchain optimized for app-specific L2 chains. Nervos wants its native asset (CKB) to function as a more sustainable SoV than BTC and its chain to function as a more secure smart contract platform than Ethereum." class="img-responsive" style="max-width:100%;"/>