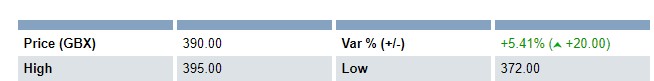

Shares in CareTech, the UK& #39;s biggest private provider of children& #39;s homes and foster care, jumped today after the company said #COVID19 has been good for business. 1/

Turns out the company& #39;s profits are going to be & #39;in line with City expectations& #39; pre-pandemic, unlike pretty much every other business in the UK 2/

The company has told local authorities that it is putting up the rates it charges to find homes for children and young people in care by 5% from April 1. This will cost LAs millions of pounds. Cos, why not? 3/

CareTech has also confirmed that it is still going to pay shareholders the final dividend (many companies have cancelled theirs). Dividend payments will cost CareTech £10.8 million this year. This is effectively paid for by local authorities. 4/

... out of fees for the care of vulnerable children and young people.

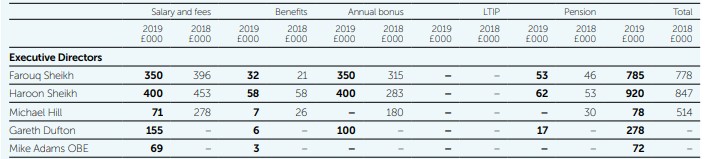

This means the Sheikh brothers Farouk and Haroon, chairman and chief executive respectively, will get total dividends of £1.5 million this year. 5/

This means the Sheikh brothers Farouk and Haroon, chairman and chief executive respectively, will get total dividends of £1.5 million this year. 5/

This is in addition to remuneration of £1.7 million for the year ( #COVID19 being the great leveller, of course). 6/

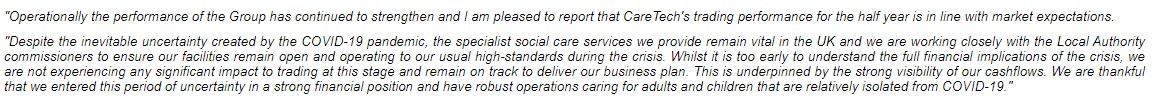

From today& #39;s statement:

-"The performance of the group has continued to strengthen..."

- "This is underpinned by the strong visibility of our cashflows..."

Also known as vulnerable children and young people in care.

-"The performance of the group has continued to strengthen..."

- "This is underpinned by the strong visibility of our cashflows..."

Also known as vulnerable children and young people in care.

Despite the pandemic, CareTech still expected profits to increase by another £5 million through savings arising from its takeover of Cambian. A great time to be cutting costs, obviously. 8/

This company is prospering at an exceptionally difficult time for the most vulnerable families, children and young people. And its bosses are earning millions while its carers earn the minimum wage, often putting their own health at risk. 9/

Privatisation of children& #39;s homes and foster care is abhorrent. This is all I have to say. 10/

Read on Twitter

Read on Twitter