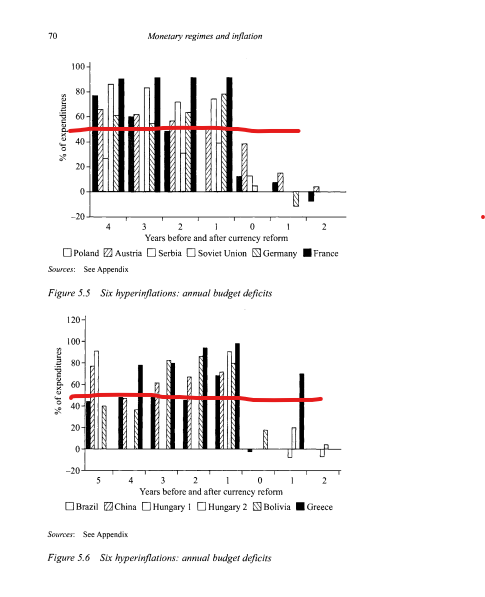

Most comprehensive statistical study of hyperinflations by Peter Bernholz concluded that once a govt borrows more than 40% what it spends annually, it is statistically significant predictor of hyperinflation. SA was at 20% before lockdown/R500bn stimulus, goes to 50% by year end.

Red line I& #39;ve drawn here is where SA govt deficit/spending likely to be by year end. Remember, 40% is the line you do not want to cross. After this point is crossed there would need to be rapid GDP/tax growth to get back below it. Without growth only other lever is taxation.

Without some serious growth, which is nigh impossible with "radical economic transformation" the president tipped his hat to last night, coupled with more govt spending, taxation and borrowing, believe it or not hyperinflation is now a real risk SA is facing right now.

An objective look at history and economic stats show if SA govt finances can& #39;t get out of this hole, quickly, we& #39;re 3-5 years away from major monetary reform. Stars are aligned: Fourth Turning, increasing use of cryptocurrencies, wide internet adoption, ExO& #39;s scaling borders.

So for those who think destroying the economy with lockdown and stimulus is "worth the cost" to save COVID-19 related lives, also consider the cost on lives of a now high-risk of hyperinflation. It might trivialise COVID-19. I don& #39;t make these comments lightly.

Read on Twitter

Read on Twitter