Looked into $USO today to make a trade. The assets are going to get smoked IMO. Interesting fact: this has been bought-up so much that they& #39;ve 7.5x& #39;d their share count since Feb 29. 156M to 1,188M yesterday. Crazy town. 1/n

$USO is an ETF, and the way that ETFs maintain their alignment with the underlying assets is by having market makers buy/sell the underlying assets and then exchange them for shares of the ETF. e.g. buy WTI, short ETF, and then exchange the WTI for shares from ETF, cancel out 2/n

Because of massive demand (see #1), $USO is trying hard to create more shares to fulfill the market makers& #39; needs. You see, if people buy the ETF, the price goes up. If price > NAV, the situation in #2 happens to bring price back to NAV. ETF needs to issue shares here. 3/n

So $USO applies to the SEC to allow them to make more and more shares by the day. Today, SEC said "NO MORE".

http://www.uscfinvestments.com/documents/united-states-oil-fund-8-k-20200421.pdf

https://www.uscfinvestments.com/documents... href="https://twitter.com/search?q=%24USO&src=ctag">$USO can now only redeem shares, no longer issue. This means that market makers can only arbitrage when price < NAV, not > NAV. 4/n

http://www.uscfinvestments.com/documents/united-states-oil-fund-8-k-20200421.pdf

If the price can only be >= NAV, then it& #39;s a speculative instrument that can fly. This only comes back to earth is if new shares can be created (given all the baggies thinking "wow, oil& #39;s negative, it can& #39;t stay down here forever" without understanding how futures work) 5/n

"But Tim, what does this *mean*"

Right now, the NAV of $USO is about $2.30/share, but is trading at $2.70. This dislocation will continue to widen as long as the inability for $USO to create shares exists, or until the fund completely blows up and has to wind up for ~$0. 6/n

Right now, the NAV of $USO is about $2.30/share, but is trading at $2.70. This dislocation will continue to widen as long as the inability for $USO to create shares exists, or until the fund completely blows up and has to wind up for ~$0. 6/n

So how am I playing this?

I shorted the weekly $2.50 put and went long 1.5x the $2.00 put for a net cost of $0. Either this thing stays dislocated and above $2.50 (because, "BTFD, bro") or it slams into earth. I make money < $1.50, and breakeven >$2.50. Time will tell. TBC.

I shorted the weekly $2.50 put and went long 1.5x the $2.00 put for a net cost of $0. Either this thing stays dislocated and above $2.50 (because, "BTFD, bro") or it slams into earth. I make money < $1.50, and breakeven >$2.50. Time will tell. TBC.

Update: an 8K was filed today (h/t @MelsonNandella). $USO has stated that they& #39;ve rolled their portfolio today from what was 84% June contracts, to 40%. and from 16% July to 55% July. (and the 5% balance in August).

https://www.sec.gov/ix?doc=/Archives/edgar/data/1327068/000117120020000259/i20262_uso-8k.htm">https://www.sec.gov/ix...

https://www.sec.gov/ix?doc=/Archives/edgar/data/1327068/000117120020000259/i20262_uso-8k.htm">https://www.sec.gov/ix...

The swing in CL2 (June) today has been from $21.5 to $7. And their filing was made *right* after that $7 mark. The issue with contango for these funds isn& #39;t the fact that you& #39;re trading up for higher value barrels, it& #39;s the erosion of price from buy to sell. NAV today will be fun

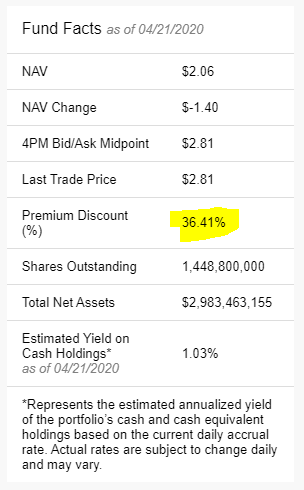

Update: NAV today WAS fun for $USO. NAV currently sitting at $2.06, and the price is at $2.81.

Thanks, @SEC_News, really helping keep the market in check by not allowing this one to issue new shares. After allowing 260MM shares to be created since yesterday, no more? What gives?

Thanks, @SEC_News, really helping keep the market in check by not allowing this one to issue new shares. After allowing 260MM shares to be created since yesterday, no more? What gives?

Turns out $USO *did* sell at the perfect worst time today. Check out their pending trades here:

http://www.uscfinvestments.com/holdings/uso

And">https://www.uscfinvestments.com/holdings/... a chart of daily prices of CL June futures here:

https://www.cmegroup.com/apps/cmegroup/widgets/productLibs/esignal-charts.html?code=CL&title=JUN_2020_Crude_Oil_&type=p&venue=1&monthYear=M0&year=2020&exchangeCode=XNYM

And">https://www.cmegroup.com/apps/cmeg... see where it& #39;s at all possible to get an average fill of ~$12/bbl. Nice, $USO.

http://www.uscfinvestments.com/holdings/uso

And">https://www.uscfinvestments.com/holdings/... a chart of daily prices of CL June futures here:

https://www.cmegroup.com/apps/cmegroup/widgets/productLibs/esignal-charts.html?code=CL&title=JUN_2020_Crude_Oil_&type=p&venue=1&monthYear=M0&year=2020&exchangeCode=XNYM

And">https://www.cmegroup.com/apps/cmeg... see where it& #39;s at all possible to get an average fill of ~$12/bbl. Nice, $USO.

Read on Twitter

Read on Twitter