A thread on why very high inequality is constricting our economy now.

Some people think there is a trade-off between inequality and efficiency (or growth). The argument says that while we may not like inequality, higher inequality is necessary for growth.

1/

Some people think there is a trade-off between inequality and efficiency (or growth). The argument says that while we may not like inequality, higher inequality is necessary for growth.

1/

The argument is built on the premise that the rich tend to be entrepreneurs, or "job creators".

Hence if we shift a larger share of dollars towards the rich, they can invest more money into job creation, leading to higher growth.

Is this hypothesis correct?

2/

Hence if we shift a larger share of dollars towards the rich, they can invest more money into job creation, leading to higher growth.

Is this hypothesis correct?

2/

The U.S. offers a nice laboratory to test the idea.

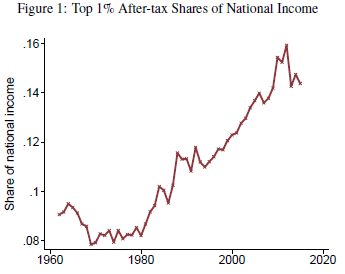

@PikettyLeMonde, Saez and @gabriel_zucman have shown that the share of dollars going to the very rich (top 1%) has close to doubled since 1980.

3/

@PikettyLeMonde, Saez and @gabriel_zucman have shown that the share of dollars going to the very rich (top 1%) has close to doubled since 1980.

3/

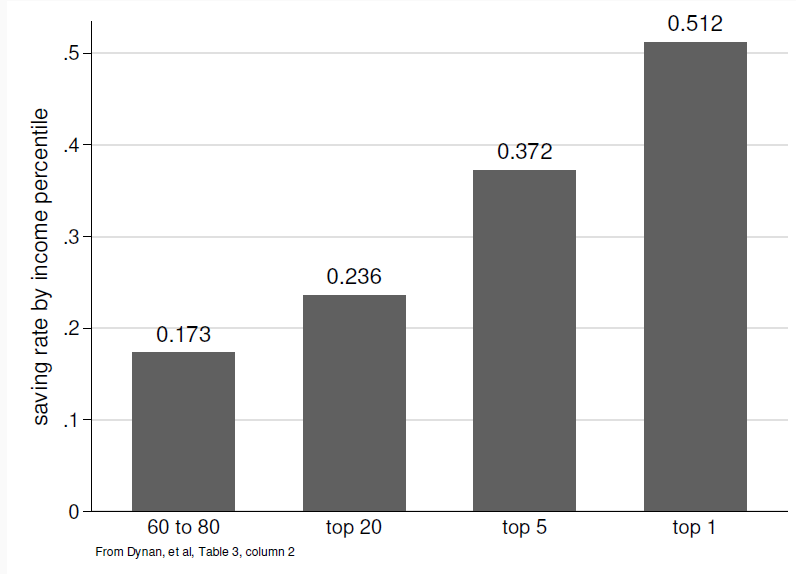

We also know that the top 1% save a much higher fraction of their income than the rest of the population (see evidence below from Dynan, Skinner and Zeldes)

So it must be true then, right? The rise in inequality must have lead to higher investment in the U.S.?

4/

So it must be true then, right? The rise in inequality must have lead to higher investment in the U.S.?

4/

Again the logic is:

(i) Larger share of the income goes to the top 1%

(ii) We know the top 1% save at a much higher rate.

(iii) Hence it must be true that U.S. total saving, and hence investment went up since 1980.

WRONG!

While (i) and (ii) are true, (iii) does not follow!

5/

(i) Larger share of the income goes to the top 1%

(ii) We know the top 1% save at a much higher rate.

(iii) Hence it must be true that U.S. total saving, and hence investment went up since 1980.

WRONG!

While (i) and (ii) are true, (iii) does not follow!

5/

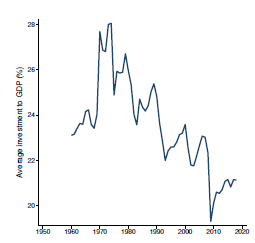

As you can see, investment actually *declined* since 1980.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?

6/

6/

The answer:

Top 1% have been saving more and more, *but* the financial system has *not* converted those additional savings into investment.

Instead more and more of top 1% savings have been channeled back to the rest of the economy as debt to finance consumption.

7/

Top 1% have been saving more and more, *but* the financial system has *not* converted those additional savings into investment.

Instead more and more of top 1% savings have been channeled back to the rest of the economy as debt to finance consumption.

7/

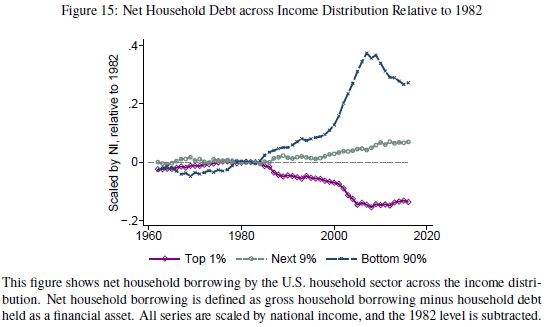

Here is one picture that summarizes this result: Since 1980, top 1% have become net creditors largely to the bottom 90%, who have in turn become more and more indebted!

8/

8/

At this point someone might say,

"Fine. Rising inequality generated more debt so non-rich could borrow from the rich and consume. But so what? What does any of this have to do with growth?".

This is where the plot thickens.

9/

"Fine. Rising inequality generated more debt so non-rich could borrow from the rich and consume. But so what? What does any of this have to do with growth?".

This is where the plot thickens.

9/

What the non-rich borrow today, has consequences for tomorrow as they need to pay interest on debt to the rich.

But paying additional interest reduces their disposable income and hence spending.

10/

But paying additional interest reduces their disposable income and hence spending.

10/

Will the rich spend the interest income from the non-rich and cover the drop in spending?

Unfortunately, no. Remember the rich have very high saving rate.

So now the economy is in danger of getting into a demand-driven recession!

Unless ....

11/

Unfortunately, no. Remember the rich have very high saving rate.

So now the economy is in danger of getting into a demand-driven recession!

Unless ....

11/

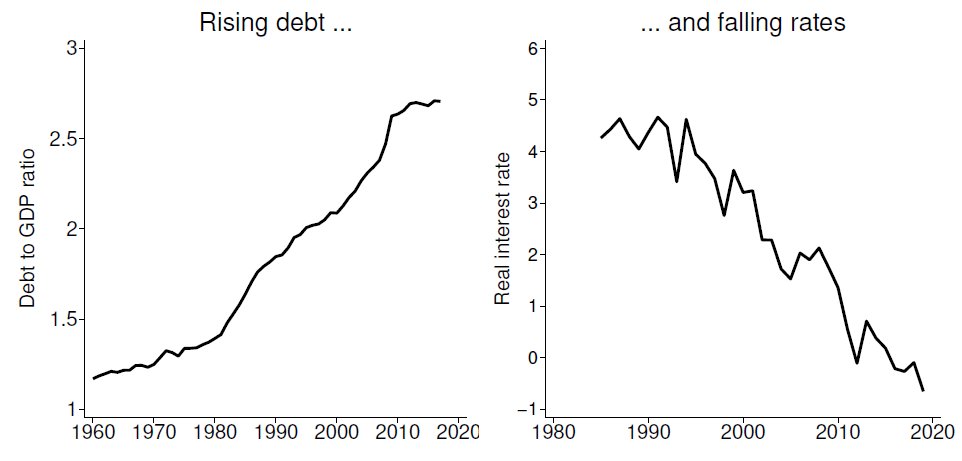

the interest rate falls, hence reducing the debt service burden on the non-rich, and allowing them to boost spending.

It turns out this is exactly how the economy has maintained normalcy: the large rise in debt has been closely followed by a fall in interest rate.

12/

It turns out this is exactly how the economy has maintained normalcy: the large rise in debt has been closely followed by a fall in interest rate.

12/

But we now have a problem.

Interest rates cannot fall beyond a certain point. More generally, very low interest rates start creating all sorts of problems.

This is when high inequality becomes a noose around the neck. We need to cut the noose off.

13/

Interest rates cannot fall beyond a certain point. More generally, very low interest rates start creating all sorts of problems.

This is when high inequality becomes a noose around the neck. We need to cut the noose off.

13/

If you have come this far in the thread, then presumably the topic interests you.

Please join me on Saturday April 25th to continue the conversation. It is for a good cause - helping those in need.

So please do sign up if you can. Thanks! https://twitter.com/AtifRMian/status/1251667010783674375?s=20">https://twitter.com/AtifRMian...

Please join me on Saturday April 25th to continue the conversation. It is for a good cause - helping those in need.

So please do sign up if you can. Thanks! https://twitter.com/AtifRMian/status/1251667010783674375?s=20">https://twitter.com/AtifRMian...

https://register.gotowebinar.com/register/3518026397820588559">https://register.gotowebinar.com/register/...

Read on Twitter

Read on Twitter

What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?6/" title="As you can see, investment actually *declined* since 1980.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?6/" class="img-responsive" style="max-width:100%;"/>

What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?6/" title="As you can see, investment actually *declined* since 1980.https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤔" title="Thinking face" aria-label="Emoji: Thinking face">What is going on? If more money is going to the top 1%, who are saving more and more of it than before, then where does it all go?6/" class="img-responsive" style="max-width:100%;"/>