Happy to release our first round of housing market forecasts this morning. We& #39;ll be updating these forecasts on a monthly basis going forward. Our models suggest the housing market recovery will look like a "flying W." Here& #39;s a summary thread: https://haus.com/resources/the-flying-w-why-the-great-lockdown-housing-recovery-will-be-a-wavy-one">https://haus.com/resources...

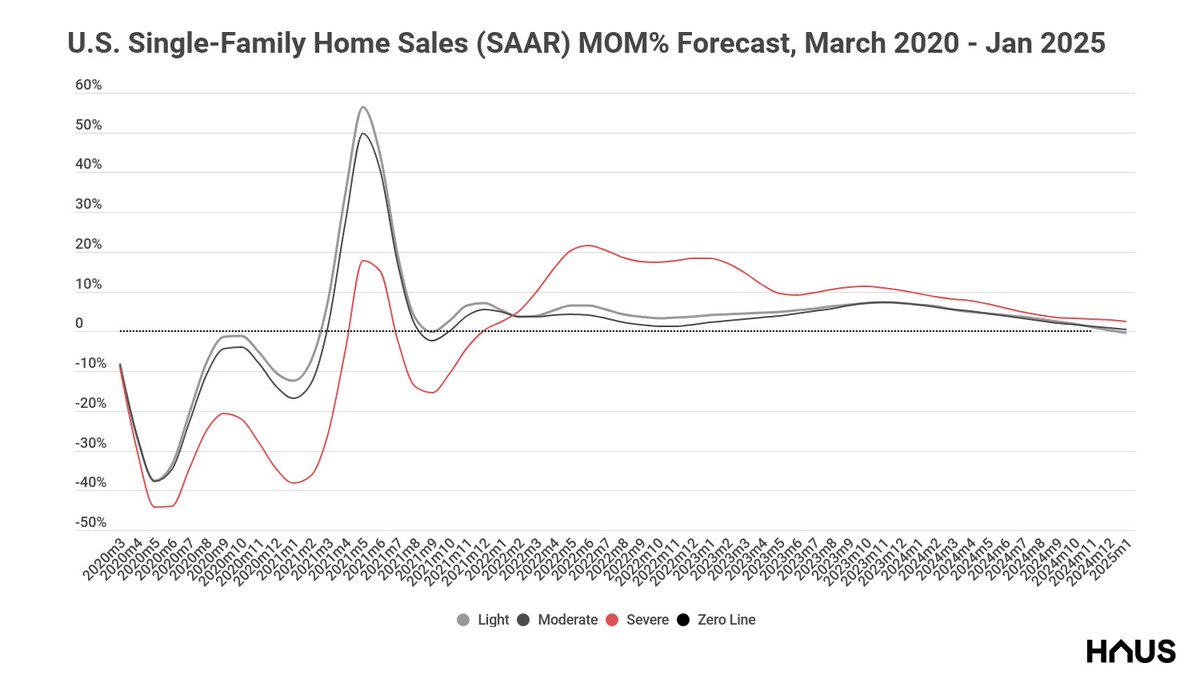

First, let& #39;s look at existing SF home sales. We& #39;re expecting sales and purchase originations to take the biggest hit, as both buyers and sellers pull back. We& #39;re forecasting a 40-50% drop at the deepest trough, which should be sometime in late spring/early summer.

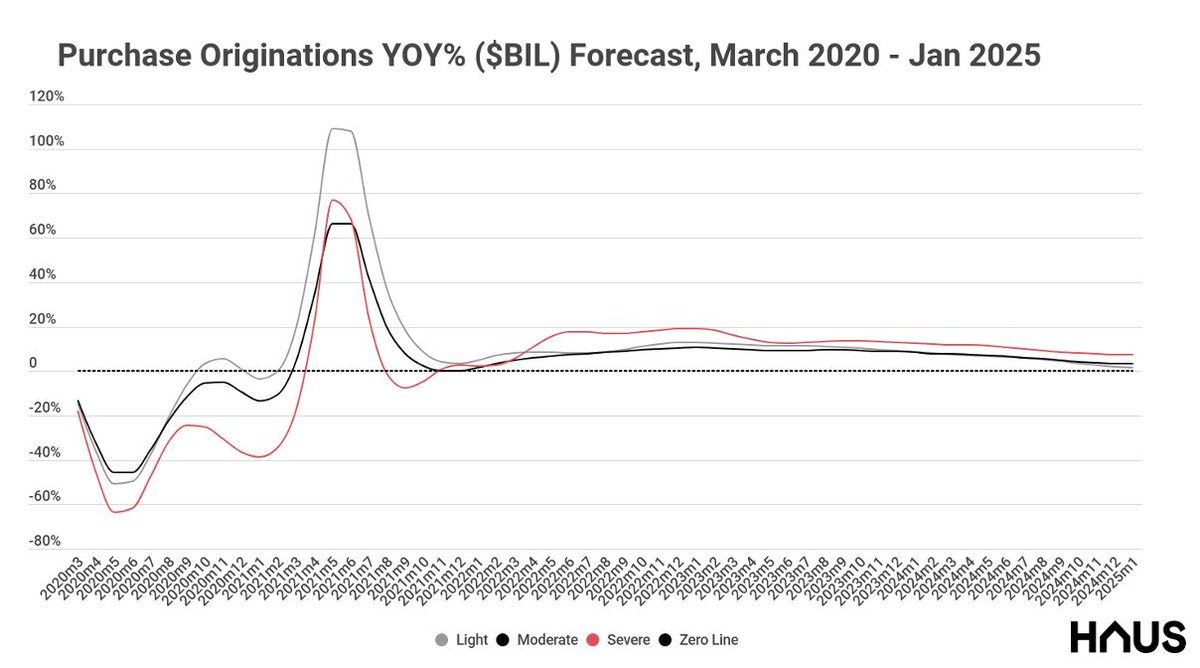

Our models suggest purchase originations will be hardest hit, with a 45% - 65% hit over the next few months, followed by a bumpy recovery. Why will purchase mortgage get hit harder than sales? Simply put, there are always buyers out there with dry powder willing to buy.

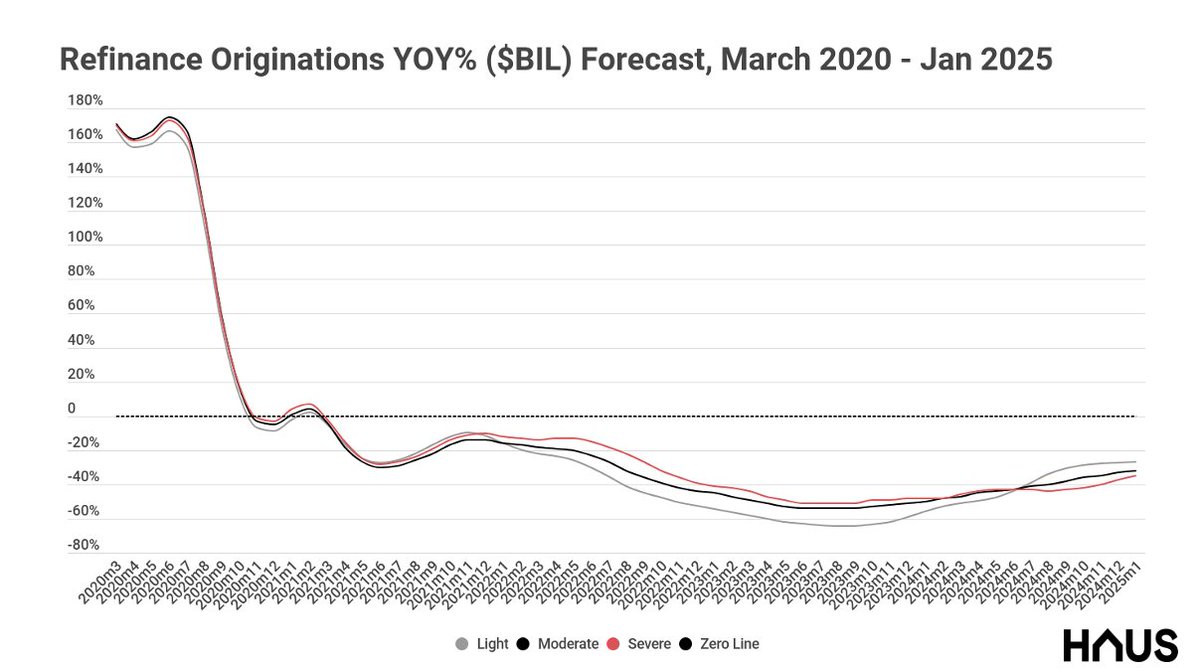

But, the mortgage industry isn& #39;t doomed. Our forecast suggests a huge boom in refis (160-180%), both opportunistic and due to hardship. This should keep lenders afloat, assuming servicers and MBS markets don& #39;t collapse because of forbearance issues and lack of investor payouts.

We& #39;re forecasting building permits to also take a significant hit, falling between 35%-45% this year. However, given strong demographic tailwinds and persistent low supply, our models are showing a very robust rebound early next year.

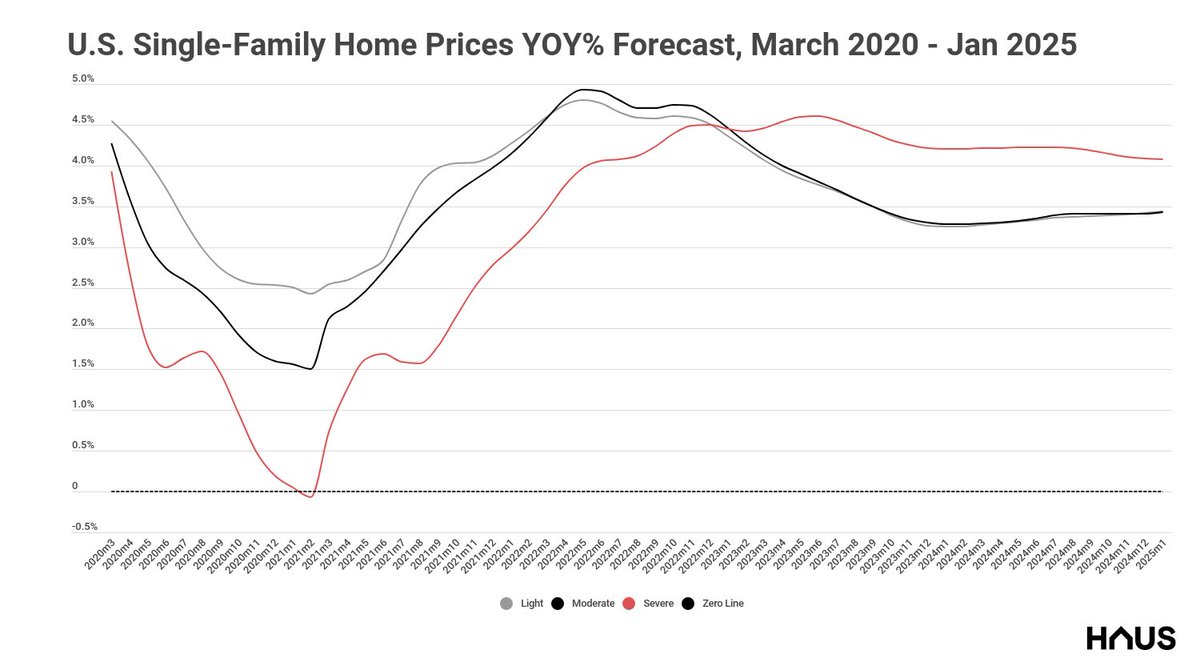

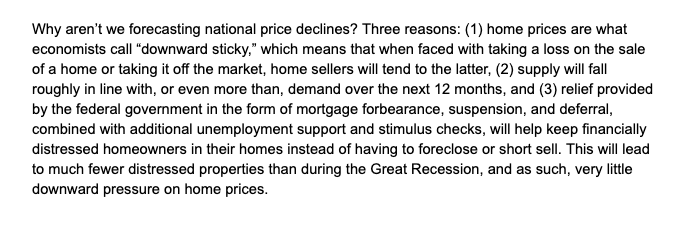

So what does all of this mean for the holy grail of housing market metrics – home prices? Well, we are only expecting a very small chance that prices will fall nationally, and if they do, it will be minimal.

Why aren& #39;t we expecting home prices to fall much, if at all?

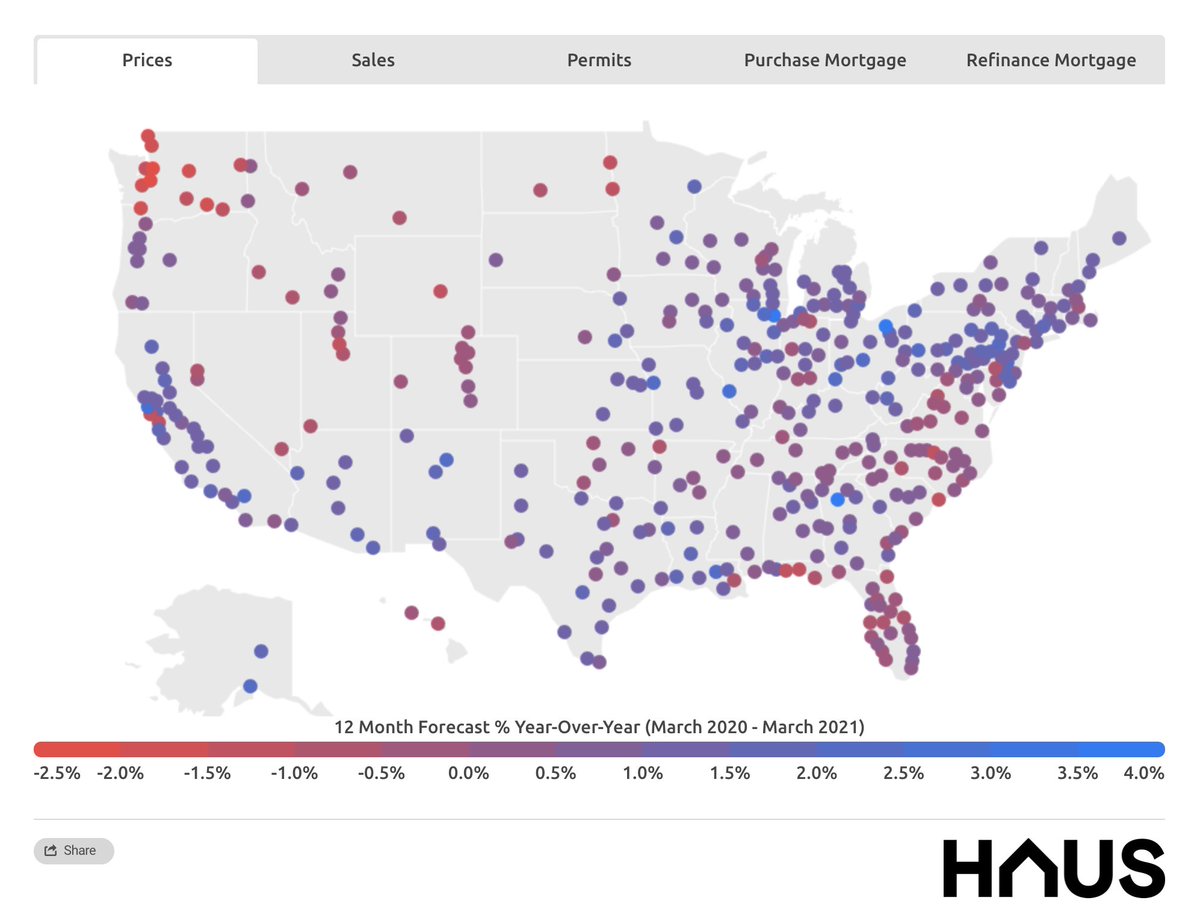

That said, we see risk of price declines regionally. Our models show highest risk in the Pacific Northwest, Nevada, and Florida. These areas are at highest risk because they either have high per-capita outbreaks of COVID19 (WA), or high reliance on hospitality/tourism (NV & FL).

All charts have interactive links on the blog itself, and the map has regional 12-month forecasts for most large and small metros. Thoughts/comments appreciated.

Read on Twitter

Read on Twitter