Yesterday, I experienced #US bureaucracy at its finest for the first time. Here& #39;s a thread on my experience (any advice on how to deal with this welcome).

In 2019, I was a & #39;non-resident alien& #39; in the US for a Fellowship. I have to file US federal and state tax in Mass. But...

In 2019, I was a & #39;non-resident alien& #39; in the US for a Fellowship. I have to file US federal and state tax in Mass. But...

I can& #39;t pay Massachusetts what I owe them because the online platform doesn& #39;t allow foreign credit card payments or transfers from foreign accounts. Note that in the civilised world we don& #39;t use checks anymore either.

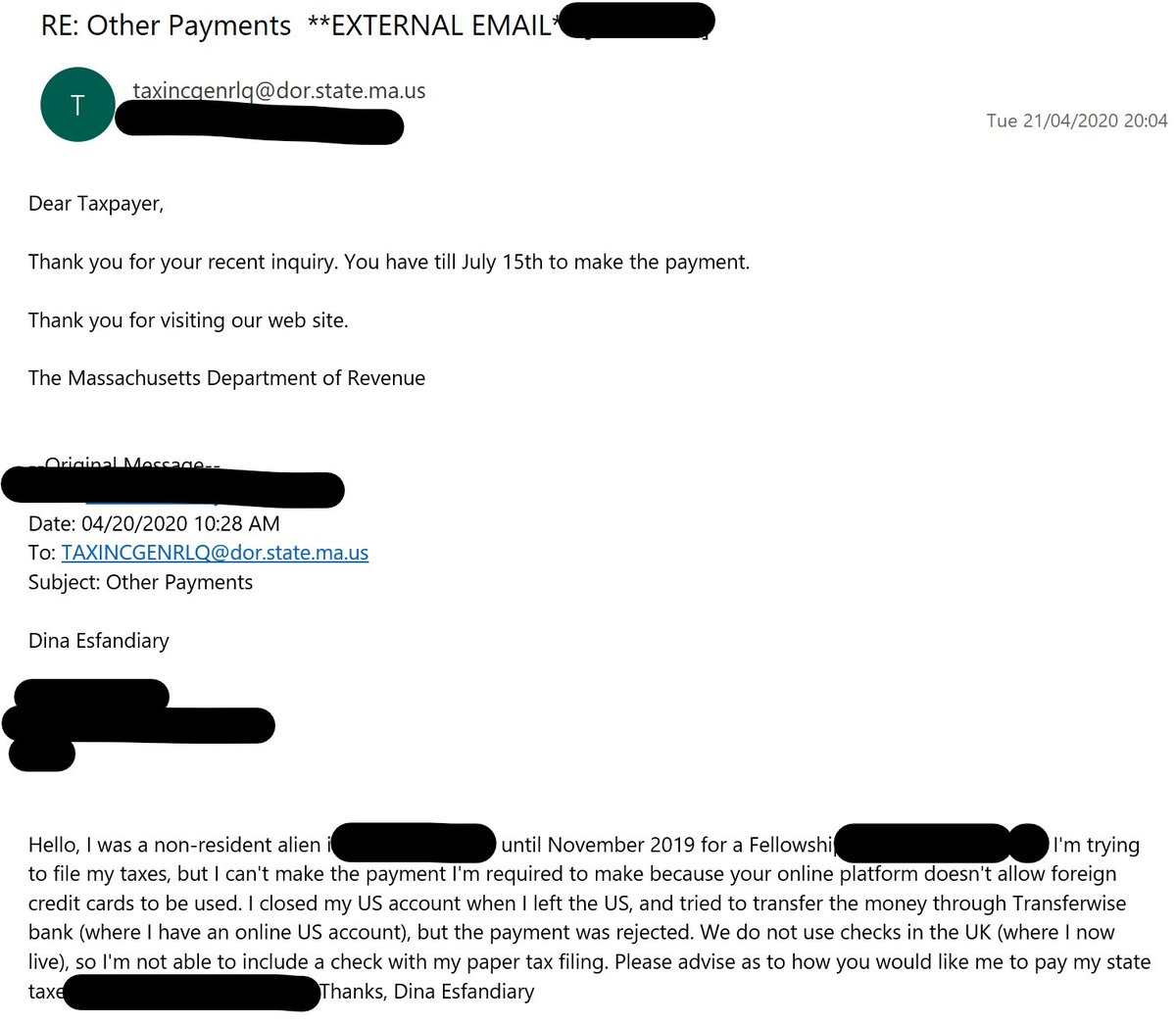

So I emailed @MassRevenue to ask what to do. See below.

So I emailed @MassRevenue to ask what to do. See below.

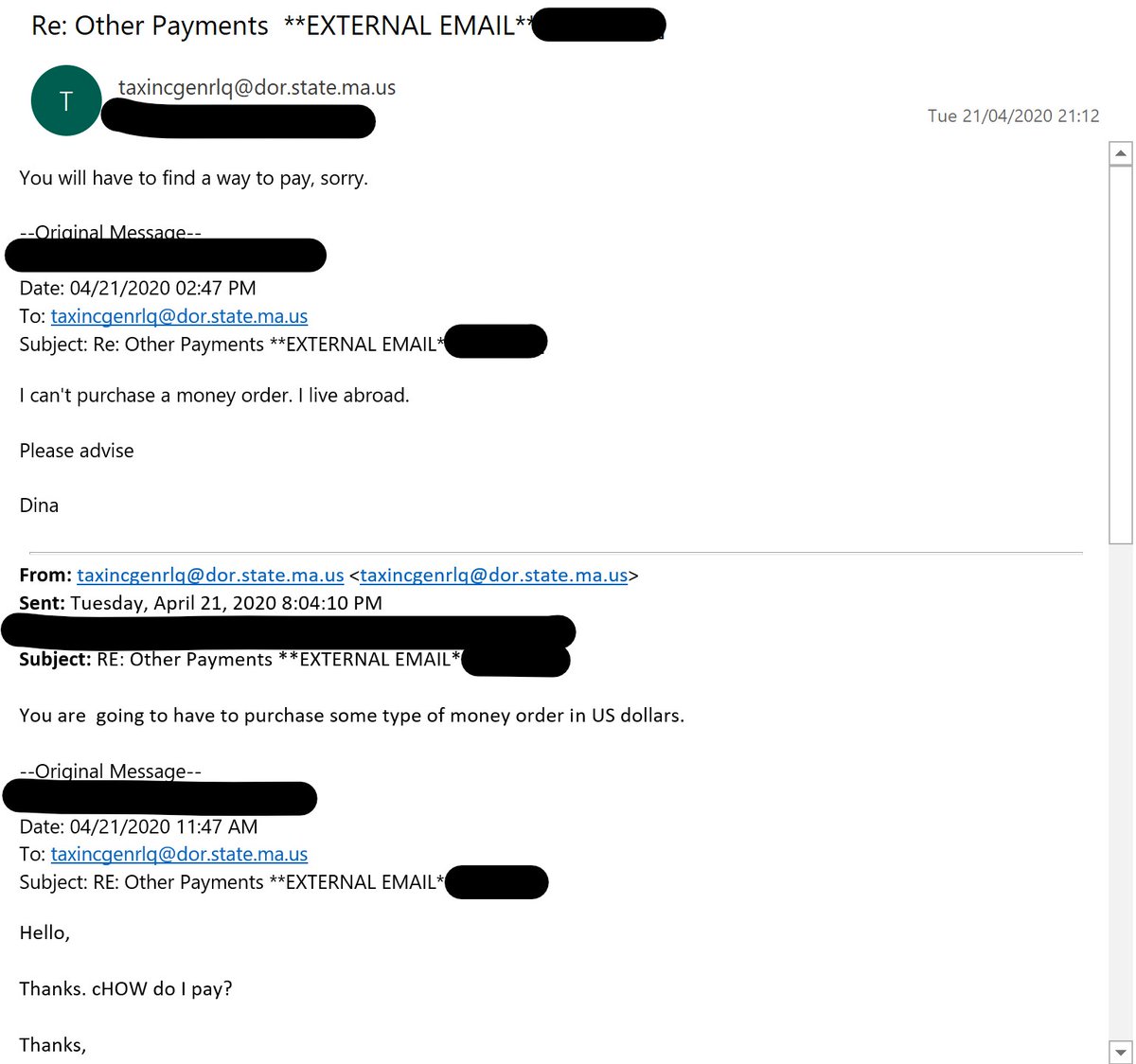

Naturally, the fact they didn& #39;t read the email rubbed me the wrong way. So I responded in a short message by asking & #39;how& #39; I should pay, not by when.

See how @MassRevenue responded below.

See how @MassRevenue responded below.

The final reply from @MassRevenue was: & #39;you have to find a way to pay& #39;. So basically, & #39;good luck, I can& #39;t be bothered to help, thanks bye& #39;. Very useful.

I, thankfully, will only have to deal with this once, since I& #39;m no longer living in the #US.

I, thankfully, will only have to deal with this once, since I& #39;m no longer living in the #US.

But how do people who can& #39;t find a way around the system do it?

Now that my rant is done. Can anyone be more helpful than @MassRevenue and suggest a solution?

Now that my rant is done. Can anyone be more helpful than @MassRevenue and suggest a solution?

Read on Twitter

Read on Twitter