this is more of a rant-after years of trading ETFs and looking at the market structure, I had initially complained that ETFs had major flaws and would be revealed in times of distress. I had been since 2011, ask @junkbondjunkie who was my roomate out of college.

For example the High Yield ETF $HYG trades in 1cent increments, and you can buy or sell $1mm USD notional in that bid offer, $10mm for 5cents (this is with VIX at 40, so $10mm was doable in 1cent previously), yet the underlying Bonds trade 0.5pts/50cents or even 1pt/100cents wide

how can that be? you jam a bunch of illiquid stuff into an ETF and it becomes 50x more liquid? and generally accepted? In the beginning it reminded me of CDOs and mortages in SPVs (SIVs), since I started my career trading those. At least these bonds can& #39;t go to negative, for now

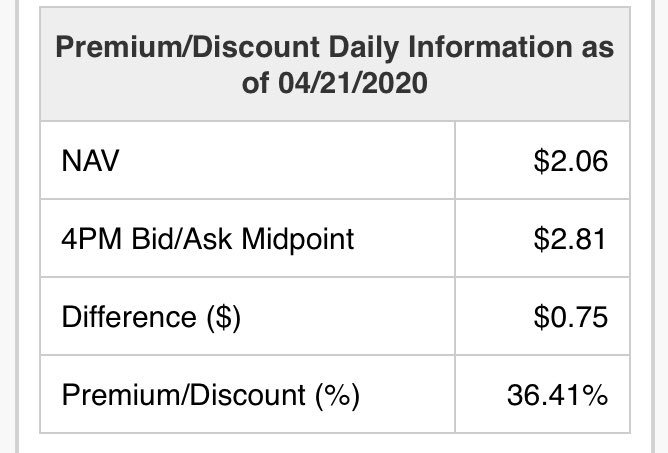

this brings me to the point on $USO, because the issue here is different than HYG but maybe much worse. The underlying in USO CAN go to negative, and as saw yesterday, it went to as negative as -$40. So here is USO going out tonight at NAV of 2 closing at 2.81, 75cents of premium

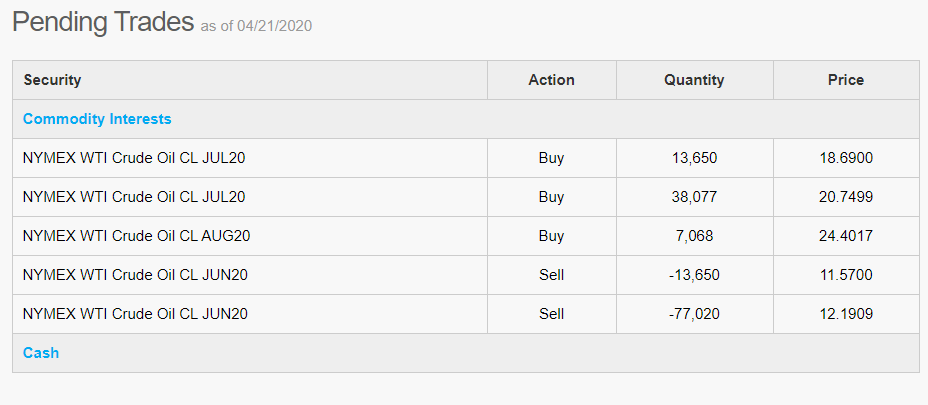

This is retail "buying the dip" on oil and high short interest covering but in reality, when USO manager rebalanced some of the CL2 (June) into CL3 (July) and small CL4 (Aug), it effectively LOCKED IN its low NAV and LOSS buy selling low and buying high in super contango

Lastly but most importantly, at around 2.8bn USD market cap, with an average price of call it $15 on the contract it owns, WHAT IF June and July trade to an average price of -15, that is a -2.8bn USD of negative equity either the manager or the CME reserve fund has to cover

This is why I think USO will eventually be liquidated, I think sooner than later in this environment, I don& #39;t know what price the post liquidation NAV comes out but it& #39;s probably lower than $2! I stand by the fact that if front month falls below $6 then it& #39;s game on, let& #39; see

each ETF has its own flaw - least flawed is SPY, because SPY is a stock and underlying shares are all stocks-stocks can’t go negative, you will buy them at 0, right? there’s no storage cost to stock-but USO is a stock, it can’t go below 0 yet oil futures can indeed go to negative

Read on Twitter

Read on Twitter