What happened to Media & Entertainment Tech in 2019?

I& #39;m excited to share a (late) review of the trends, initiatives, companies, and investments that pushed the industry forward last year.

https://maximeeyraud.com/media-entertainment-tech-review-2019/

THREAD">https://maximeeyraud.com/media-ent... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">

I& #39;m excited to share a (late) review of the trends, initiatives, companies, and investments that pushed the industry forward last year.

https://maximeeyraud.com/media-entertainment-tech-review-2019/

THREAD">https://maximeeyraud.com/media-ent...

2019 was a busy year for the space!

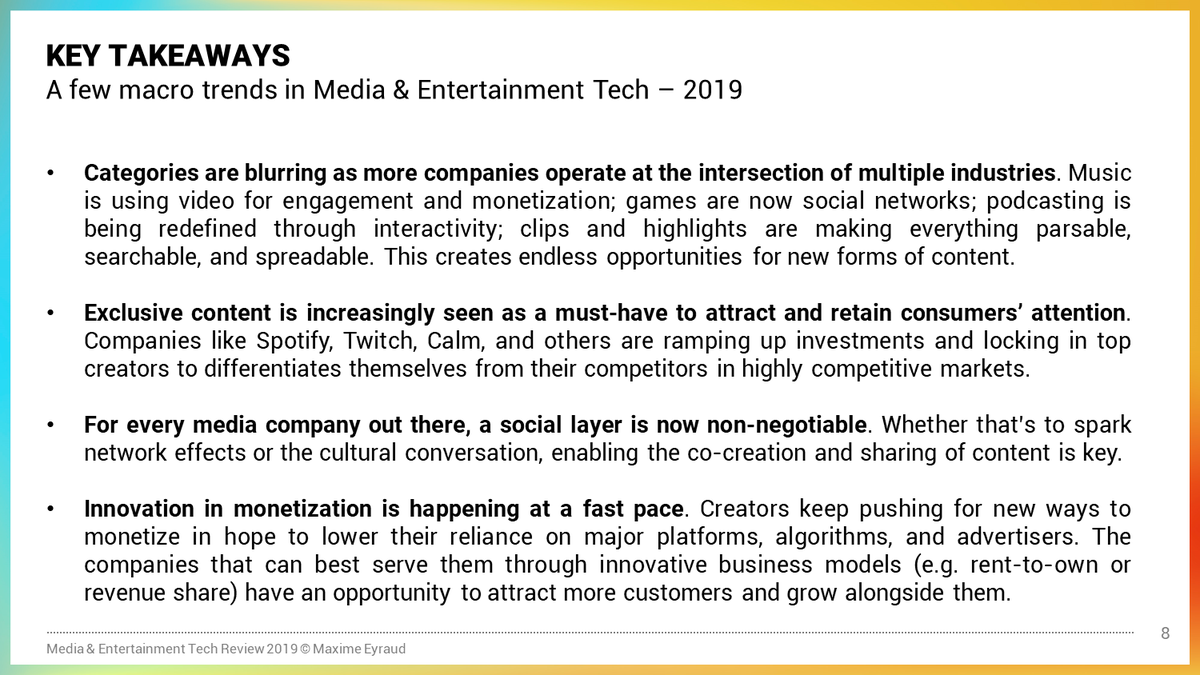

At the macro level, some takeaways:

- media categories are blurring

- players big and small are betting on exclusive content

- the social layer is now non-negotiable

- ongoing experimentation with monetization models

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

At the macro level, some takeaways:

- media categories are blurring

- players big and small are betting on exclusive content

- the social layer is now non-negotiable

- ongoing experimentation with monetization models

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

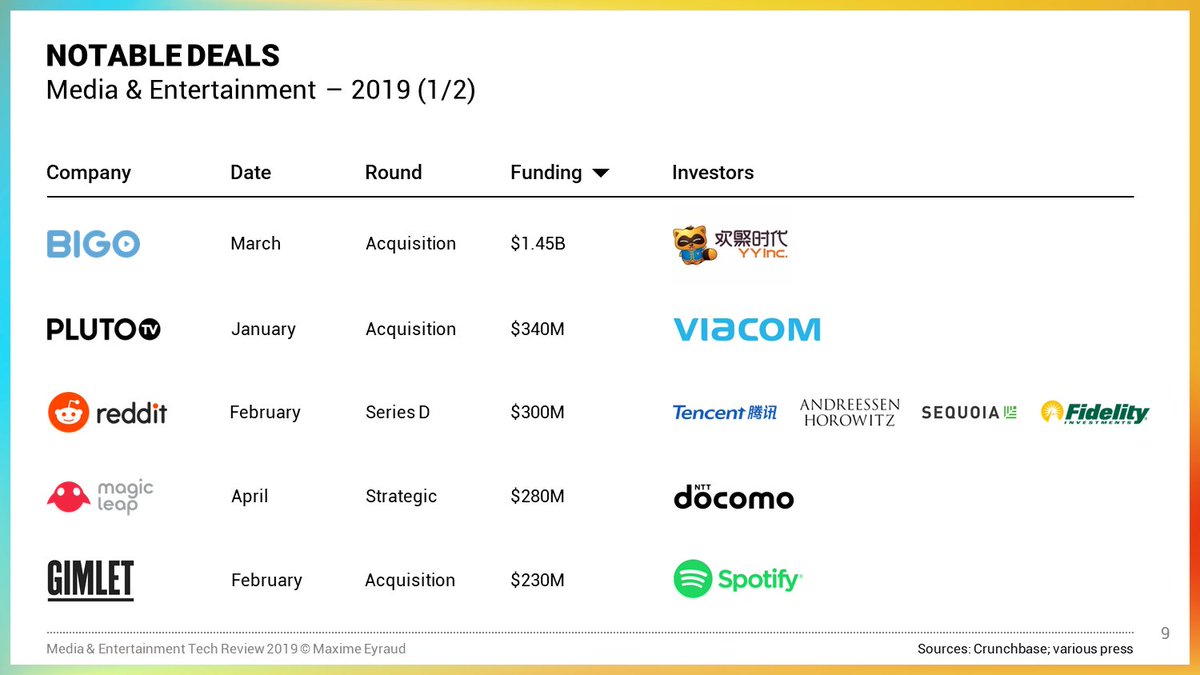

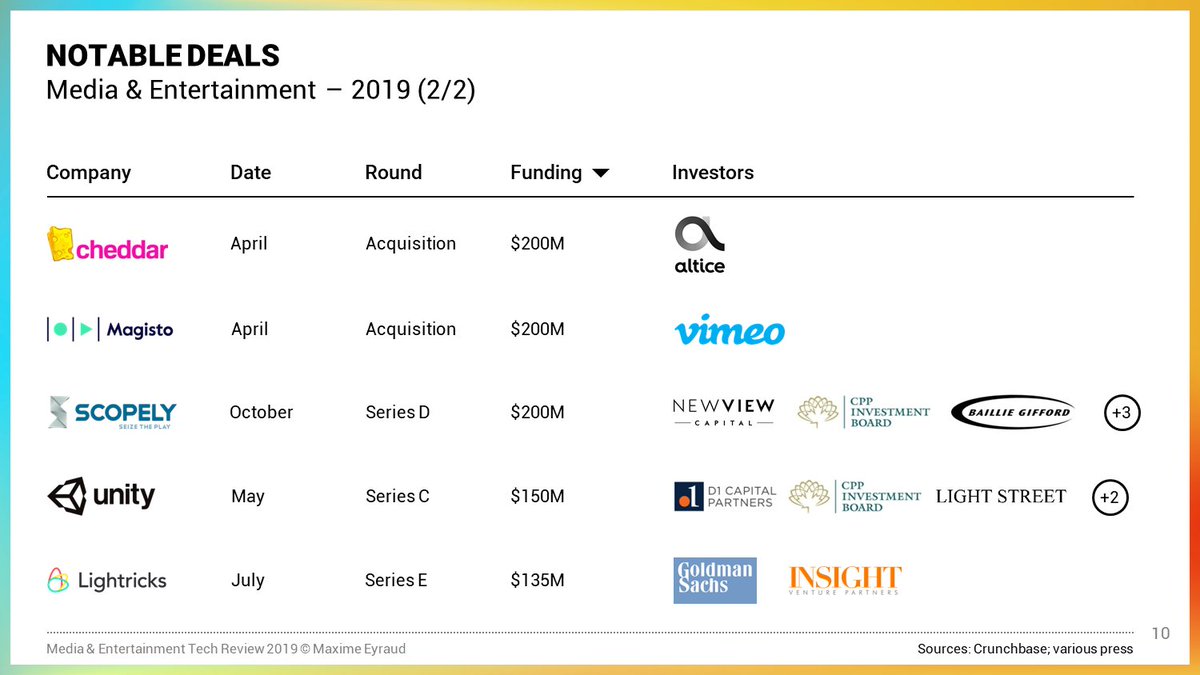

Notable deals included a number of acquisitions:

Bigo => YY ($1.45B)

Pluto TV => Viacom ($340M)

Gimlet => Spotify ($230M)

but also later-stage deals:

Reddit& #39;s $300M Series D

Magic Leap& #39;s $280M Strategic investment from Docomo

Unity& #39;s $150M Series C

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Bigo => YY ($1.45B)

Pluto TV => Viacom ($340M)

Gimlet => Spotify ($230M)

but also later-stage deals:

Reddit& #39;s $300M Series D

Magic Leap& #39;s $280M Strategic investment from Docomo

Unity& #39;s $150M Series C

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

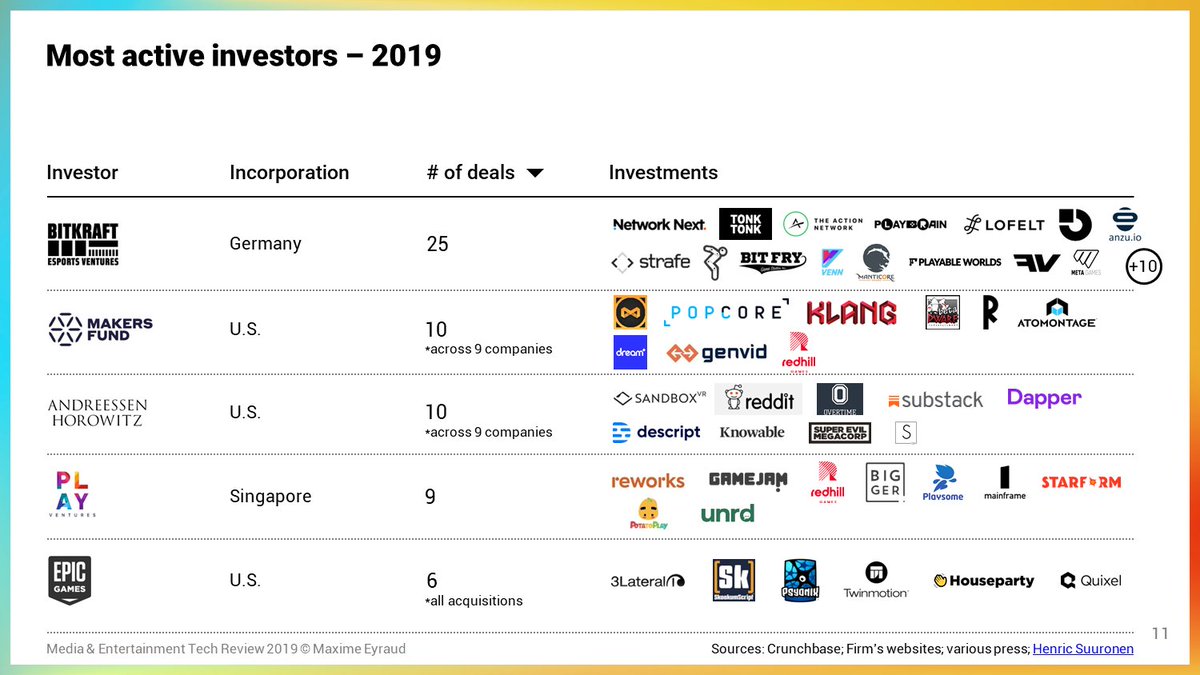

In terms of deal activity, some investors clearly stood out.

This includes both specialized and generalist firms, as well as corporates.

Among them:

@BITKRAFTEsports

@makersfundvc

@a16z

@PlayVentures

@EpicGames, with a total of 6 acquisitions!

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

This includes both specialized and generalist firms, as well as corporates.

Among them:

@BITKRAFTEsports

@makersfundvc

@a16z

@PlayVentures

@EpicGames, with a total of 6 acquisitions!

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

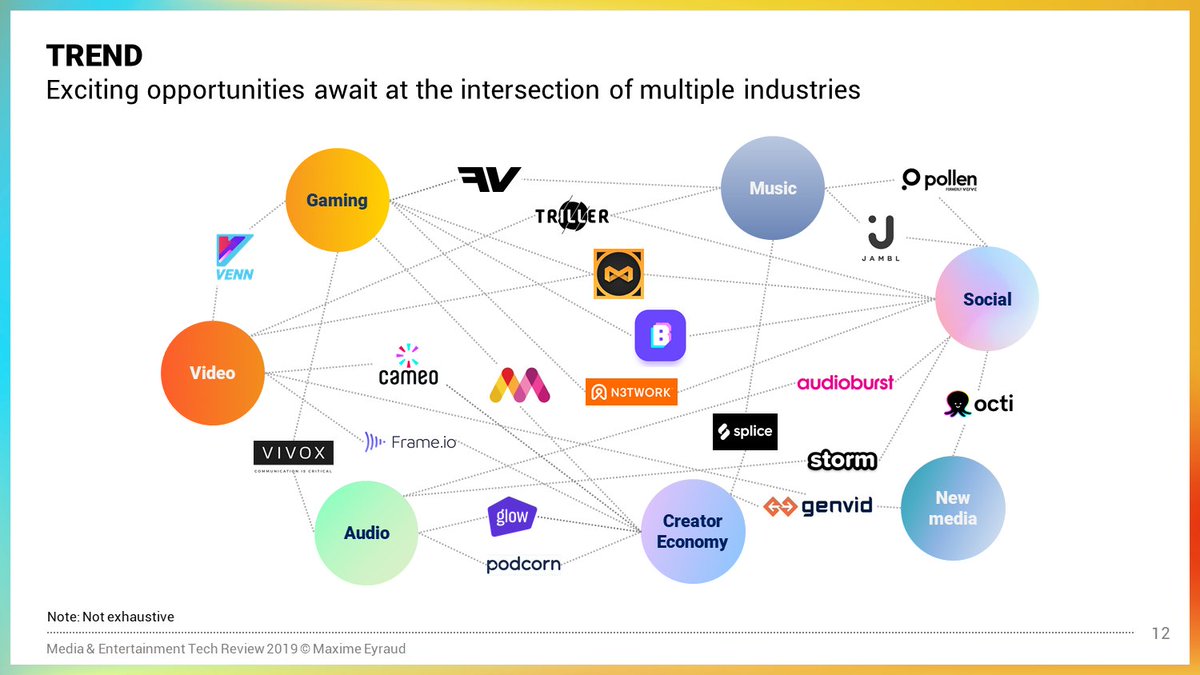

As I& #39;ve mentioned, media categories are increasingly blurry.

This means new opportunities for companies at the intersection of various formats + exciting content to watch / listen to / read / play with

Some examples: @BookCameo @GenvidTech @FiveVectors

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

This means new opportunities for companies at the intersection of various formats + exciting content to watch / listen to / read / play with

Some examples: @BookCameo @GenvidTech @FiveVectors

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

In Gaming, 2019 saw *a lot* of acquisitions, at every layer of the stack

- Gaming studios: Seriously, Gumbug, Beat Games

- Tools: Megacool

- Infrastructure: The Multiplayer Guys

The interest in studio acquisitions points to the growing role of owning IP

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

- Gaming studios: Seriously, Gumbug, Beat Games

- Tools: Megacool

- Infrastructure: The Multiplayer Guys

The interest in studio acquisitions points to the growing role of owning IP

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

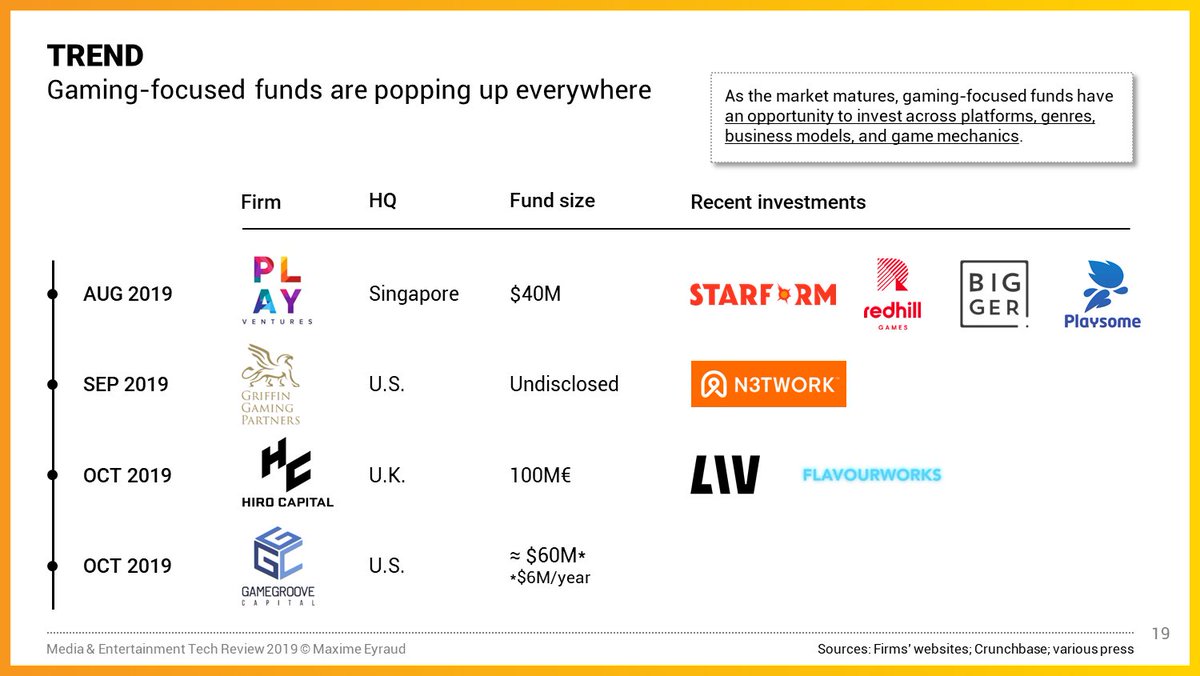

Now seizing the market opportunity are a number of gaming-focused players.

Firms like @PlayVentures, Griffin Gaming Partners, @HiroCapital or @GameGroove have raised substantial amounts to focus on the medium and are taking a global approach from day 1

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Firms like @PlayVentures, Griffin Gaming Partners, @HiroCapital or @GameGroove have raised substantial amounts to focus on the medium and are taking a global approach from day 1

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

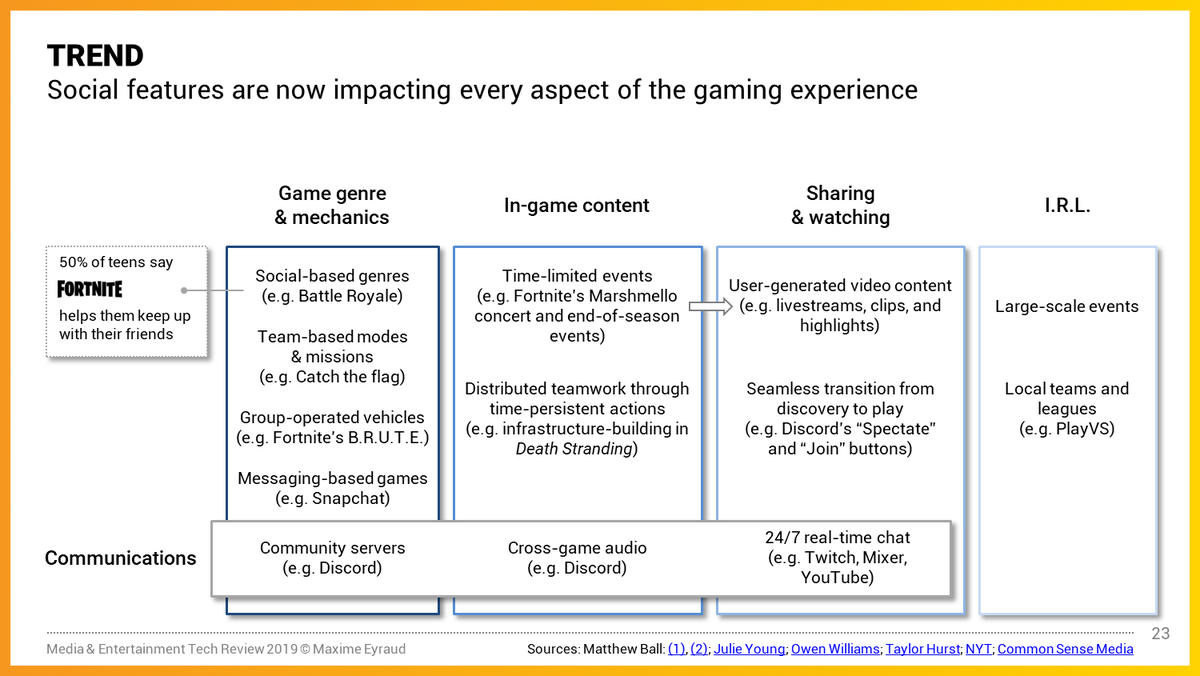

Social features have taken over gaming.

From game mechanics and genres to communications and in-game content, every aspect of the experience is now social-driven towards success.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

From game mechanics and genres to communications and in-game content, every aspect of the experience is now social-driven towards success.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

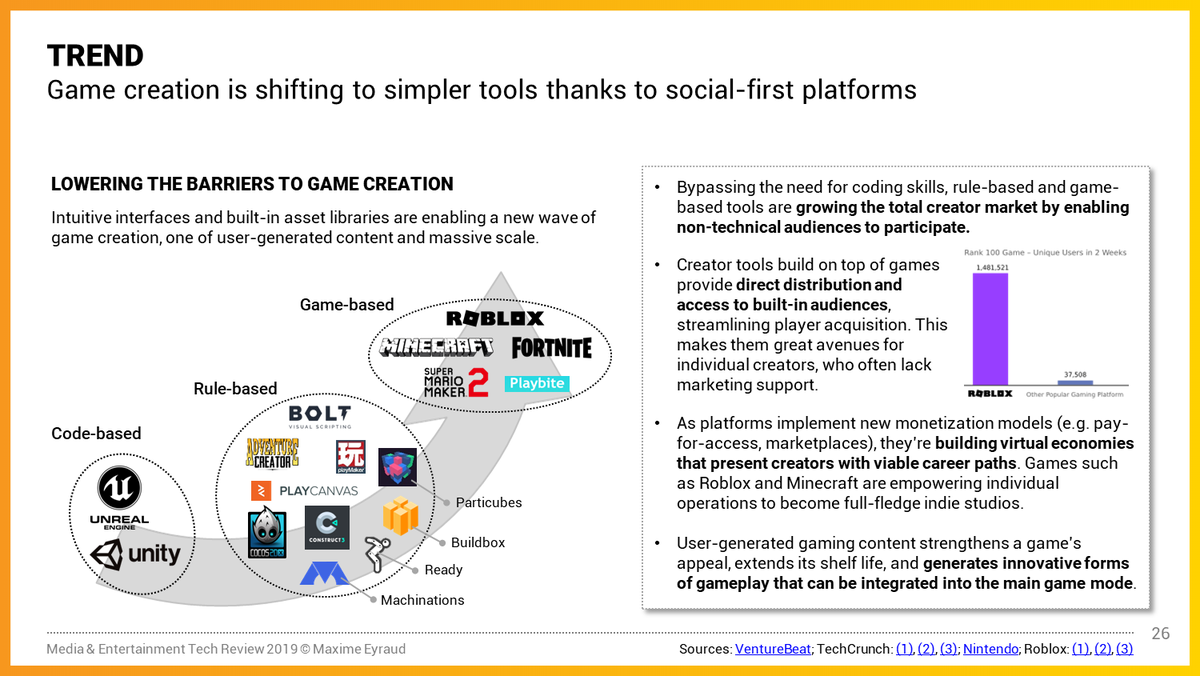

Game creation is shifting from complex tools to rule-based, and now game-based platforms.

Games like Fortnite, Minecraft, and Roblox are empowering creators at scale with ready-made assets and building blocks. They& #39;re to gaming what YouTube was to video.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Games like Fortnite, Minecraft, and Roblox are empowering creators at scale with ready-made assets and building blocks. They& #39;re to gaming what YouTube was to video.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

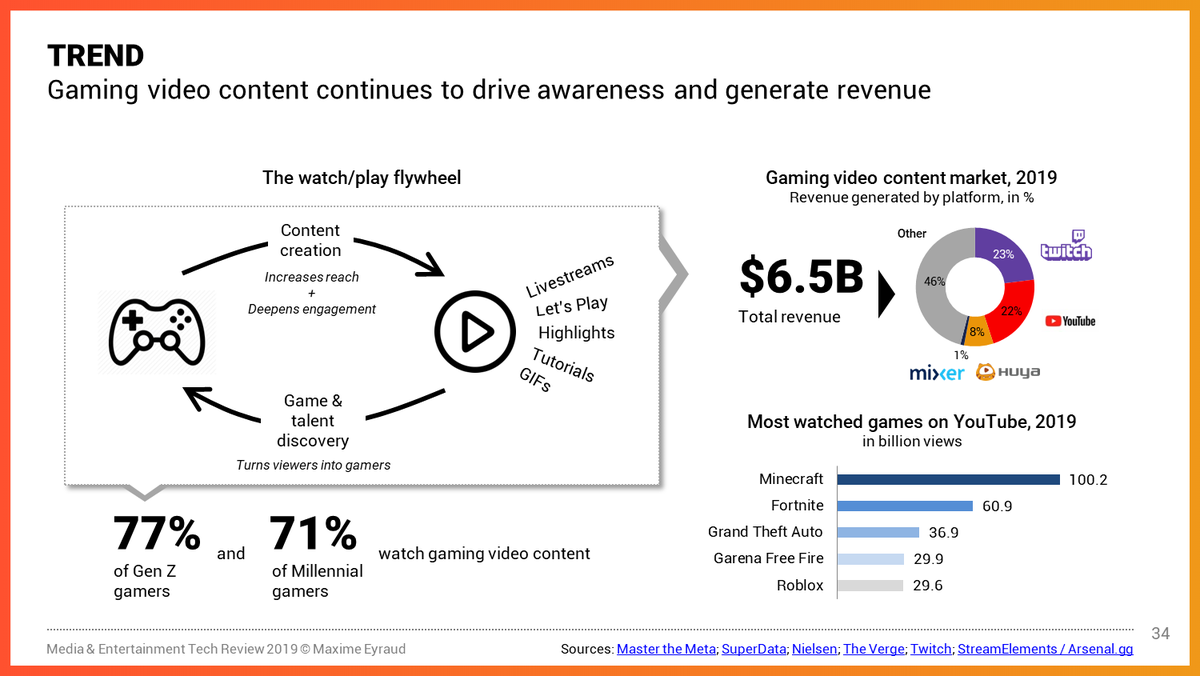

In Video, gaming-related content continues to grow across formats, from clips to livestreams.

77% of Gen Z gamers watch gaming video content.

Game-focused platforms like @Medal_TV and @JukedGG are on the rise

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

77% of Gen Z gamers watch gaming video content.

Game-focused platforms like @Medal_TV and @JukedGG are on the rise

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

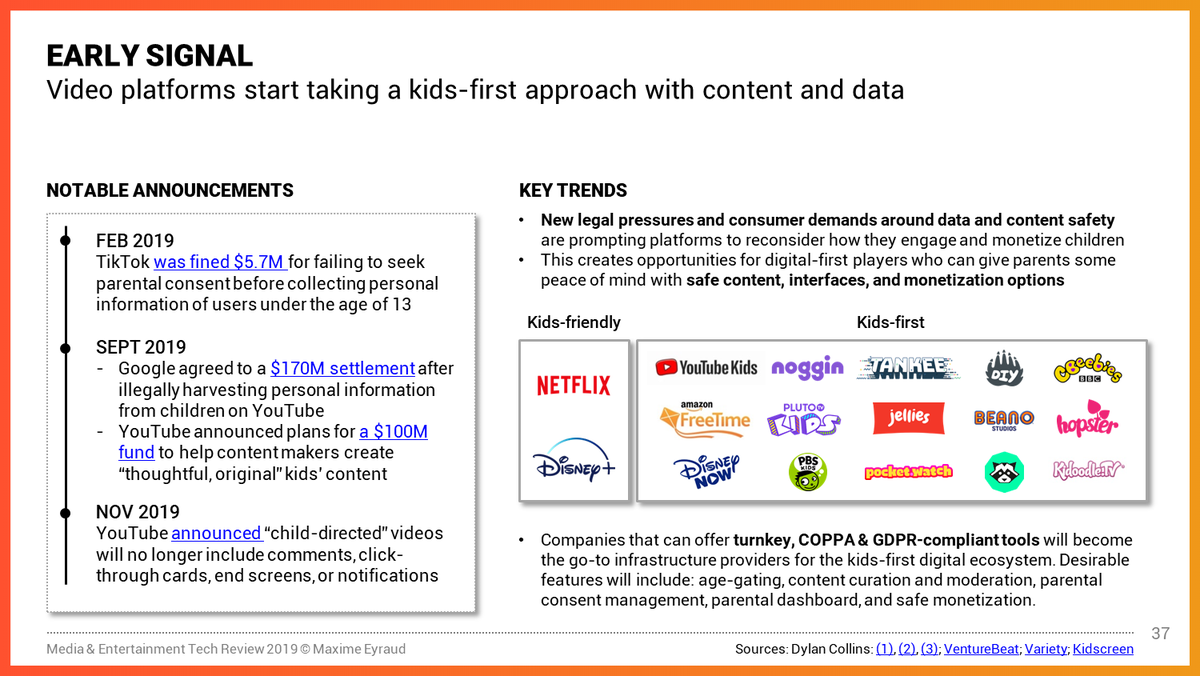

One overlooked trend is video platforms& #39; moves towards a kids-first approach with content and data.

Growing legal pressures and consumer demands will push the industry towards kids-safe infrastructure providers like @GoSuperAwesome

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Growing legal pressures and consumer demands will push the industry towards kids-safe infrastructure providers like @GoSuperAwesome

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

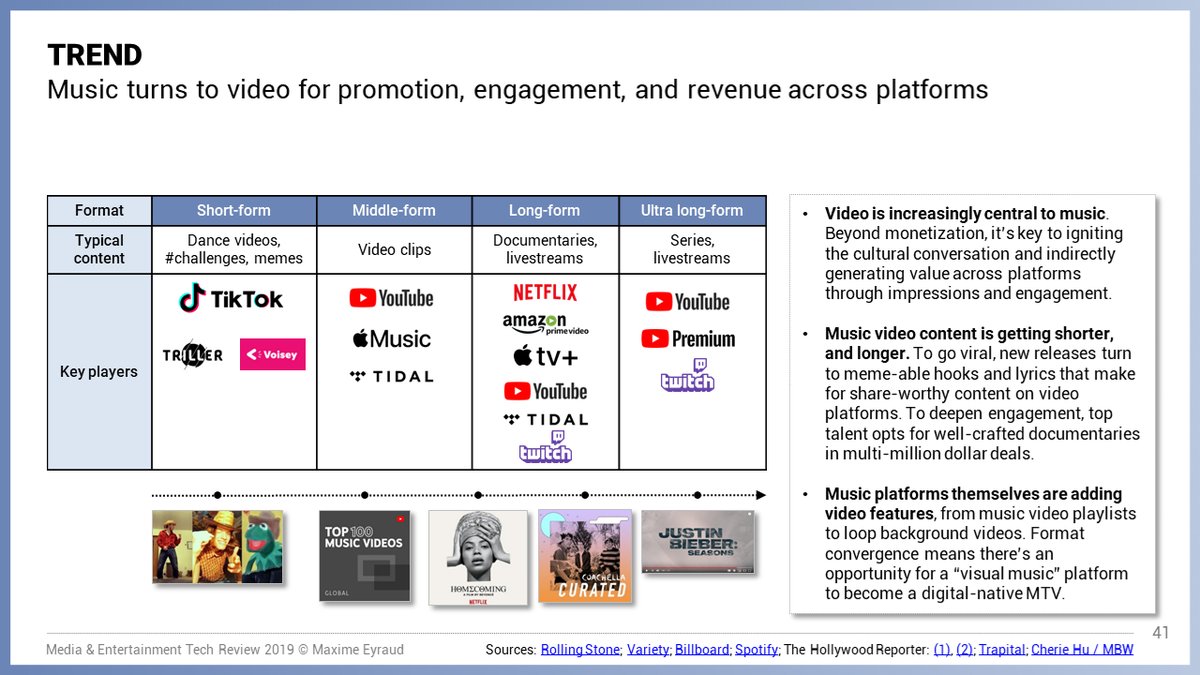

Music in turning to video for engagement and revenue.

From short-form to extra long-form, video enables artists to expand their brand and add new layers of meaning to the cultural conversation

@cheriehu42 and @RuncieDan have written great things on this

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

From short-form to extra long-form, video enables artists to expand their brand and add new layers of meaning to the cultural conversation

@cheriehu42 and @RuncieDan have written great things on this

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

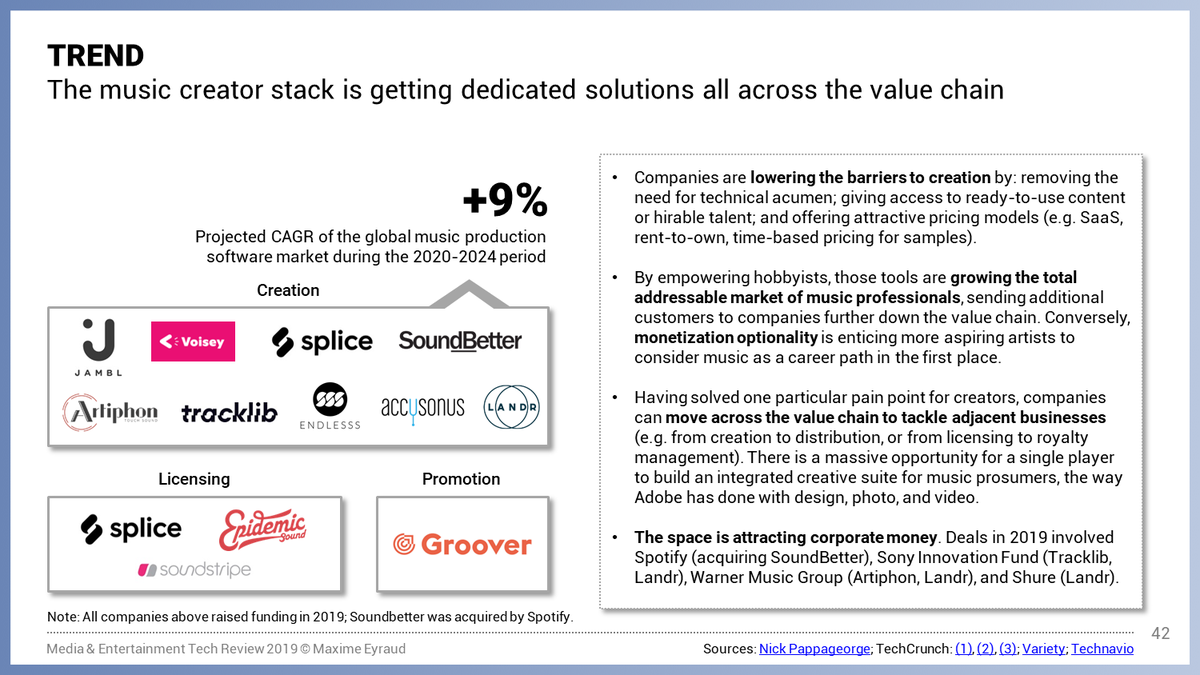

The Music creator stack drew a lot of interest (and dollars!), notably from corporates, with deals including:

Spotify => Soundbetter

Sony => Tracklib, Landr

Shure => Landr

WMG => Artiphon, Landr

There& #39;s a lot more coming in this area! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎧" title="Headphone" aria-label="Emoji: Headphone">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎧" title="Headphone" aria-label="Emoji: Headphone">

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Spotify => Soundbetter

Sony => Tracklib, Landr

Shure => Landr

WMG => Artiphon, Landr

There& #39;s a lot more coming in this area!

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Music rights are drawing interest as an attractive asset class.

Consumption of catalogue music + synchronization opportunities = huge long-term potential for culture-defining songs

Some firms are raising huge sums to seize the opportunity

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Consumption of catalogue music + synchronization opportunities = huge long-term potential for culture-defining songs

Some firms are raising huge sums to seize the opportunity

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

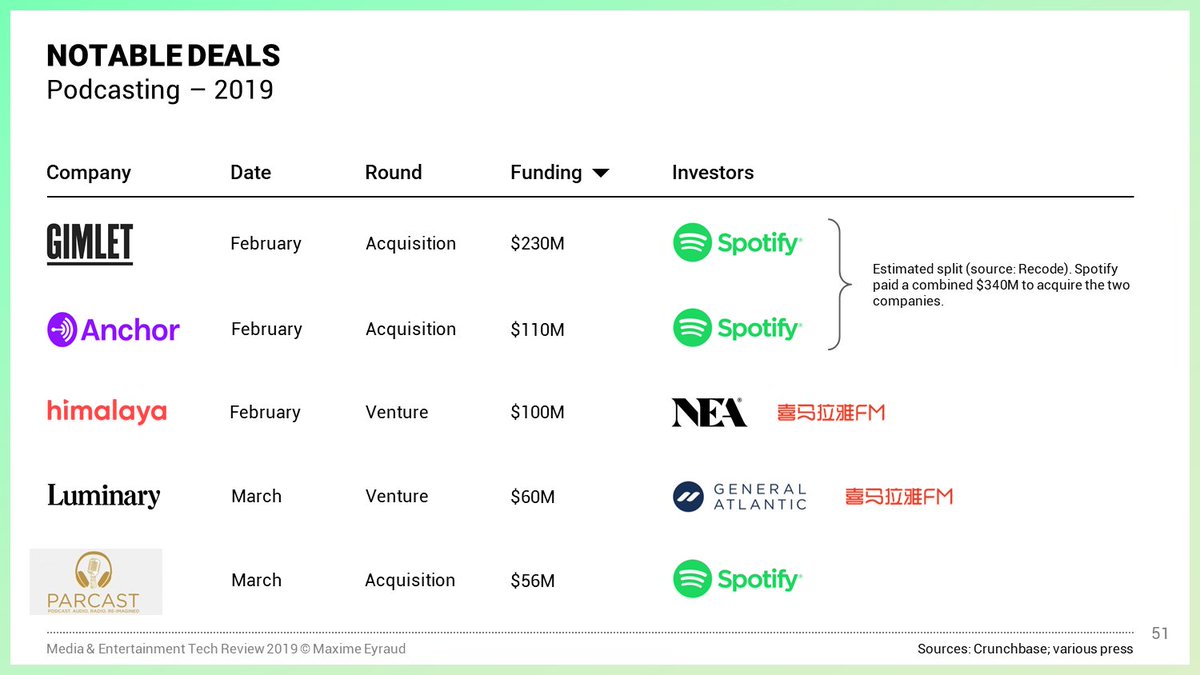

If audio overall had a good year, podcasting in particular had an *amazing* year, with large acquisitions and venture deals that helped spark broader interest in the medium.

Spotify acquiring Gimlet, Anchor, and Parcast generated massive buzz

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Spotify acquiring Gimlet, Anchor, and Parcast generated massive buzz

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

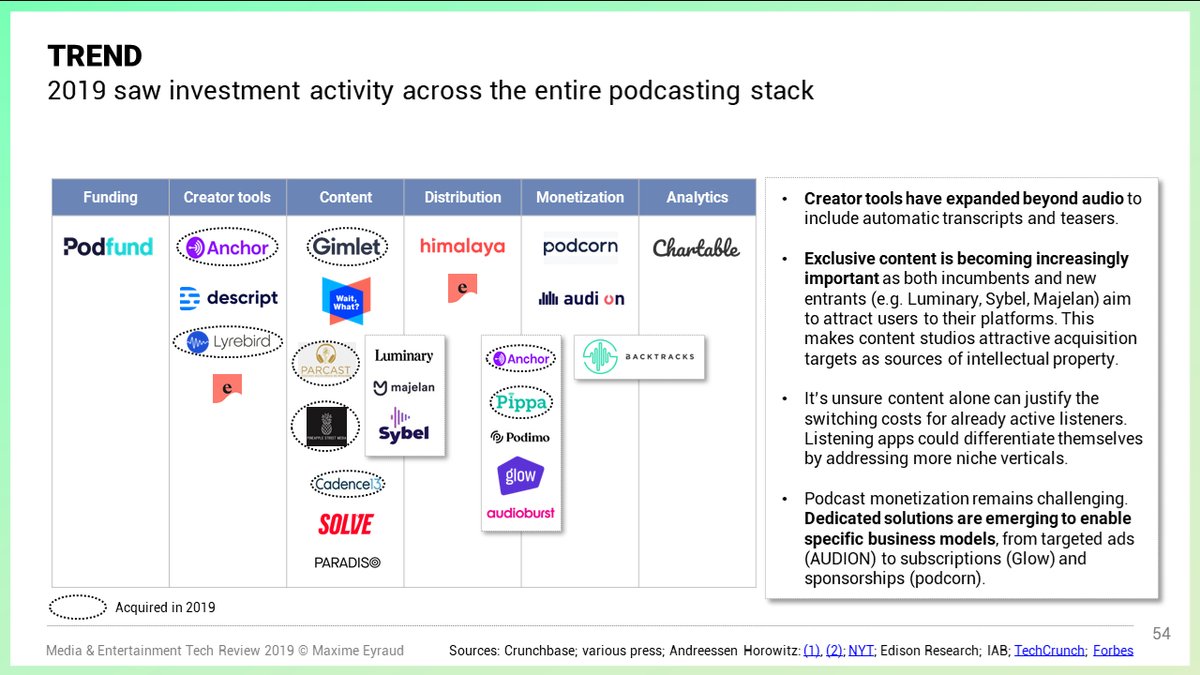

Activity happened across the entire stack, with creator tools and content studios raking in most of the deals.

Despite M&A activity, the space is getting more fragmented as new solutions start to tackle highly specific pain points and business models

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Despite M&A activity, the space is getting more fragmented as new solutions start to tackle highly specific pain points and business models

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

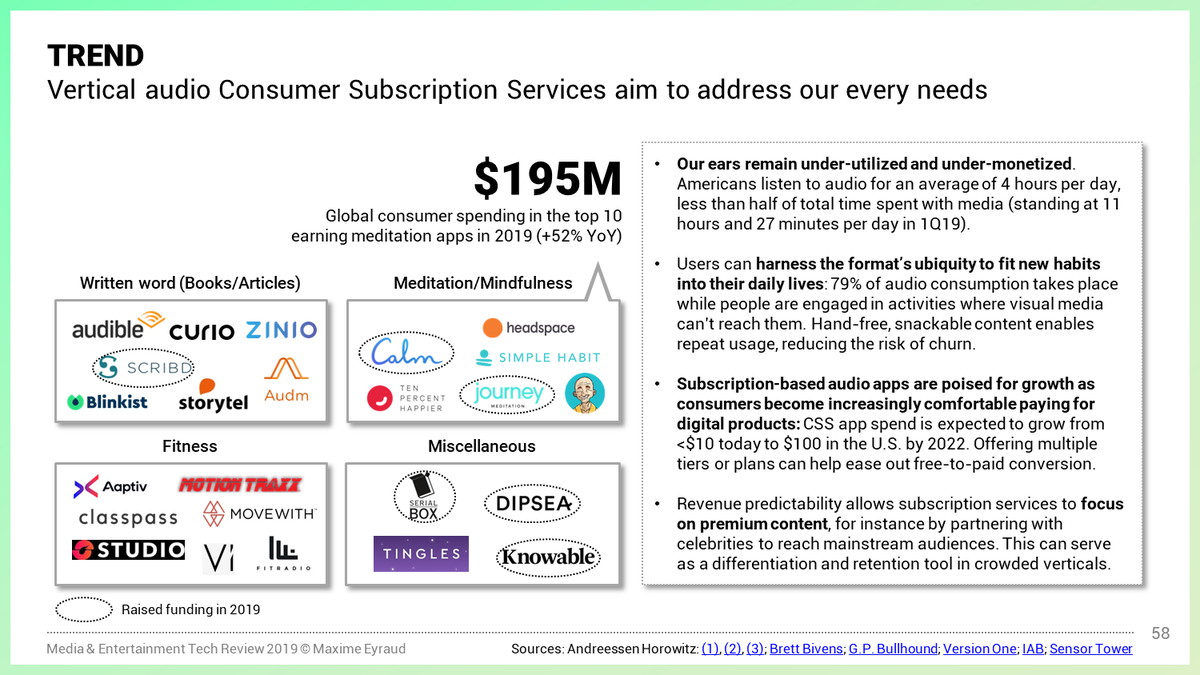

Of course, there& #39;s more to audio than just podcasting.

Vertical audio Consumer Subscription Services are capturing ever-larger shares of our time, attention, and spending.

I& #39;d bet the demand for such services is only growing with quarantine

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Vertical audio Consumer Subscription Services are capturing ever-larger shares of our time, attention, and spending.

I& #39;d bet the demand for such services is only growing with quarantine

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

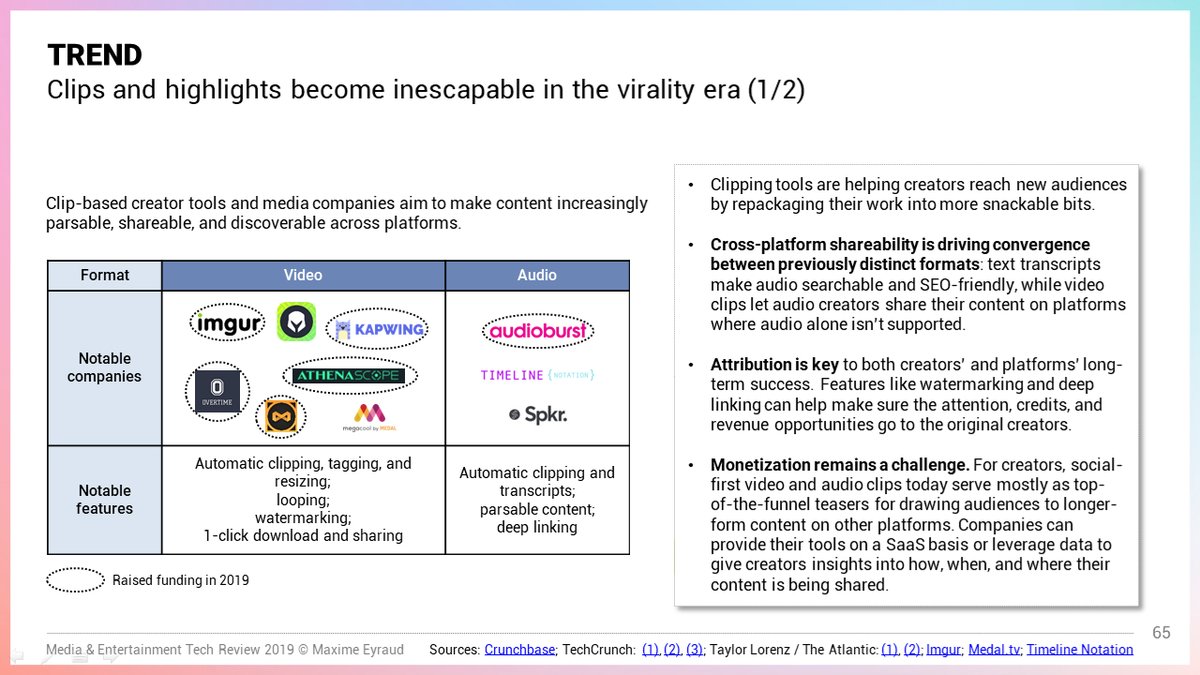

In the Social realm, content is getting ever shorter and spreading across media and platforms as clips and highlights.

There& #39;s a dire need for better attribution and monetization tools.

Examples include @Medal_TV @audioburst @OvertimeGG

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

There& #39;s a dire need for better attribution and monetization tools.

Examples include @Medal_TV @audioburst @OvertimeGG

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

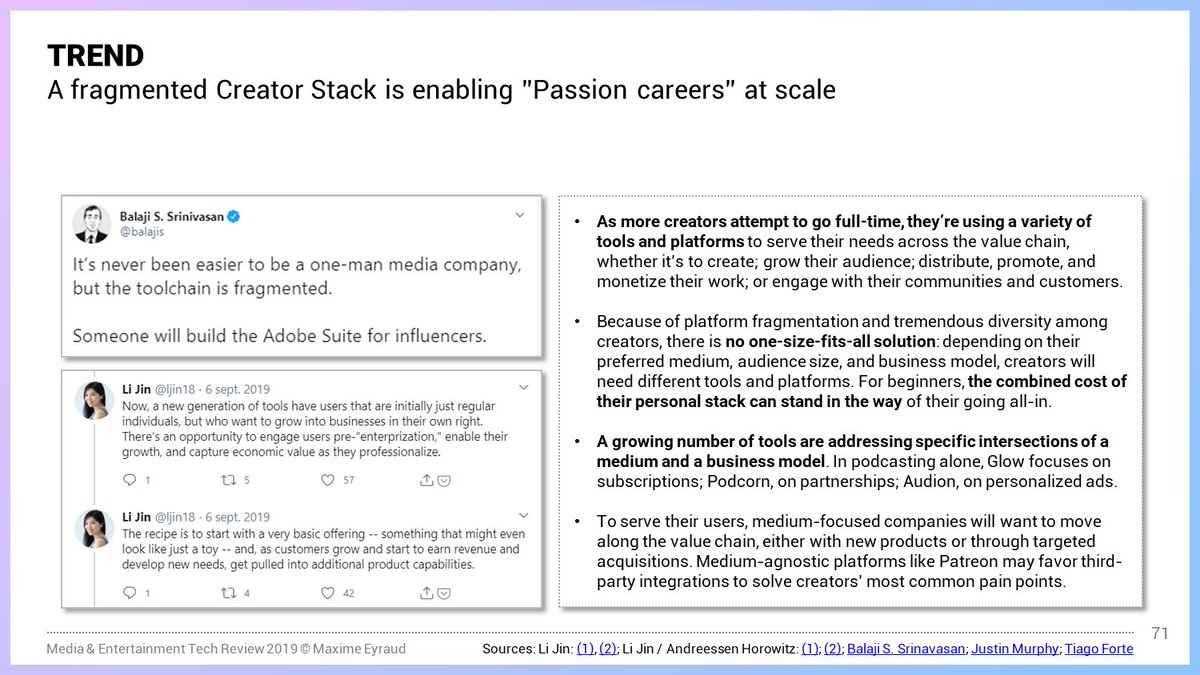

If you didn& #39;t hear about the Passion economy in 2019, are you even a VC? The Creator Stack is empowering millions of creators, but is only getting more fragmented.

@ljin18 is the go-to person here, with invaluable threads and articles on the topic

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

@ljin18 is the go-to person here, with invaluable threads and articles on the topic

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

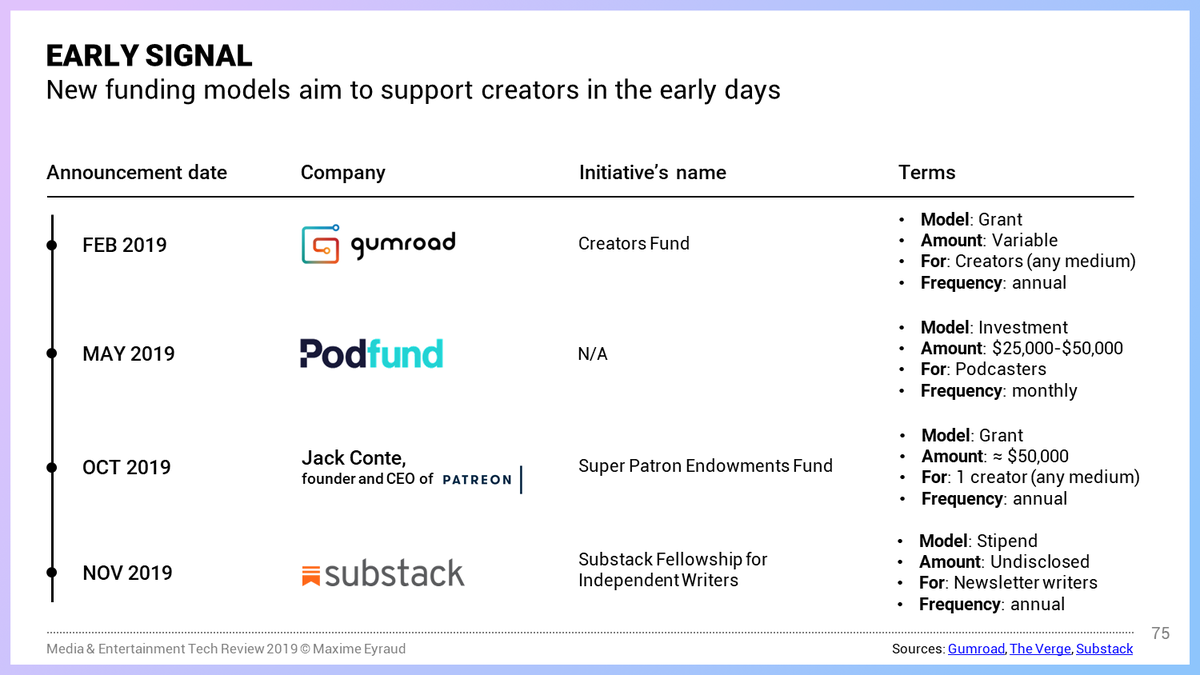

With more creators taking the leap, early funding is key. Companies including @SubstackInc, @gumroad @podfund and @Patreon have announced various support programs, from grants to rev share and stipend.

The crisis only makes those resources more pressing.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

The crisis only makes those resources more pressing.

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

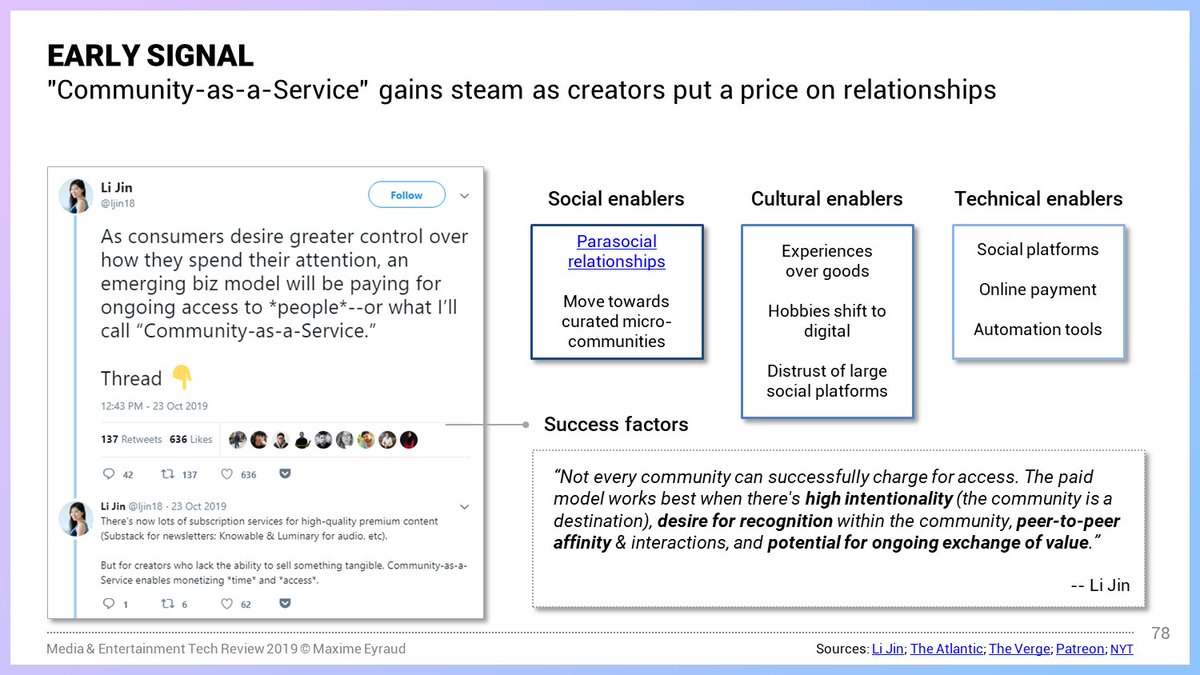

"Community-as-a-Service" could empower a more diverse set of creators by letting them monetize time and access, vs. any specific production.

Again, follow @ljin18 for the best insights here

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

Again, follow @ljin18 for the best insights here

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

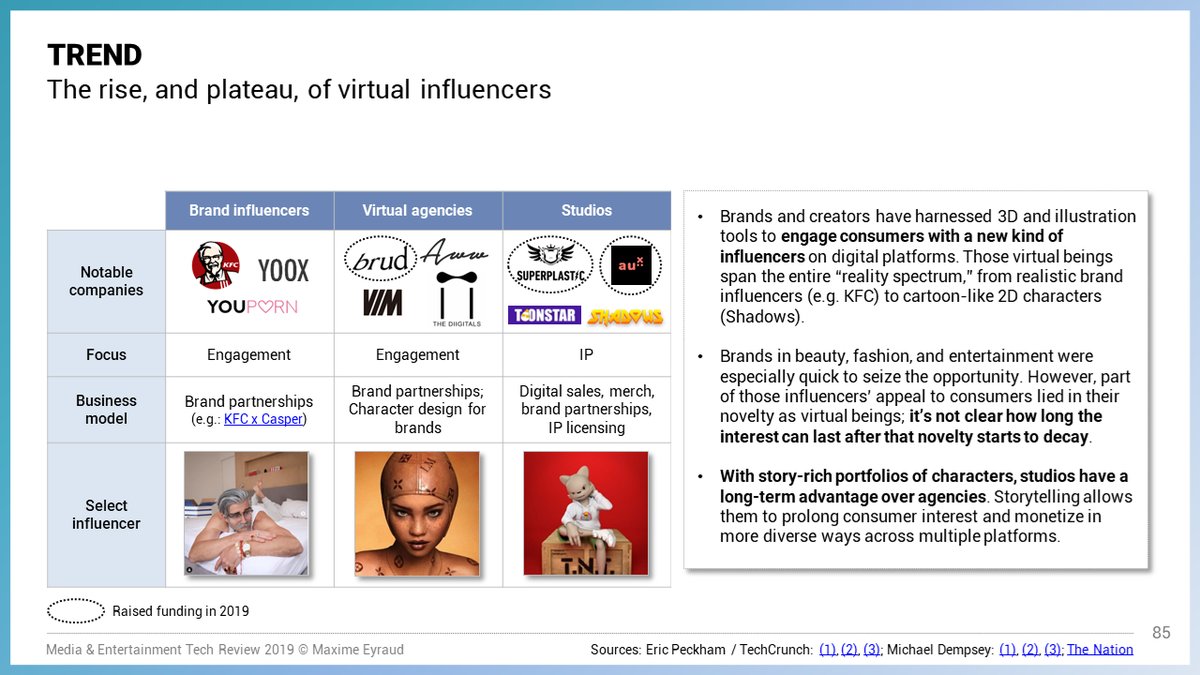

As for New Media! After a promising start in 2018, 2019 was kind of disappointing for virtual being companies.

@mhdempsey& #39;s writing is the best resource on that topic

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

@mhdempsey& #39;s writing is the best resource on that topic

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

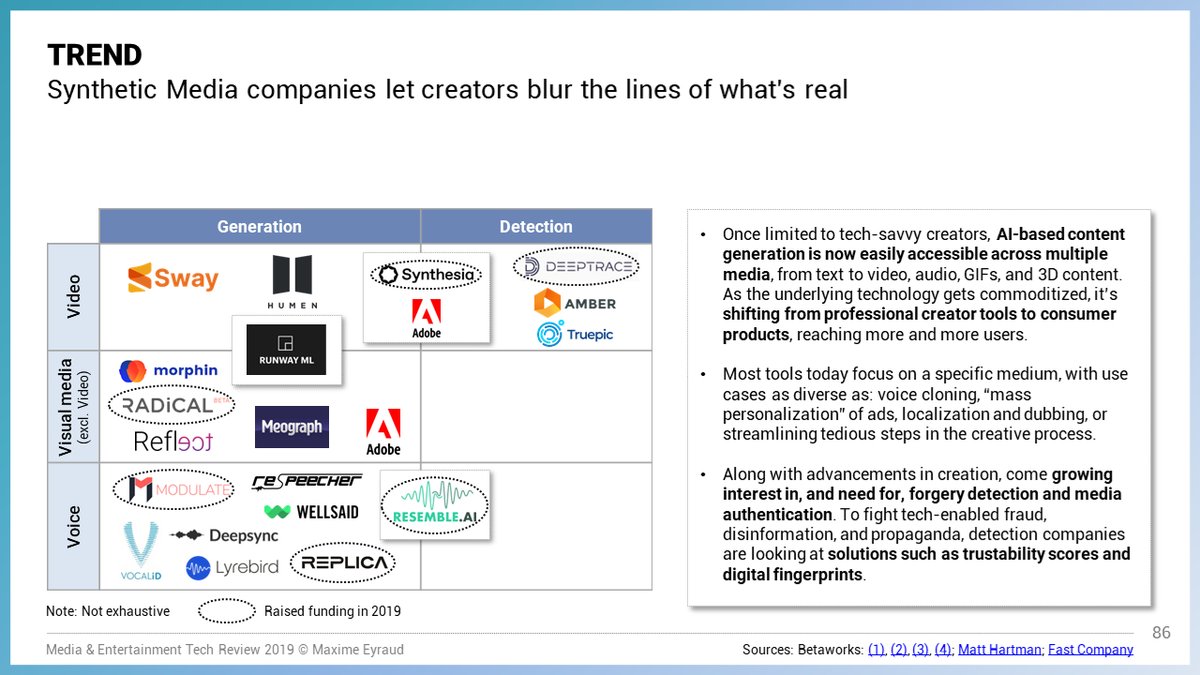

Synthetic Media companies are now everywhere, enabling even non-technical creators to forge and alter media in new ways.

@betaworks& #39;s @MattHartman @borthwick and @peterrojas are leading the way, pushing for thoughtful creativity and preemptive ethics

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

@betaworks& #39;s @MattHartman @borthwick and @peterrojas are leading the way, pushing for thoughtful creativity and preemptive ethics

https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

All this is just a fraction of everything that happened in Media & Entertainment Tech last year - I touched on a lot more in my report.

This review was my attempt to unpack some of it, and make it accessible even to industry outsiders https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

This review was my attempt to unpack some of it, and make it accessible even to industry outsiders https://maximeeyraud.com/media-entertainment-tech-review-2019/">https://maximeeyraud.com/media-ent...

I& #39;ve made the full report freely accessible on my personal website! I hope it can help others learn more about Media & Entertainment Tech and its potential.  https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌️" title="Victory hand" aria-label="Emoji: Victory hand">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌️" title="Victory hand" aria-label="Emoji: Victory hand">

https://maximeeyraud.com/media-entertainment-tech-review-2019">https://maximeeyraud.com/media-ent...

https://maximeeyraud.com/media-entertainment-tech-review-2019">https://maximeeyraud.com/media-ent...

Read on Twitter

Read on Twitter " title="What happened to Media & Entertainment Tech in 2019?I& #39;m excited to share a (late) review of the trends, initiatives, companies, and investments that pushed the industry forward last year. https://maximeeyraud.com/media-ent... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">" class="img-responsive" style="max-width:100%;"/>

" title="What happened to Media & Entertainment Tech in 2019?I& #39;m excited to share a (late) review of the trends, initiatives, companies, and investments that pushed the industry forward last year. https://maximeeyraud.com/media-ent... https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">" class="img-responsive" style="max-width:100%;"/>

https://maximeeyraud.com/media-ent..." title="The Music creator stack drew a lot of interest (and dollars!), notably from corporates, with deals including:Spotify => SoundbetterSony => Tracklib, LandrShure => LandrWMG => Artiphon, LandrThere& #39;s a lot more coming in this area! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎧" title="Headphone" aria-label="Emoji: Headphone"> https://maximeeyraud.com/media-ent..." class="img-responsive" style="max-width:100%;"/>

https://maximeeyraud.com/media-ent..." title="The Music creator stack drew a lot of interest (and dollars!), notably from corporates, with deals including:Spotify => SoundbetterSony => Tracklib, LandrShure => LandrWMG => Artiphon, LandrThere& #39;s a lot more coming in this area! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🎧" title="Headphone" aria-label="Emoji: Headphone"> https://maximeeyraud.com/media-ent..." class="img-responsive" style="max-width:100%;"/>

https://maximeeyraud.com/media-ent..." title="I& #39;ve made the full report freely accessible on my personal website! I hope it can help others learn more about Media & Entertainment Tech and its potential. https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌️" title="Victory hand" aria-label="Emoji: Victory hand"> https://maximeeyraud.com/media-ent..." class="img-responsive" style="max-width:100%;"/>

https://maximeeyraud.com/media-ent..." title="I& #39;ve made the full report freely accessible on my personal website! I hope it can help others learn more about Media & Entertainment Tech and its potential. https://abs.twimg.com/emoji/v2/... draggable="false" alt="✌️" title="Victory hand" aria-label="Emoji: Victory hand"> https://maximeeyraud.com/media-ent..." class="img-responsive" style="max-width:100%;"/>